Employee Payroll Record

Description Employee Record File

How to fill out Payroll Record Blank?

Among hundreds of free and paid templates that you’re able to find on the web, you can't be certain about their reliability. For example, who created them or if they are qualified enough to take care of what you need these people to. Always keep relaxed and use US Legal Forms! Discover Employee Payroll Record templates developed by professional legal representatives and get away from the costly and time-consuming procedure of looking for an lawyer and after that paying them to write a document for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button next to the file you’re looking for. You'll also be able to access all your previously saved templates in the My Forms menu.

If you are using our service the very first time, follow the tips below to get your Employee Payroll Record fast:

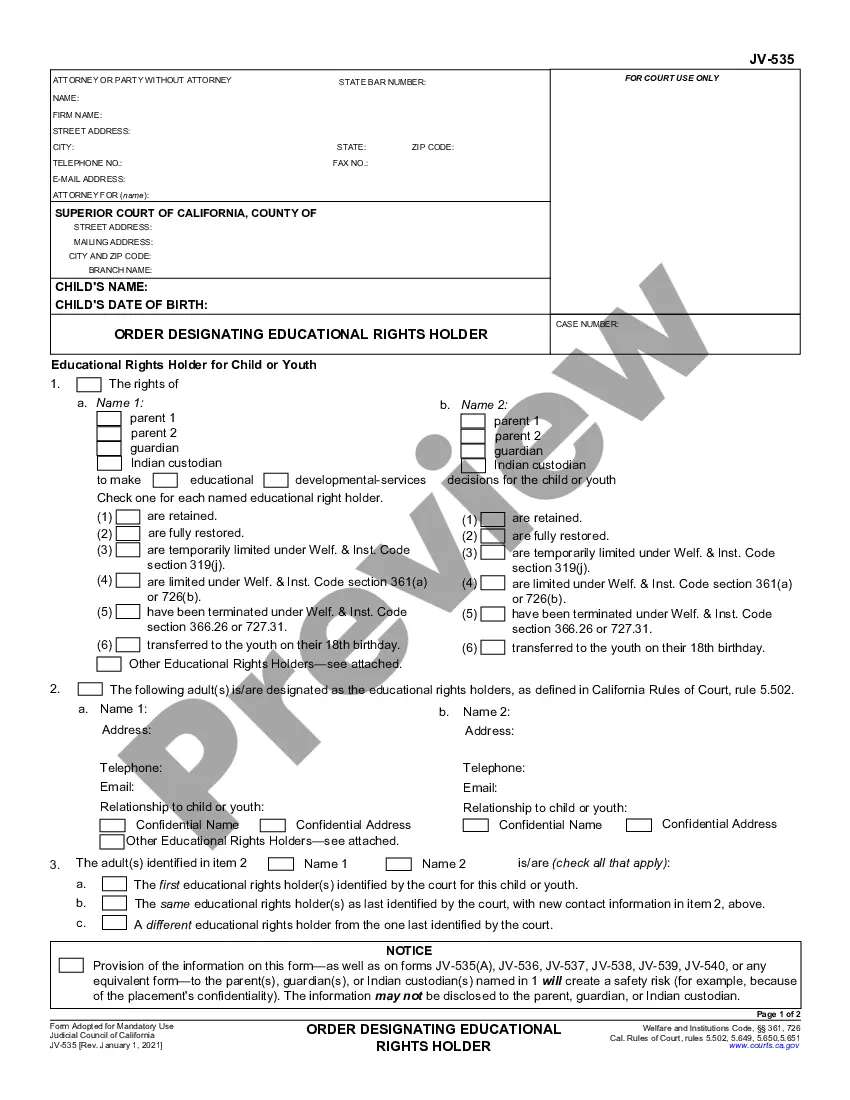

- Make sure that the file you discover applies in the state where you live.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to start the purchasing process or look for another sample using the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

When you’ve signed up and paid for your subscription, you may use your Employee Payroll Record as many times as you need or for as long as it continues to be active where you live. Revise it in your preferred editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Employee Record Template Form popularity

Employee Payroll Record Form Other Form Names

Payroll Record Sample FAQ

Payroll records are a form of documentation which must be maintained by an employer for all individuals in the workplace. This includes the number of hours worked, average pay rates, and deductions for each employee.

Go to the Reports menu. Find the Payroll section, then Payroll Summary by Employee. Set a date range from the dropdown. Select the single employee or group of employees. Choose how you'd like your columns to be viewed by (by employee, weekly, bi-weekly, etc).

Step 1: Have all employees complete a W-4 form. Step 2: Find or sign up for Employer Identification Numbers. Step 3: Choose your payroll schedule. Step 4: Calculate and withhold income taxes. Step 5: Pay payroll taxes. Step 6: File tax forms & employee W-2s.

Step 1: Have all employees complete a W-4 form. Step 2: Find or sign up for Employer Identification Numbers. Step 3: Choose your payroll schedule. Step 4: Calculate and withhold income taxes. Step 5: Pay payroll taxes. Step 6: File tax forms & employee W-2s.

Whether you use paper, electronic files or both, consistency is the key to effective recordkeeping. For example, if your hiring records are sorted by employee name, organize payroll records the same way. Keep the same system across all types of records, and make sure your file folders have accurate, uniform names.

What is a payroll report? A payroll report is a form you use to notify governments of employment tax liabilities.You must report both the taxes you withhold from employee wages and the taxes you contribute to. And, you'll need to submit payroll reports for both federal and state taxes.

These records include records of wages paid, bonuses, and payments made to benefit accounts. Keep records that wage computations are based on for at least two years. These records include time cards, work and time schedules, and records of additions to or deductions from wages.

Total wages paid each pay period. 14. Date of payment and the pay period covered by the payment. How Long Should Records Be Retained: Each employer shall preserve for at least three years payroll records, collective bargaining agreements, sales and purchase records.