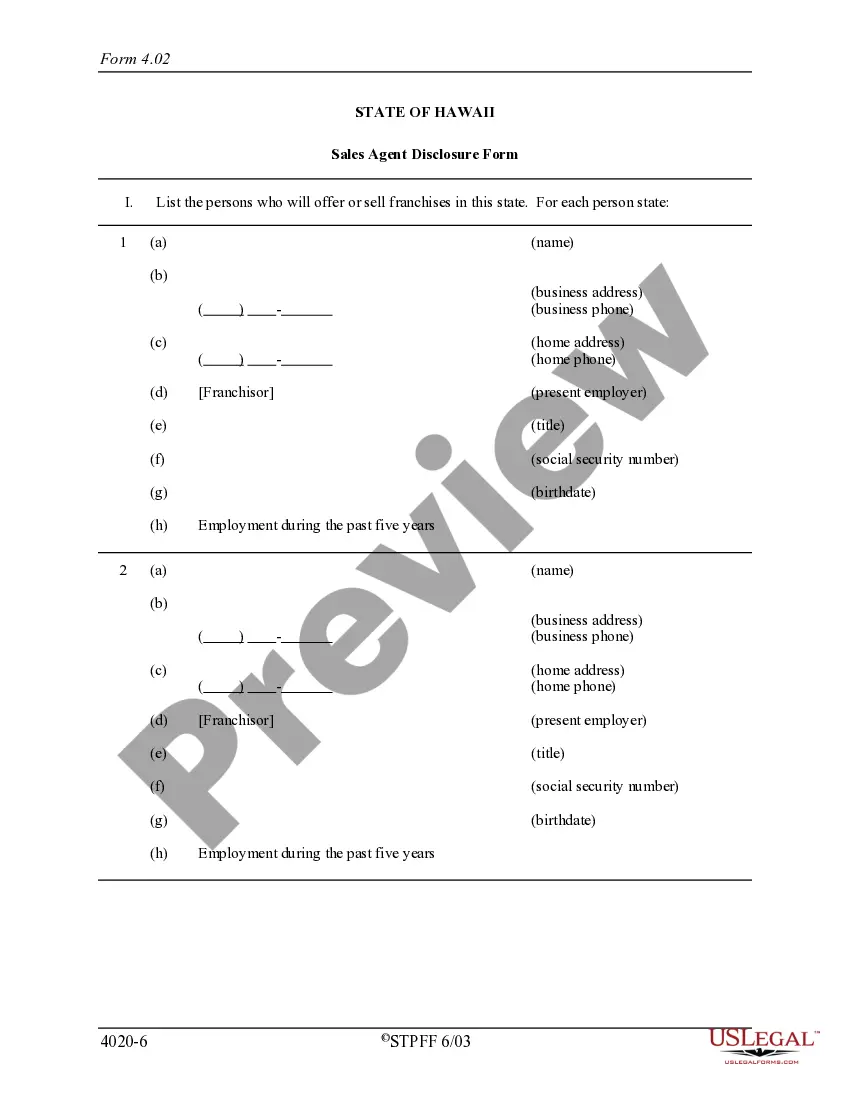

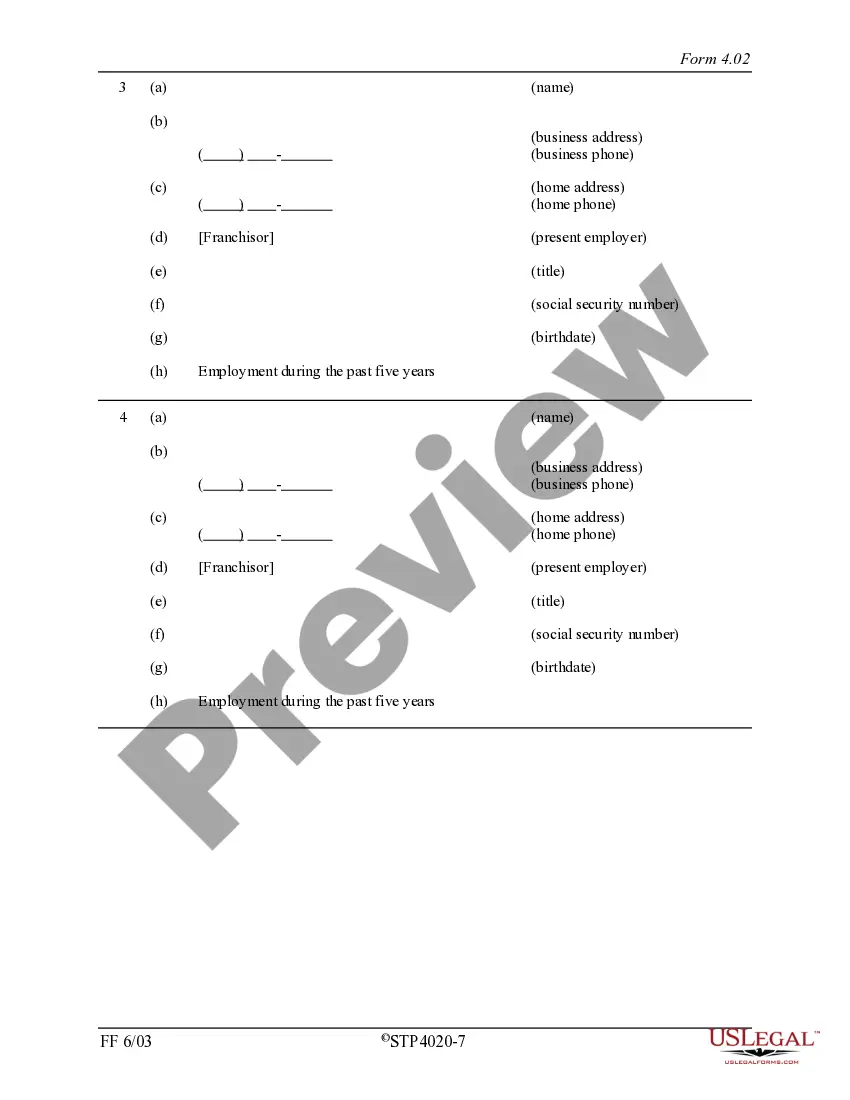

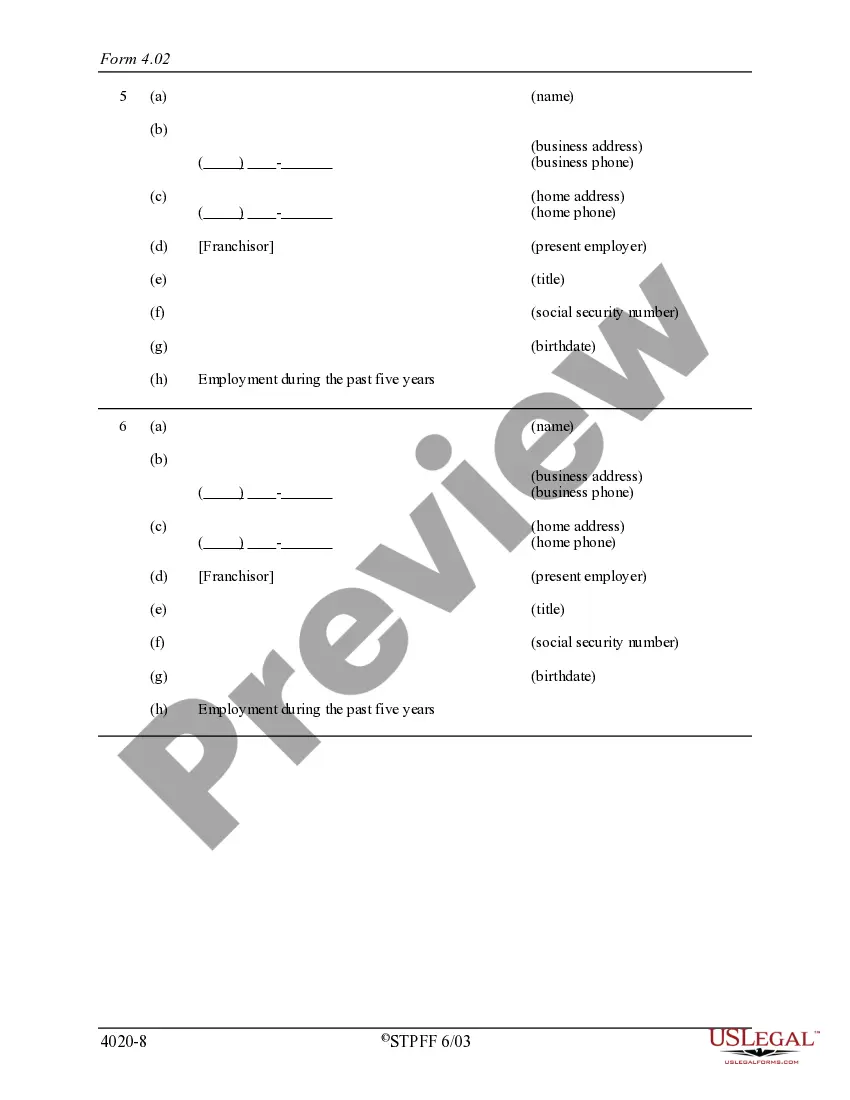

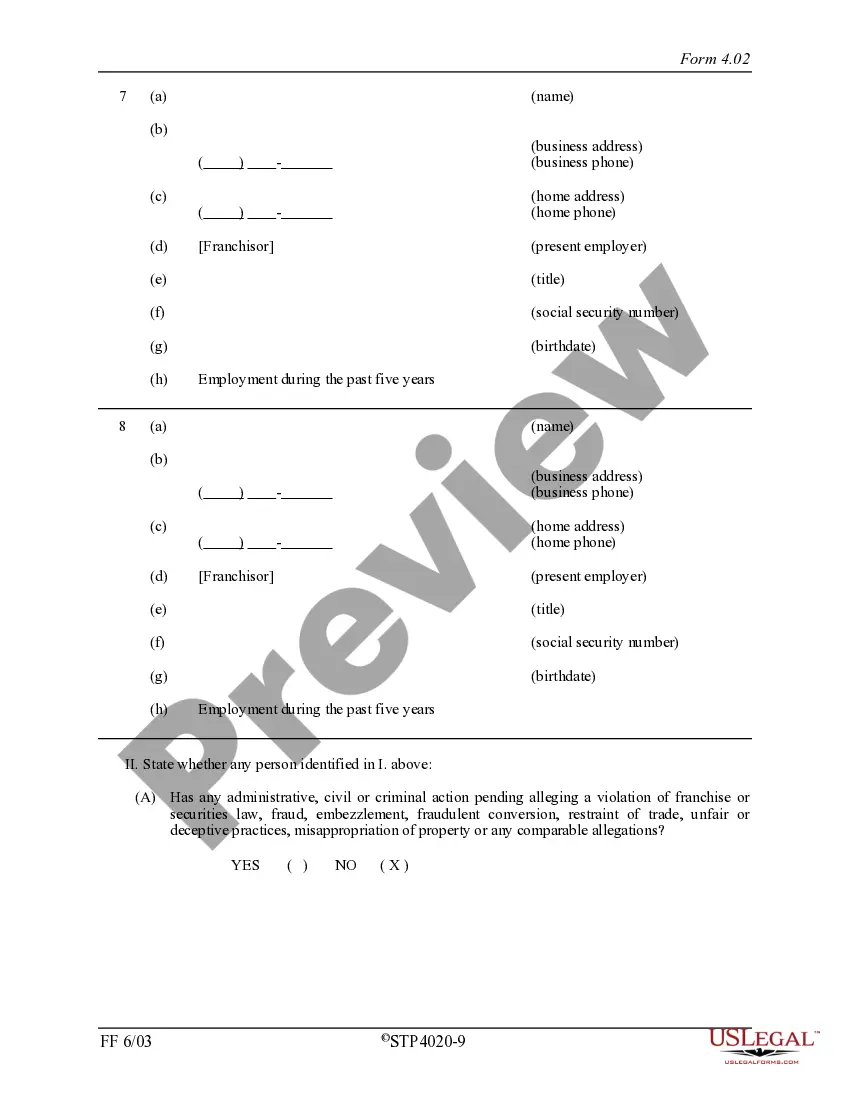

Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement

Description

How to fill out Hawaii Registration For Offer Sale Of Franchise Or Supplemental Report To Registration Statement?

Employ the most comprehensive legal catalogue of forms. US Legal Forms is the best platform for finding up-to-date Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement templates. Our platform offers a large number of legal documents drafted by licensed legal professionals and grouped by state.

To obtain a template from US Legal Forms, users only need to sign up for a free account first. If you are already registered on our platform, log in and choose the template you need and purchase it. After purchasing templates, users can see them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the steps listed below:

- Find out if the Form name you have found is state-specific and suits your needs.

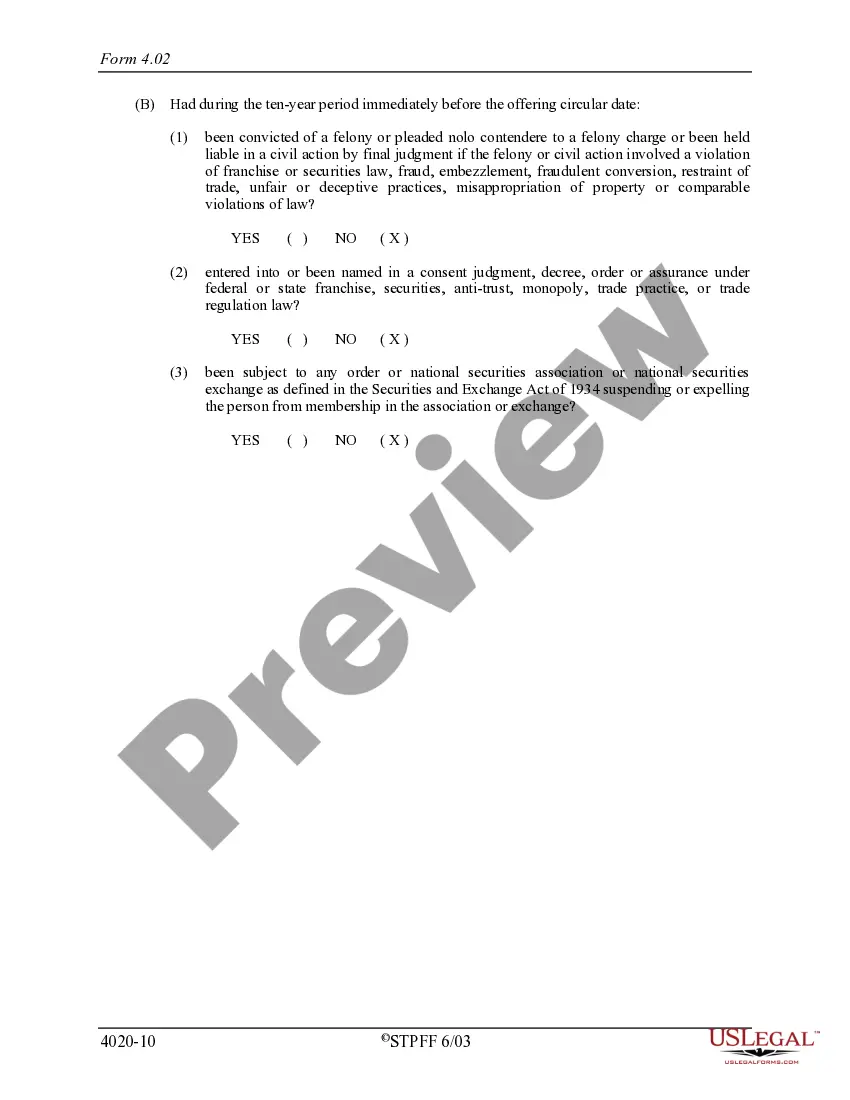

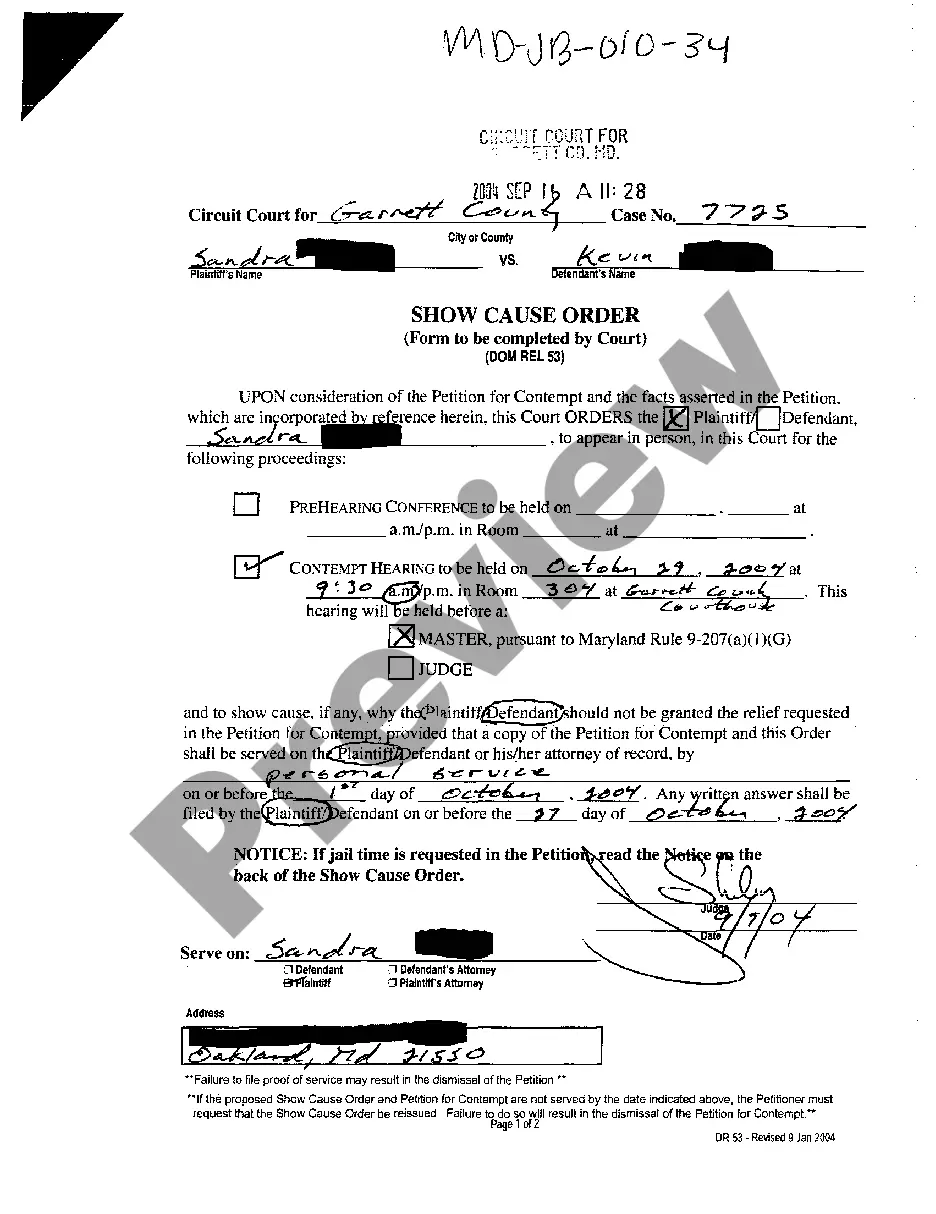

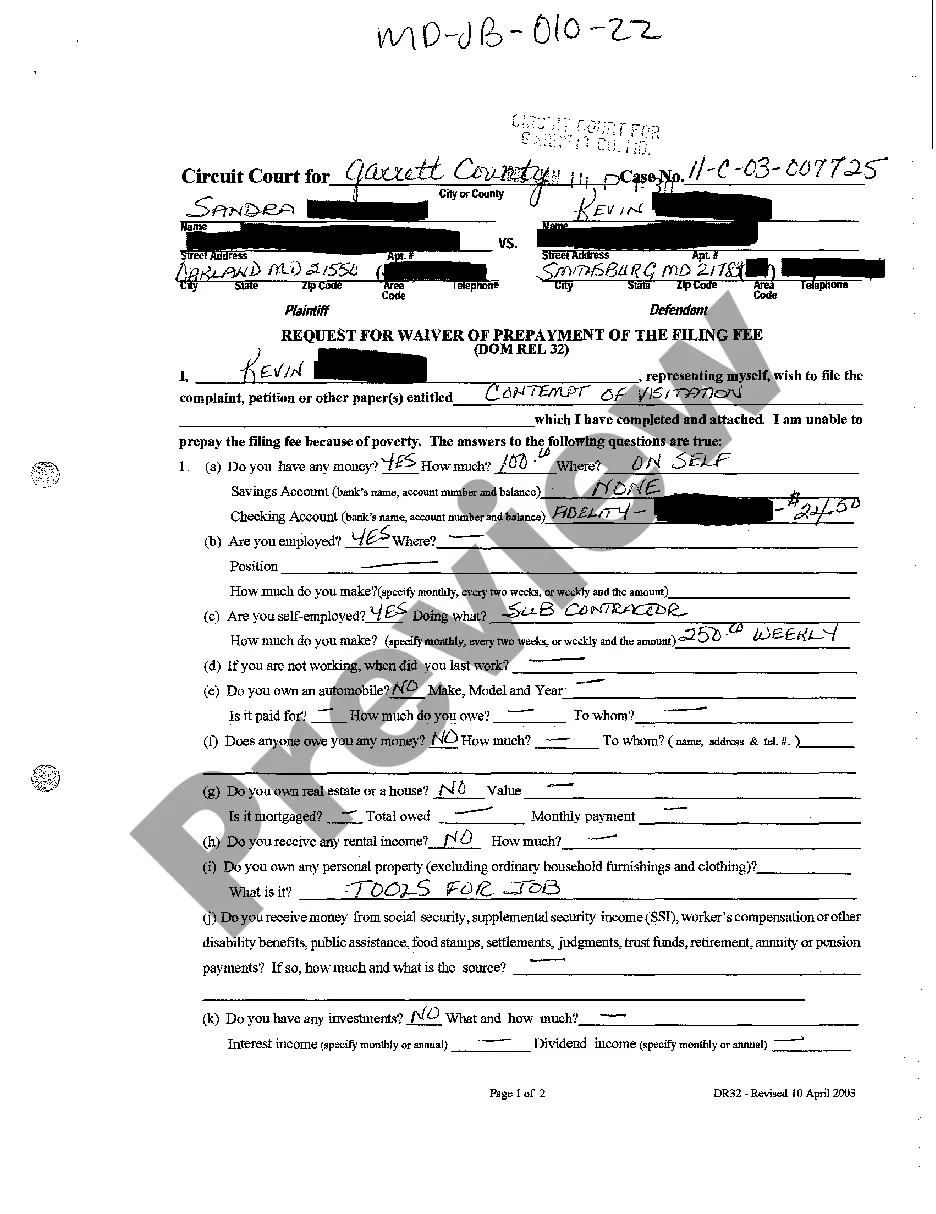

- When the form features a Preview function, use it to review the sample.

- In case the template doesn’t suit you, use the search bar to find a better one.

- PressClick Buy Now if the sample meets your expections.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with yourr credit/bank card.

- Select a document format and download the sample.

- As soon as it’s downloaded, print it and fill it out.

Save your effort and time with our service to find, download, and fill out the Form name. Join a huge number of happy subscribers who’re already using US Legal Forms!

Form popularity

FAQ

The updated franchise tax levies a 1 percent tax on the gross receipts of businesses in Texas (retailers pay a . 5 percent rate), but exempts sole proprietorships and general partnerships. Businesses can elect to deduct either the cost of goods sold or employment costs.

Minimum Franchise Tax An entity that calculates an amount of tax due that is less than $1,000 or that has annualized total revenue less than or equal to $1,180,000 is not required to pay any tax.

The Texas Franchise Tax is calculated on a company's margin for all entities with revenues above $1,110,000. The margin can be calculated in one of the following ways: Total Revenue Multiplied by 70 Percent. Total Revenue Minus Cost of Goods Sold.

XT Numbers: The number begins with the letters XT followed by six digits. They are for filing franchise tax reports, and they are printed in the upper right corner of the notification letter you receive from our office.

The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.Form 05-359, Request for Certificate of Account Status to Terminate a Taxable Entity's Existence in Texas, if needed to terminate the entity with the Secretary of State.

The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.Form 05-359, Request for Certificate of Account Status to Terminate a Taxable Entity's Existence in Texas, if needed to terminate the entity with the Secretary of State.

The Texas Franchise Tax is levied annually by the Texas Comptroller on all taxable entities doing business in the state.Each business in Texas must file an Annual Franchise Tax Report by May 15 each year.

The 2020 annual report is due May 15, 2020. Accounting Period Accounting Year Begin Date: Enter the day after the end date on the previous franchise tax report. For example, if the 2019 annual franchise tax report had an end date of 12-31-18, then the begin date on the 2020 annual report should be 01-01-19.

151.310 and 171.063) The Texas Tax Code provides an exemption from franchise tax and sales tax to: Nonprofit organizations with an exemption from Internal Revenue Service (IRS) under IRC Section 501(c) (3), (4), (8), (10) or (19);