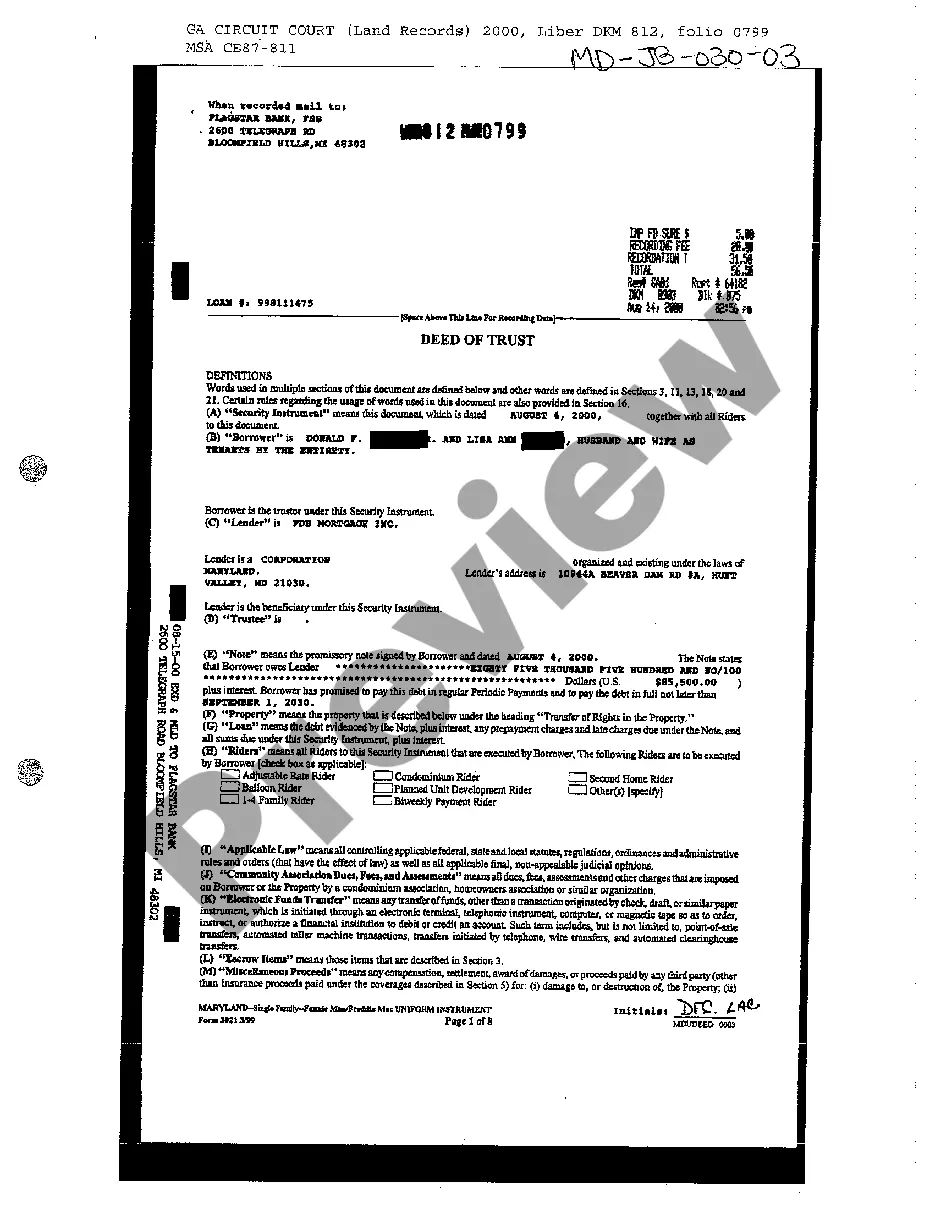

Multistate Fannie Mae Assignment of Mortgage — Single Family is a legal document used to transfer ownership of a mortgage from one party to another. The document is used when a lender (Fannie Mae) is selling or transferring an existing mortgage to another lender. It outlines the terms of the transaction, including the amount of the mortgage, the interest rate, and the loan terms, as well as the rights and responsibilities of the parties involved. The document also states the conditions under which the mortgage may be transferred. There are two types of Multistate Fannie Mae Assignment of Mortgage — Single Family: the standard assignment and the specialized assignment. The standard assignment is used for standard residential mortgages and includes all the necessary terms and conditions of the transfer. The specialized assignment is for specific types of mortgages, such as adjustable rate mortgages, balloon mortgages, and other types of mortgages with special terms.

Multistate Fannie Mae Assignment of Mortgage - Single Family

Description

How to fill out Multistate Fannie Mae Assignment Of Mortgage - Single Family?

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them correspond with federal and state regulations and are verified by our experts. So if you need to complete Multistate Fannie Mae Assignment of Mortgage - Single Family, our service is the perfect place to download it.

Getting your Multistate Fannie Mae Assignment of Mortgage - Single Family from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they find the correct template. Later, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a quick guideline for you:

- Document compliance verification. You should attentively examine the content of the form you want and make sure whether it satisfies your needs and complies with your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab above until you find an appropriate template, and click Buy Now when you see the one you need.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Multistate Fannie Mae Assignment of Mortgage - Single Family and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.

Assignment of Mortgage ? The Basics. When your original lender transfers your mortgage account and their interests in it to a new lender, that's called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner.

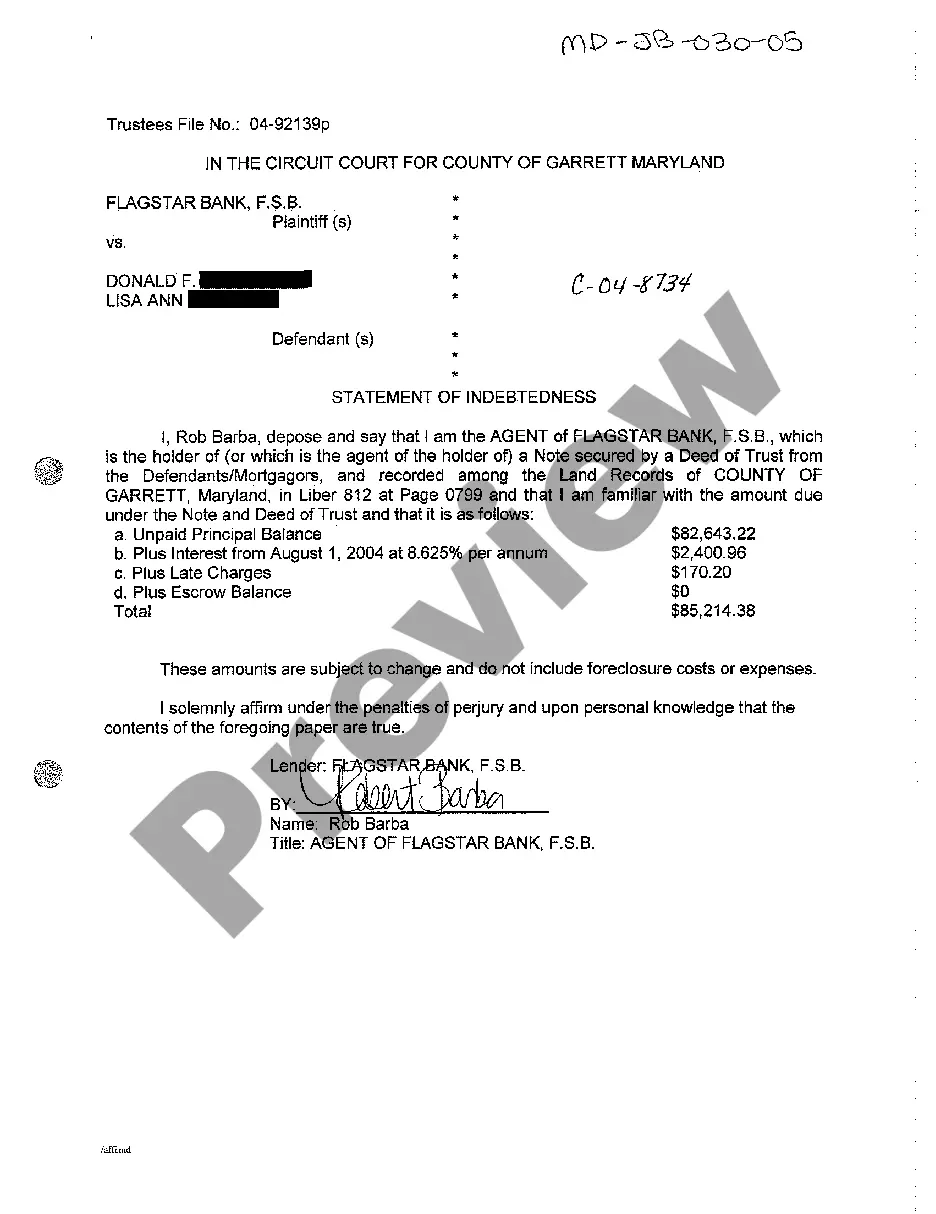

If the mortgagee fails to execute and record a Satisfaction of Mortgage within the 60-day period afforded by statute, the mortgagor (property owner) may file suit and seek a court order directing the mortgagee to execute a satisfaction of mortgage or an order extinguishing the lien against the property.

Legally, the term ?mortgage? refers only to the document that states that the home can be sold in case of default. Under an assignment of mortgage, both documents are transferred to their new owner for servicing.

Once a loan has been assigned to MERS, it can be bought and sold any number of times later without recording assignments. Don't be surprised if you find out that your mortgage was assigned to MERS at some point. In most cases, the loan will have to be assigned out of MERS' name before a foreclosure can begin.

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.