A Construction Loan Escrow Agreement is a contract between a lending institution (such as a bank) and a borrower that outlines the terms of a loan used to finance the construction of a building or other structure. The Agreement establishes an escrow account that serves as a repository for the funds used to finance the construction. The Agreement typically includes provisions regarding the amount of the loan, the interest rate, the repayment terms, the security for the loan, and the roles of the parties in the loan. It may also include provisions related to the disbursement of funds, payments to contractors, and the use of any remaining funds at the completion of the construction. There are generally two types of Construction Loan Escrow Agreements: a “take-out” loan agreement, in which the lender agrees to provide a permanent loan to the borrower once construction is complete; and a “construction-only” loan agreement, in which the lender provides funds for the duration of the construction, and the borrower is responsible for obtaining a permanent loan at the end of the construction period.

Construction Loan Escrow Agreement

Description

What is a Construction Loan Escrow Agreement?

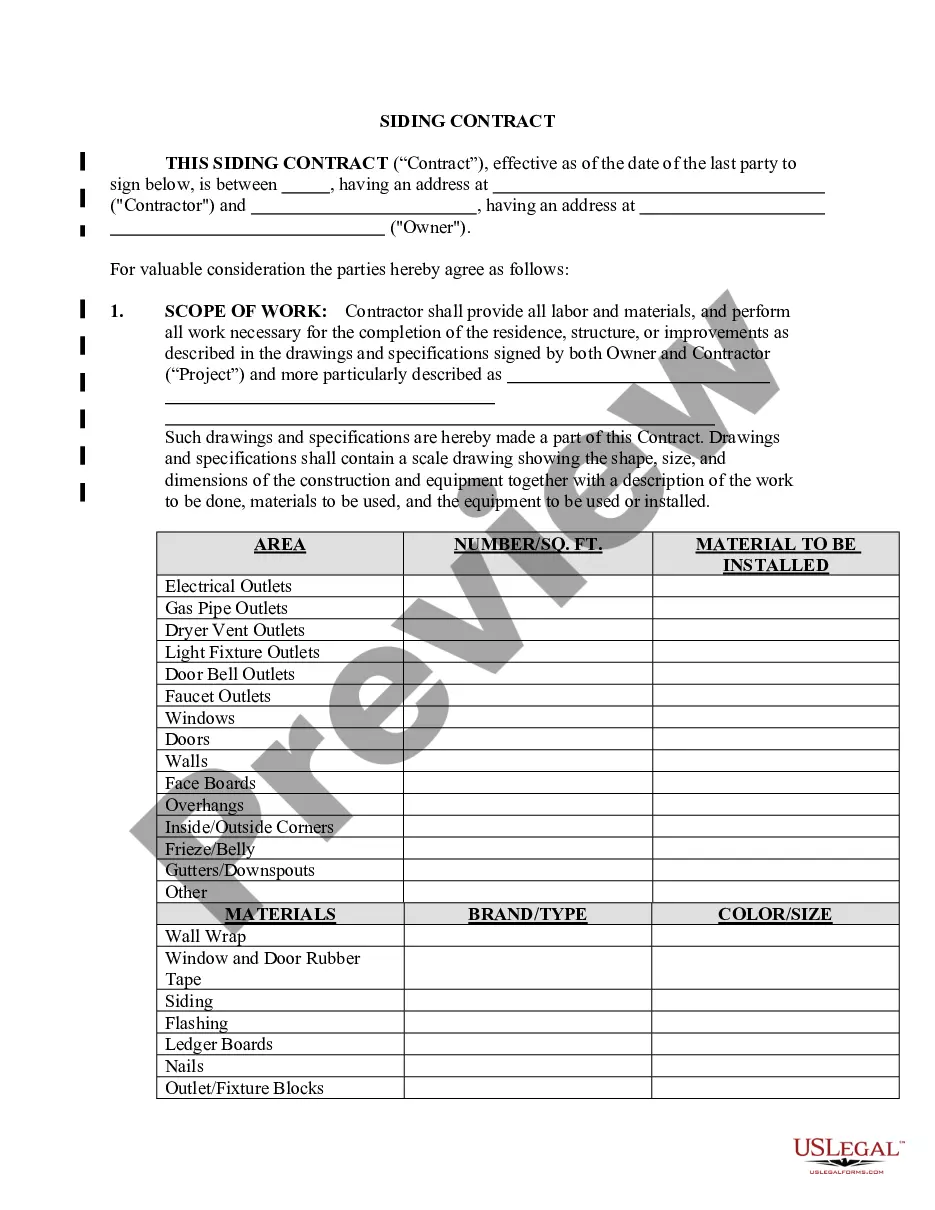

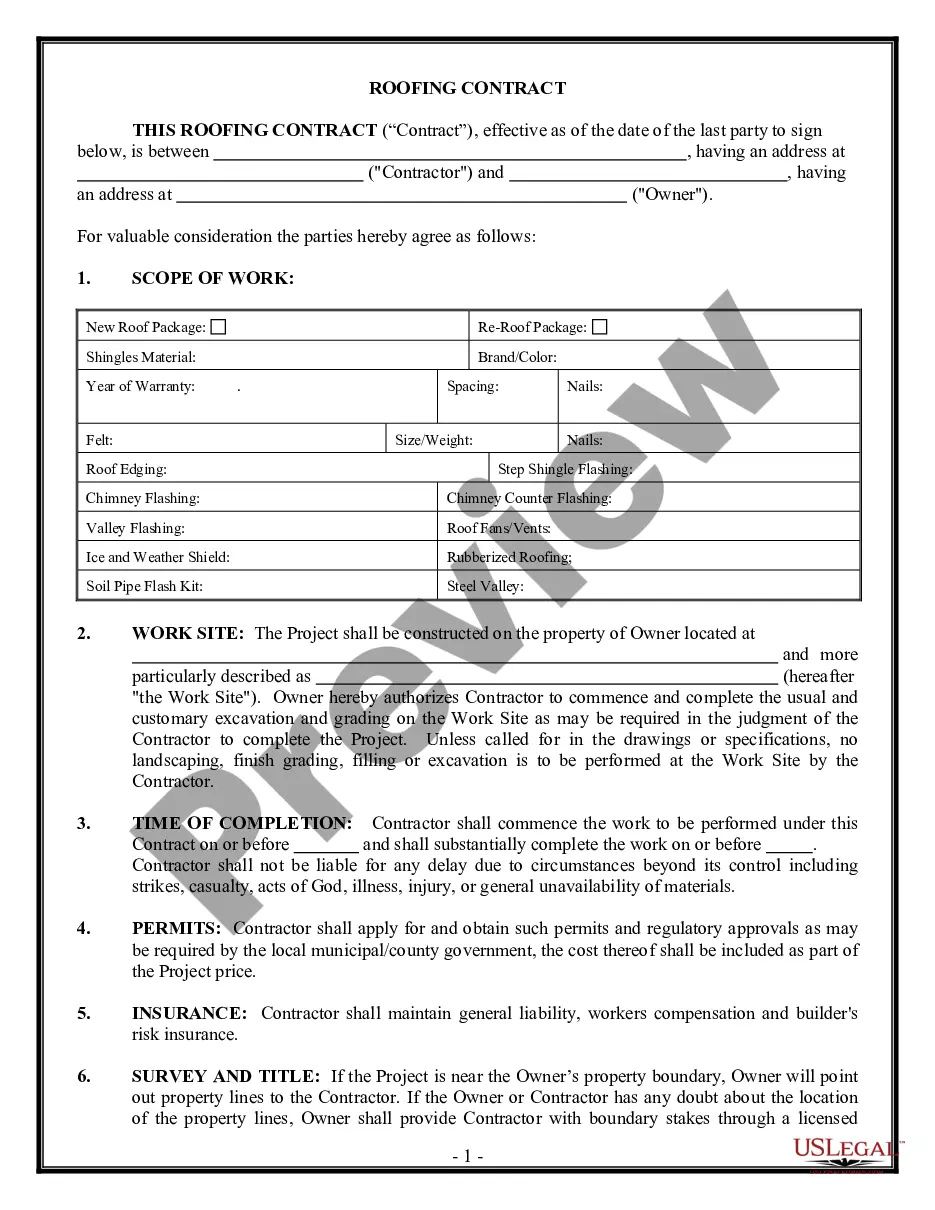

A construction loan escrow agreement is a legal document used in the United States during the construction of a building or development. This agreement outlines the conditions under which construction loan funds will be disbursed by an escrow company. The funds are typically held by a neutral third party (the escrow company) and released to contractors and suppliers at predetermined stages of the construction project, based on the completion of specified milestones.

Key Concepts & Definitions

- Escrow: A financial arrangement where a third party holds and regulates payment of the funds required for two parties involved in a given transaction.

- Draw Schedule: A detailed payment plan for construction projects. It outlines when the contractor will receive disbursements from the escrow account.

- Lien Waivers: Documents from subcontractors and suppliers stating they have received payment and waive any future lien rights to the property concerning the payment.

Step-by-Step Guide to Setting Up a Construction Loan Escrow Agreement

- Loan Approval: Obtain approval for a construction loan from a financial institution.

- Select an Escrow Provider: Choose an escrow company experienced with construction projects.

- Agreement Drafting: Draft the escrow agreement detailing the draw schedule, conditions for disbursement, and responsibilities of all parties involved.

- Signatures: Have the escrow agreement signed by the homebuyer, contractor, and escrow agent.

- Disbursements: Funds are disbursed according to the agreement as construction milestones are completed.

Risk Analysis of Construction Loan Escrow Agreements

- Disbursement Disputes: Miscommunication about milestone completion can lead to disputes over fund disbursement.

- Project Delays: Delays in project completion can complicate the terms of the escrow, potentially increasing costs for the borrower.

- Insufficient Funds: Underestimating the project budget might lead to a shortage of funds, risking incomplete projects.

Best Practices for Construction Loan Escrow Agreements

- Clear Terms: Ensure all terms of the agreement, including draw schedules and disbursement conditions, are clear to all parties.

- Regular Inspections: Schedule regular inspections to verify each stage of construction before releasing funds.

- Legal Review: Have the agreement reviewed by a legal expert to protect all parties involved.

How to fill out Construction Loan Escrow Agreement?

If you’re looking for a way to properly complete the Construction Loan Escrow Agreement without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every individual and business situation. Every piece of paperwork you find on our web service is designed in accordance with federal and state regulations, so you can be certain that your documents are in order.

Follow these straightforward instructions on how to acquire the ready-to-use Construction Loan Escrow Agreement:

- Make sure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the document name in the Search tab on the top of the page and choose your state from the dropdown to locate an alternative template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Construction Loan Escrow Agreement and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Most escrow agreements are put into place when one party wants to make sure the other party meets certain conditions or obligations before it moves forward with a deal. For instance, a seller may set up an escrow agreement to ensure a potential homebuyer can secure financing before the sale goes through.

The two essential elements for a valid sale escrow are a binding contract/agreement between buyer and seller and the conditional delivery to a neutral third party of something of value, as defined, which typically includes written instruments of conveyance (grant deed) or encumbrance (deed of trust) and related

An escrow agreement refers to a contract that outlines the terms and conditions of a transaction for something of value ? such as a bond, deed, or asset ? which is held by a third party until all conditions have been met.

Escrow agreements are commonly used in real estate transactions. The escrow agreement generally includes, but is not limited to, information about the escrow agent's identity, the funds in escrow, and the acceptable use of funds by the agent?.

Construction escrow is a third party holding account for funds on a construction project. This account holds funds for the project until specific terms are met, then releases those funds to the contractor. Having funds in escrow helps guarantee that funds will be available for the project.

Essential elements of a valid escrow arrangement are: A contract between the grantor and the grantee agreeing to the conditions of a deposit; Delivery of the deposited item to a depositary; and. Communication of the agreed conditions to the depositary.

In the home purchasing context, some mortgage lenders require that the buyer use an escrow account during the transaction. Even if there is no requirement to use an escrow account in the home purchase context, using such an account may provide additional protection to all parties involved in the transaction.

You must withdraw from escrow in writing. In California, buyers must usually provide written notice to the seller before canceling via a Notice to Seller to Perform. The written cancellation of contract and escrow that follows must then be signed by the seller to officially withdraw from escrow.