Training Expense Agreement

Description

How to fill out Training Expense Agreement?

Among hundreds of free and paid templates that you can find on the web, you can't be sure about their reliability. For example, who created them or if they’re skilled enough to deal with the thing you need them to. Keep calm and make use of US Legal Forms! Locate Training Expense Agreement samples created by professional lawyers and prevent the expensive and time-consuming procedure of looking for an lawyer or attorney and then having to pay them to write a document for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you are searching for. You'll also be able to access all of your earlier acquired templates in the My Forms menu.

If you’re making use of our platform the first time, follow the guidelines listed below to get your Training Expense Agreement quick:

- Ensure that the file you discover is valid in the state where you live.

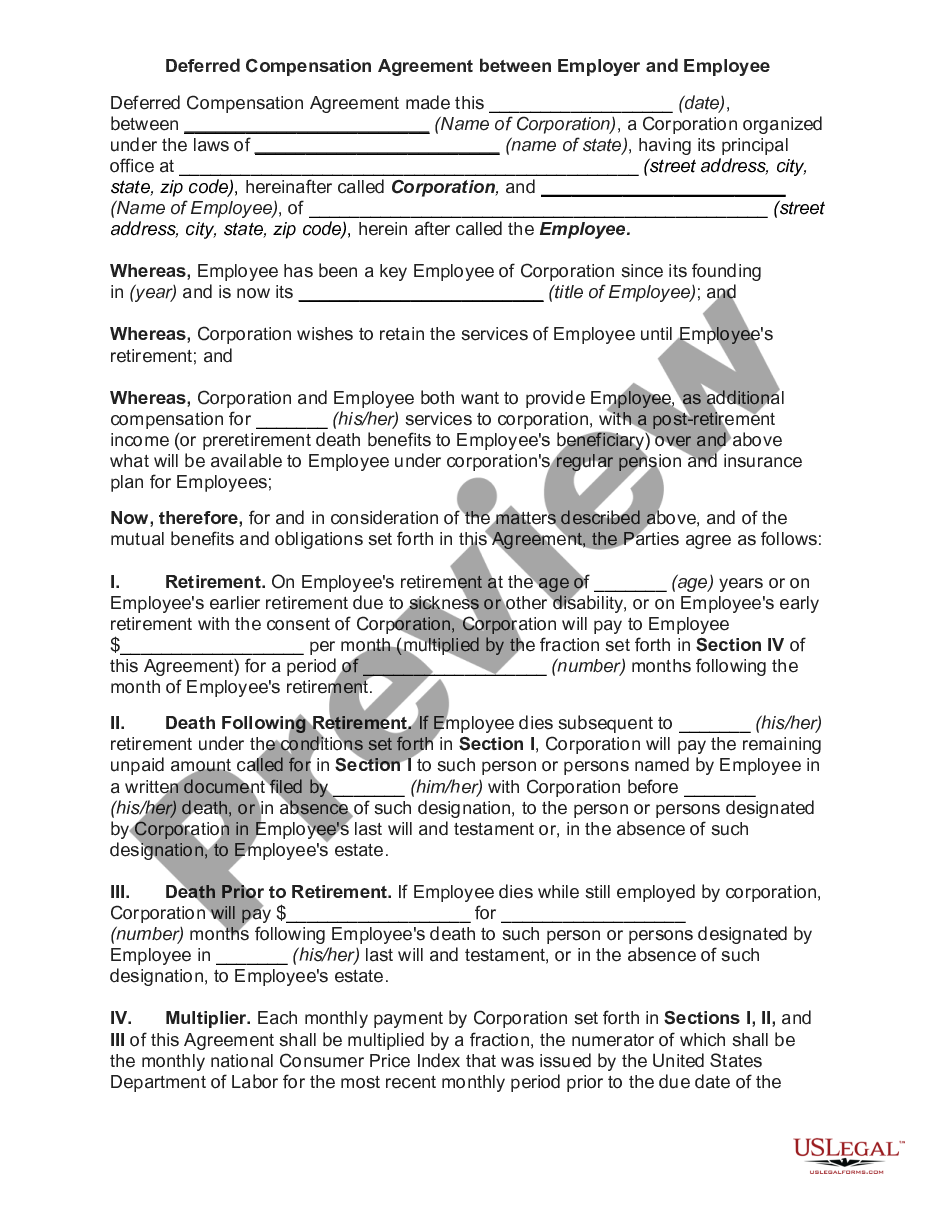

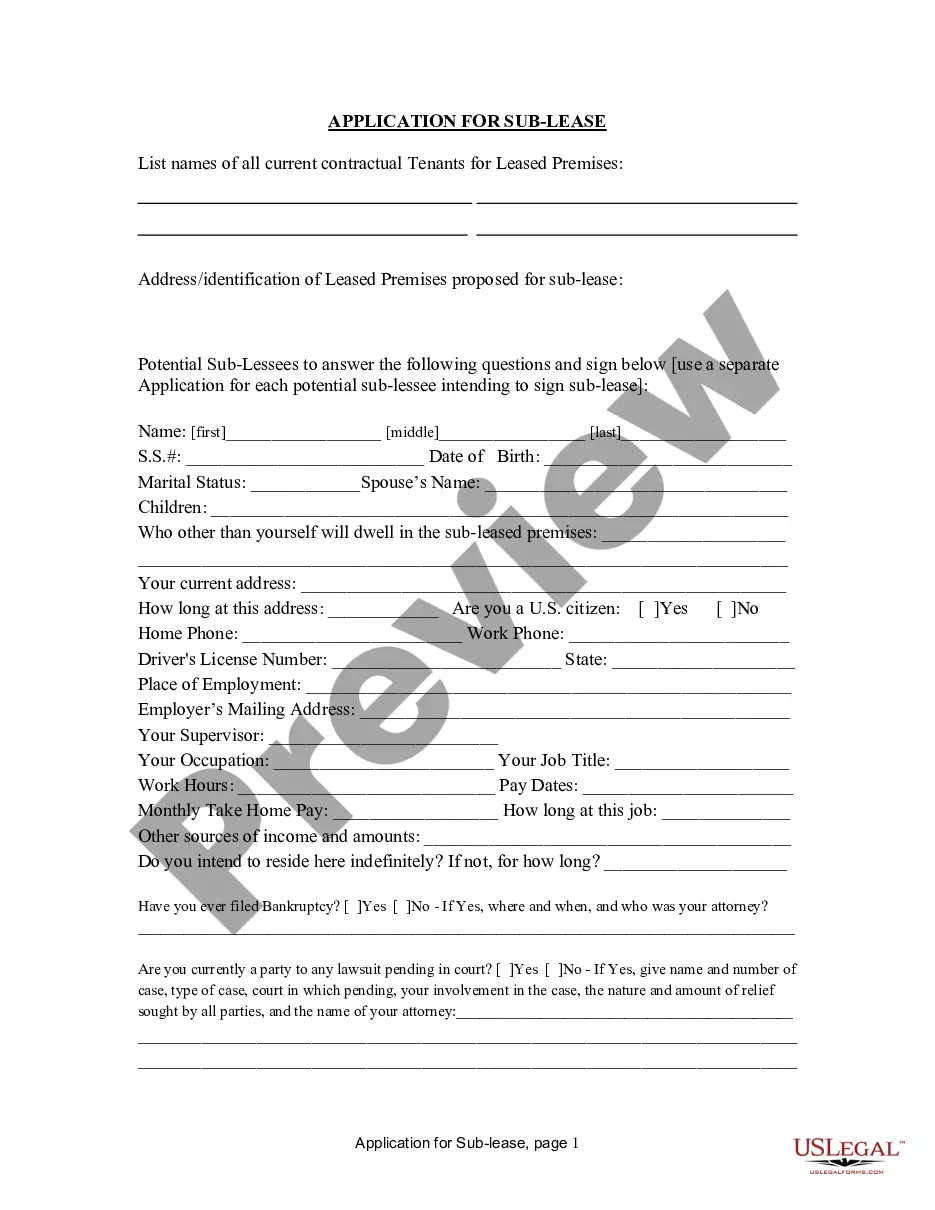

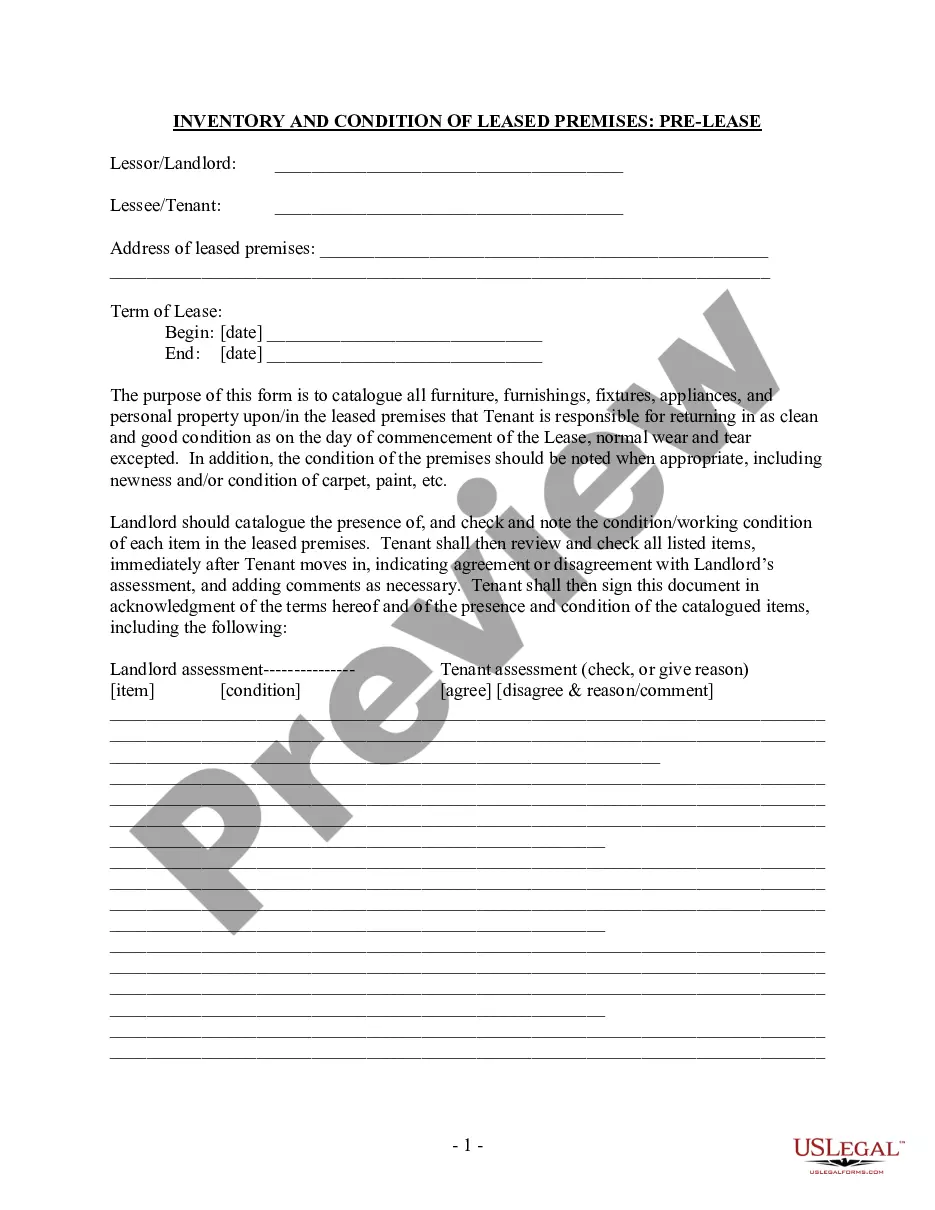

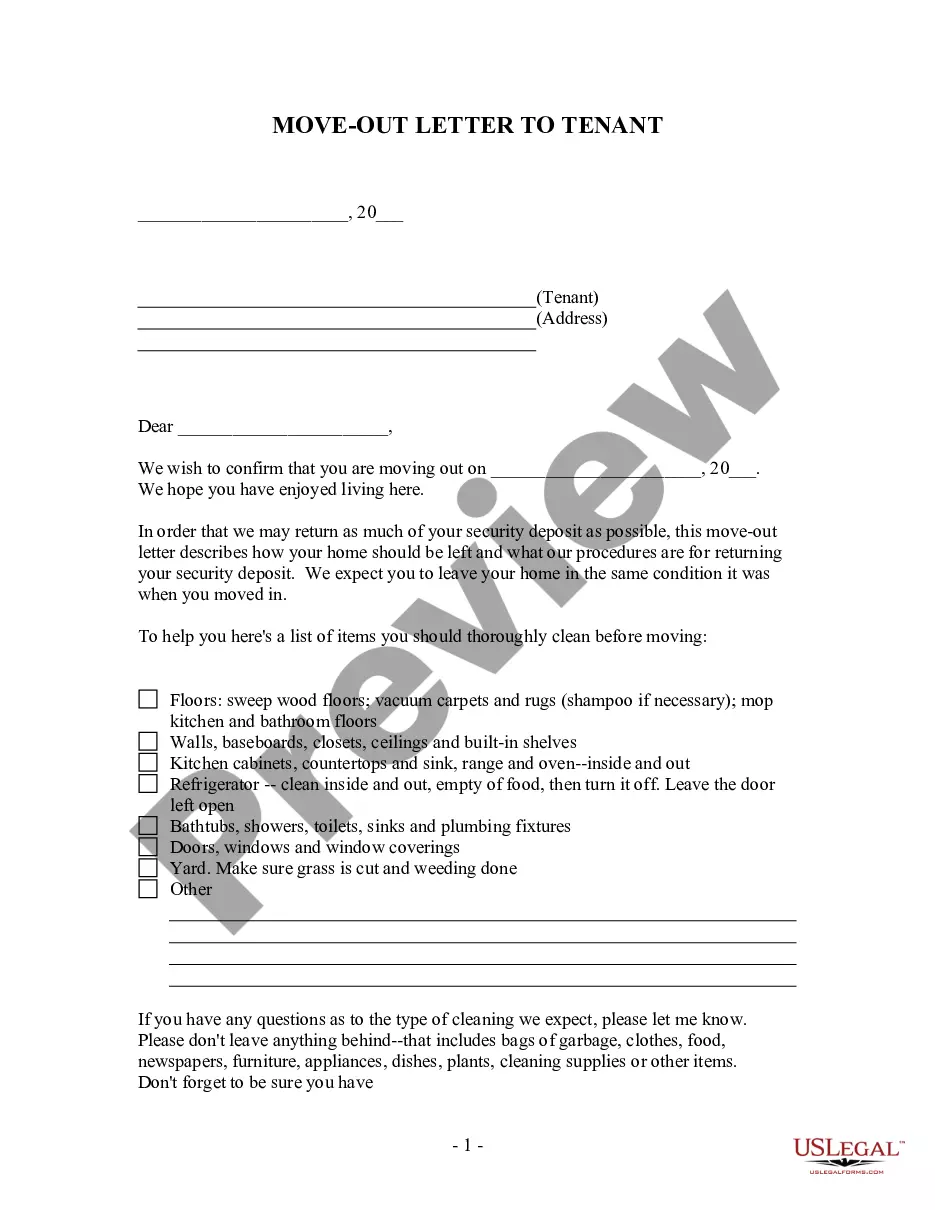

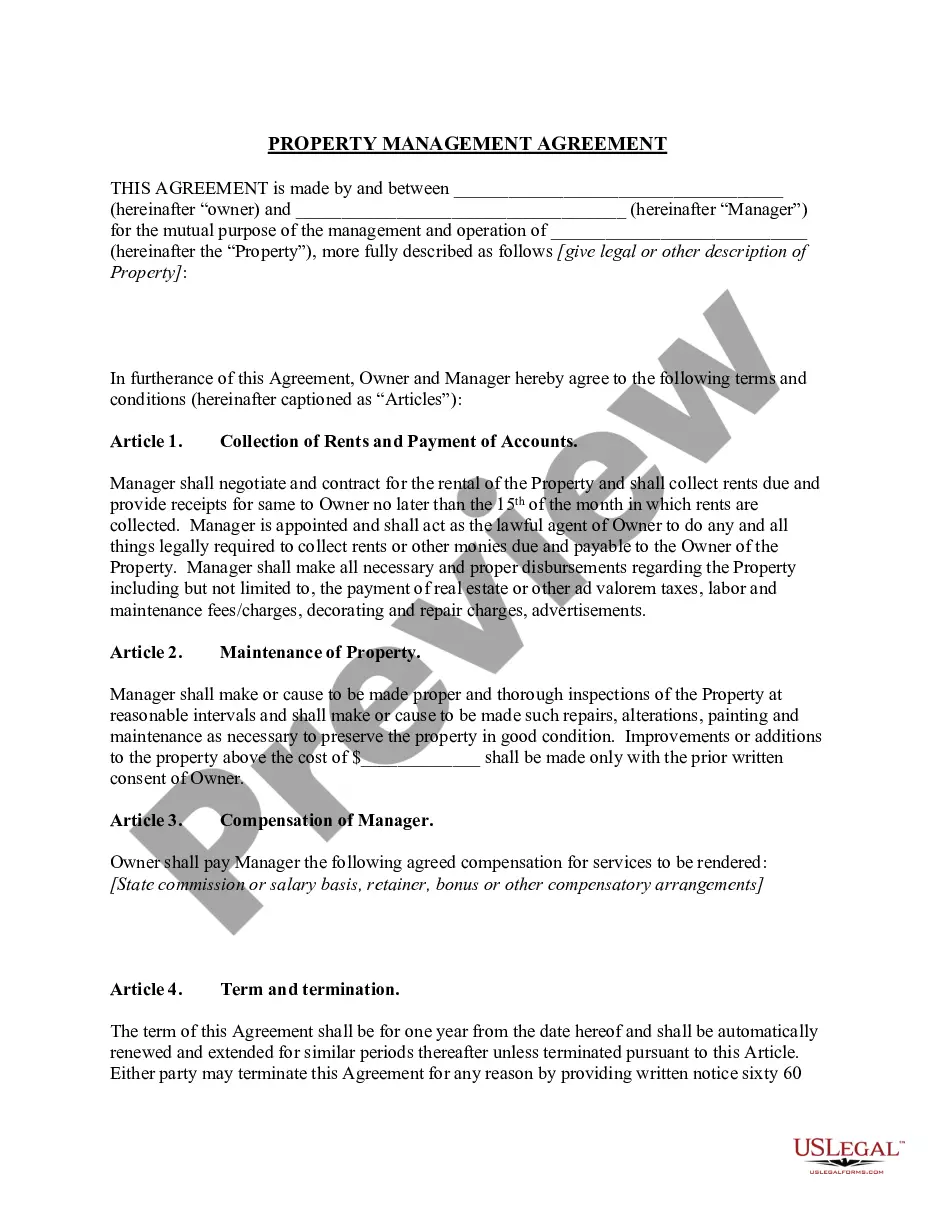

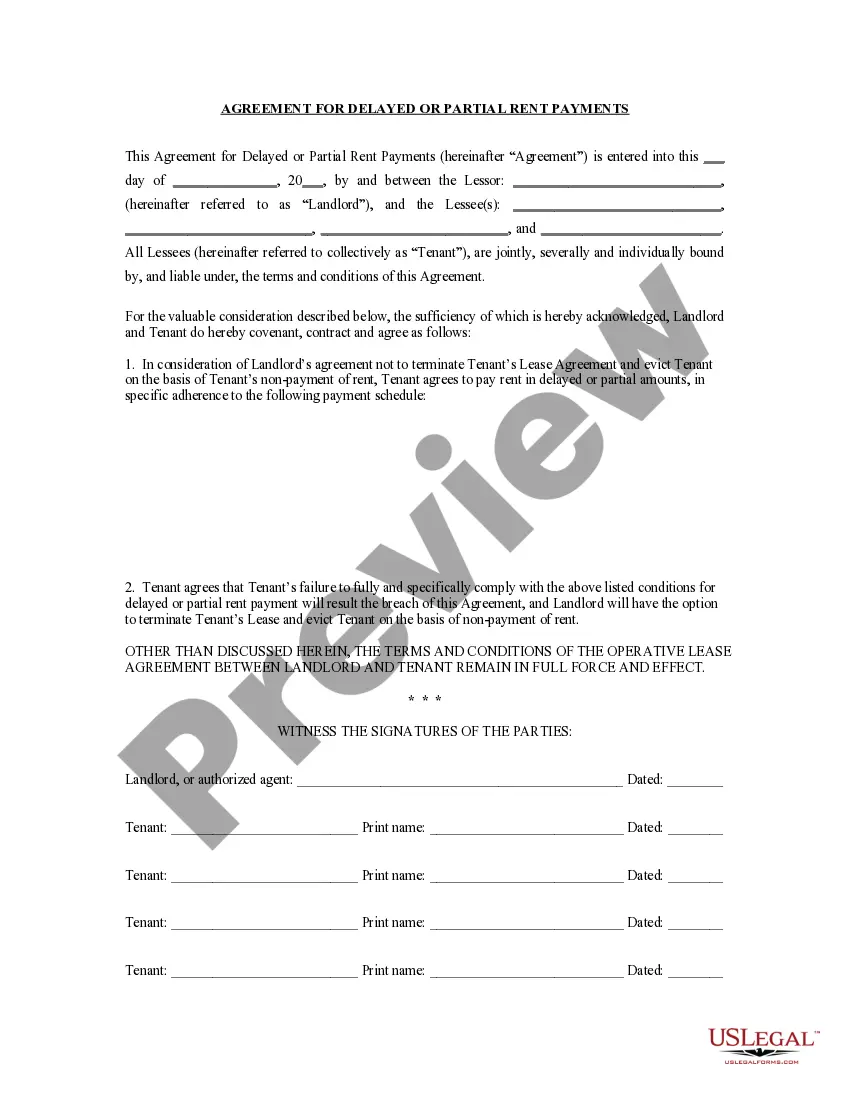

- Review the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another sample using the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

When you have signed up and paid for your subscription, you can utilize your Training Expense Agreement as often as you need or for as long as it remains valid where you live. Edit it in your favored offline or online editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

An agreement between a postgraduate dean and a trainee which defines, in terms of education and training, the relationship, duties and obligations of each party. A commitment to providing an educational plan.2022 A commitment to regular tuition by consultants.

It is not that unusual for employers to require employees to repay their costs of training or other professional fees that the employer has incurred on their behalf if they leave their employment. Occasionally, an employee will argue that this type of clause is a penalty clause and therefore unenforceable.

Agreements to repay your employer for training costs are valid and enforceable.That means that if there is a contract to repay your employer any training costs they paid for you in the event you quit, then if you do quit, you must repay them.

Yes, according to a California Court of Appeal.

Final pay when someone leaves a job Employers can only deduct money for training courses if it was agreed in the contract or in writing beforehand. For example, an employer could ask someone to agree in writing before a training course to pay back costs if they leave within 6 months.

Bonding Agreement means any agreement evidencing or relating to any performance bonds, construction bonds or similar obligations issued by a surety or other bonding party (or any designee on its behalf) for the benefit of customers of any Group Company and/or their Subsidiaries between such surety or other bonding

A standard bond agreement: A training course is funded by the Company, costs are a known value, the Employee is paid to attend and is bonded for either 12 or 18 months with a diminishing repayment value through time.With the option for the Company to fund it all or the Employee to self fund but paid time to undertake.

Can employers deduct your pay for training? If the employer is relying on a contract provision or written consent from the employee, the answer is Yes. If the deduction for training occurred without such authority, then the deduction would be illegal and the employee may have a potential employment claim.

In the UK they are any bond is un-enforceable in law after the Bosman ruling in football. This made any employer unable to restrict the movement of employees to better and other employment or career changes.