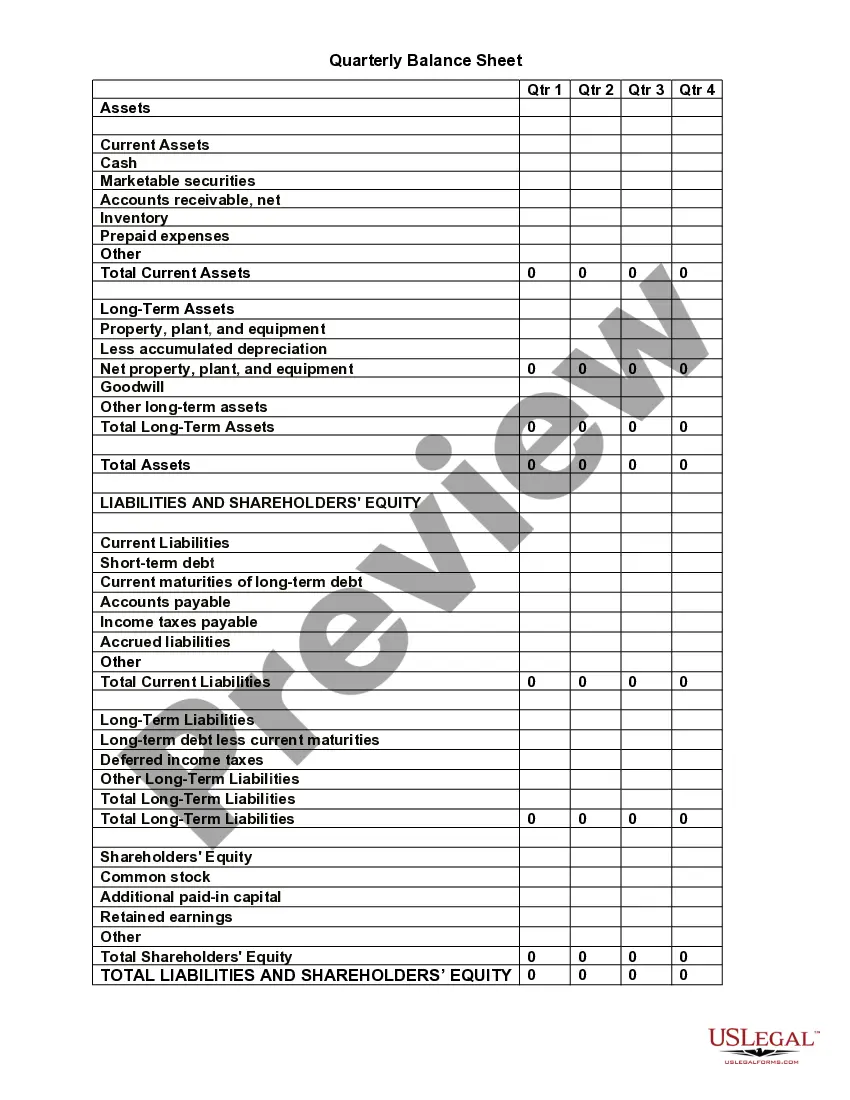

A Balance Sheet (also known as a Statement of Financial Position) is a financial statement that summarizes a company's assets, liabilities, and equity at a specific point in time. It is typically prepared at the end of the fiscal year to provide an accurate and up-to-date representation of the company's financial position. Balance Sheet items can include cash, investments, accounts receivable, inventory, property, equipment, and liabilities such as accounts payable, short-term debt, and long-term debt. Equity is usually composed of common stock, retained earnings, and other reserves. There are two types of Balance Sheets: the Single-Step Balance Sheet and the Multiple-Step Balance Sheet. The Single-Step Balance Sheet is a simple summary of the company's assets and liabilities. The Multiple-Step Balance Sheet includes more detail, such as a breakdown of current assets and liabilities, as well as a more detailed analysis of equity.

Balance Sheet (Year End)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Balance Sheet (Year End)?

US Legal Forms is the most straightforward and profitable way to locate appropriate formal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and checked by attorneys. Here, you can find printable and fillable templates that comply with federal and local regulations - just like your Balance Sheet ??? Year End.

Obtaining your template takes only a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Balance Sheet ??? Year End if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make certain you’ve found the one meeting your demands, or locate another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and choose the subscription plan you prefer most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Balance Sheet ??? Year End and download it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - just find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more proficiently.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the corresponding formal paperwork. Give it a try!

Form popularity

FAQ

A balance sheet will provide you a quick snapshot of your business's finances - typically at a quarter- or year-end?and provide insights into how much cash or how much debt your company has.

At the end of the fiscal year, closing entries are used to shift the entire balance in every temporary account into retained earnings, which is a permanent account. The net amount of the balances shifted constitutes the gain or loss that the company earned during the period.

A balance sheet will provide you a quick snapshot of your business's finances - typically at a quarter- or year-end?and provide insights into how much cash or how much debt your company has.

Balance Sheet is part of final accounts, prepared by a business firm to know its financial position on a particular date for a particular period. Balance sheet shows the total liabilities and total assets of a business firm on a particular date.

Balance sheets are usually prepared at the close of an accounting period such as month-end, quarter-end, or year-end. New business owners should not wait until the end of 12 months or the end of an operating cycle to complete a balance sheet.

Typically, a balance sheet is prepared at the end of set periods (e.g., every quarter; annually). A balance sheet is comprised of two columns. The column on the left lists the assets of the company. The column on the right lists the liabilities and the owners' equity.

This financial statement details your assets, liabilities and equity, as of a particular date. Although a balance sheet can coincide with any date, it is usually prepared at the end of a reporting period, such as a month, quarter or year.