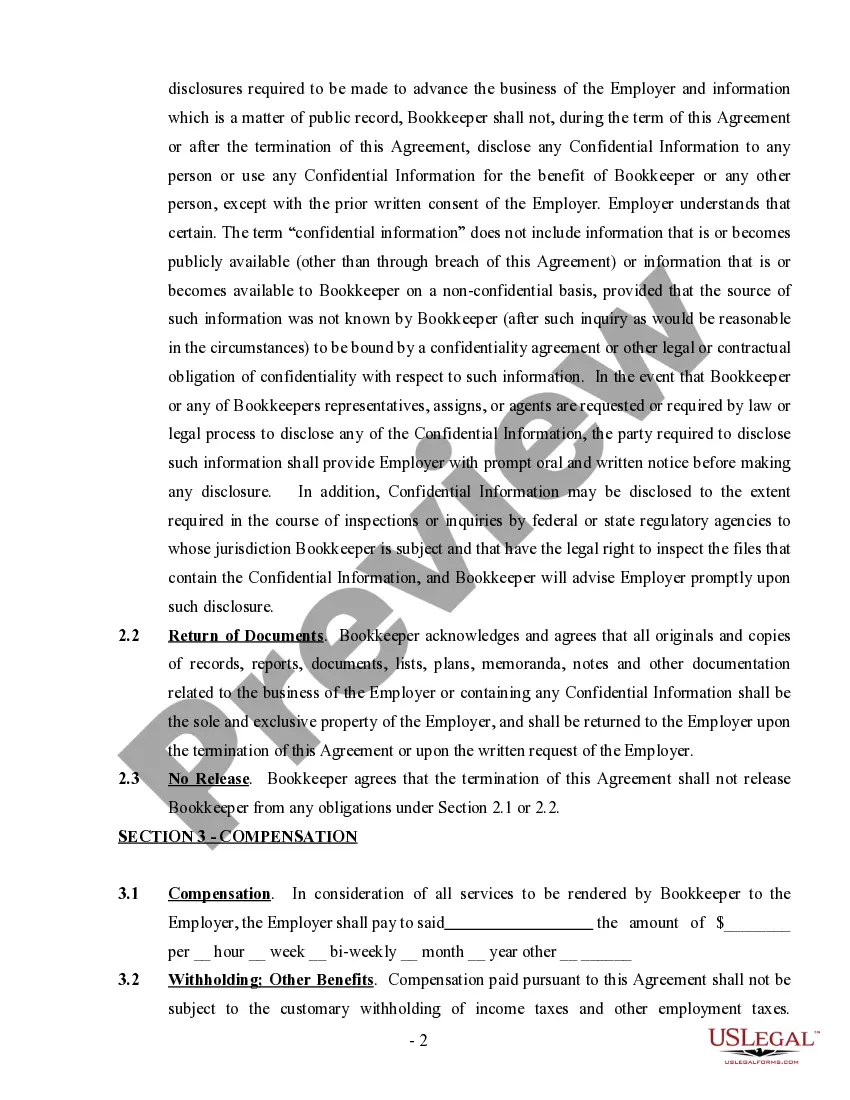

Bookkeeping Agreement is a legally binding contract between a bookkeeper and their client, outlining the scope of services, fees, and any additional terms and conditions related to the bookkeeping services. It defines the roles and responsibilities of each party and outlines the payment terms for the bookkeeper’s services. Types of Bookkeeping Agreement include: 1. Fixed Fee Bookkeeping Agreement: This type of agreement sets a fixed rate for the bookkeeping services, regardless of the hours worked. 2. Hourly Rate Bookkeeping Agreement: This type of agreement requires the bookkeeper to track their hours and bill the client an hourly rate for their services. 3. Retainer Bookkeeping Agreement: This type of agreement requires the client to pay a set fee for a period of time, regardless of the hours worked. 4. Project-based Bookkeeping Agreement: This type of agreement outlines a specific project with a predetermined fee for completion.

Bookkeeping Agreement

Description

How to fill out Bookkeeping Agreement?

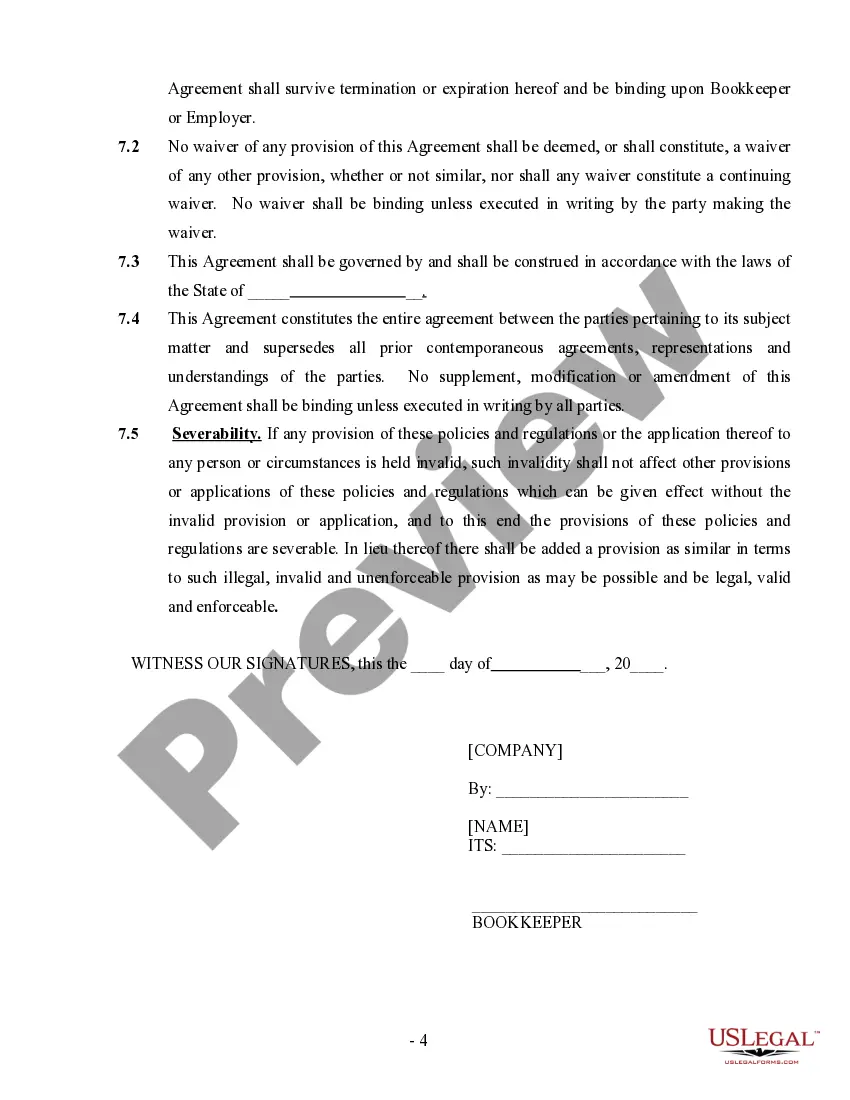

Coping with official documentation requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Bookkeeping Agreement template from our service, you can be sure it meets federal and state laws.

Working with our service is straightforward and fast. To obtain the necessary document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to find your Bookkeeping Agreement within minutes:

- Make sure to carefully examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative official blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Bookkeeping Agreement in the format you need. If it’s your first experience with our website, click Buy now to proceed.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are created for multi-usage, like the Bookkeeping Agreement you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

Yes, the company should send you a 1099. Its easy to forget to include yourself when you're doing the books! All you need to do is print out a blank form 1099 (from IRS.gov), fill it out, check the "Corrected" box, and mail to the IRS.....and keep your copy of course!

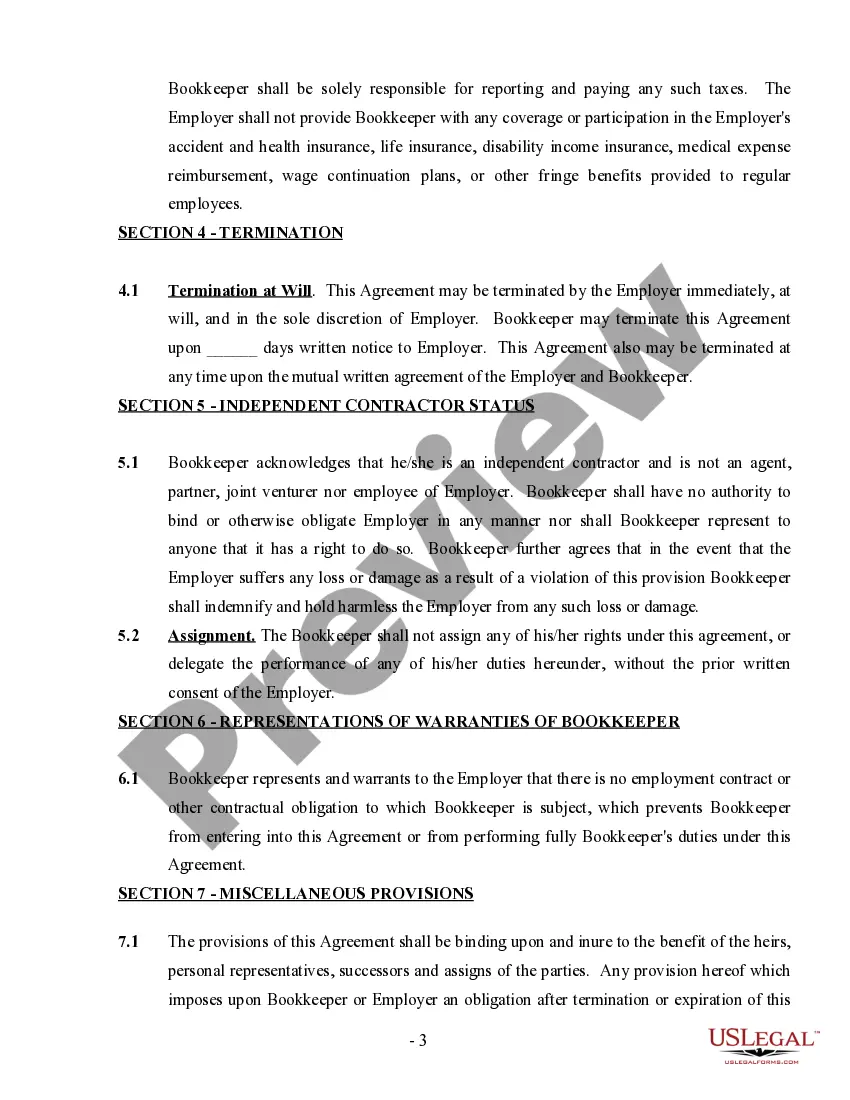

What Is an Independent Contractor Agreement for Accountant? An independent contractor agreement for accountant and bookkeeper is an important document to determine, for tax purposes, that the worker is not an employee of the company.

Bookkeeping is a direct record of all purchases and sales your business conducts, while accounting is a subjective look at what that data means for your business. An accountant can be considered a bookkeeper, but a bookkeeper can't be an accountant without proper certification.

How to Find Your First 10 Accounting Clients Ask Friends and Family for Referrals.Use Online Ratings and Review Sites.Focus on a Niche.Get Involved with Social Media Groups.Target Startup Businesses.Embrace Content Marketing.Partner With Other Professionals.Arrange for Barter.

What is a Bookkeeping Contract? A Bookkeeping Contract enables a bookkeeper to outline the terms of an arrangement with a client. Signed by both the client and the bookkeeper, this essential document helps to set expectations and reduce the risk of conflicts.

This legal contract usually includes information regarding the scope of the work, payment, and deadlines. The agreement might also provide guidance regarding any confidentiality requirements, insurance, and indemnification. Independent contractor agreements go by many names, including: Independent Contractor Contracts.

How to Write 1 ? Access The Services Agreement Template On This Page.2 ? The Accountant And Client Must Be Fully Identified.3 ? Define The Accounting Services That Will Be Provided.4 ? Record The Agreed Upon Compensation For The Accountant's Services.5 ? Report The When ANd Where This Agreement Is Effective.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.