Independent Contractor Agreement for Hair Stylist

Description

Key Concepts & Definitions

Independent Contractor Agreement for Hair Stylist: A legal document that outlines the terms and conditions under which a hair stylist will provide services as an independent contractor rather than an employee. This agreement clarifies aspects such as payment, duties, rights, and the duration of the contract.

Step-by-Step Guide

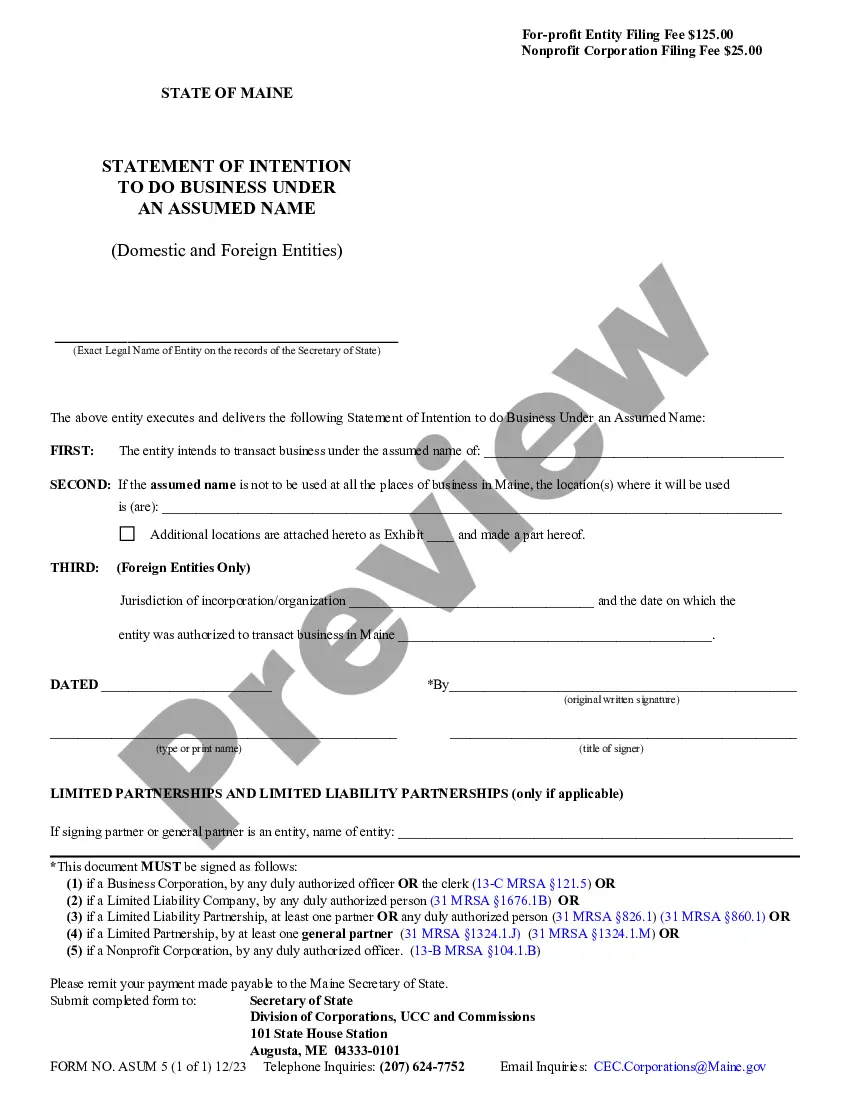

- Identify the Parties: Clearly mention the names of the contractor and the client, along with contact information.

- Define the Scope of Services: Describe in detail the services that will be provided by the hair stylist.

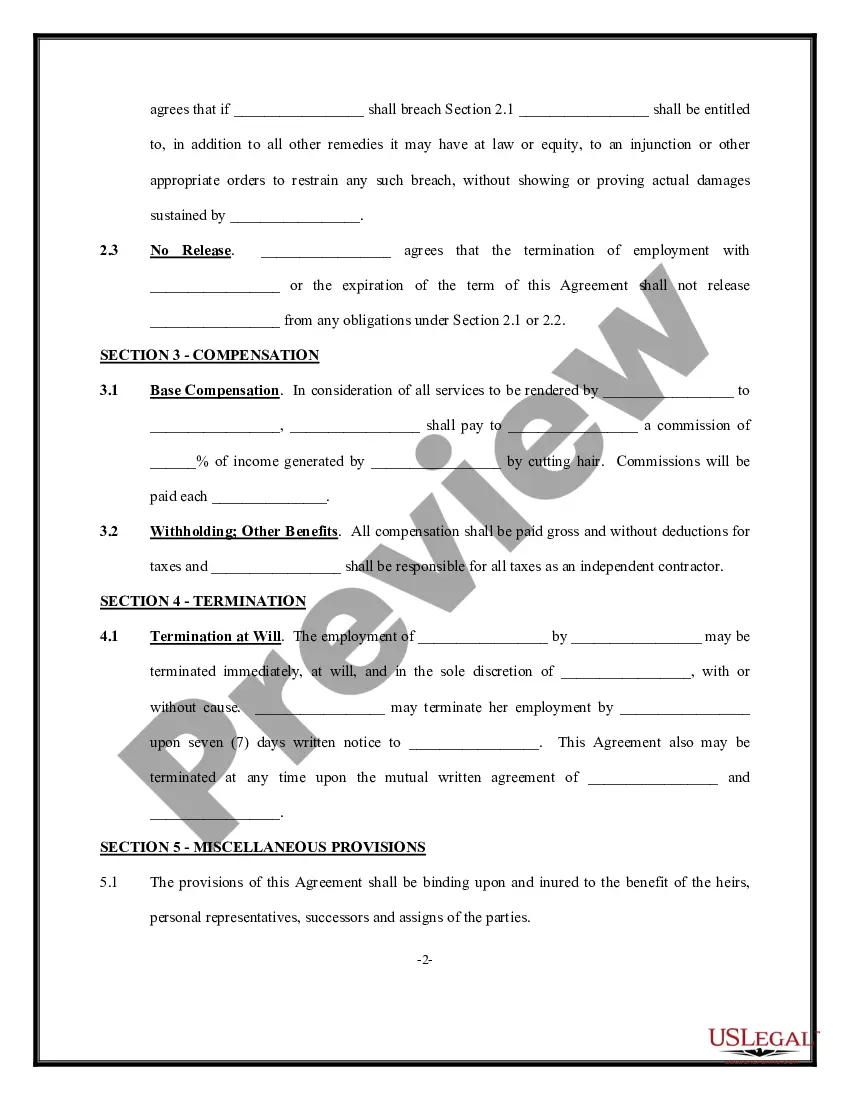

- Set the Terms of Compensation: Specify the payment terms including rates, schedules, and any other expenses.

- Include Duration and Termination Clauses: State the starting date of the contract and the conditions under which it can be terminated.

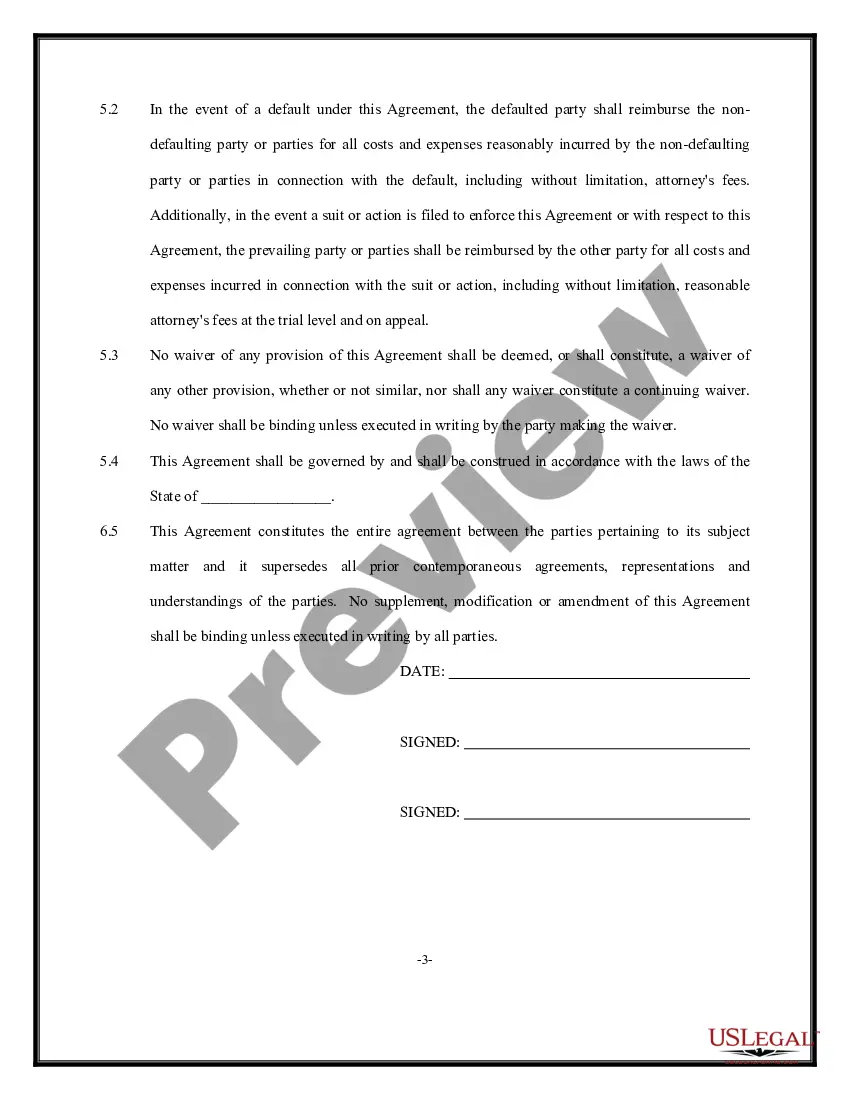

- Address Legal Rights and Responsibilities: Include clauses on confidentiality, non-compete, and intellectual property if applicable.

- Signature: Ensure both parties sign the agreement to make it legally binding.

Risk Analysis

- Lack of Clarity: Vague terms can lead to misunderstandings or legal disputes.

- Compliance Risks: Non-adherence to state laws regarding independent contractors could result in penalties.

- Financial Risks: Without a clear agreement, payment issues may arise, affecting financial stability.

Best Practices

- Consult Legal Professionals: Obtain advice from an attorney to ensure the contract complies with local laws.

- Be Precise: Clearly define all terms and conditions to avoid ambiguity.

- Regular Updates: Review and update the agreement periodically to adhere to new laws and regulations.

Common Mistakes & How to Avoid Them

- Ignoring State Laws: Research and adhere to laws specific to your state to avoid legal consequences.

- Incomplete Details: Ensure every necessary section is fully detailed to prevent disputes.

- Lack of Professional Review: Always have a contract reviewed by a legal expert.

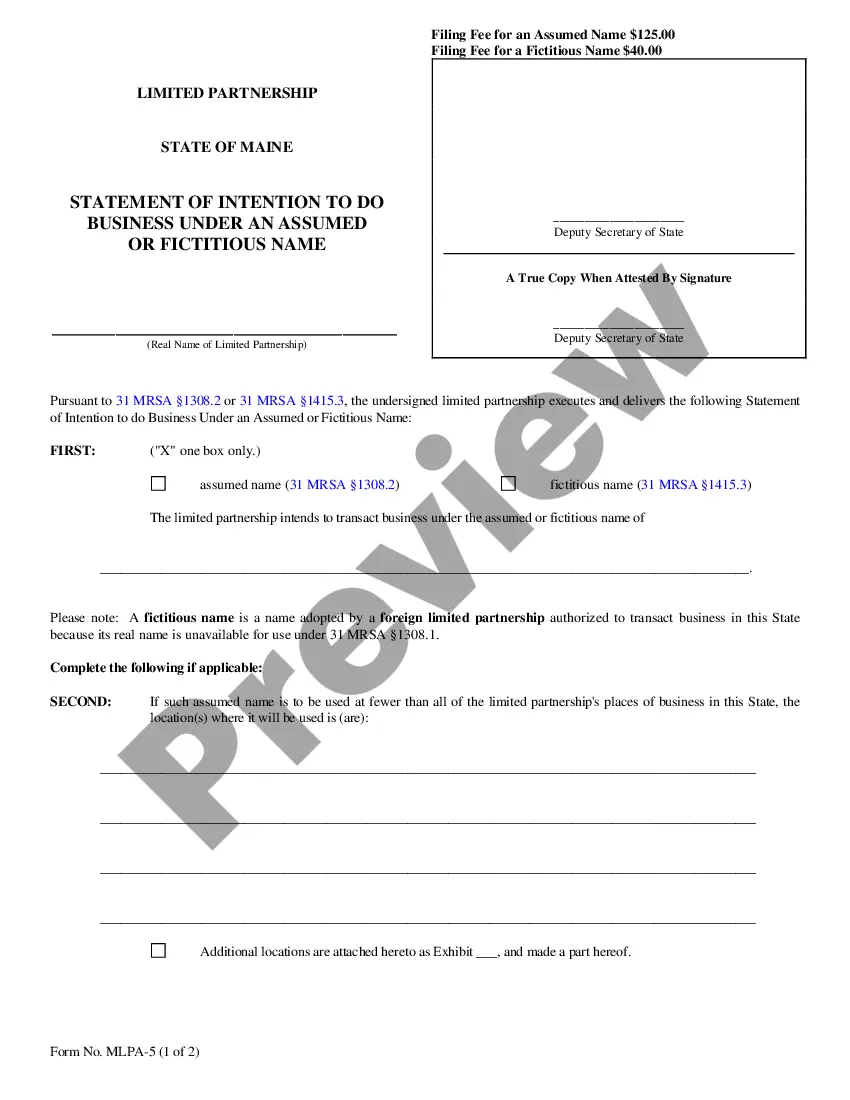

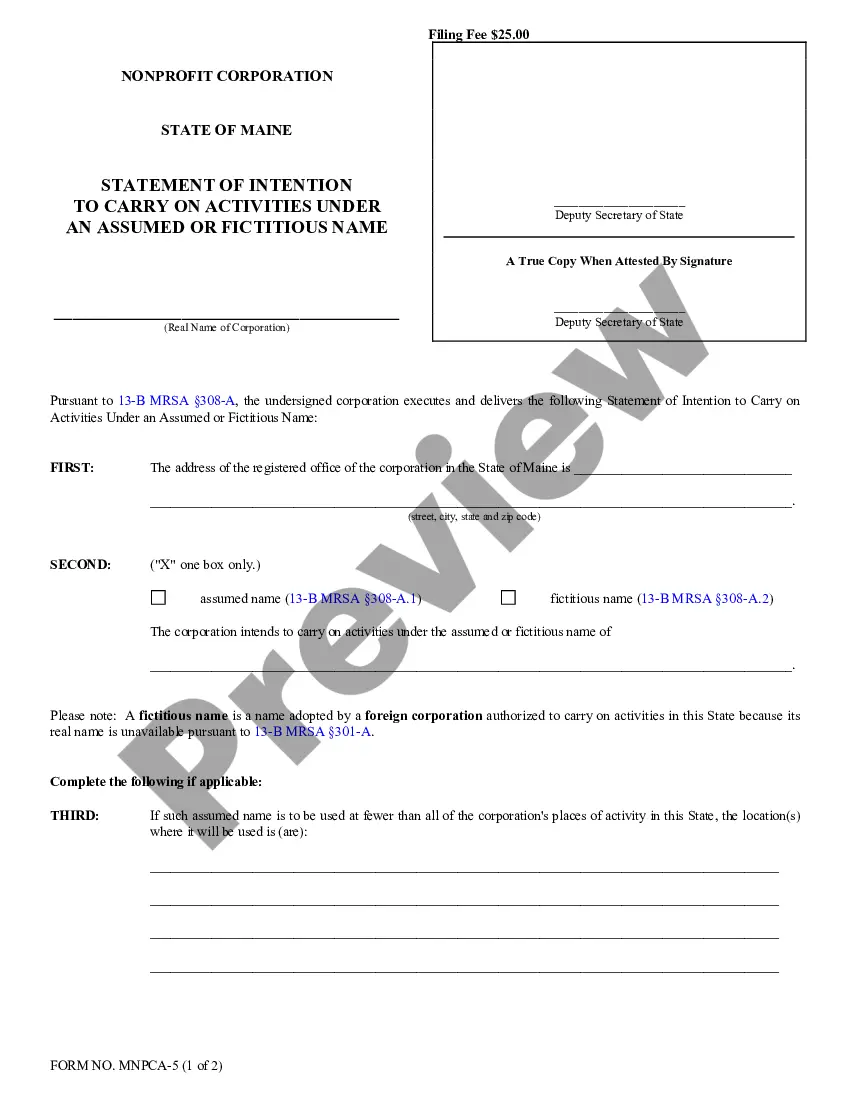

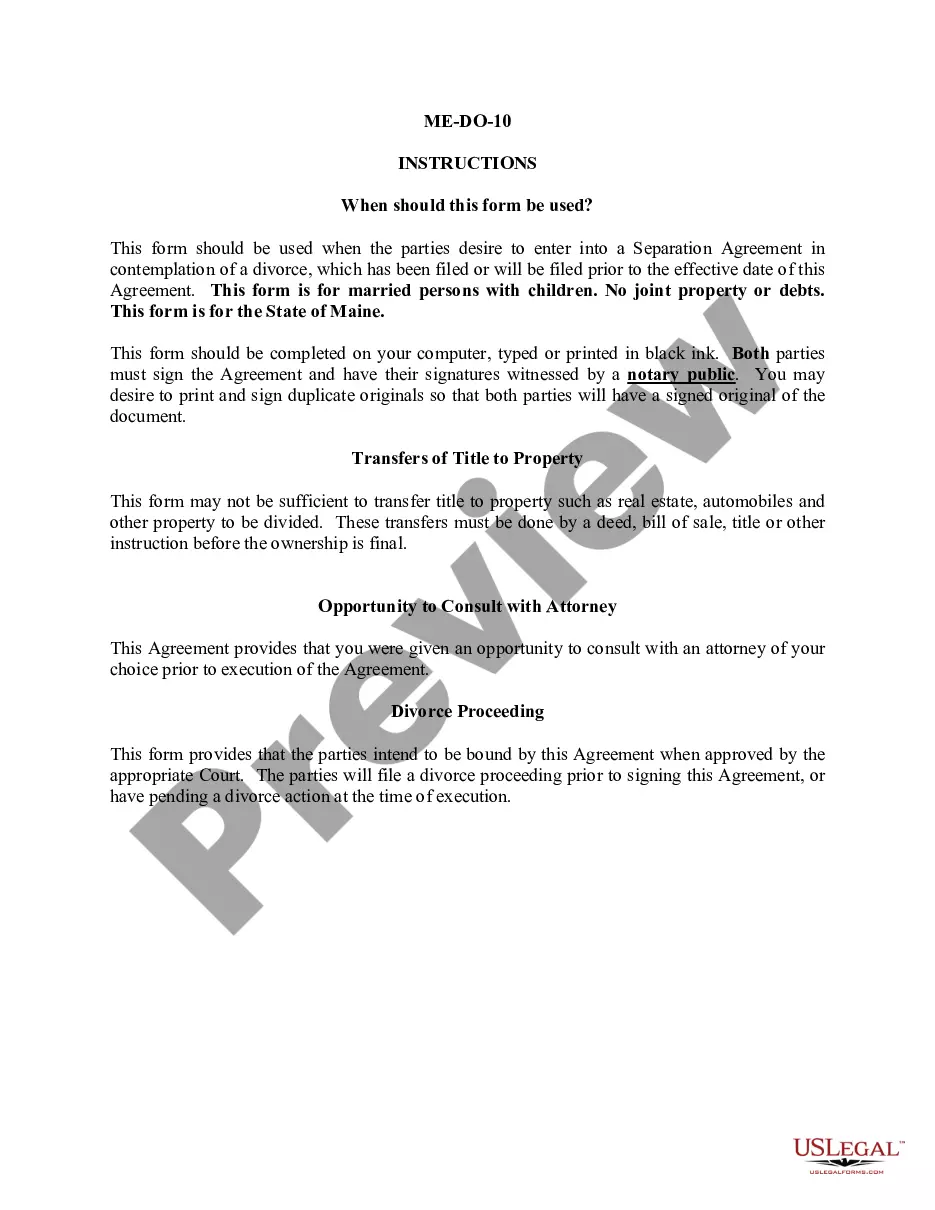

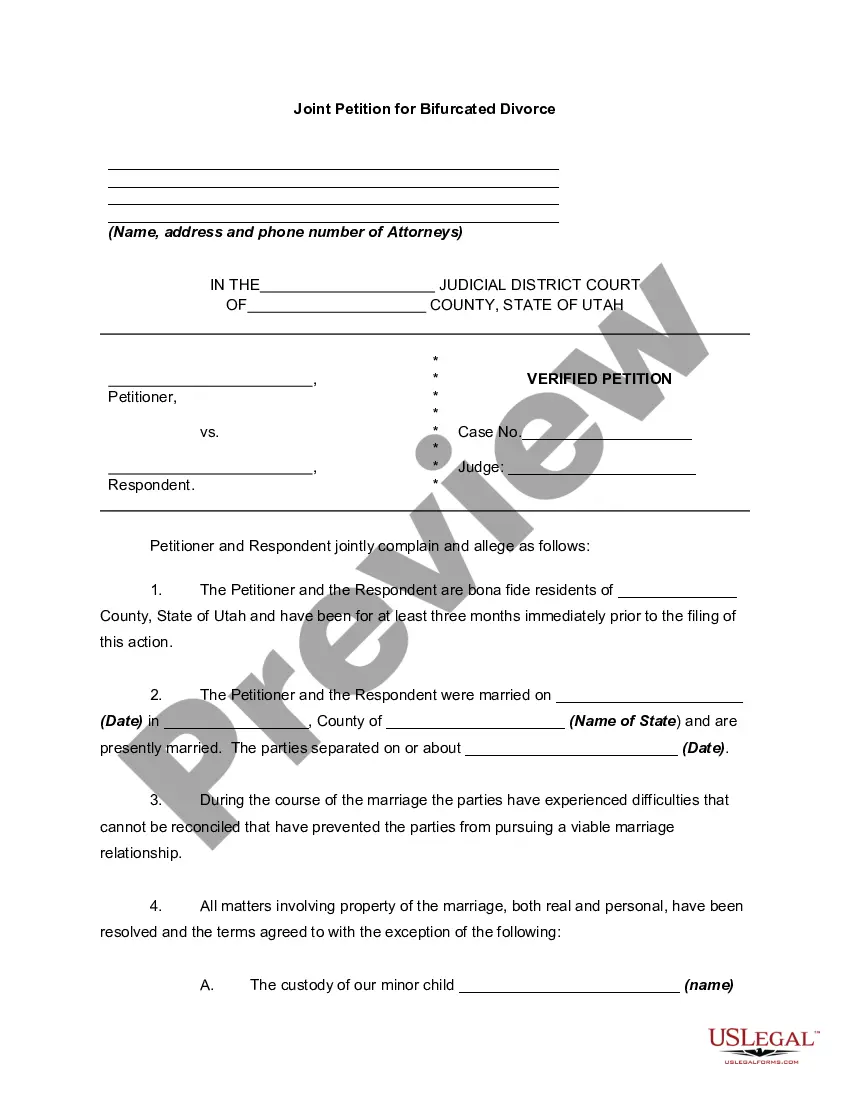

How to fill out Independent Contractor Agreement For Hair Stylist?

Use US Legal Forms to obtain a printable Independent Contractor Agreement for Hair Stylist. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most complete Forms library on the internet and provides reasonably priced and accurate templates for customers and legal professionals, and SMBs. The templates are categorized into state-based categories and a few of them might be previewed before being downloaded.

To download samples, customers must have a subscription and to log in to their account. Hit Download next to any template you want and find it in My Forms.

For those who do not have a subscription, follow the following guidelines to easily find and download Independent Contractor Agreement for Hair Stylist:

- Check out to make sure you have the proper form in relation to the state it’s needed in.

- Review the document by looking through the description and by using the Preview feature.

- Click Buy Now if it’s the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Use the Search field if you want to get another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Independent Contractor Agreement for Hair Stylist. More than three million users have used our platform successfully. Select your subscription plan and get high-quality forms in a few clicks.

Form popularity

FAQ

Under the new test for independent contractor vs employee status in California, it is illegal to classify a barber or hair stylist as an independent contractor unless the salon can prove that: (1) the hair stylist is free the hair salon's control; (2) the job of cutting or styling hair falls outside the salon's usual

Under the new test for independent contractor vs employee status in California, it is illegal to classify a barber or hair stylist as an independent contractor unless the salon can prove that: (1) the hair stylist is free the hair salon's control; (2) the job of cutting or styling hair falls outside the salon's usual

They have a dress code to follow, behavioral or procedural policies are in place, they need to arrive on time and their prices are determined by the salon owner. In this structure stylists are paid their agreed upon commission split throughout the year and then are handed a 1099 to file on their own.

Hairdressers are Exempt from AB5 Under AB5's Professional Services carve-out, hairdressers (defined as a licensed barber or cosmetologist) are exempt from AB5.This means that the independent contractor status of hairdressers will be governed by the Borello test, and not the ABC test.

An independent stylist is mostly self-taught and always self-employed. The stylist can have a degree or diploma but they practice their skills according to their own terms. Independent stylists can book a booth in other salons or open their own salons to provide their customers with customized services.

Under the new test for independent contractor vs employee status in California, it is illegal to classify a barber or hair stylist as an independent contractor unless the salon can prove that: (1) the hair stylist is free the hair salon's control; (2) the job of cutting or styling hair falls outside the salon's usual

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

If you run your own hair salon, you already know you're self-employed. But if you're working at someone else's establishment, your status as either an employee or an independent contractor may not be so clear.If you're self-employed you'll need to pay self-employment tax, and you might need to pay taxes quarterly.