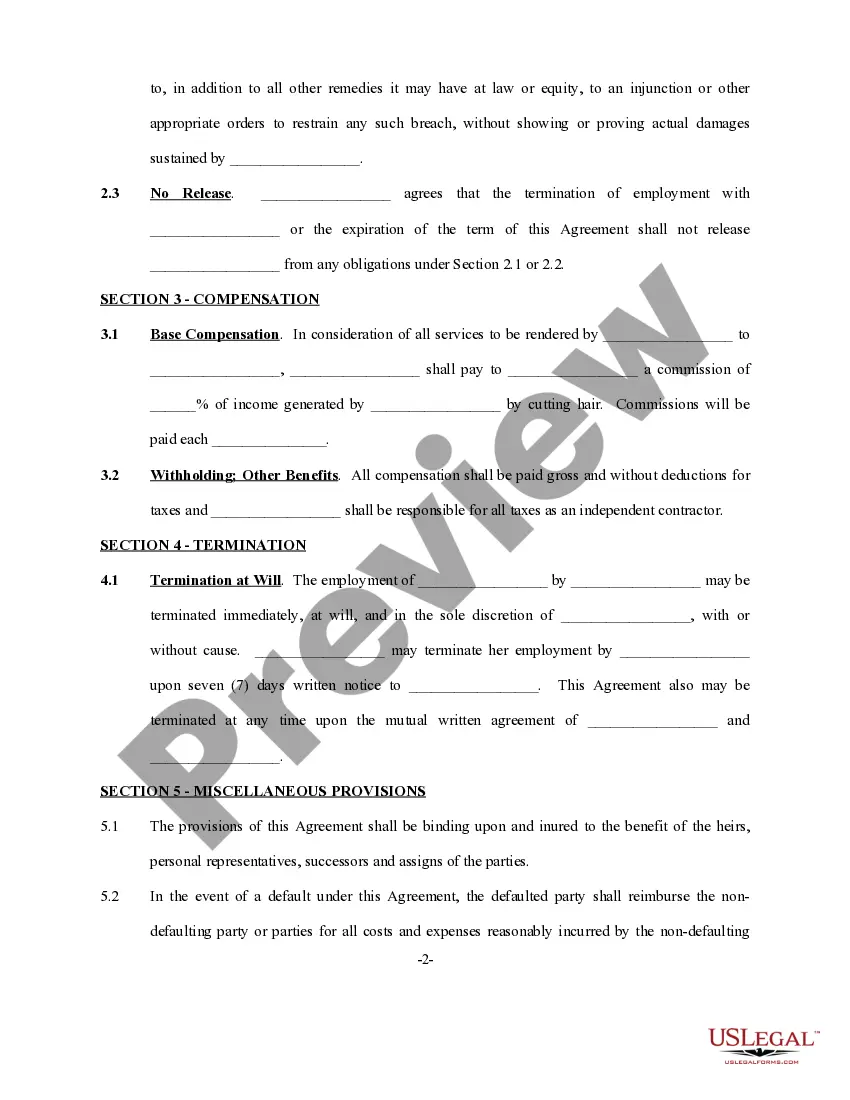

Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop

Description

How to fill out Self-Employed Independent Contractor Employment Agreement - Hair Salon Or Barber Shop?

Make use of the most extensive legal catalogue of forms. US Legal Forms is the best platform for finding updated Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop templates. Our service provides thousands of legal documents drafted by certified legal professionals and grouped by state.

To get a template from US Legal Forms, users just need to sign up for an account first. If you are already registered on our platform, log in and select the template you are looking for and buy it. After buying forms, users can see them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the guidelines listed below:

- Check if the Form name you have found is state-specific and suits your requirements.

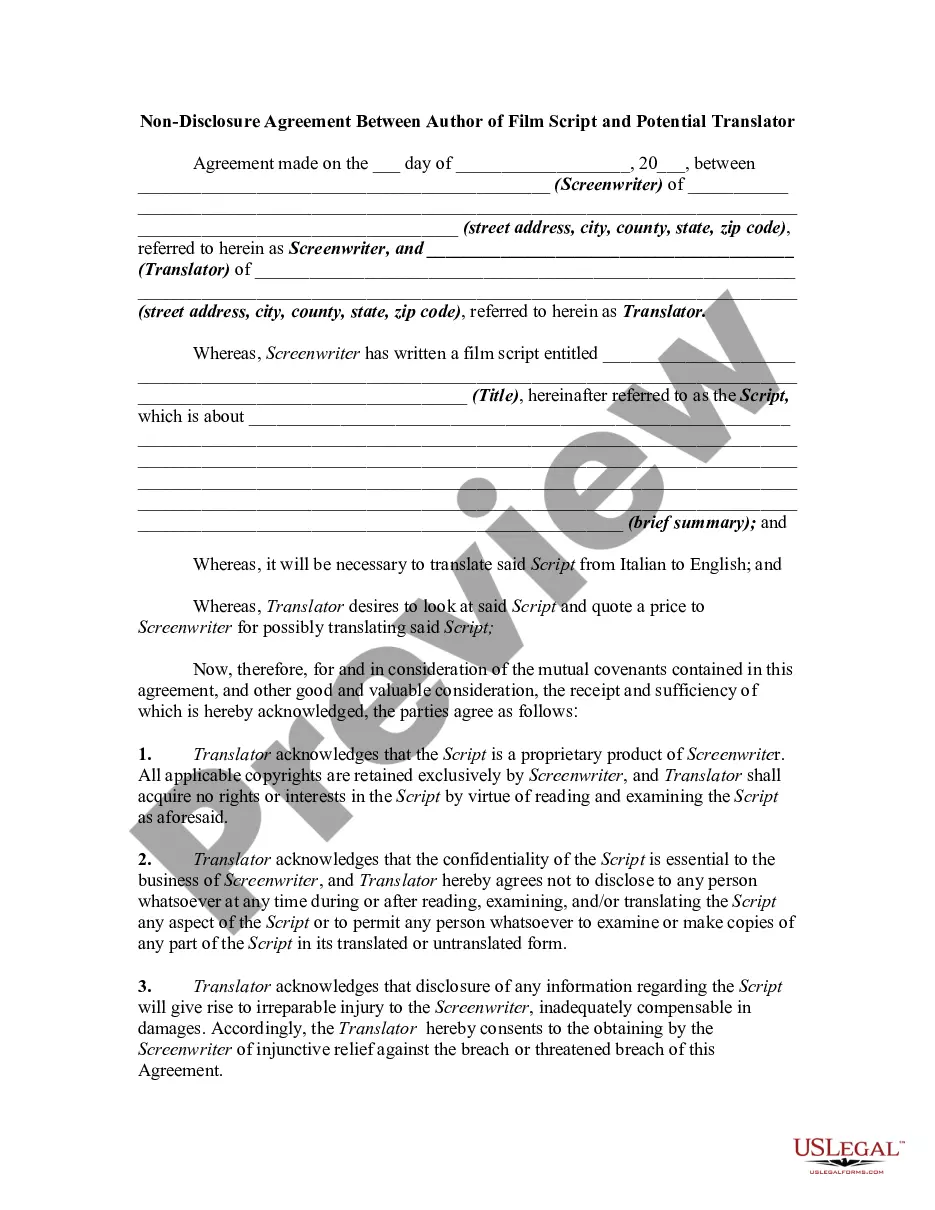

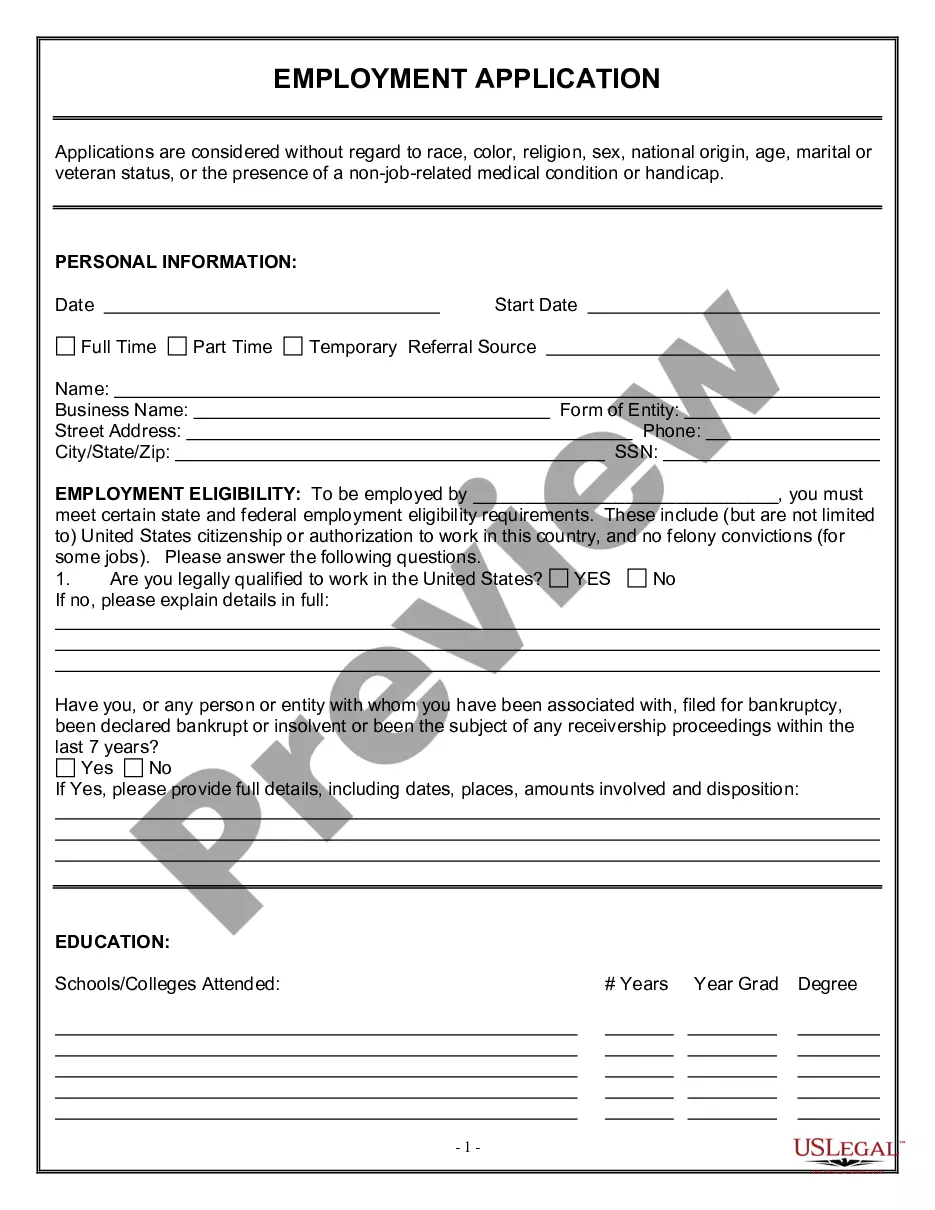

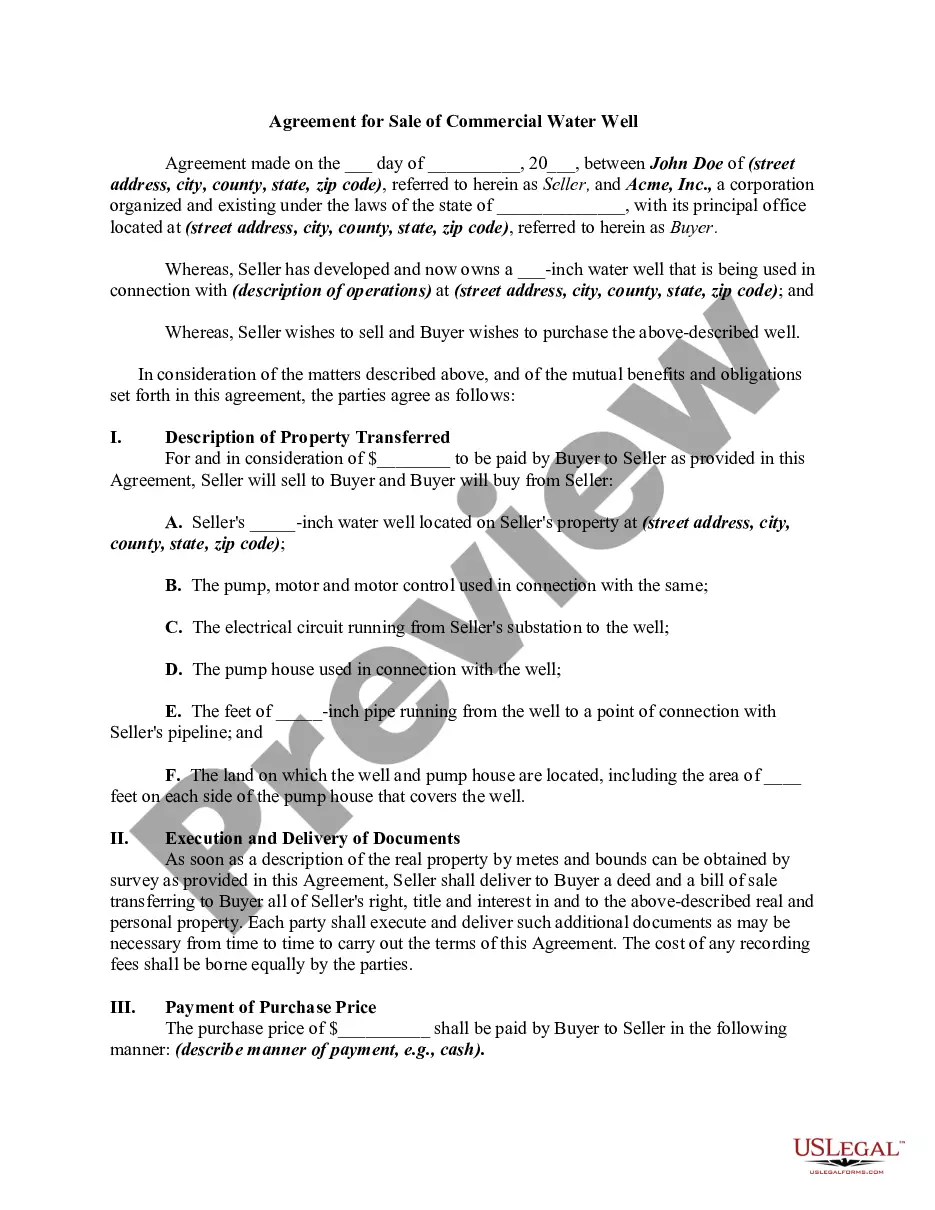

- When the form has a Preview function, utilize it to check the sample.

- If the sample does not suit you, use the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your requirements.

- Choose a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with the credit/bank card.

- Select a document format and download the sample.

- After it is downloaded, print it and fill it out.

Save your effort and time using our platform to find, download, and fill in the Form name. Join thousands of delighted subscribers who’re already using US Legal Forms!

Form popularity

FAQ

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed.You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done).

They have a dress code to follow, behavioral or procedural policies are in place, they need to arrive on time and their prices are determined by the salon owner. In this structure stylists are paid their agreed upon commission split throughout the year and then are handed a 1099 to file on their own.

If you run your own hair salon, you already know you're self-employed. But if you're working at someone else's establishment, your status as either an employee or an independent contractor may not be so clear.If you're self-employed you'll need to pay self-employment tax, and you might need to pay taxes quarterly.

Under the new test for independent contractor vs employee status in California, it is illegal to classify a barber or hair stylist as an independent contractor unless the salon can prove that: (1) the hair stylist is free the hair salon's control; (2) the job of cutting or styling hair falls outside the salon's usual

Under the new test for independent contractor vs employee status in California, it is illegal to classify a barber or hair stylist as an independent contractor unless the salon can prove that: (1) the hair stylist is free the hair salon's control; (2) the job of cutting or styling hair falls outside the salon's usual