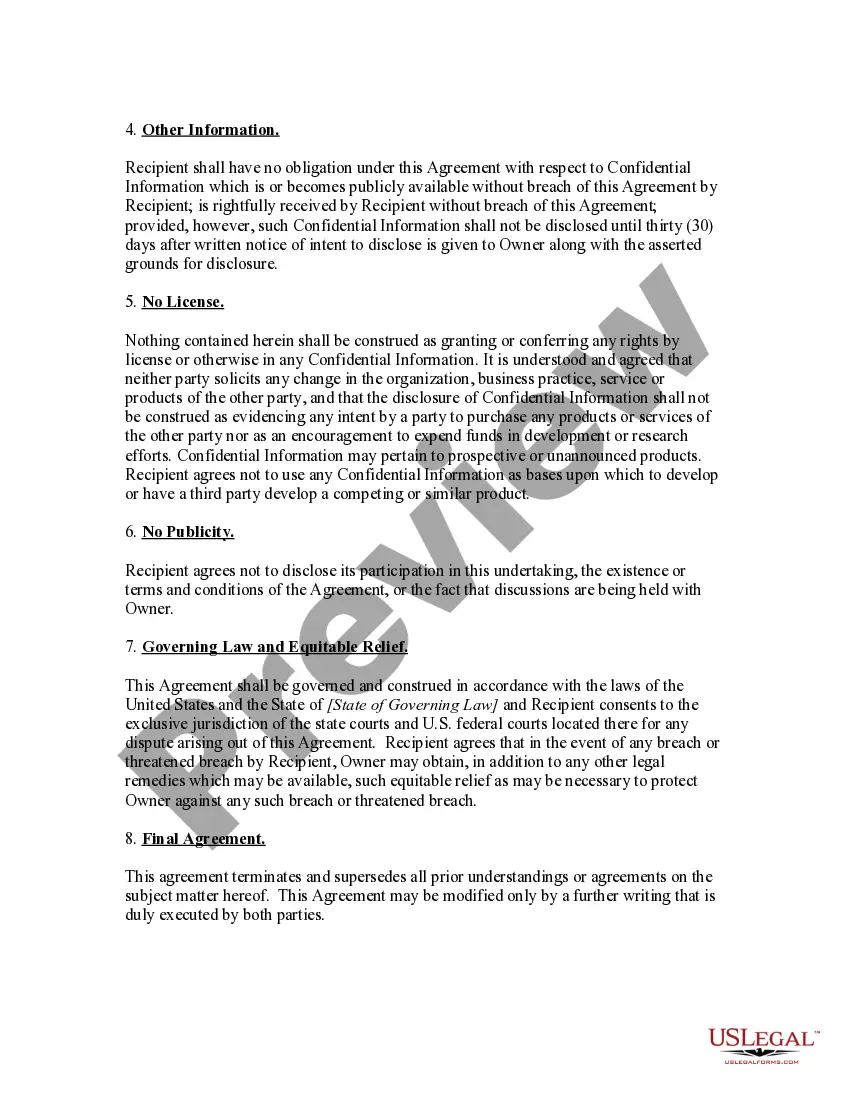

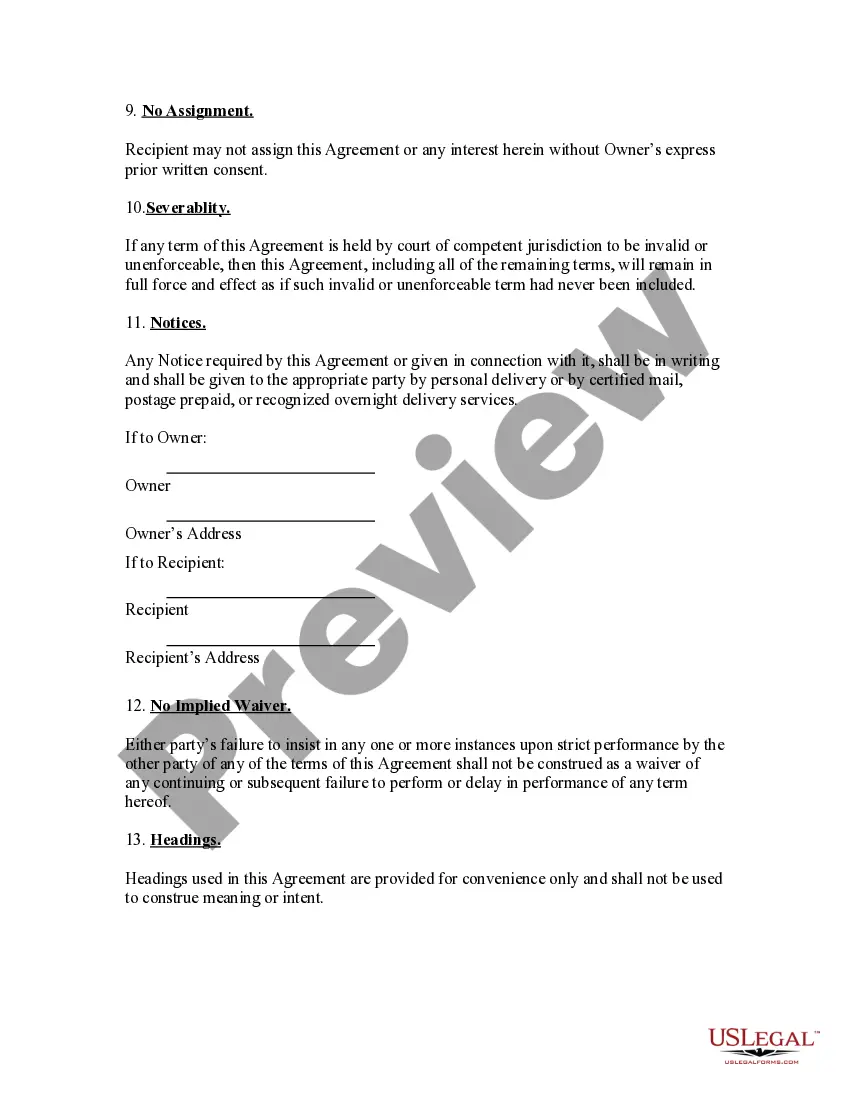

Confidentiality Agreement for Independent Contractors

Description

How to fill out Confidentiality Agreement For Independent Contractors?

Use US Legal Forms to get a printable Confidentiality Agreement for Independent Contractors. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most comprehensive Forms catalogue on the web and provides cost-effective and accurate samples for consumers and legal professionals, and SMBs. The templates are grouped into state-based categories and some of them can be previewed prior to being downloaded.

To download samples, customers must have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For those who do not have a subscription, follow the tips below to quickly find and download Confidentiality Agreement for Independent Contractors:

- Check out to ensure that you have the proper template in relation to the state it’s needed in.

- Review the document by reading the description and using the Preview feature.

- Click Buy Now if it’s the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Use the Search engine if you want to get another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Confidentiality Agreement for Independent Contractors. Over three million users already have utilized our platform successfully. Choose your subscription plan and obtain high-quality forms in a few clicks.

Form popularity

FAQ

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Employers must be prepared to terminate any employee who refuses to sign the agreement. If an employer allows even one employee to refuse and remain employed, the agreements signed by the other employees will not be legally binding.

If you want a nondisclosure/confidentiality agreement tailored to your specific situation and anticipating potential legal issues, most attorneys charge $100-$300 or more an hour.

Set the date of the agreement. Describe the two parties, sometimes called the Disclosing Party and the Receiving Party.7feff Include names and identification, so there can be no misunderstanding about who signed the agreement.

A confidentiality agreement (also called a nondisclosure agreement or NDA) is a legally binding contract in which a person or business promises to treat specific information as a trade secret and promises not to disclose the secret to others without proper authorization.

Form W-9. The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Get it in writing. Keep it simple. Deal with the right person. Identify each party correctly. Spell out all of the details. Specify payment obligations. Agree on circumstances that terminate the contract. Agree on a way to resolve disputes.

A definition of confidential information. Who is involved. Why the recipient knows the information. Exclusions or limits on confidential information. Receiving party's obligations. Time frame or term. Discloser to the recipient.

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.