General Partnership for Business

Description

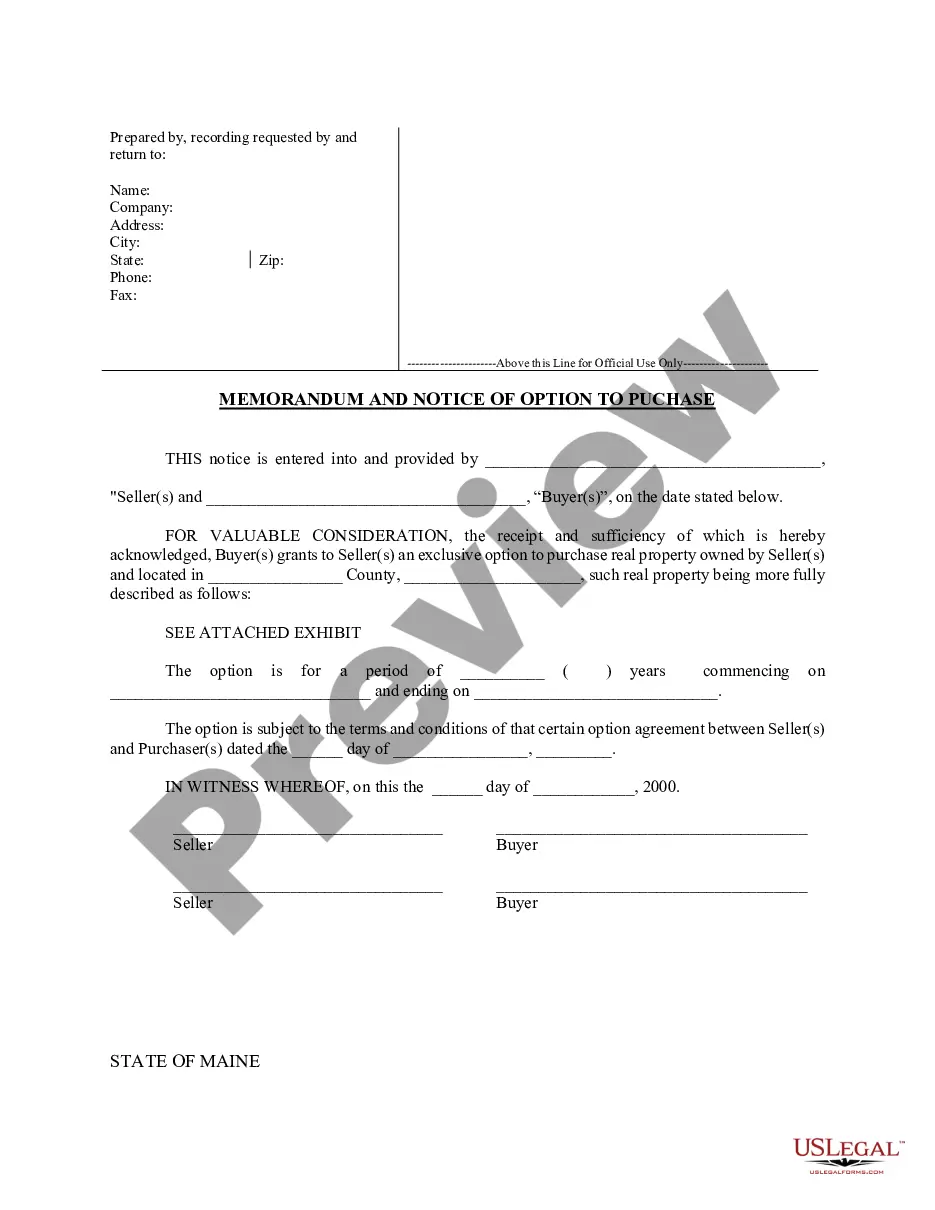

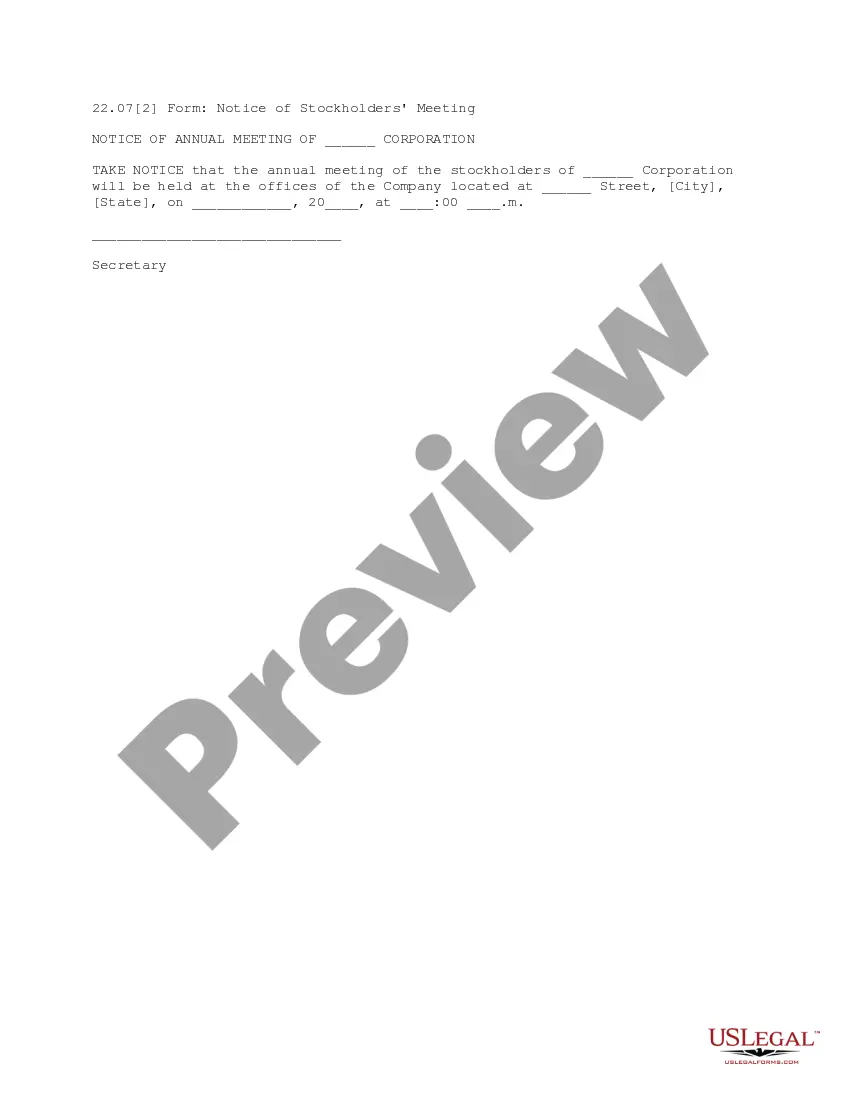

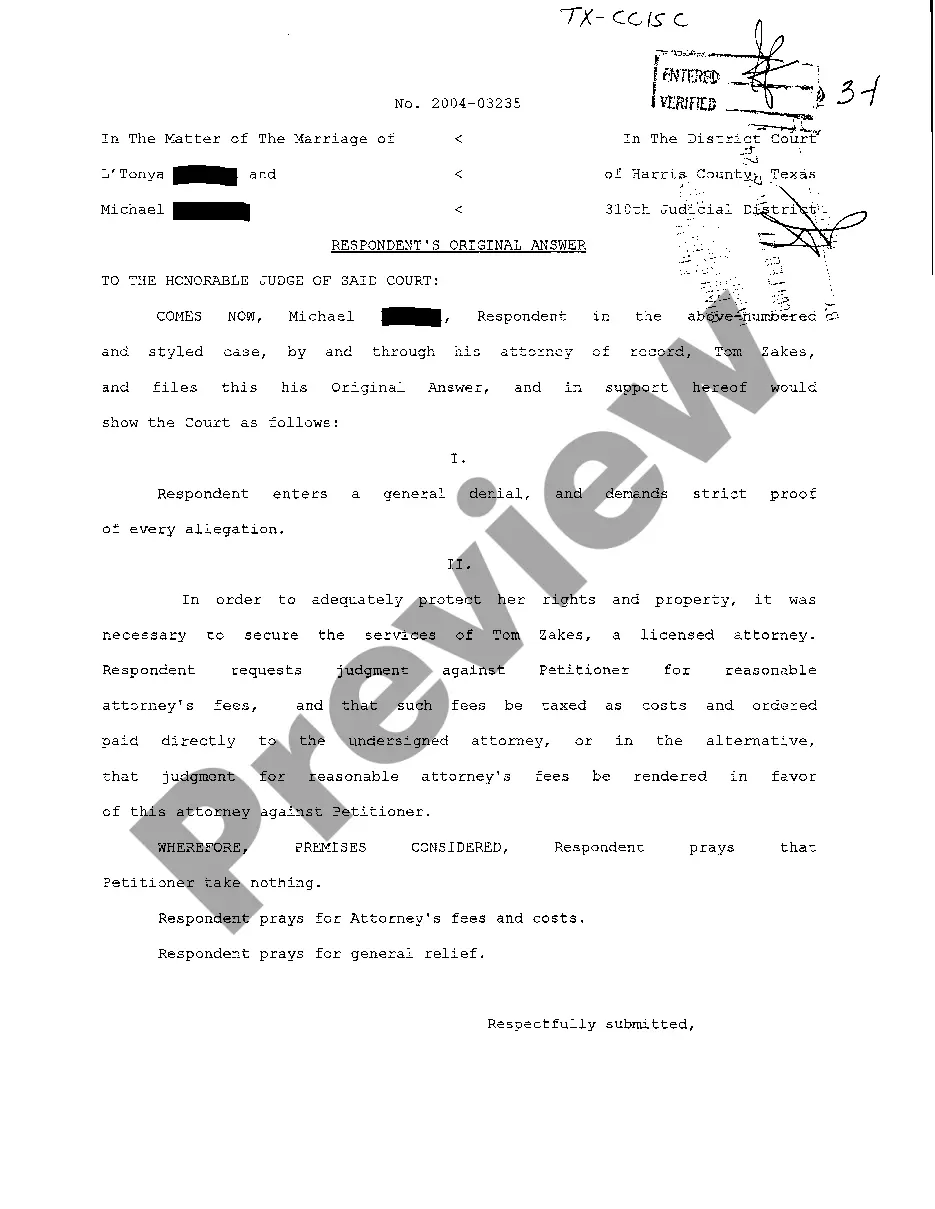

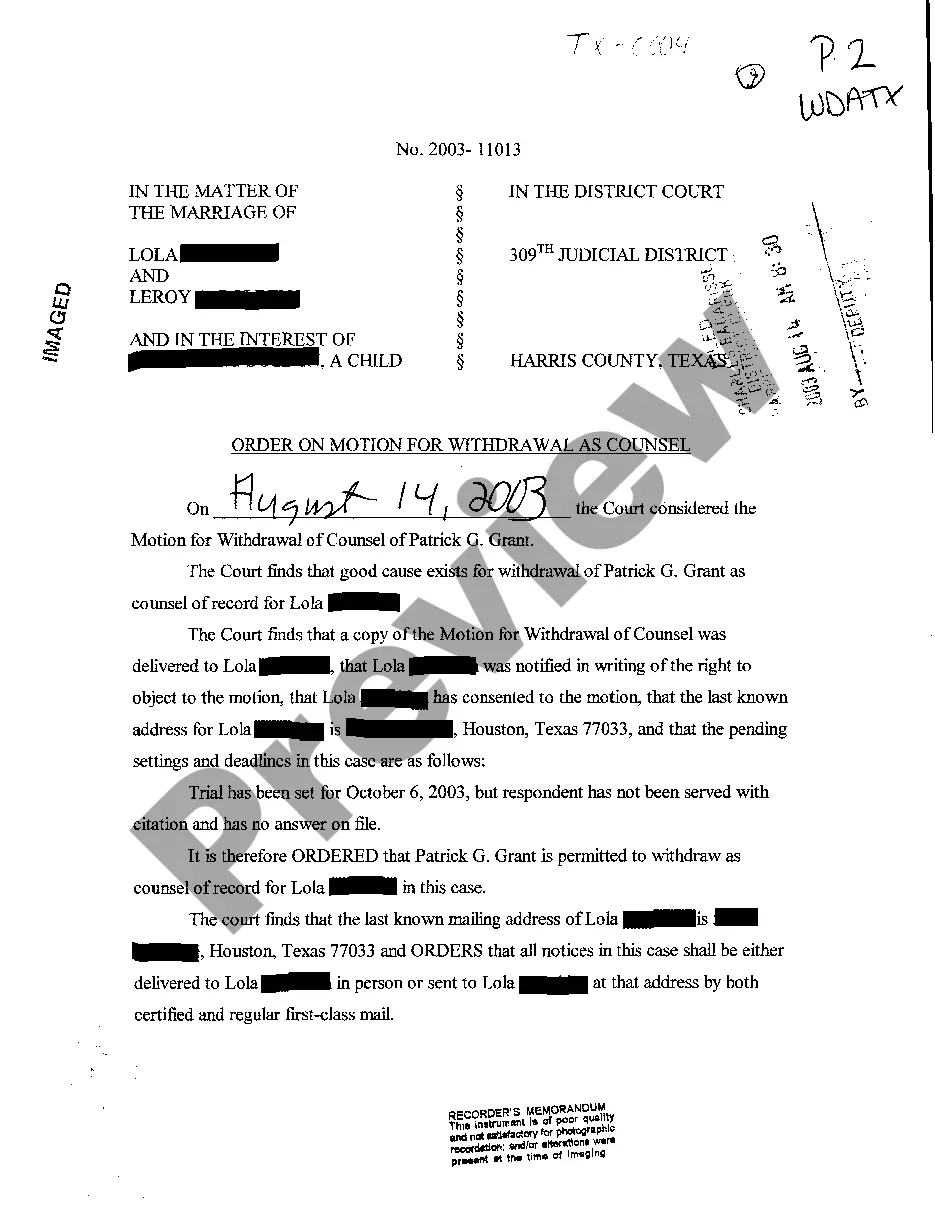

How to fill out General Partnership For Business?

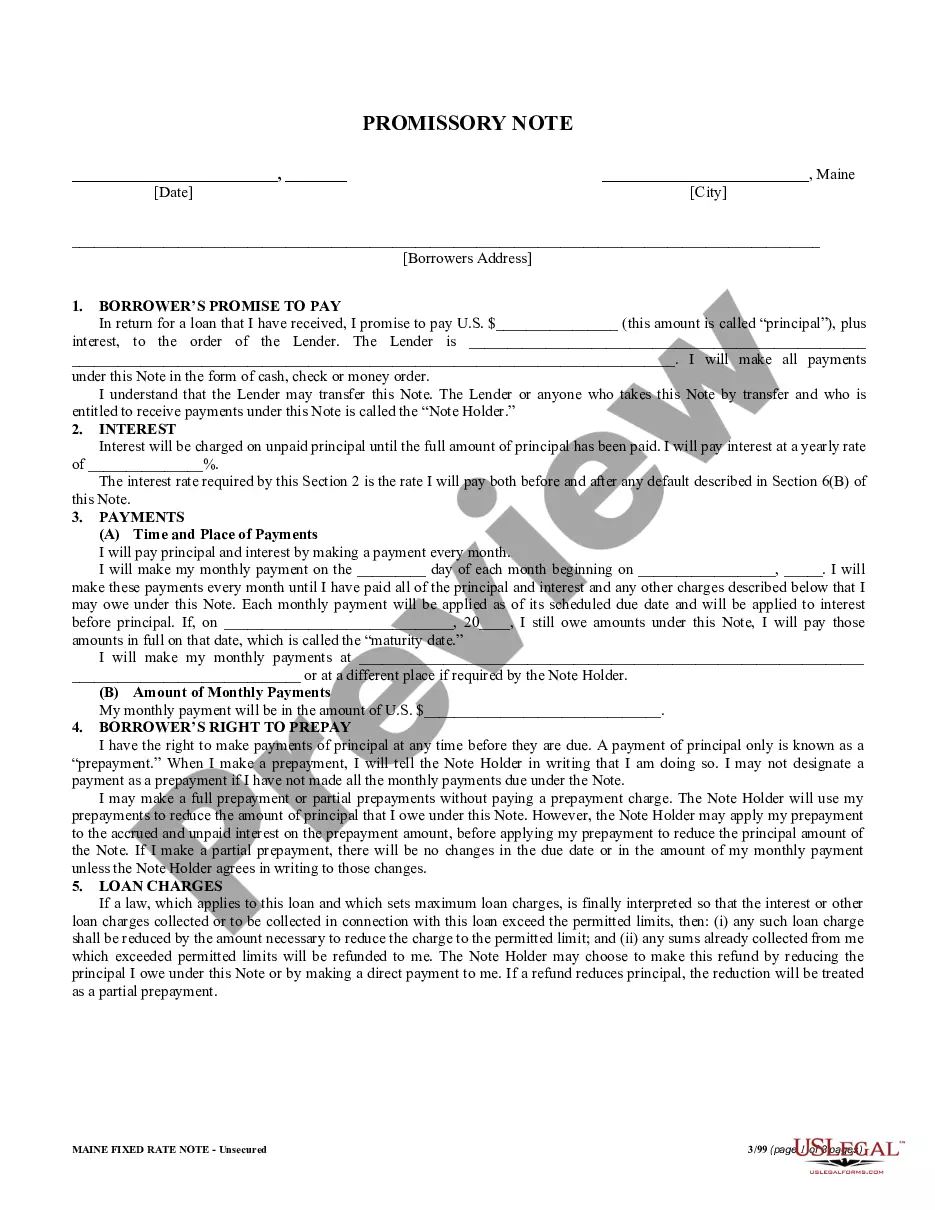

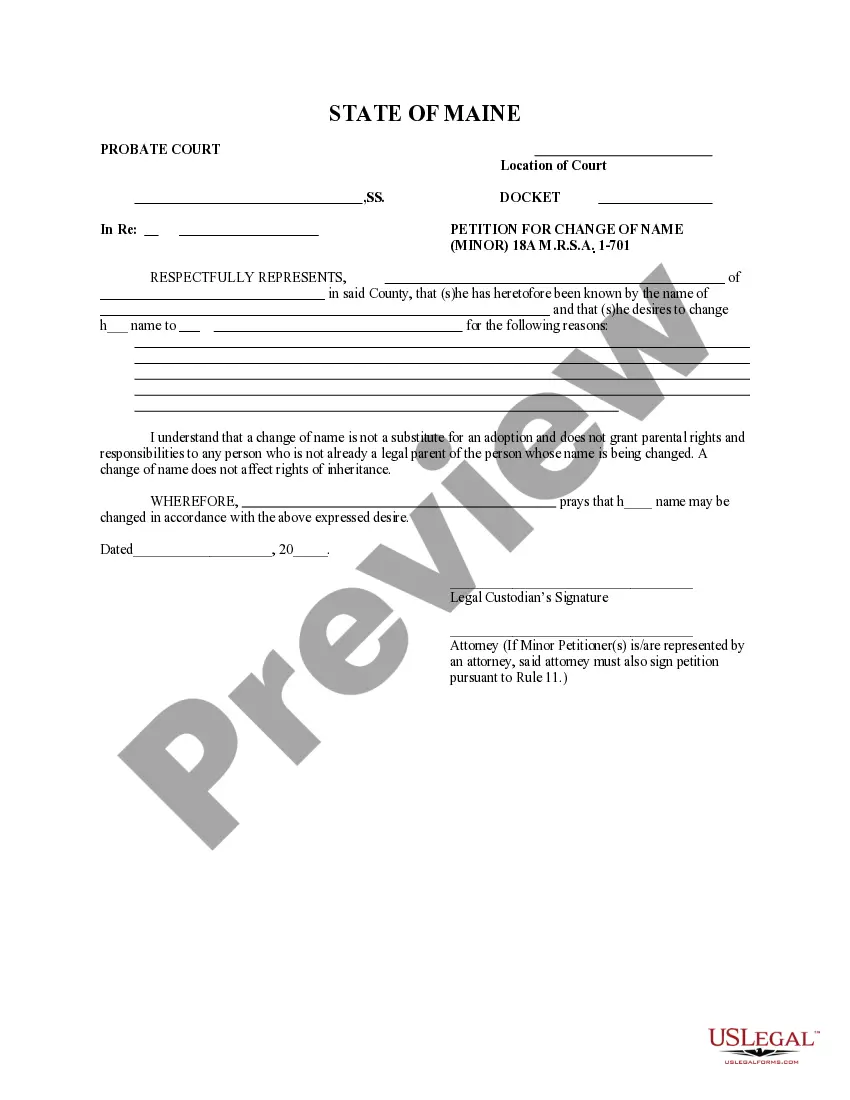

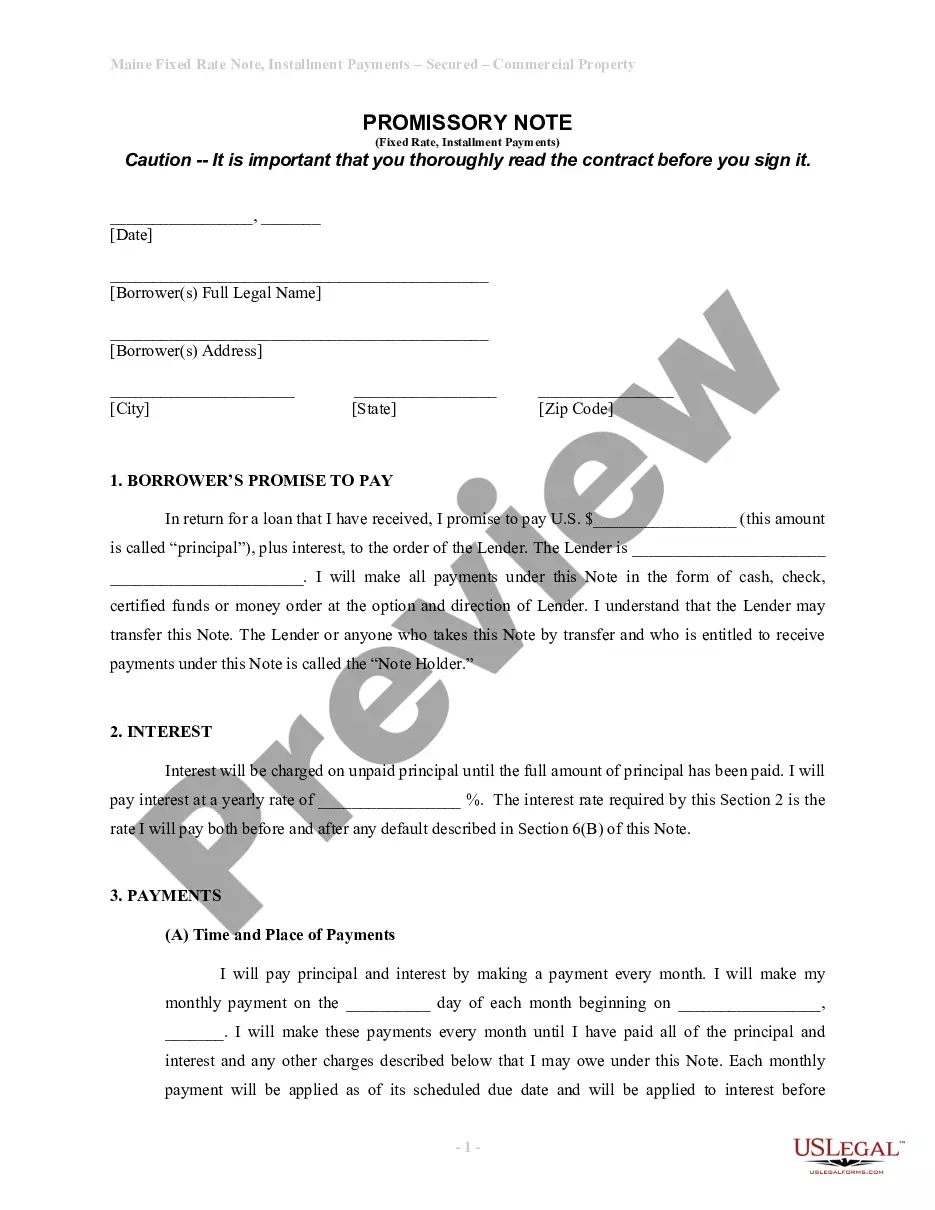

Use US Legal Forms to obtain a printable General Partnership for Business. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms library online and provides affordable and accurate templates for consumers and attorneys, and SMBs. The templates are categorized into state-based categories and a few of them might be previewed prior to being downloaded.

To download templates, users need to have a subscription and to log in to their account. Click Download next to any template you need and find it in My Forms.

For individuals who do not have a subscription, follow the following guidelines to quickly find and download General Partnership for Business:

- Check to ensure that you get the correct form in relation to the state it’s needed in.

- Review the document by looking through the description and using the Preview feature.

- Hit Buy Now if it is the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Use the Search engine if you want to find another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including General Partnership for Business. More than three million users already have used our platform successfully. Choose your subscription plan and have high-quality documents in a few clicks.

Form popularity

FAQ

A general partner is a part-owner of a business and shares in its profits. A general partner is often a doctor, lawyer, or another professional who has joined a partnership in order to remain independent while being part of a larger business.

General Partnership. A voluntary association of two or more persons to carry on business for profit. Personal liability. Liability for business debt, which extends beyond what is invested in a business to include an individual's personal assets.

A general partner is one of two or more investors who jointly own a business and assume a day-to-day role in managing it. A general partner has the authority to act on behalf of the business without the knowledge or permission of the other partners.

A general partnership is a business arrangement by which two or more individuals agree to share in all assets, profits, and financial and legal liabilities of a jointly-owned business.

For example, let's say that Fred and Melissa decide to open a baking store. The store is named F&M Bakery. By opening a store together, Fred and Melissa are both general partners in the business, F&M Bakery. It is important to note that each general partner must be involved in the business.

Compensation of General Partner The general partner earns an annual management fee of up to 2%, which is used to carry out admin duties, covering expenses to be made like overhead and salaries. GPs can also earn a proportion of the private equity fund's profits, and this fee is carried interest.

A general partnership is a business made up of two or more partners, each sharing the business's debts, liabilities, and assets. Partners assume unlimited liability, potentially subjecting their personal assets to seizure if the partnership becomes insolvent.

A limited partnership must have at least one general partner. The general partner or partners are responsible for running the business. They have control over the day-to-day management of the business and have the authority to make legally binding business decisions.

This is basically a general partnership, but with the addition of giving the partners at least some limited personal liability. Limited liability limited partnership (LLLP). This is basically a limited partnership, but with the addition of giving the general partners limited personal liability.