Approbation of New Credit Account is the process of approving a customer's application for a new credit account. This process involves verifying the customer's identity, credit history, and financial information, as well as assessing the customer's ability to manage the credit account responsibly. Once an application is approved, the customer will receive an approval letter from the credit provider that outlines the terms and conditions of the credit account. There are two main types of Approbation of New Credit Account: automated and manual. Automated approval occurs when a credit provider uses software to analyze a customer's credit report and other financial information and make a decision about whether to approve the application. Manual approval involves a credit provider reviewing the customer's application manually and making a decision about whether to approve or decline the application.

Approbation of New Credit Account

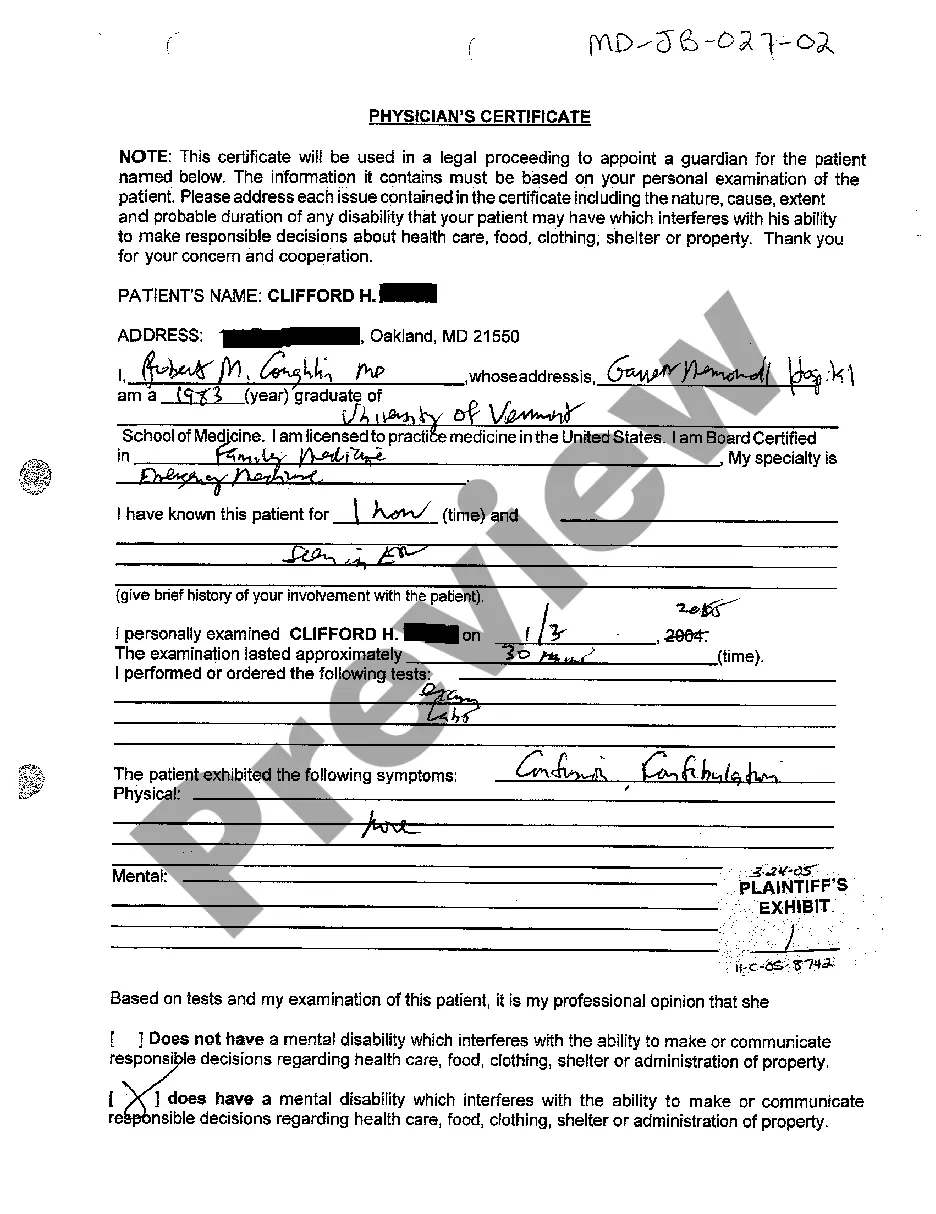

Description

How to fill out Approbation Of New Credit Account?

US Legal Forms is the most straightforward and cost-effective way to locate appropriate formal templates. It’s the most extensive online library of business and personal legal paperwork drafted and checked by legal professionals. Here, you can find printable and fillable templates that comply with federal and local regulations - just like your Approbation of New Credit Account.

Obtaining your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Approbation of New Credit Account if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make certain you’ve found the one corresponding to your demands, or locate another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your Approbation of New Credit Account and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more proficiently.

Take full advantage of US Legal Forms, your reliable assistant in obtaining the corresponding official paperwork. Give it a try!