Nonexempt Employee Time Report

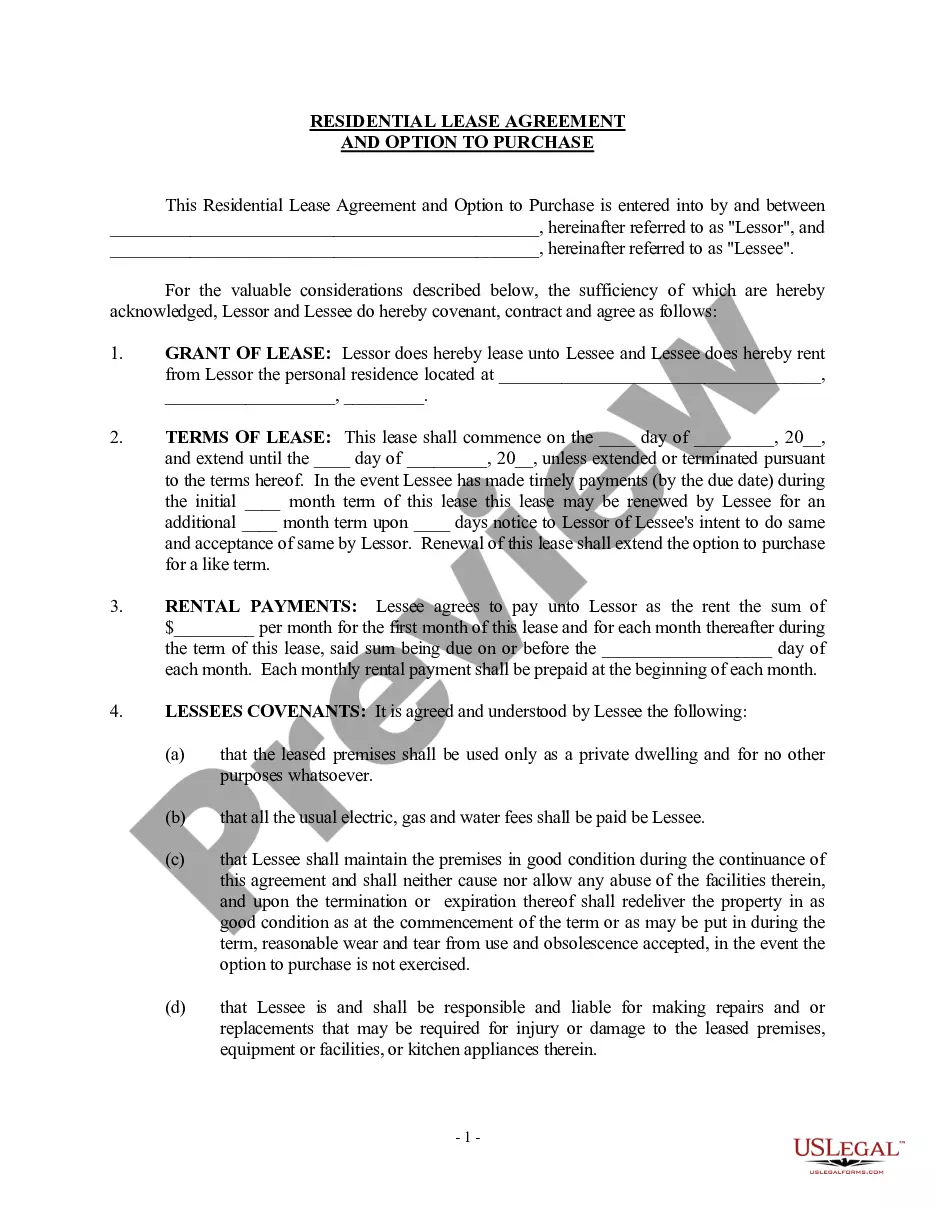

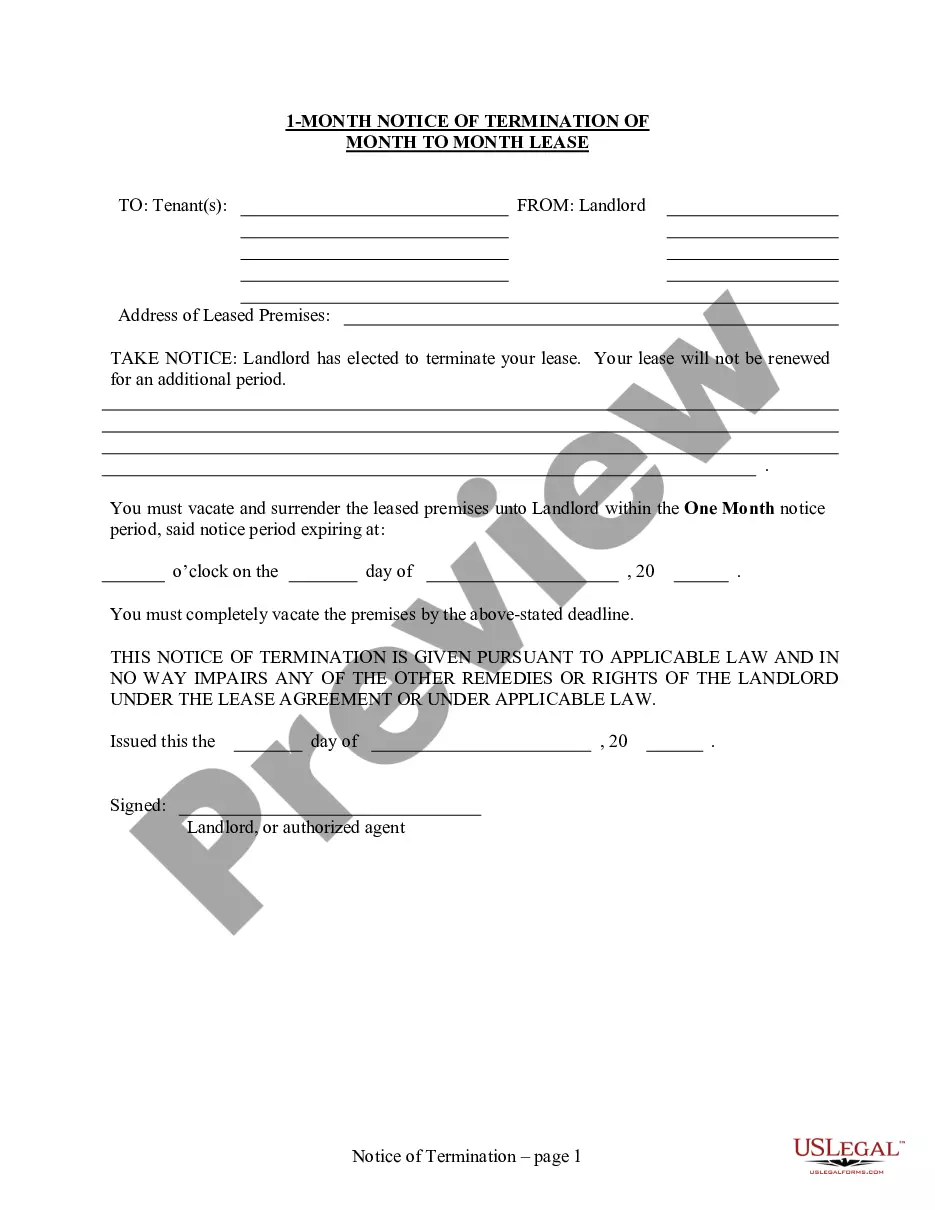

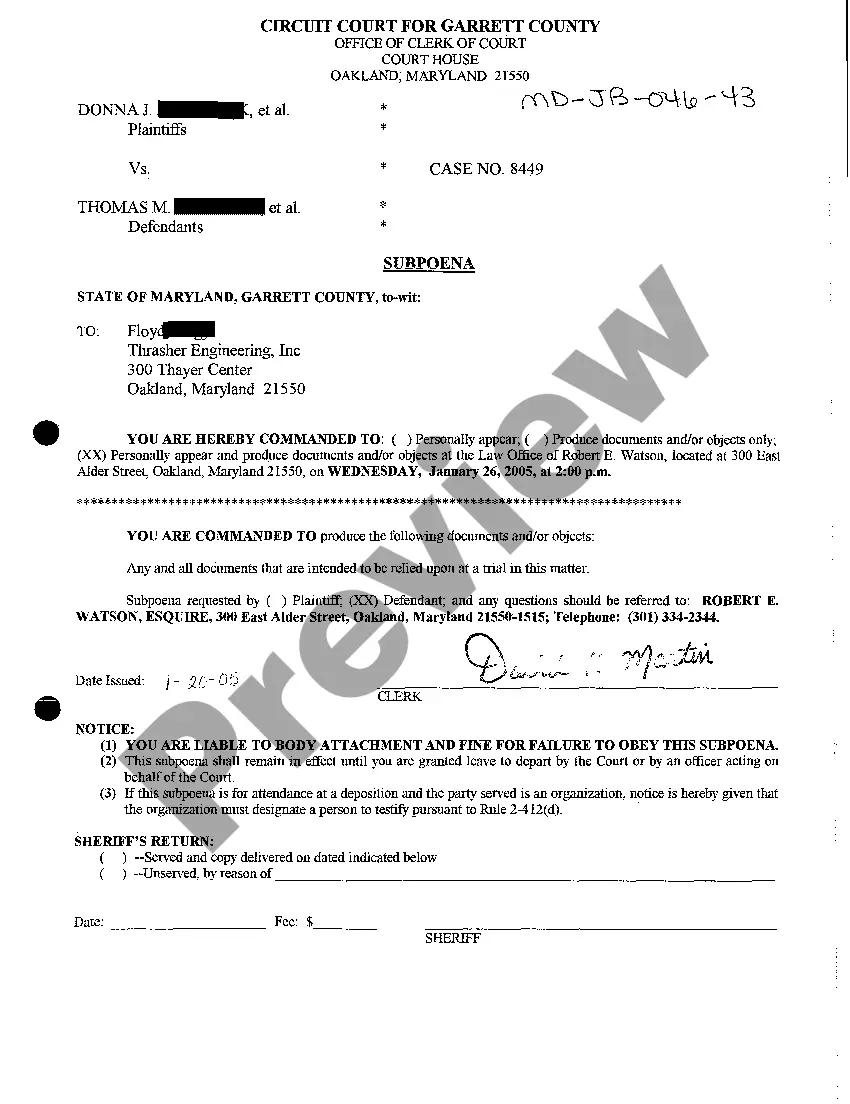

Description Nonexempt Time

How to fill out Nonexempt Employee Uslegal?

Among numerous free and paid examples that you can find on the internet, you can't be certain about their reliability. For example, who created them or if they are skilled enough to deal with what you need these to. Always keep calm and use US Legal Forms! Locate Nonexempt Employee Time Report templates created by skilled attorneys and prevent the expensive and time-consuming process of looking for an lawyer or attorney and after that having to pay them to write a document for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you’re searching for. You'll also be able to access your previously downloaded files in the My Forms menu.

If you’re using our website the very first time, follow the guidelines listed below to get your Nonexempt Employee Time Report with ease:

- Make certain that the document you see is valid in your state.

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering process or find another sample using the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

Once you’ve signed up and paid for your subscription, you may use your Nonexempt Employee Time Report as often as you need or for as long as it continues to be valid in your state. Revise it with your preferred editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Nonexempt Contract Form popularity

Nonexempt Agreement Other Form Names

Nonexempt Report Template FAQ

Non-exempt employees must receive overtime pay. In certain states, employees may be eligible for overtime pay when they work more than eight hours in one day. But, generally, most non-exempt employees must be paid overtime pay only after they work more than 40 hours in a workweek.

When the employer is aware, or invites, a non-exempt employee to send off the clock emails, calls or texts, the employer must have a way to track that time and ensure that the employee is paid.If an employee breaks this rule, and works after hours, the employee can be disciplined but must be paid.

The FLSA does not limit the amount of working hours an employer can expect of exempt workers. However, nothing in the FLSA prohibits employers from requiring exempt employees to clock in or track time either. Tracking time is a good idea, because it prevents disagreements between the employee and employer.

Time clocks typically are used for recordkeeping purposes. The FLSA doesn't mandate time clocks at all, not even for hourly, non-exempt employees. The FLSA's Fact Sheet No. 21, titled "Recordkeeping Requirements Under the Fair Labor Standards Act (FLSA)" states: "Employers may use any timekeeping method they choose.

Company management must exercise control over employees to ensure that work is not performed off the clock.For example, a supervisor can now text or email an employee 24/7. If the employee is expected to answer, they must be paid for their time in reviewing and responding to the message.

If they're exempt, which a majority of salaried employees are, you're not required to have them fill out a timesheetbut if they fall under the non-exempt category (for example, if the employee's salary is less than $684 per week) then they would need to fill out a timecard.

The number of hours worked doesn't affect an exempt employee's pay because the salary is considered full compensation for all hours worked, whether more or fewer than 40 in a week. However, there is nothing illegal about requiring exempt employees to clock in and out at the start and end of the workday, or for lunch.

These rules and regulations apply to both part-time and full-time employees. When an employee is considered non-exempt, it means they aren't covered by FLSA standards and regulations.However, any paid leave they take during the week will not apply to the traditional 40 hours of work.

While there are no time clock laws that mandate that all employees clock in and clock out, employers are required to keep accurate records of all non-exempt employees' hours worked.