Employment Firm Audit

Description Employment Audit Document

How to fill out Service Work Contract?

Among lots of free and paid examples which you find online, you can't be sure about their reliability. For example, who created them or if they’re qualified enough to deal with what you require them to. Keep relaxed and make use of US Legal Forms! Discover Employment Firm Audit samples made by skilled attorneys and prevent the costly and time-consuming process of looking for an lawyer or attorney and then having to pay them to draft a document for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the file you’re seeking. You'll also be able to access all your previously acquired examples in the My Forms menu.

If you are using our platform for the first time, follow the guidelines listed below to get your Employment Firm Audit with ease:

- Ensure that the file you find applies in your state.

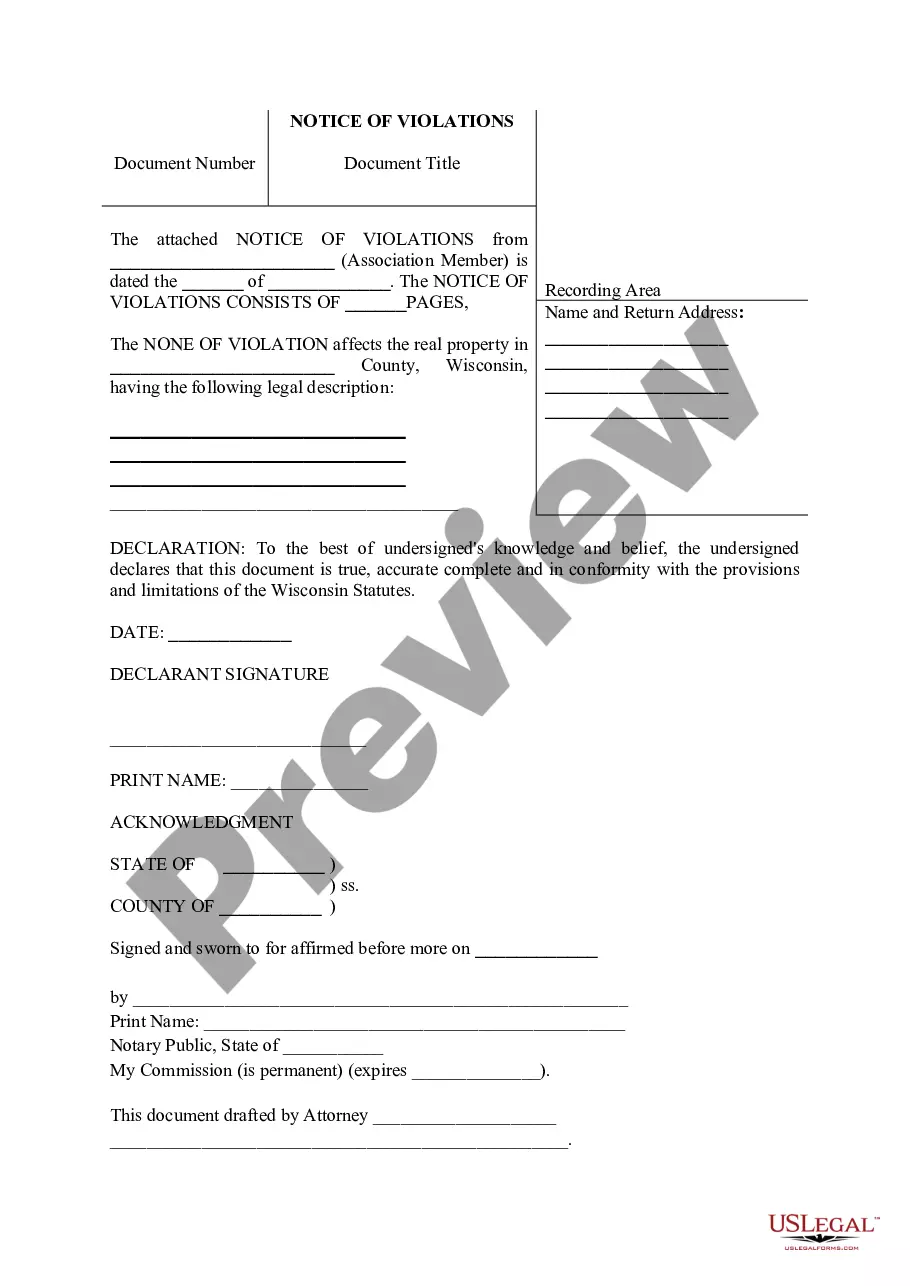

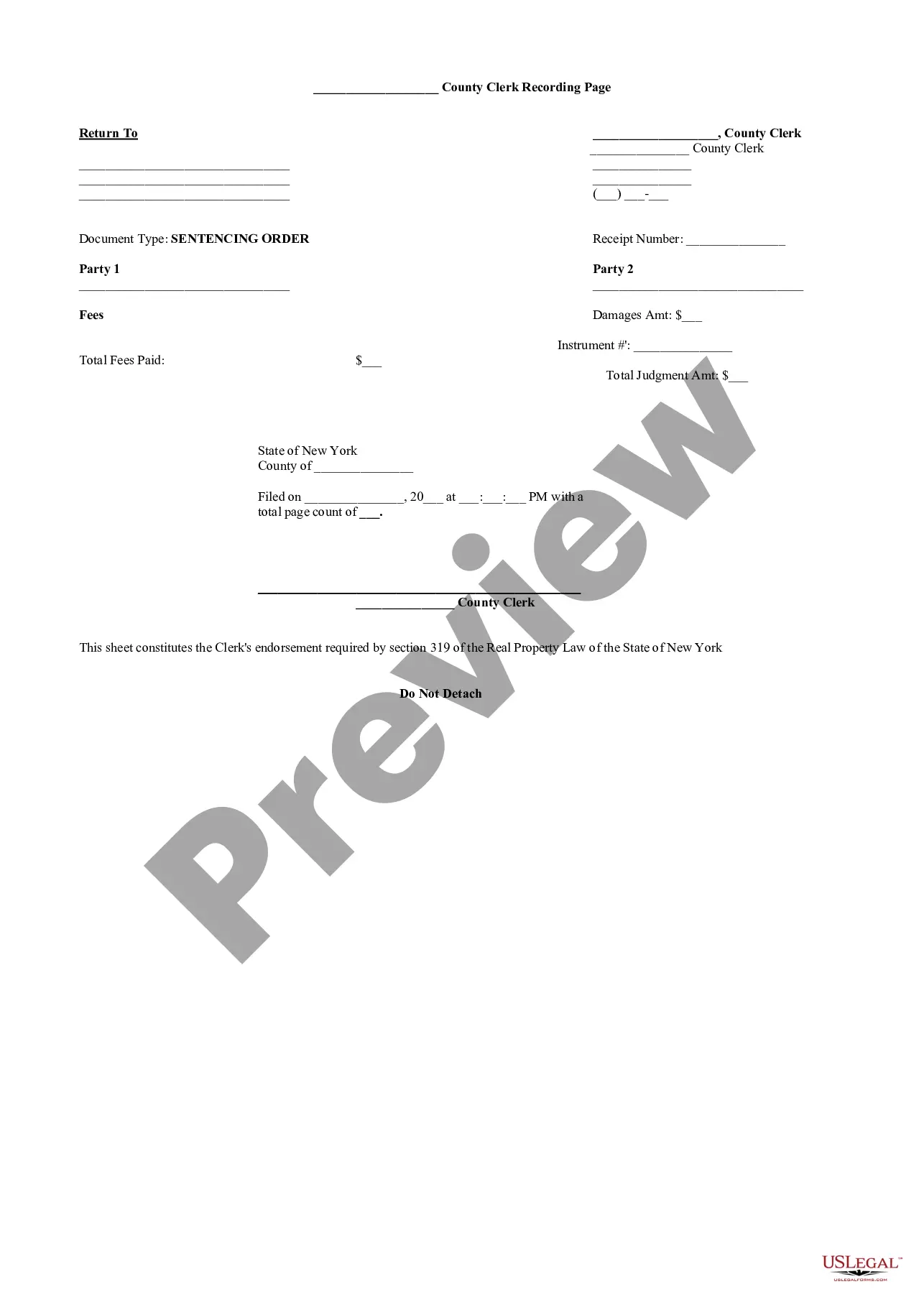

- Review the template by reading the description for using the Preview function.

- Click Buy Now to start the purchasing process or find another example utilizing the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

Once you have signed up and purchased your subscription, you can use your Employment Firm Audit as many times as you need or for as long as it stays active in your state. Change it in your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Employment Written Contract Form popularity

Employment Audit Order Other Form Names

Require Work Contract FAQ

There are three main types of audits: external audits, internal audits, and Internal Revenue Service (IRS) audits. External audits are commonly performed by Certified Public Accounting (CPA) firms and result in an auditor's opinion which is included in the audit report.

PwC is the largest by revenue and the most prestigious of the Big Four with a strong and established audit client base. Deloitte is just a fraction smaller than PwC. It gets significantly less of its revenue from audit services and more from consulting.

A job audit is a formal procedure in which a compensation professional meets with the manager and employee to discuss and explore the position's current responsibilities.The audit assists in determining where a position fits into the hierarchy of positions whether unionized or non-aligned.

Internal audit. Internal audits take place within your business. External audit. An external audit is conducted by a third party, such as an accountant, the IRS, or a tax agency. IRS tax audit. Financial audit. Operational audit. Compliance audit. Information system audit. Payroll audit.

The three general types of audit test include risk assessment procedures, a test of controls, and substantive procedures. The risk assessment procedures test is used to understand the entity and its environment. The auditor will use the risk assessment test to make inquiries of management and analytical procedures.

Mumbai: After more than a decade, a professional services firm has managed to break the stranglehold of the Big Four in the ranking of number of listed companies audited, with Grant Thornton pipping PwC to capture the No. 4 position and KPMG, EY and Deloitte taking the top three.

In a 2018 survey by the Financial Education & Research Foundation, 83 public companies reported average audit fees of $9.8 million and a median fee of $3.7 millionan increase of 4.1% from 2017. Audit fees for private companies averaged about $139,000, which is an increase of 5.6% over 2017.

Who are the Big Four Accounting Firms? The Big Four accounting firms are Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY), and KPMG. They are professional services firms that are renowned worldwide for their reputation and prestige.

Aside from auditing services, the Big Four offer tax and management consulting, valuation, market research, assurance, and legal advisory services.