Farm Lease or Rental - General

Description

Key Concepts & Definitions

Farm Lease or Rental General refers to a legal agreement wherein a landowner allows a tenant to use the land primarily for agricultural purposes. This may include crops, livestock, or both. The terms may vary significantly based on duration, payment structure, and land use rights.

Step-by-Step Guide

- Determine Your Needs: Assess whether you need the land for crop production, livestock raising, or a mix of both.

- Search for Available Properties: Look for available farm leases in your desired areas that meet your agricultural needs.

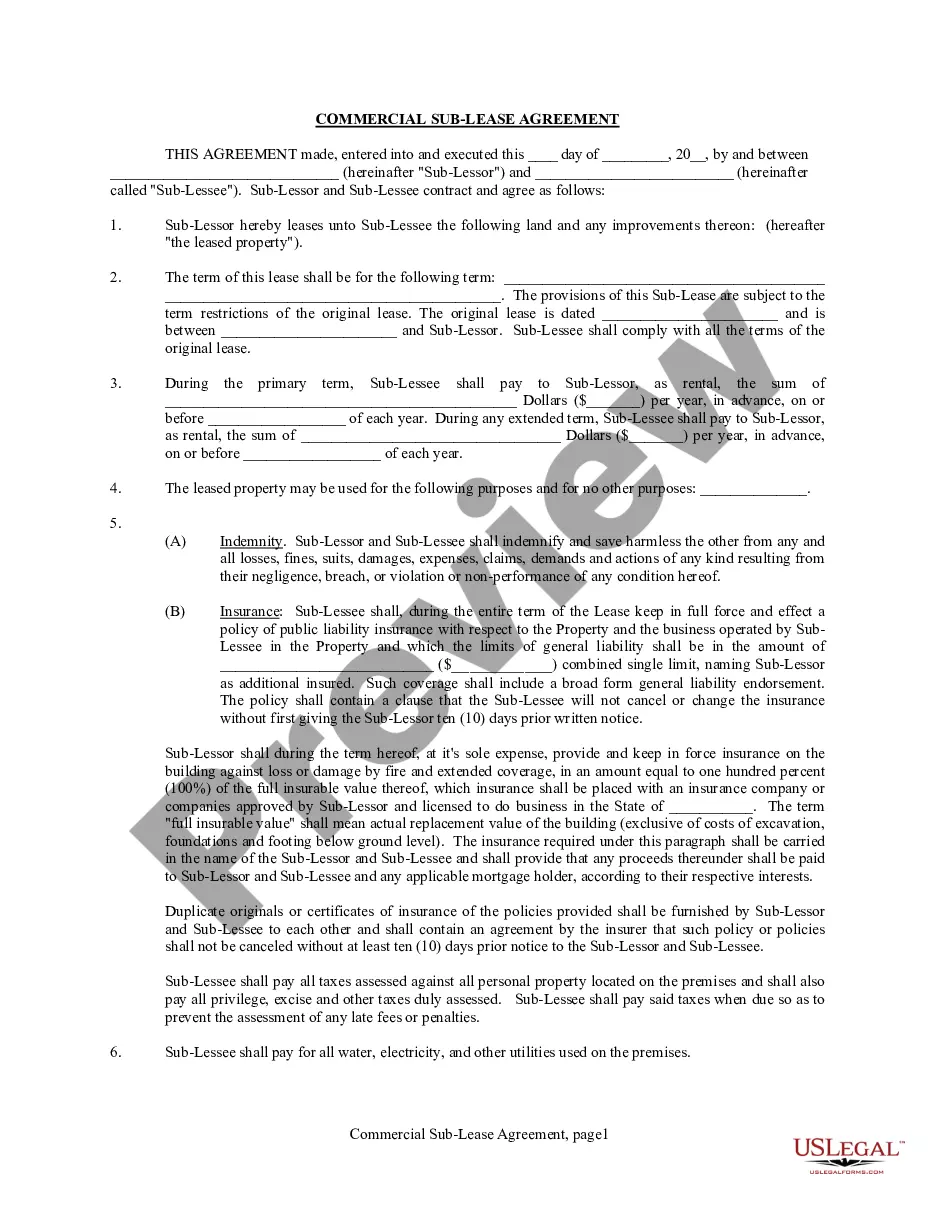

- Review Lease Terms: Pay close attention to lease length, rent payments, land use restrictions, and subleasing rights.

- Negotiate Terms: Negotiate any terms that could better suit your farming operations or financial plans.

- Sign the Lease: Once all parties agree, sign the lease and adhere to its conditions throughout its duration.

Risk Analysis

Engaging in a farm lease or rental poses risks such as unexpected changes in market prices for crops or livestock, possible disputes over lease terms, and environmental factors affecting farming conditions. To mitigate these, lessees should consider lease agreements with flexible terms and seek legal advice prior to signing.

Best Practices

- Get Everything in Writing: Ensure all agreements and amendments are documented to avoid disputes.

- Understand Your Responsibilities: Be clear about who takes care of land maintenance, taxes, and insurance.

- Plan for the Long Term: Consider the future of your farming operation and whether the lease will still meet your needs.

Common Mistakes & How to Avoid Them

- Ignoring Soil and Water Testing: Prior to leasing, test the farm's soil and water quality to ensure they meet your agricultural needs.

- Neglecting to Define Specific Land Use Terms: Clearly define what the land will be used for to prevent misuse and conflict.

- Failing to Plan for Natural Disasters: Have a contingency plan for floods, droughts, and other environmental challenges.

Terminology Glossary

- Sublease: An agreement where the tenant leases part or all of the leased land to another party.

- Land Use Rights: Rights granted to the lessee about how the land can be used.

- Farm Lease: A specific type of lease focused on agricultural use of the property.

FAQ

- What is the typical length of a farm lease? Farm leases can range from one to several years, or even be on a crop-share basis.

- Can I terminate a farm lease early? This depends on the lease terms; some may have specific clauses allowing early termination under certain circumstances.

- Who is responsible for farm maintenance? This should be specified in the lease; responsibilities can vary widely.

How to fill out Farm Lease Or Rental - General?

Use the most extensive legal catalogue of forms. US Legal Forms is the perfect platform for getting up-to-date Farm Lease or Rental - General templates. Our service offers a large number of legal documents drafted by certified legal professionals and grouped by state.

To download a sample from US Legal Forms, users simply need to sign up for an account first. If you are already registered on our platform, log in and choose the template you are looking for and buy it. After purchasing templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the guidelines below:

- Check if the Form name you have found is state-specific and suits your requirements.

- If the template features a Preview function, use it to review the sample.

- If the sample doesn’t suit you, utilize the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your requirements.

- Choose a pricing plan.

- Create a free account.

- Pay via PayPal or with the credit/visa or mastercard.

- Select a document format and download the sample.

- After it is downloaded, print it and fill it out.

Save your time and effort using our platform to find, download, and complete the Form name. Join a large number of satisfied customers who’re already using US Legal Forms!

Form popularity

FAQ

Farm Land Leases In a typical cash rent lease, the tenant is obligated to pay a set price per acre or a set rate for the leased land. With this form of lease, the tenant bears certain economic risks, and the landlord is guaranteed a predictable return, regardless of commodity prices.

Farmers are easily earning 8-10 lakhs per acre in a year. So if you don't have huge amount of land, you can still earn in lakhs.

Lease is a type of agreement where lessor gives possession of its assets to lessee for predetermined period in lieu of periodic payments where maintenance of such is the responsibility of lessee whereas Rent is an arrangement where the possession is transferred by asset owner or landlord to its tenant for periodic

Rental Income The average rate to rent irrigated and non-irrigated cropland in 2018 was $215 and $125 per acre, respectively. The average rate to rent pastureland was $12.50 per acre in 2018.

Most rental agreements are short-term agreements, such as month-to-month tenancies, while lease agreements are usually for longer rental periods, such as six months, a year, or more.

According to salary data for farmers, ranchers and other agricultural managers from May 2016, the average salary is $75,790 a year. In contrast, they make a median salary of $66,360, with half getting lower salaries and half being paid more.

Renting is for when you only need a car for a little while. Exact price will be determined by the companies you go through, but the simplest answer is that renting a car is cheaper.Leasing companies finance a loan for you and charge the price of the car, interest and depreciation.

Since many cash rent contracts are fully prepaid before planting season, this arrangement prevents landowners from taking on any crop risk from the farmers and prevents farmers from taking on any credit risk from the landowners. Cash rents are a truly passive income opportunity with relatively little risk.

The difference between lease and rent is that a lease generally lasts for 12 months while a rental agreement generally lasts for 30 days.That means the landlord can't raise the rent without your written consent or evict you without cause, and you can't stop paying rent or break the lease without consequence.