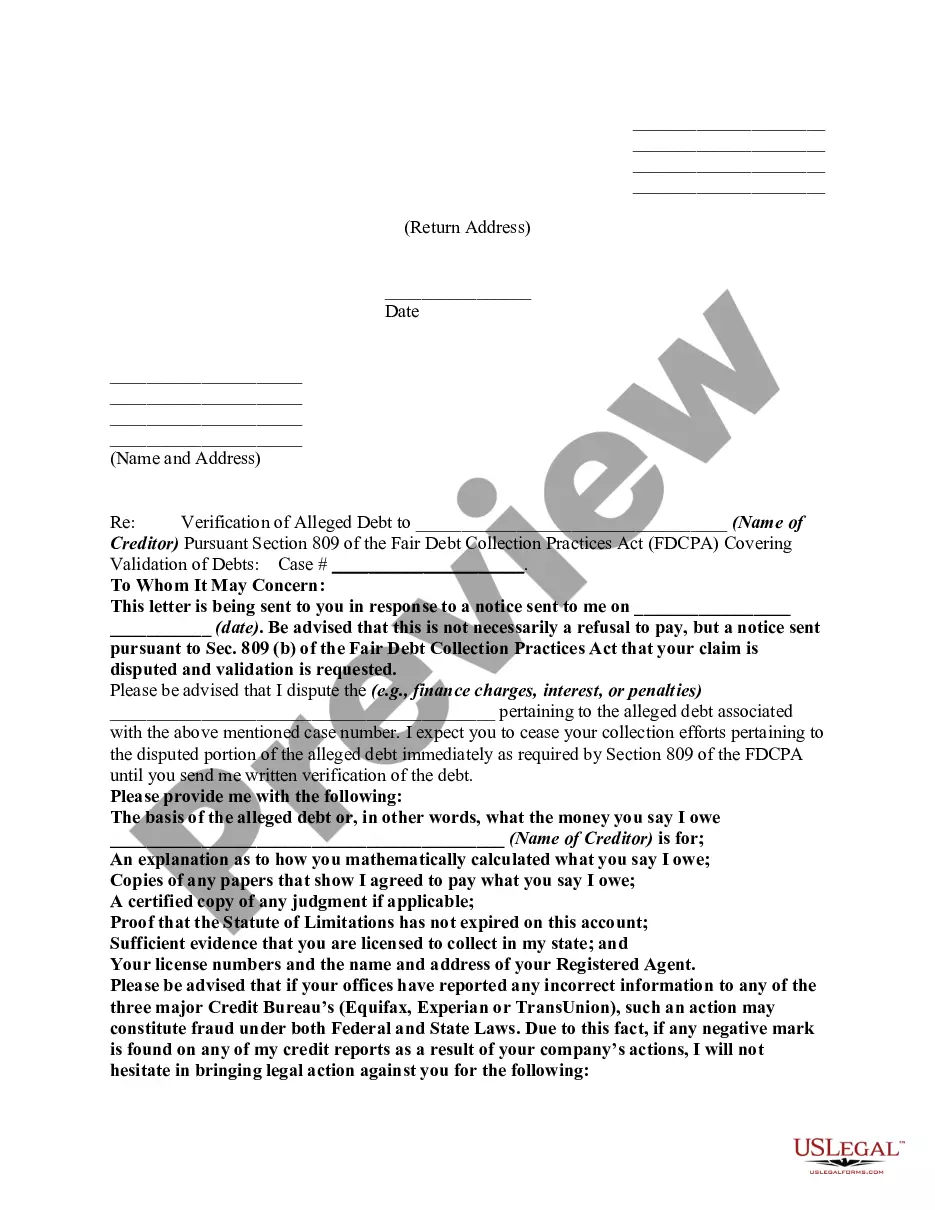

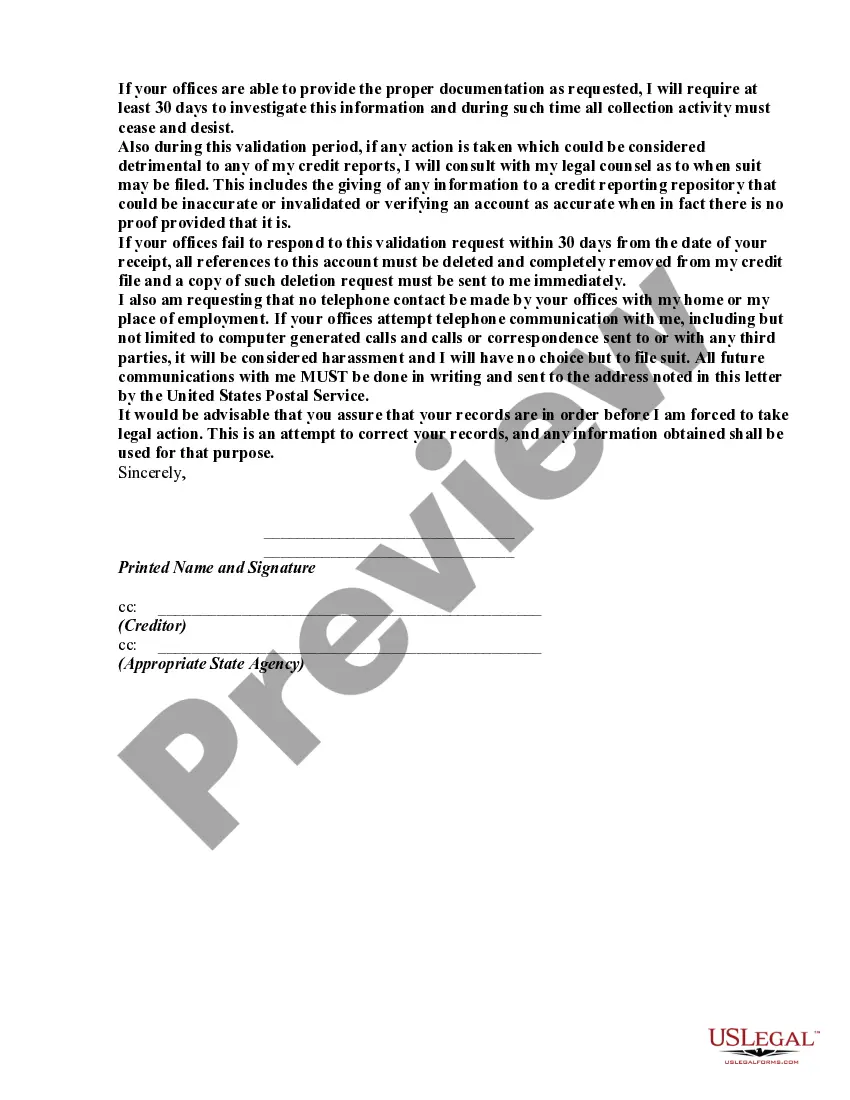

A Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt is a document used to dispute the repayment of any finance charges, interest or penalties which a creditor claims a debtor owes on an alleged debt. This letter may be used to deny or dispute the amount of the alleged debt, or to dispute the existence of the debt all together. There are three main types of letters denying that alleged debtor owes the amount of finance charges, interest or penalties being charged on the alleged debt: 1. Letter Denying Unpaid Debts: This letter is used to deny the claim that the debtor owes any unpaid debts. It outlines the factual reasons why the debt does not exist or why the amount of the alleged debt is not owed. 2. Letter Denying Payment of Interest or Fees: This letter is used to deny the claim that the debtor owes any finance charges, interest or penalties. It outlines the factual reasons why the amount of interest or fees being charged is not owed. 3. Letter Denying Unauthorized Charges: This letter is used to deny the claim that the debtor owes any unauthorized charges. It outlines the factual reasons why the amount of the alleged debt is not owed. These letters denying that alleged debtor owes the amount of finance charges, interest or penalties being charged on the alleged debt should include the debtor's name and address, the creditor's name and address, the date of the letter, a detailed explanation of why the debt is being denied, and a signature from the debtor.

Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt

Description Letter Denying Owes Finance

How to fill out Letter Denying That Alleged Debtor Owes The Amount Of Finance Charges, Interest Or Penalties Being Charged On The Alleged Debt?

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state regulations and are checked by our experts. So if you need to complete Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt, our service is the best place to download it.

Obtaining your Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt from our library is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button after they locate the proper template. Afterwards, if they need to, users can take the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a brief guide for you:

- Document compliance check. You should carefully examine the content of the form you want and make sure whether it satisfies your needs and complies with your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate blank, and click Buy Now when you see the one you want.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and click Download to save it on your device. Print it to fill out your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

WRITING REFUSAL-TO-PAY LETTERS Refusal-to-pay letters are simple to write. The consumer only needs to send a letter to the debt collector stating something like ?I refuse to pay this debt? with the debt amount and account number listed for reference to eliminate confusion.

If you get a summons notifying you that a debt collector is suing you, don't ignore it. If you do, the collector may be able to get a default judgment against you (that is, the court enters judgment in the collector's favor because you didn't respond to defend yourself) and garnish your wages and bank account.

The collection dispute letter to debt collectors should include the following information: Your details ? name, address, official email address, etc. Request for more information about the creditor. Amount of debt owed. A request note to not report the matter to the credit reporting agency until the matter is resolved.

If you receive a notice from a debt collector, it's important to respond as soon as possible?even if you do not owe the debt?because otherwise the collector may continue trying to collect the debt, report negative information to credit reporting companies, and even sue you.

Despite it being against the law, many debt collectors respond to consumers' ?refusal-to-pay? letters. These are letters written by a consumer to a debt collector that state that the consumer will not pay the debt it's trying to collect from them.

Unless you agree to continue accepting my regular payment amount, then per your communication informing me that you refuse to accept my payments, you leave me no choice but to terminate this relationship. For the record, do not contact me by phone on any number ever again regarding this account.

Your debt will go to a collection agency. Debt collectors will contact you. Your credit history and score will be affected. Your debt will probably haunt you for years.

How to Write a Debt Verification Letter Determine the exact amounts you owe. Gather documents that verify your debt. Get information on who you owe. Determine how old the debt is. Place a pause on the collection proceedings.