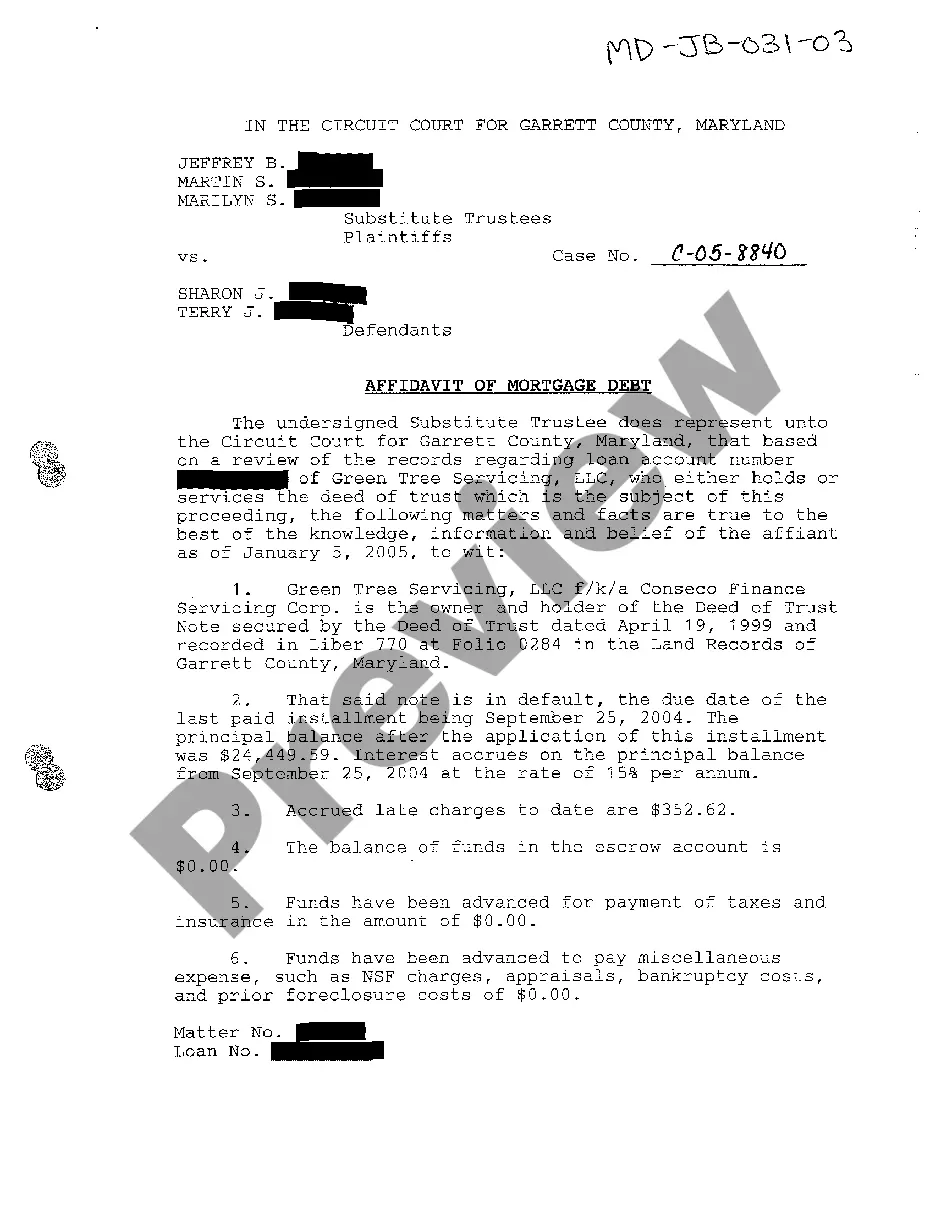

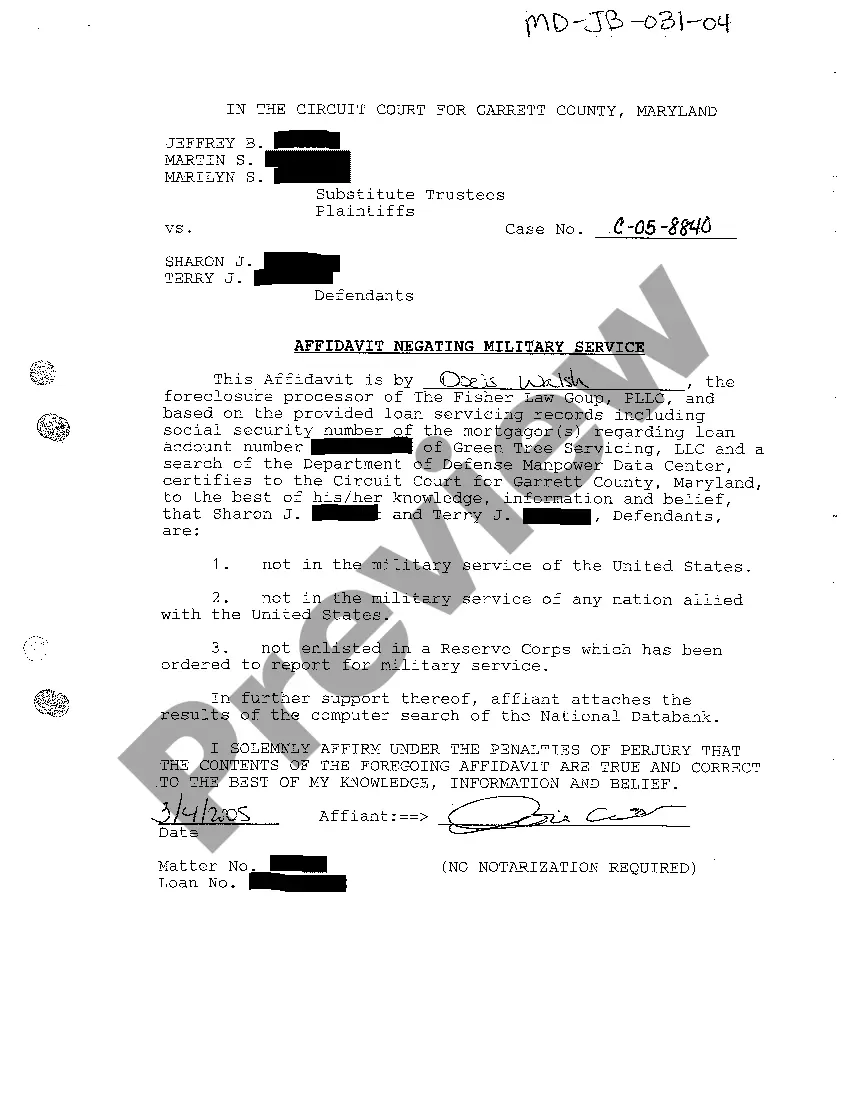

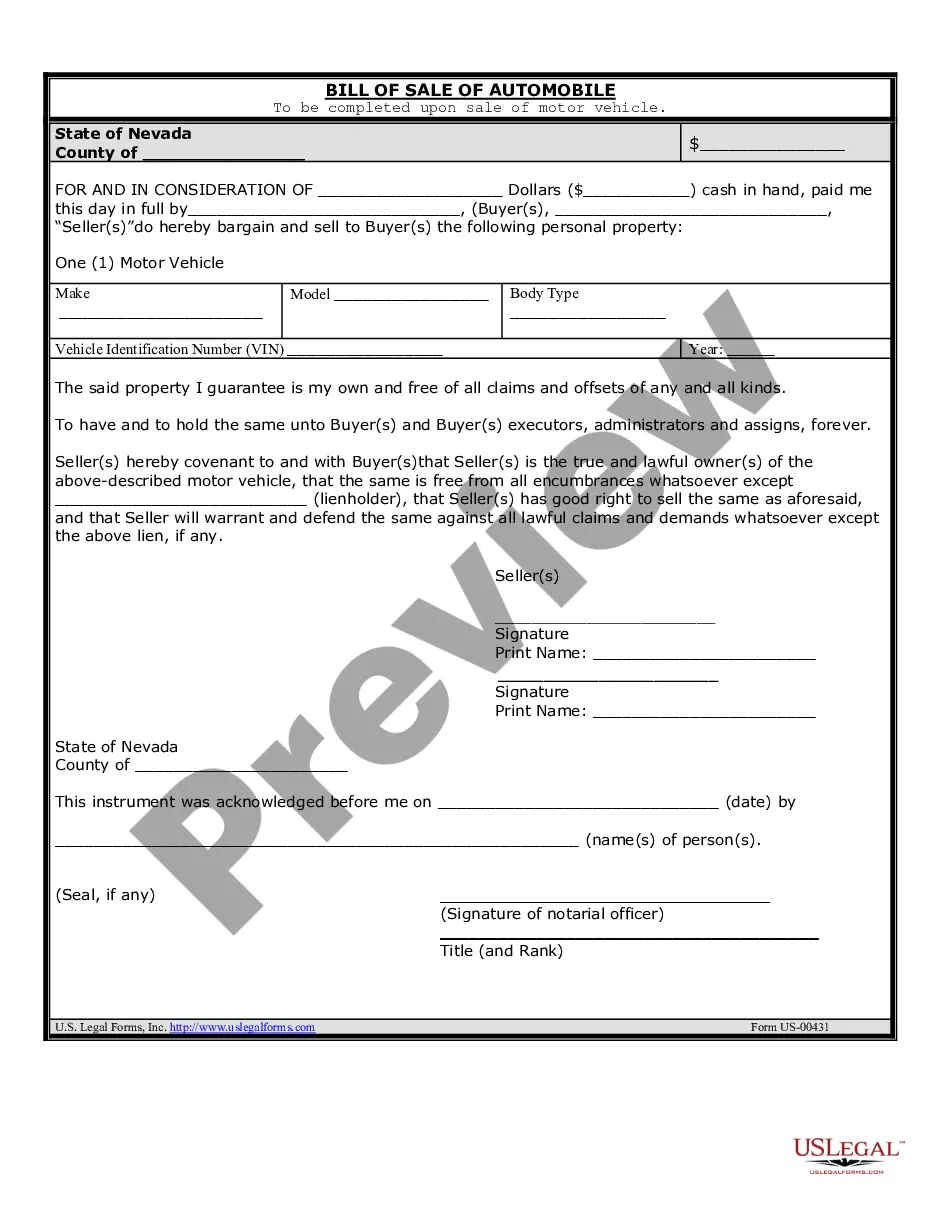

Multistate Fannie Mae Assignment of Deed of Trust with Property Description — Single Family is a document that is used to transfer the title for a single-family residential property from a lender to Fannie Mae. This document outlines the details of the transfer of ownership, such as the property address, the amount of the loan, the date of the transfer, and the name of the lender. This document must be signed by both the lender and Fannie Mae in order to be legally binding. There are two types of Multistate Fannie Mae Assignment of Deed of Trust with Property Description — Single Family: "Warranty Deed" and "Quitclaim Deed". A Warranty Deed is a type of deed that guarantees that the title is valid and free of any liens or encumbrances. The seller warrants that they are the rightful owner of the property and have the right to transfer the title. A Quitclaim Deed is a type of deed that transfers the property without any warranties or guarantees. The granter relinquishes all rights to the property, but does not guarantee that the title is valid or free of any liens or encumbrances.

Multistate Fannie Mae Assignment of Deed of Trust with Property Description - Single Family

Description

How to fill out Multistate Fannie Mae Assignment Of Deed Of Trust With Property Description - Single Family?

How much time and resources do you often spend on drafting formal paperwork? There’s a better way to get such forms than hiring legal experts or spending hours searching the web for an appropriate blank. US Legal Forms is the premier online library that offers professionally drafted and verified state-specific legal documents for any purpose, like the Multistate Fannie Mae Assignment of Deed of Trust with Property Description - Single Family.

To acquire and complete a suitable Multistate Fannie Mae Assignment of Deed of Trust with Property Description - Single Family blank, adhere to these simple instructions:

- Look through the form content to make sure it complies with your state regulations. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your requirements, find another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Multistate Fannie Mae Assignment of Deed of Trust with Property Description - Single Family. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally secure for that.

- Download your Multistate Fannie Mae Assignment of Deed of Trust with Property Description - Single Family on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously acquired documents that you securely keep in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trusted web services. Sign up for us today!

Form popularity

FAQ

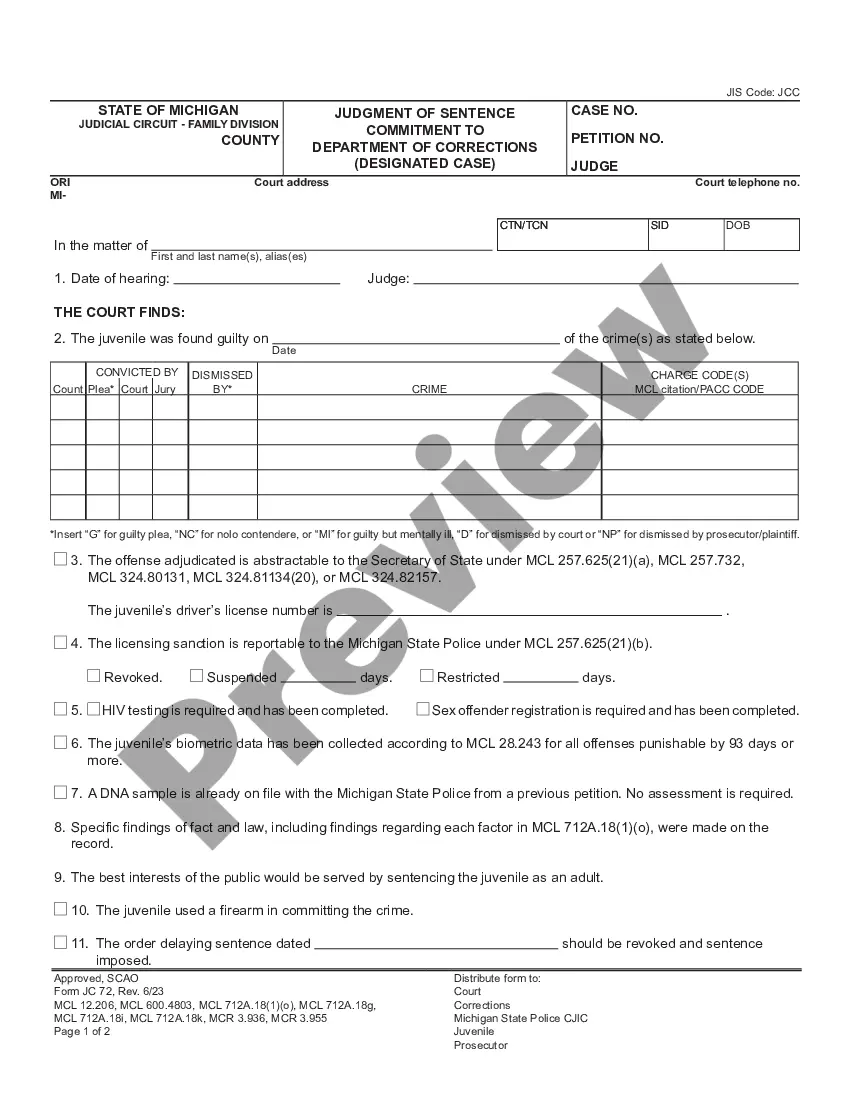

1-4 Family Rider. A 1-4 Family Rider is typically required for multifamily investment properties with up to four units or two-to-four unit properties that are owner-occupied. This type of rider permits the lender to collect rent from the property if you default on the loan.

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.

In the deed of trust vs mortgage conversation, this is a key differentiator. Mortgages don't loop in the third party; the agreement is just between the lender and the borrower. With a deed of trust, the lender gives the borrower the funds to make the home purchase.

Business start-up and personal asset protection services. StateMortgage StateDeed of Trust StateCaliforniaYColoradoYConnecticutYDelawareY47 more rows

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

Assignment of Note and Deed of Trust means an assignment of all of the Participating Lending Institution's right, title, and interest in a Note and Deed of Trust, in substantially the form provided in the applicable Lender's Manual.

Deeds of trust and mortgages are both used in bank and private loans for creating liens on real estate?that is, establishing a property as collateral for a loan.

?They both give the lender the right to sell the home through a foreclosure if you default on the loan. Both deeds of trusts and mortgages are: Agreements to exchange home loan proceeds for a borrower's agreement to repay the loan. Agreements that use the home as collateral during the repayment period.