Bulk cash smuggling into or out of the United States is a form of money laundering which involves the illegal transfer of large amounts of currency across international borders. It is typically done to evade taxes, launder criminal proceeds, or finance terrorist activities. Bulk cash smuggling can occur through three main methods: physical smuggling, digital smuggling, and bulk-cash smuggling. Physical smuggling involves the physical transportation of cash, usually in the form of a suitcase or backpack, across borders. Digital smuggling involves the transfer of funds via digital payments, such as wire transfers, cryptocurrency transactions, or digital money transfers. Bulk-cash smuggling is the transportation of large amounts of currency through a financial institution, such as a bank or money service business. Bulk cash smuggling can have serious consequences, as it can be used to finance illegal activities or evade taxes. To combat this, the U.S. government has implemented various regulations, such as the Bank Secrecy Act, which requires financial institutions to report large cash transactions and suspicious activity. In addition, most countries have laws that prohibit the transportation of large amounts of currency across borders without declaring it.

Bulk Cash Smuggling into or out of the United States

Description

How to fill out Bulk Cash Smuggling Into Or Out Of The United States?

If you’re looking for a way to properly complete the Bulk Cash Smuggling into or out of the United States without hiring a legal professional, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every personal and business scenario. Every piece of documentation you find on our web service is created in accordance with federal and state regulations, so you can be sure that your documents are in order.

Follow these straightforward instructions on how to acquire the ready-to-use Bulk Cash Smuggling into or out of the United States:

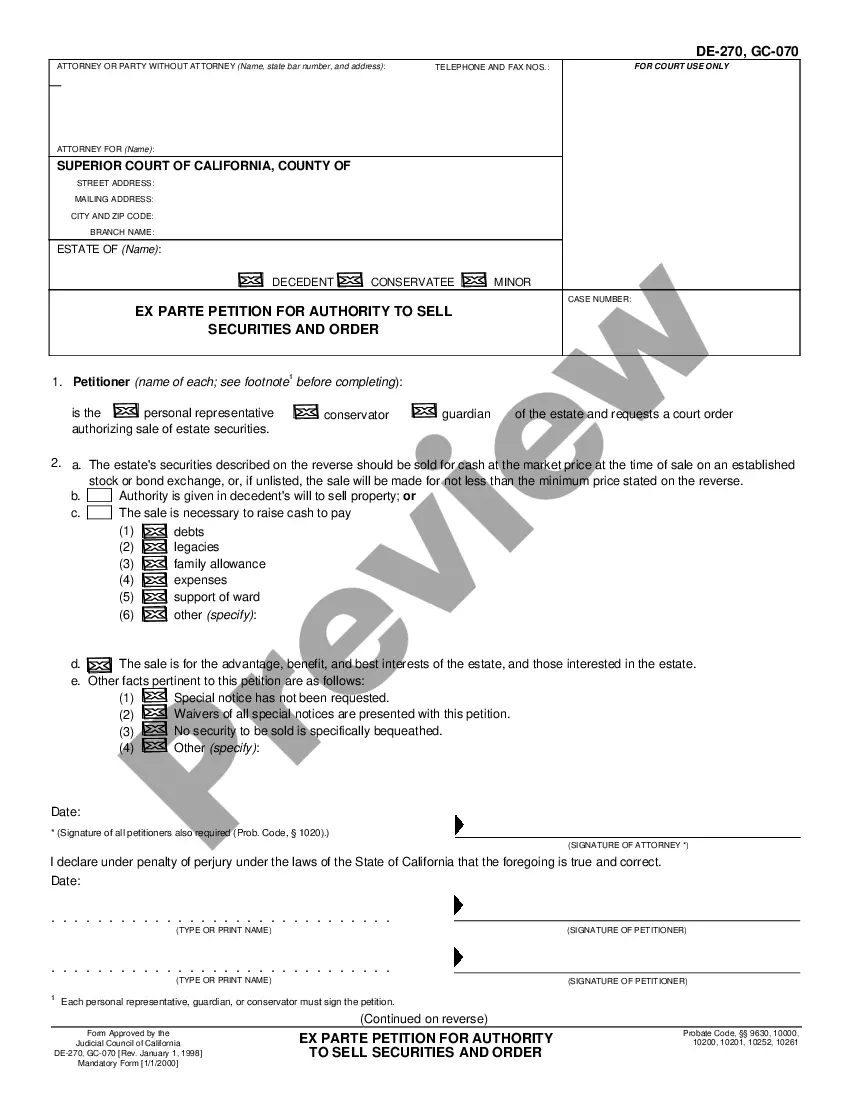

- Ensure the document you see on the page corresponds with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Enter the document title in the Search tab on the top of the page and select your state from the dropdown to locate another template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your Bulk Cash Smuggling into or out of the United States and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Bulk cash smuggling often involves the transfer of large amounts of money that make up the proceeds of an illegal activity. In many cases, the money that is being smuggled is used to fund an unlawful organization.

Meaning of bulk cash in English a very large quantity of paper money or coins: Bulk cash smuggling is an increasing problem, with more drug traffickers moving their profits across the US border.

§ 5332 (Bulk Cash Smuggling) makes it a crime to smuggle or attempt to smuggle more than $10,000 in currency or monetary instruments into or out of the United States, with the specific intent to evade the U.S. currency reporting requirements codified in Title 31 U.S.C. §§ 5316 and 5317.

For example, hiding cash inside a secret compartment in a car or truck, or sewing cash into the lining of luggage, or stuffing money into a woman's bra is clearly bulk cash smuggling.

Cash is contraband. Cash mailed to an inmate will be deposited in the inmate's confiscated account. 002 Checks or Money Orders. Checks or money orders mailed to an inmate must be made payable to the inmate using his/her committed name and inmate number.

Money laundering can also be accomplished through the use of currency exchanges, wire transfers, and ?mules??cash smugglers, who sneak large amounts of cash across borders and deposit them in foreign accounts, where money-laundering enforcement is less strict.

Meaning of bulk cash in English a very large quantity of paper money or coins: Bulk cash smuggling is an increasing problem, with more drug traffickers moving their profits across the US border.