Tax Evasion — Computation of Tax Deficiency is the illegal practice of deliberately avoiding or underpaying taxes by not reporting income, inflating expenses, or misrepresenting information to reduce the amount of tax owed. This is a form of fraud that is punishable by law and carries serious consequences. There are two types of Tax Evasion — Computation of Tax Deficiency: Direct Tax Evasion and Indirect Tax Evasion. Direct Tax Evasion is when an individual or business deliberately underreports income or overstates deductions to reduce the amount of taxes owed. Indirect Tax Evasion is when an individual or business attempts to avoid paying taxes by transferring income to an offshore account or exploiting loopholes in the tax code. Both types of Tax Evasion — Computation of Tax Deficiency are illegal and can lead to severe financial penalties and even jail time.

Tax Evasion - Computation of Tax Deficiency

Description

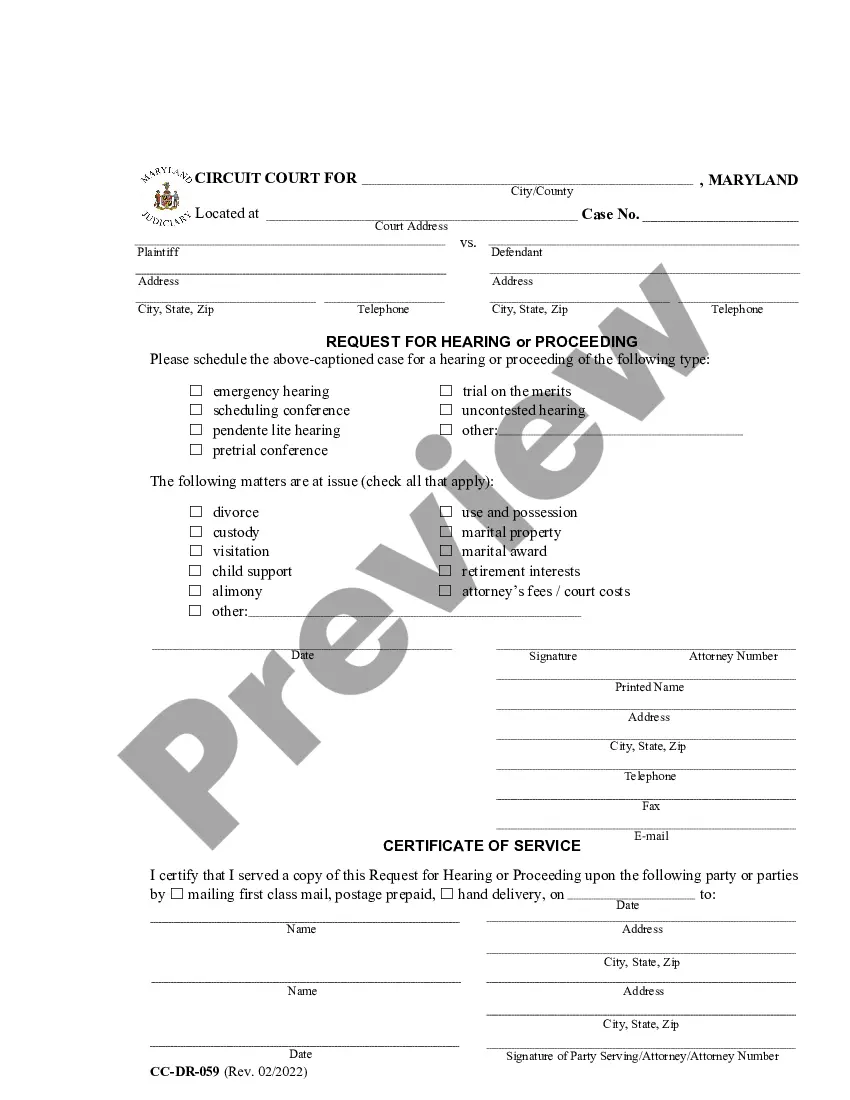

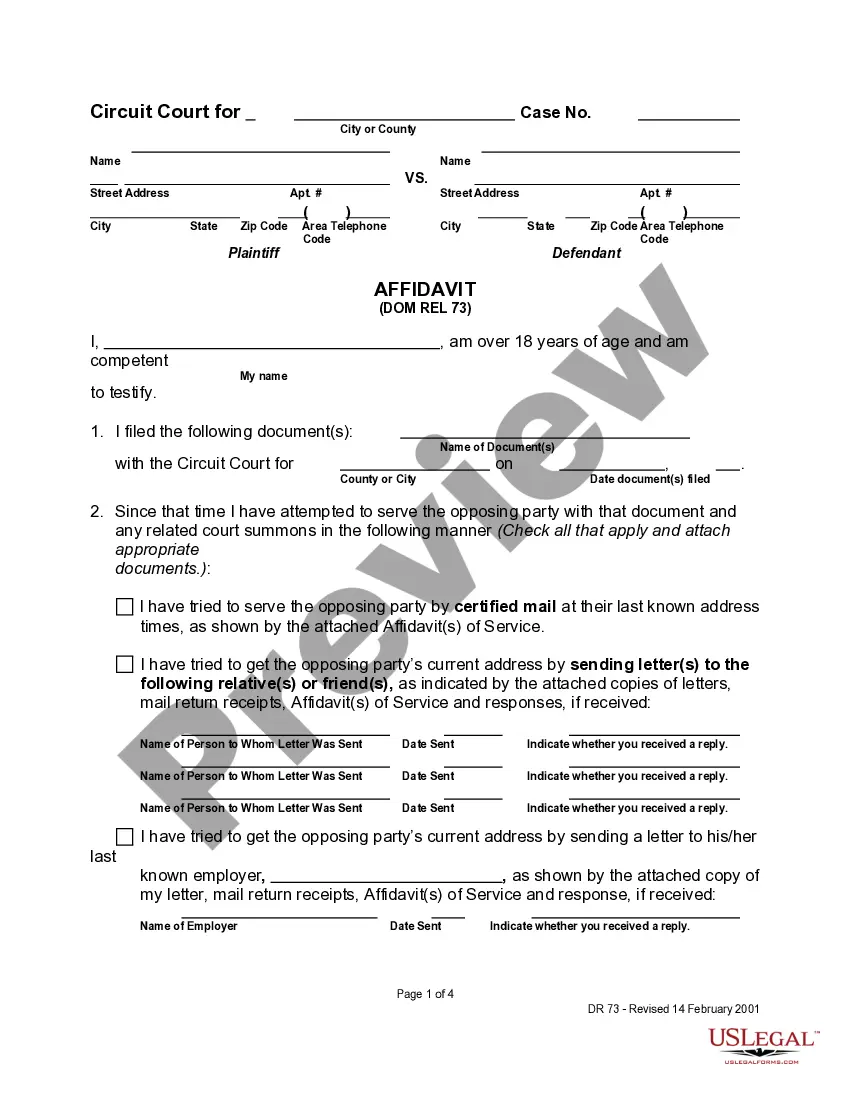

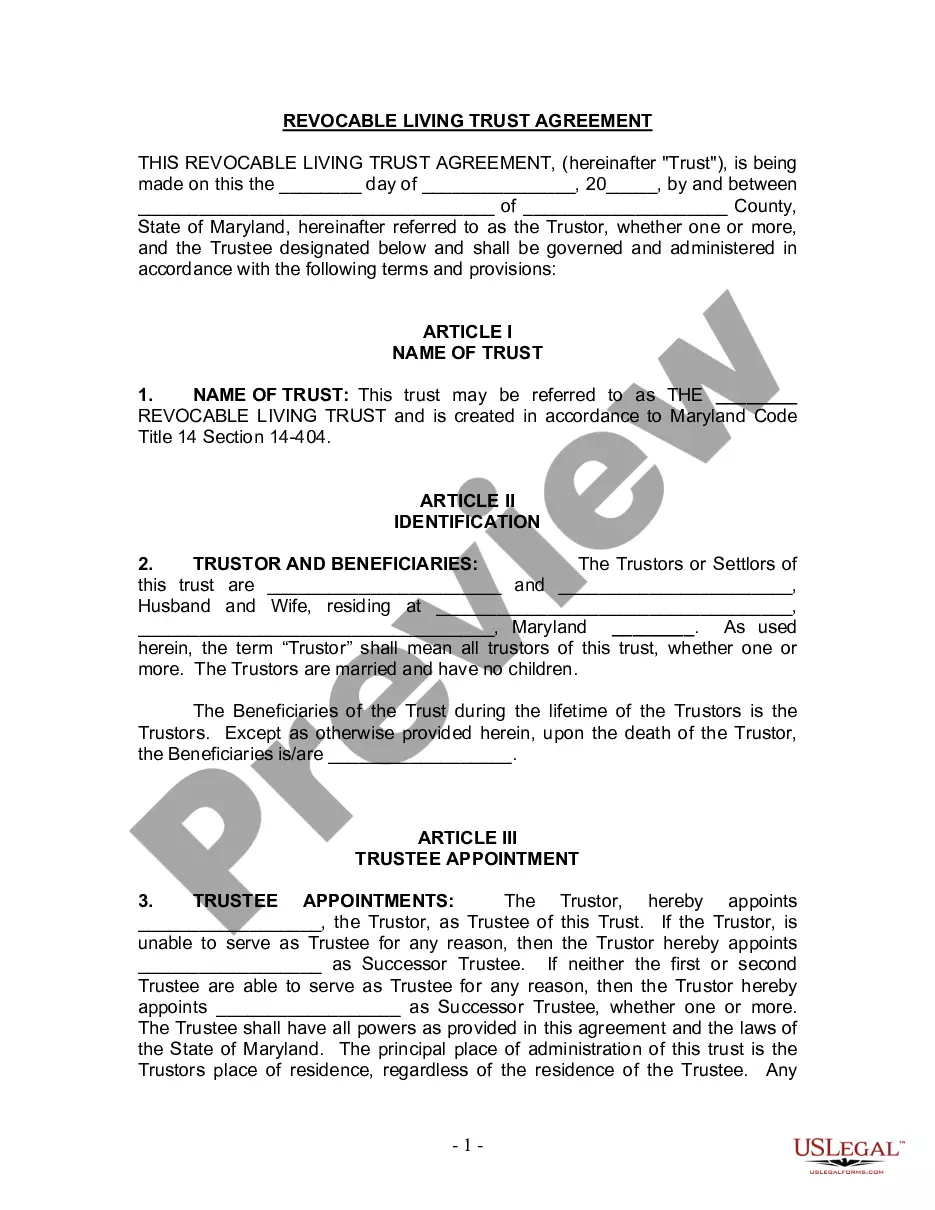

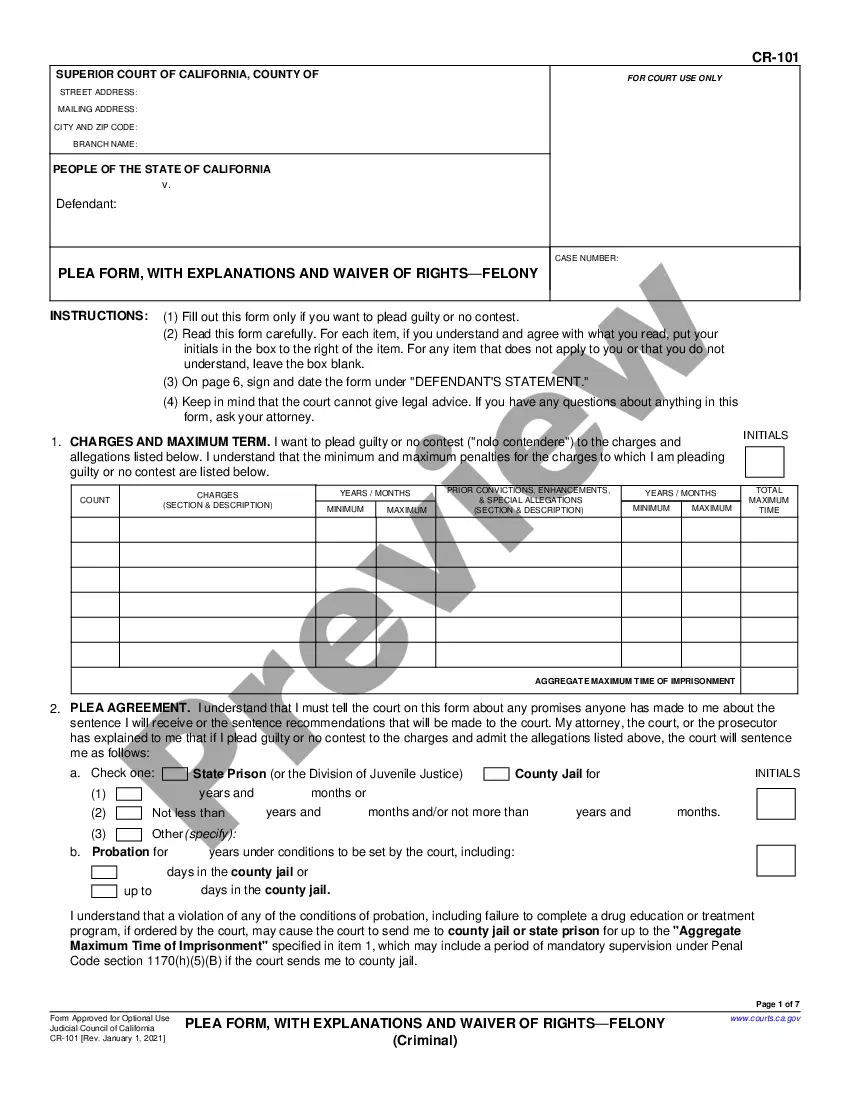

How to fill out Tax Evasion - Computation Of Tax Deficiency?

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them correspond with federal and state regulations and are examined by our specialists. So if you need to complete Tax Evasion - Computation of Tax Deficiency, our service is the best place to download it.

Obtaining your Tax Evasion - Computation of Tax Deficiency from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they find the proper template. Later, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a quick instruction for you:

- Document compliance verification. You should carefully examine the content of the form you want and ensure whether it satisfies your needs and fulfills your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab above until you find an appropriate blank, and click Buy Now once you see the one you want.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Tax Evasion - Computation of Tax Deficiency and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any formal document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Tax deficiency is when the amount of taxes you reported on your return are different from what the IRS calculates you owe. If you file a tax return with a sum different from the income your employers reported, that's a tax deficiency.

A deficiency is assessed when the amount or tax liability reported to the IRS by the taxpayer is less than the amount reported by third parties. Third-party documents are an indication to the IRS that a form of income was received by the taxpayer.

Without your consent, the IRS cannot assess the proposed deficiency without first providing you an opportunity to challenge these adjustments by filing a petition with the Tax Court.

IRS Definition The notice of deficiency is a legal determination that is presumptively correct and consists of the following: A letter explaining the purpose of the notice, the amount of the deficiency, and the taxpayer's options. A waiver to allow the taxpayer to agree to the additional tax liability.

If you agree, sign the enclosed Form 5564 and mail or fax it to the address or fax number listed on the letter. If you are making a payment, include it with the Form 5564. If you pay the amount due now, you will reduce the amount of interest and penalties. If you don't agree, respond to the IRS immediately.

The Tax Court has interpreted this concept in mathematical terms as well, where the deficiency equals the correct tax minus the sum (tax on return + prior assessments ? rebates), or where the deficiency equals the correct tax minus the tax on the return minus the prior assessments plus the rebates.

Tax deficiency is when the amount of taxes you reported on your return are different from what the IRS calculates you owe. If you file a tax return with a sum different from the income your employers reported, that's a tax deficiency.

The three elements of tax evasion are: The existence of a tax deficiency. An attempt to evade or defeat tax. The taxpayer's willingness.