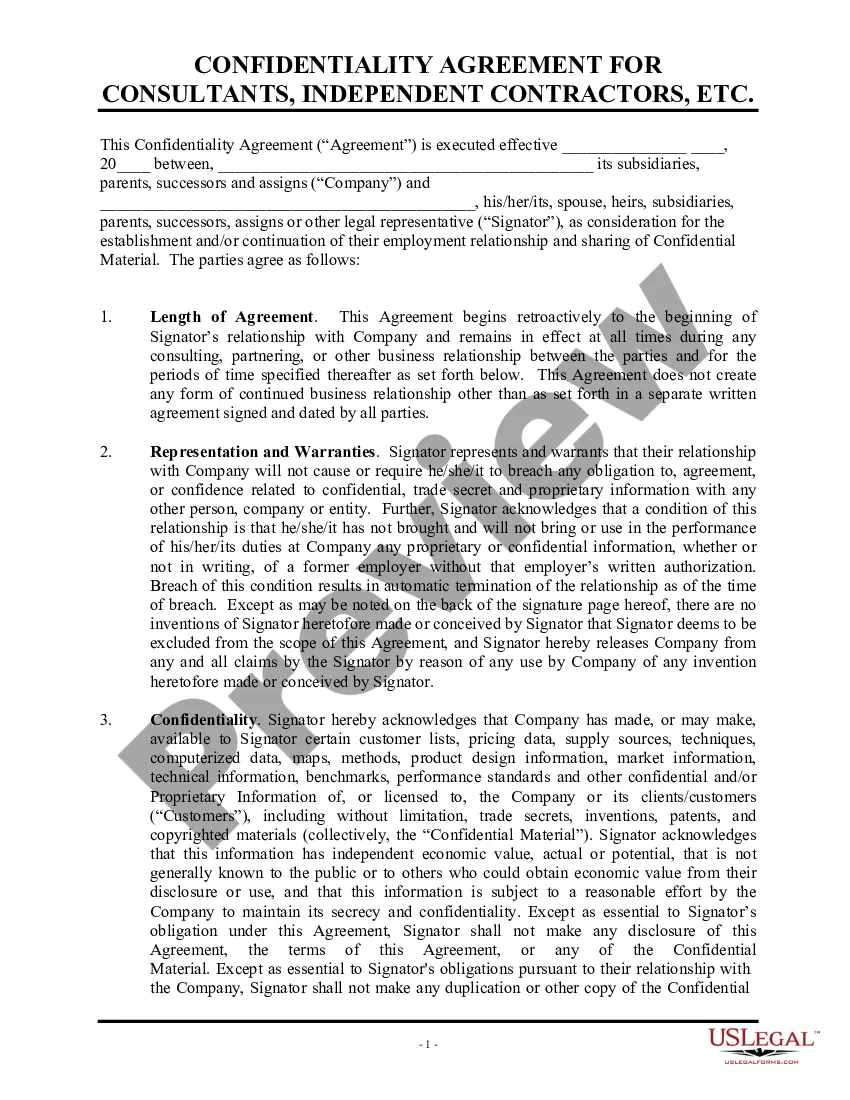

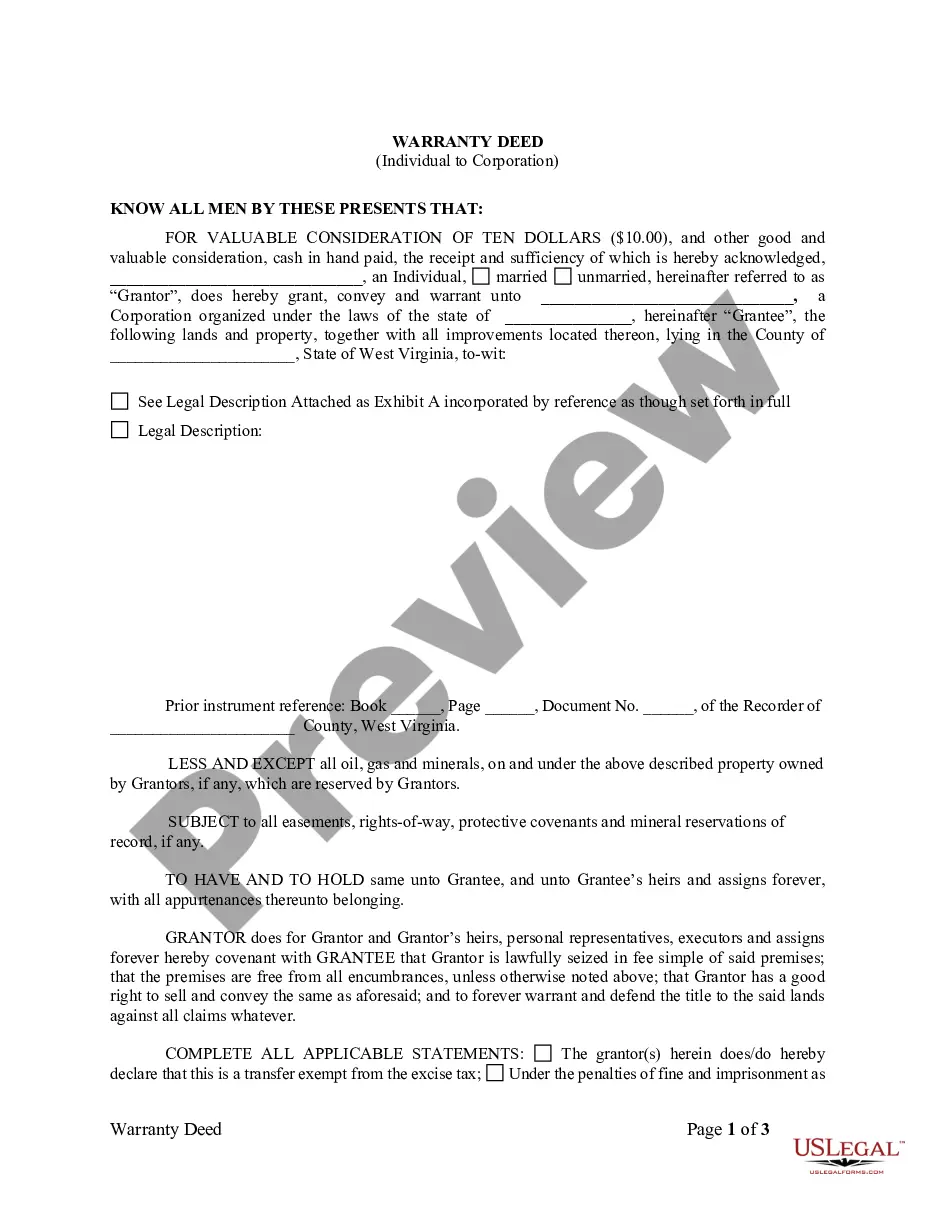

A Confidentiality Agreement for Consultants, Independent Contractors or other 1099 Employees is a legally binding document between an employer and an employee. It is designed to protect confidential information, including trade secrets, proprietary information, and any other information that could harm the employer if it were made available to the public. The agreement is typically used in situations where the employee is given access to confidential information to use in the course of their duties. There are two main types of Confidentiality Agreement for Consultants, Independent Contractors or other 1099 Employees: unilateral and mutual. In a unilateral agreement, the employer is the only party that is bound by the agreement; the employee does not receive any corresponding rights or obligations. In a mutual agreement, both parties are bound by the agreement and both parties have rights and obligations. The agreement typically specifies what information is to be kept confidential, the duration of the agreement, and what is to happen if the agreement is breached. It also typically prohibits the employee from using or disclosing the confidential information for any purpose other than their work for the employer.

Confidentiality Agreement for Consultants, Independent Contractors or other 1099 Employees

Description

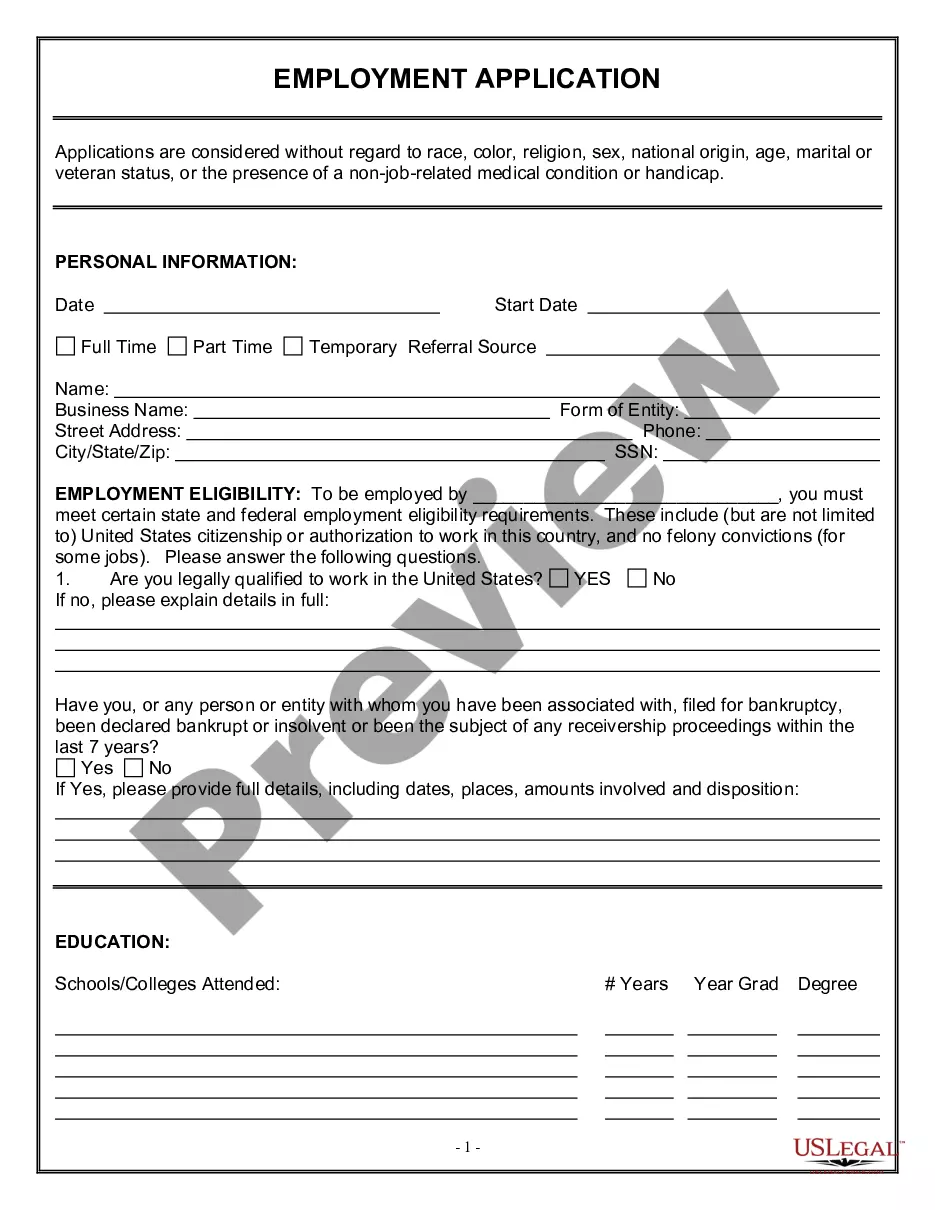

How to fill out Confidentiality Agreement For Consultants, Independent Contractors Or Other 1099 Employees?

US Legal Forms is the most straightforward and cost-effective way to locate appropriate legal templates. It’s the most extensive online library of business and personal legal paperwork drafted and verified by lawyers. Here, you can find printable and fillable templates that comply with federal and local regulations - just like your Confidentiality Agreement for Consultants, Independent Contractors or other 1099 Employees.

Obtaining your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted Confidentiality Agreement for Consultants, Independent Contractors or other 1099 Employees if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to ensure you’ve found the one corresponding to your requirements, or find another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you like most.

- Register for an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your Confidentiality Agreement for Consultants, Independent Contractors or other 1099 Employees and download it on your device with the appropriate button.

Once you save a template, you can reaccess it at any time - just find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more proficiently.

Take advantage of US Legal Forms, your reliable assistant in obtaining the corresponding official paperwork. Try it out!

Form popularity

FAQ

Here is a common example: CONFIDENTIALITY NOTICE: This message and any accompanying documents contain information belonging to the sender which may be confidential and legally privileged. This information is only for the use of the individual or entity to which it was intended.

Generally, a confidentiality agreement will: identify the parties to be bound by the agreement. state the context and reasons for the agreement. define what information is considered confidential.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

This legal contract usually includes information regarding the scope of the work, payment, and deadlines. The agreement might also provide guidance regarding any confidentiality requirements, insurance, and indemnification.

4. Confidentiality Agreement. A consulting agreement should also include an agreement that clarifies that the consultant involved must keep any of their client's company or product information confidential.

An independent contractor non-disclosure agreement prohibits a contractor from sharing any of the client's information with a third party. This form is required to be signed between the contractor and any subcontractors they should hire.

A typical confidentiality clause might say, "The phrases and circumstances of this Agreement are completely confidential between the parties and shall not be disclosed to anybody else. Any disclosure in violation shall be deemed a breach of this Agreement."

Consultant shall hold confidential and proprietary information of third parties gained in the course of Company's business in the strictest confidence and shall not disclose it to any person, firm or company (except as to carry out the Company's business as consistent with Company's agreement with such third party) or