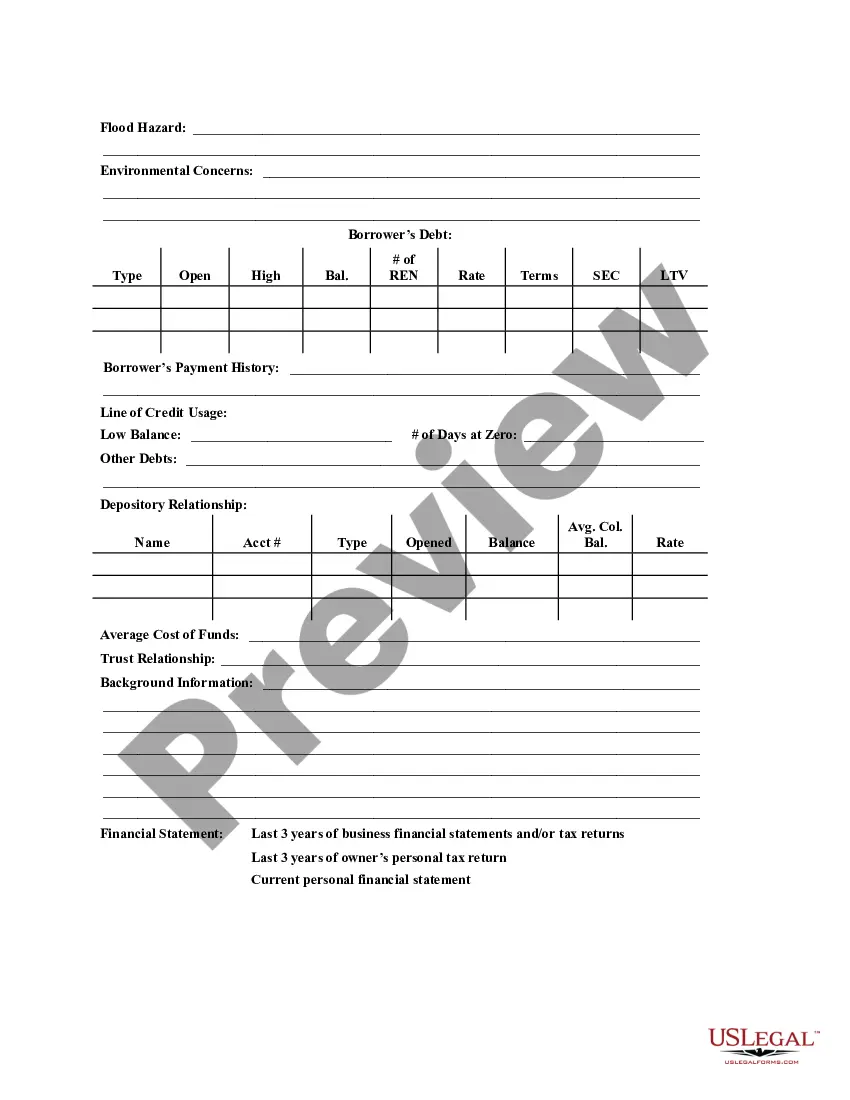

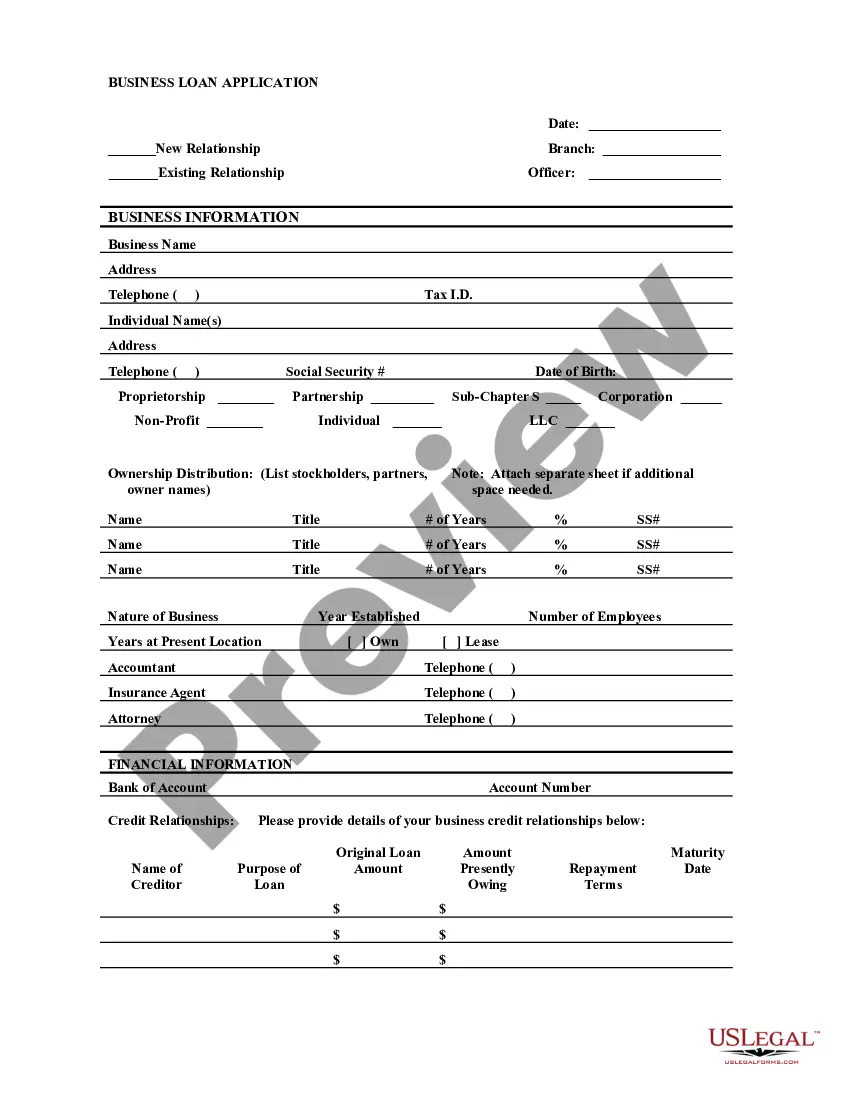

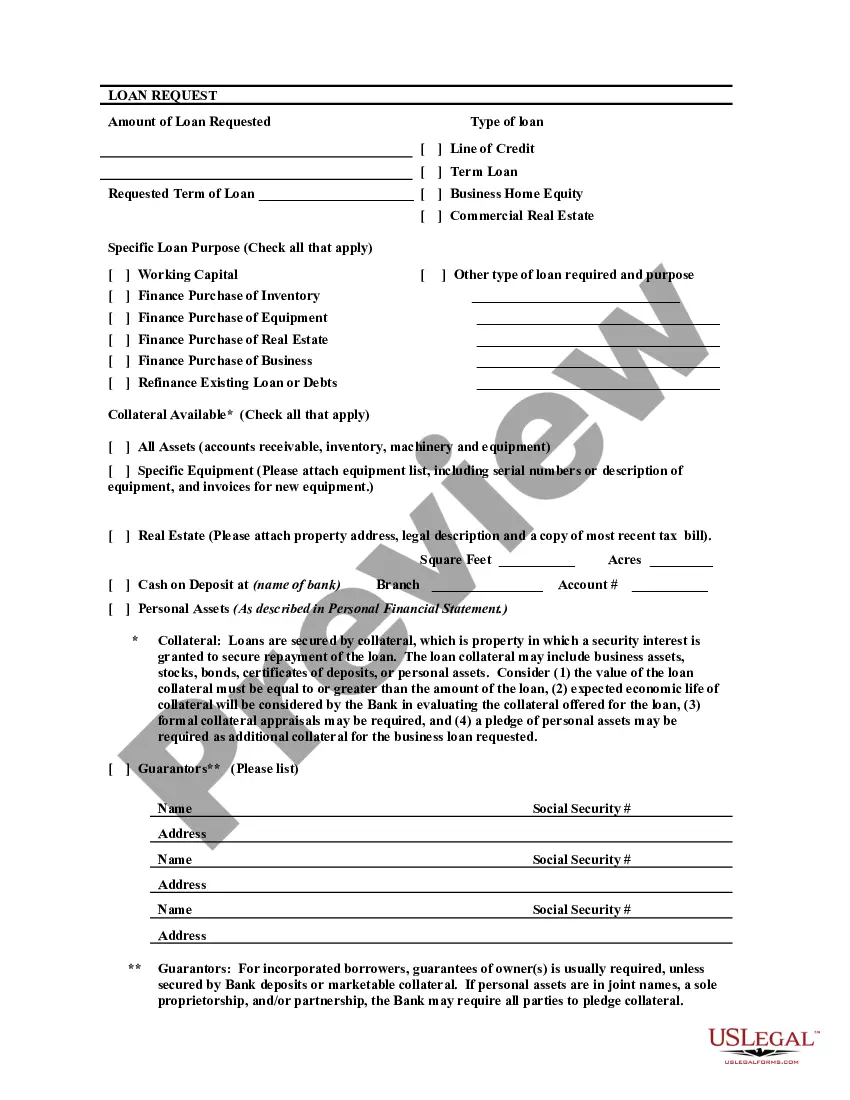

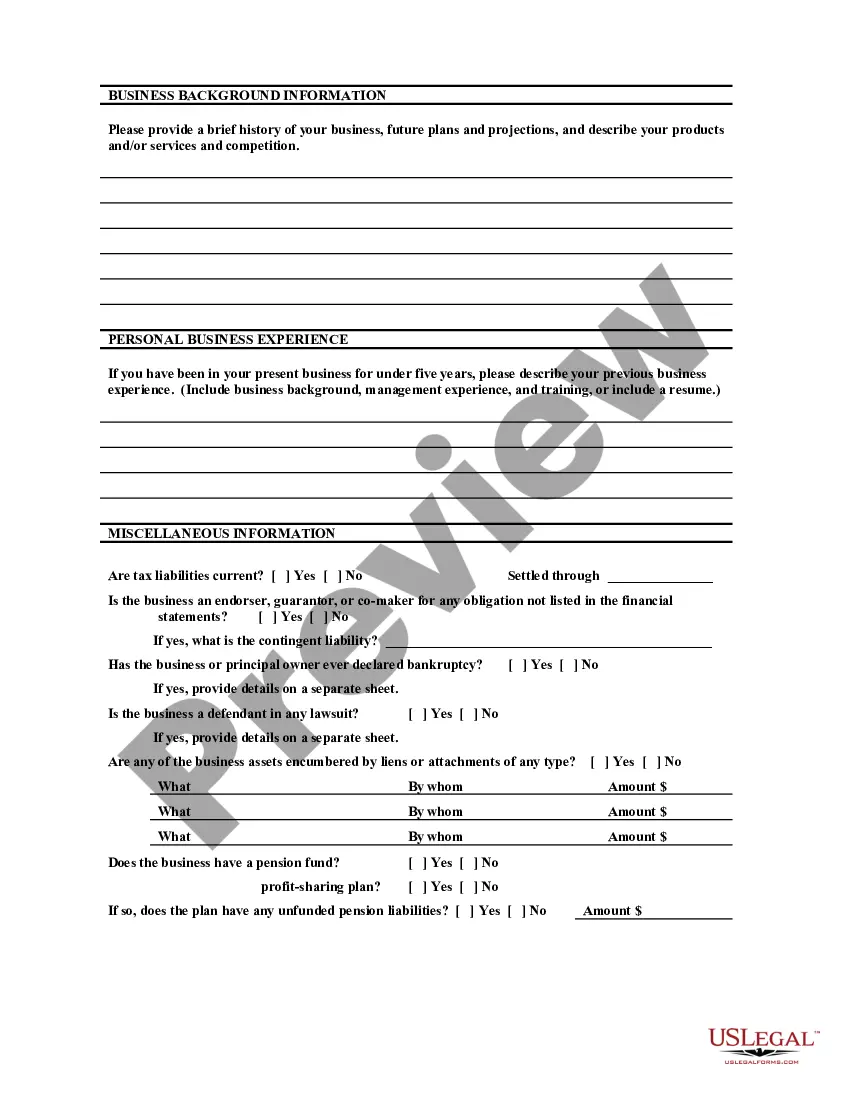

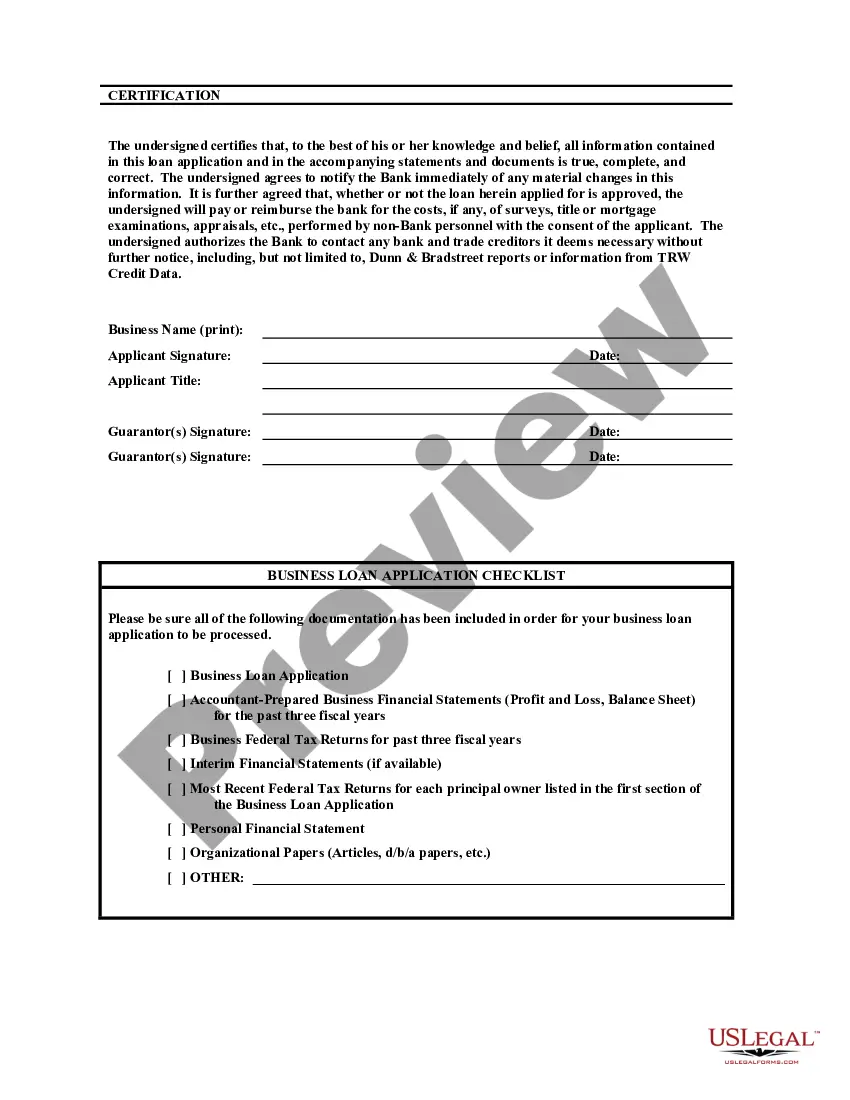

A Bank Loan Application Form and Checklist is a document used by a bank to assess a prospective borrower’s financial health and creditworthiness. The form and checklist provide the bank with an accurate assessment of the borrower’s financial history and current assets in order to determine the likelihood of repayment of the loan. The form typically includes questions related to the borrower’s income, employment, credit history, assets, liabilities, and other financial information. The checklist is used to verify the accuracy of the information provided in the form and to ensure the borrower meets the bank’s lending criteria. There are two main types of Bank Loan Application Form and Checklist: a Personal Loan Form and Checklist and a Business Loan Form and Checklist. The Personal Loan Form and Checklist is used for individual borrowers and includes questions related to the borrower’s current income, employment, and credit history. The Business Loan Form and Checklist is used for businesses and includes questions related to the business’s revenue, assets, liabilities, and other financial information.

A Bank Loan Application Form and Checklist is a document used by a bank to assess a prospective borrower’s financial health and creditworthiness. The form and checklist provide the bank with an accurate assessment of the borrower’s financial history and current assets in order to determine the likelihood of repayment of the loan. The form typically includes questions related to the borrower’s income, employment, credit history, assets, liabilities, and other financial information. The checklist is used to verify the accuracy of the information provided in the form and to ensure the borrower meets the bank’s lending criteria. There are two main types of Bank Loan Application Form and Checklist: a Personal Loan Form and Checklist and a Business Loan Form and Checklist. The Personal Loan Form and Checklist is used for individual borrowers and includes questions related to the borrower’s current income, employment, and credit history. The Business Loan Form and Checklist is used for businesses and includes questions related to the business’s revenue, assets, liabilities, and other financial information.