Overtime Report

Description

How to fill out Overtime Report?

Among lots of free and paid examples that you find on the web, you can't be sure about their reliability. For example, who made them or if they’re competent enough to deal with what you need these to. Keep relaxed and use US Legal Forms! Get Overtime Report templates created by professional attorneys and avoid the costly and time-consuming procedure of looking for an lawyer or attorney and then paying them to write a papers for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the file you are looking for. You'll also be able to access your earlier downloaded examples in the My Forms menu.

If you are utilizing our platform for the first time, follow the instructions below to get your Overtime Report with ease:

- Ensure that the document you find is valid in your state.

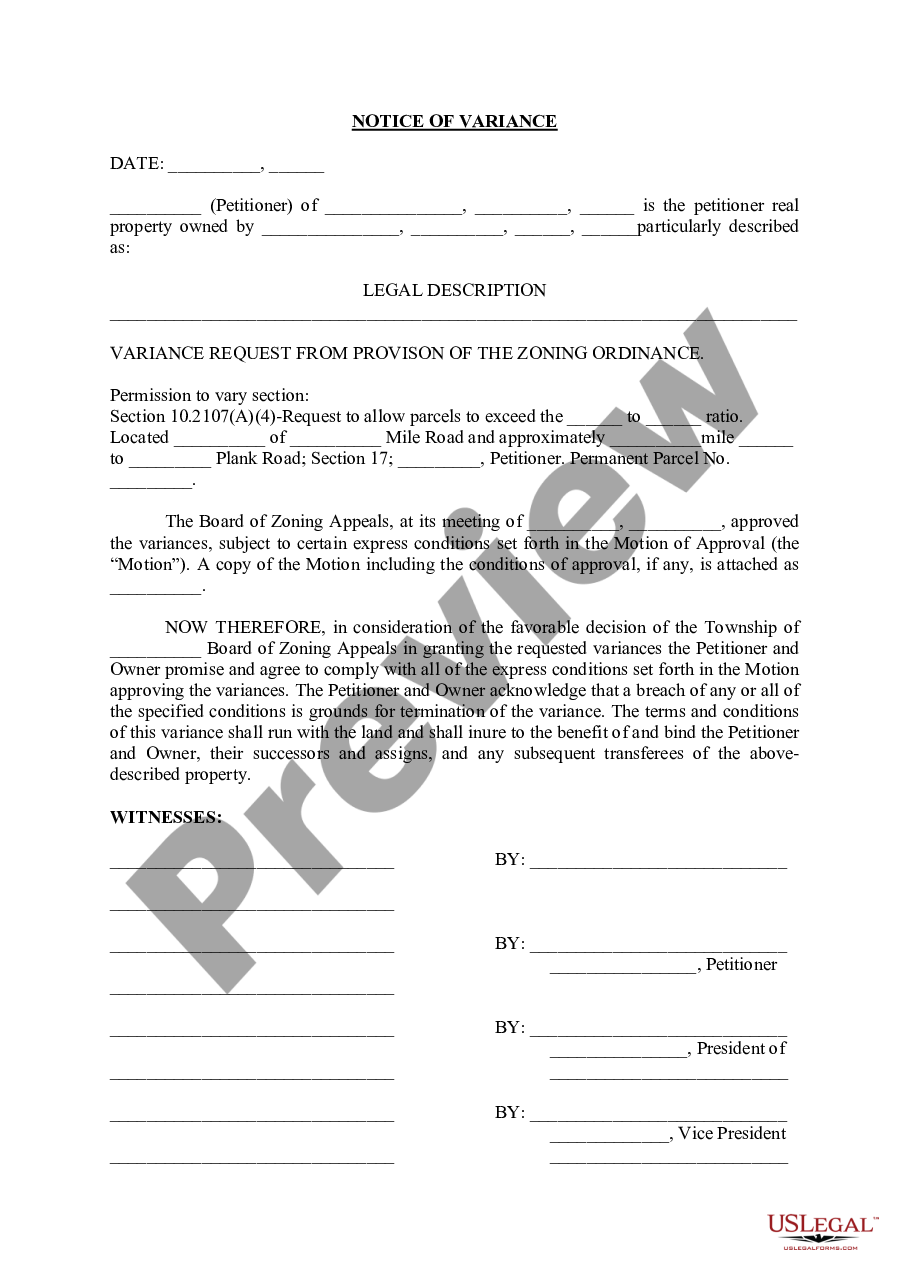

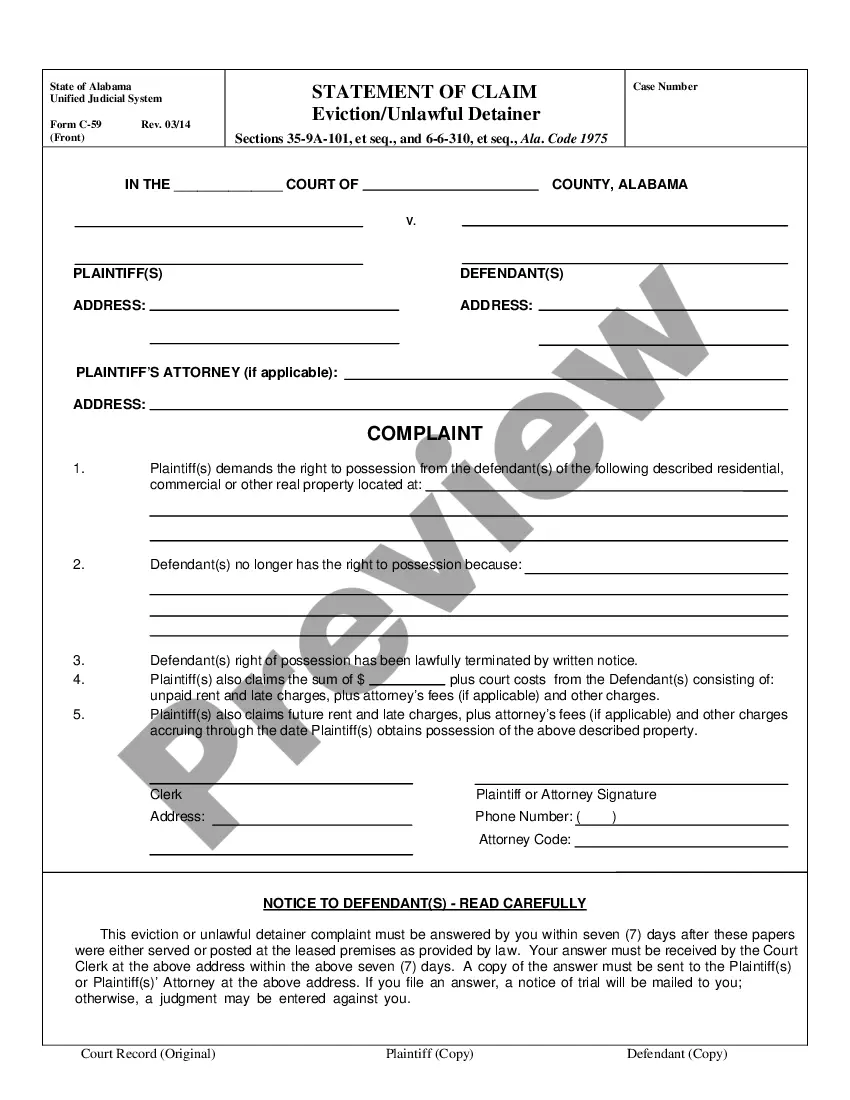

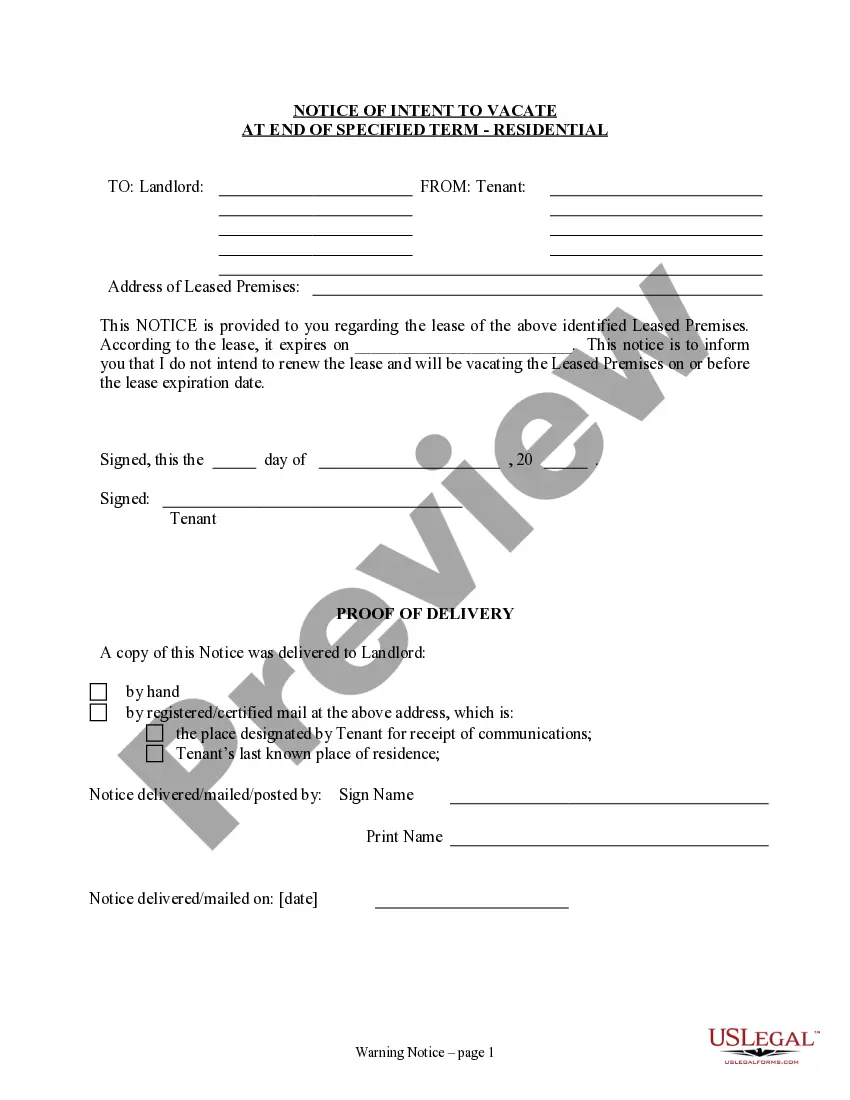

- Review the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering process or find another sample using the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

When you have signed up and purchased your subscription, you can use your Overtime Report as often as you need or for as long as it stays valid where you live. Revise it in your favorite offline or online editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Overtime Alberta GuidelinesAlberta requires that you pay overtime after 44 hours worked in a week, rather than the typical 40. Alberta does abide by the eight-hour workday rule, so any additional time after eight hours must be compensated by 1.5 times the employee's normal pay.

Overtime. extra hours of work undertaken by an employee that are additional to the number of hours specified as constituting the 'basic' working week, and for which employees are paid a WAGE RATE higher than the 'basic' wage.

Under the weekly overtime law, overtime must be paid for any hours worked over 40 in the workweek at the rate of one and one half times the regular rate of pay. Simply count all hours worked for the entire workweek. If the employee worked 40 or fewer hours that week, he or she has zero weekly overtime hours that week.

FLSA overtime pay for nonexempt employees is computed based on all the time the employee has actually worked in a work week. All time actually worked counts, but only time "actually" worked counts.

In California, the general overtime provisions are that a nonexempt employee 18 years of age or older, or any minor employee 16 or 17 years of age who is not required by law to attend school and is not otherwise prohibited by law from engaging in the subject work, shall not be employed more than eight hours in any

The 8 and 80 exception allows employers to pay one and one-half times the employee's regular rate for all hours worked in excess of 8 in a workday and 80 in a fourteen-day period.

Overtime pay is calculated: Hourly pay rate x 1.5 x overtime hours worked. Here is an example of total pay for an employee who worked 42 hours in a workweek: Regular pay rate x 40 hours = Regular pay, plus. Regular pay rate x 1.5 x 2 hours = Overtime pay, equals.

Employee Overtime: Hours, Pay and Who is Covered. The Fair Labor Standards Act (FLSA) states that any work over 40 hours in a 168 hour period is counted as overtime, since the average American work week is 40 hours - that's eight hours per day for five days a week.

Identify currently exempt employees who earn less than the new annual threshold of $47,476. Estimate how much overtime those employees currently work. Analyze your budget to help assess your compensation options. Review job descriptions for exempt positions to verify that the duties are accurately listed.