Commercial Lease Agreement

Description

Key Concepts & Definitions

Commercial Lease Agreement: A legal document that outlines the terms under which a tenant can rent commercial property from a landlord. Commercial Property: Real estate used for business purposes, such as offices, retail spaces, warehouses, and more. Landlord Tenant: The relationship between the property owner ('landlord') and the renter ('tenant'). Modified Gross Lease: A type of lease where the tenant pays base rent at the lease's outset but eventually takes on some of the operating costs like utilities and maintenance.

Step-by-Step Guide to Creating a Commercial Lease Agreement

- Determine the Type of Commercial Lease: Decide if the lease will be a gross lease, net lease, or a modified gross lease based on the property type and location.

- Measure the Square Footage: Accurately record the square footage of the leased area to prevent disputes over the area being rented.

- Negotiate Terms: Both parties should discuss terms such as the length of the lease, rent amount, property insurance responsibilities, and maintenance duties.

- Draft the Lease Agreement: Incorporate all agreed terms into the document. Assistance from a real estate attorney is advisable.

- Review and Sign: Both landlord and tenant should thoroughly review the lease. Once all parties agree, they can sign the agreement.

- Email Delivery: Send a copy of the signed agreement to all parties via email for digital records.

Risk Analysis of Commercial Lease Agreements

- Financial Risks: There may be unexpected increases in rental costs or additional charges not initially disclosed.

- Legal Risks: Poorly drafted agreements may lead to legal disputes between tenant and landlord.

- Operational Risks: Restrictions in the lease can limit the type of business activities a tenant can conduct, impacting business operations.

Pros & Cons of Commercial Lease Agreements

Pros:- Provides a clear legal framework and security for both parties.

- Potentially includes clauses that protect both the landlord's and tenant's interests.

- Can be restrictive, limiting tenant's business modifications.

- Complex negotiations might lead to misunderstandings or flawed terms.

Best Practices in Commercial Lease Agreements

- Always involve a real estate attorney to avoid legal pitfalls.

- Be clear about every party's responsibilities concerning property insurance and maintenance.

- Ensure the rental contract thoroughly outlines all terms including, rent increases, subleasing conditions, and termination clauses.

Common Mistakes & How to Avoid Them

- Underestimating Costs: Ensure all potential costs, such as property insurance and maintenance, are clearly outlined and understood.

- Bypassing Legal Help: Hiring experienced legal counsel can prevent costly disputes and lawsuits.

- Not Researching the Property: Full knowledge of the commercial property, including past use and structural integrity, is crucial.

FAQ

What is a modified gross lease? A modified gross lease is a type of leasing agreement where the tenant pays base rent at the lease's outset and eventually some of the operating costs.

How can I calculate proper square footage for my lease agreement? Employ a professional surveyor to measure the exact square footage of the commercial property to ensure accuracy and compliance with the lease agreement.

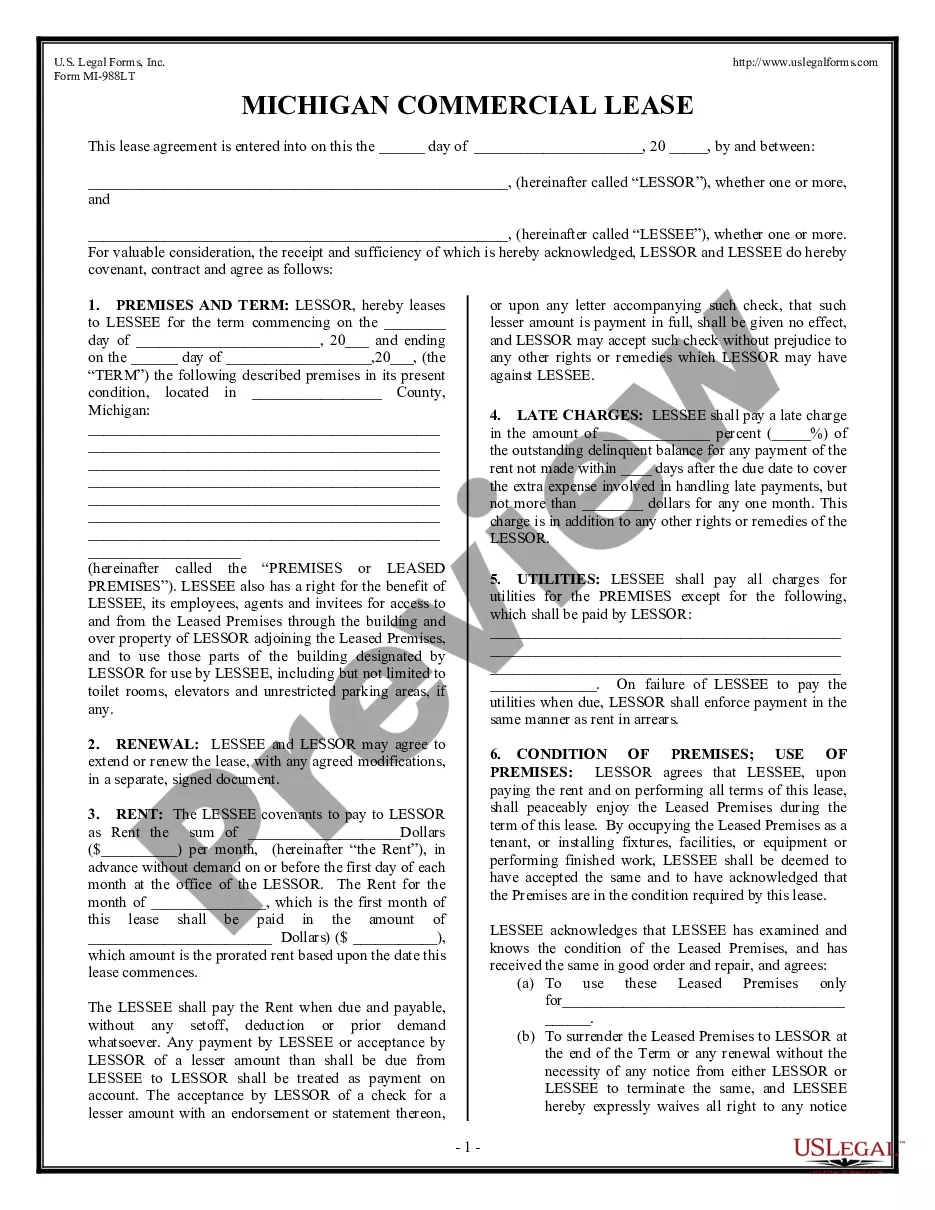

How to fill out Commercial Lease Agreement?

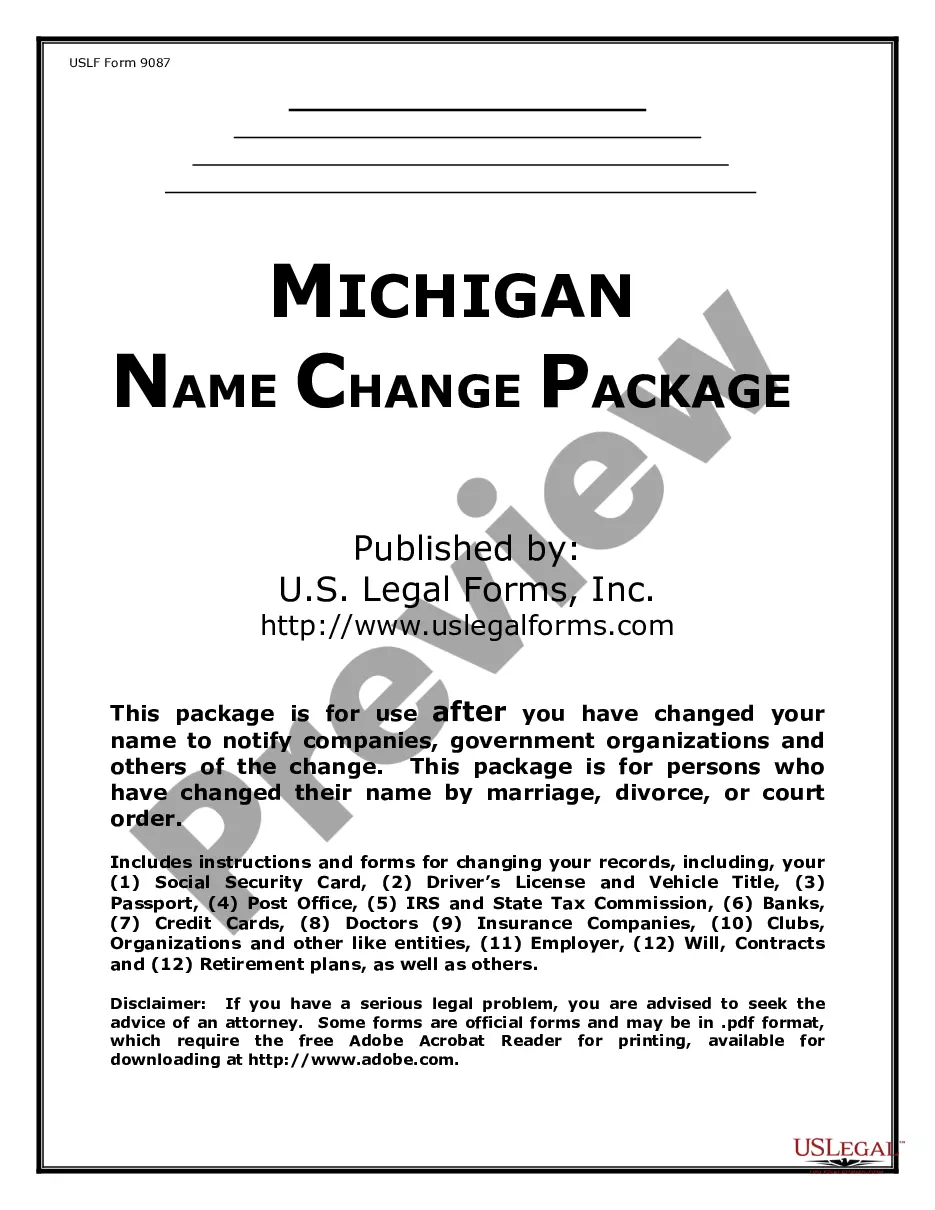

Utilize the most complete legal catalogue of forms. US Legal Forms is the perfect place for finding up-to-date Commercial Lease Agreement templates. Our service provides a huge number of legal documents drafted by certified lawyers and grouped by state.

To download a sample from US Legal Forms, users only need to sign up for an account first. If you are already registered on our platform, log in and select the template you are looking for and buy it. After purchasing forms, users can find them in the My Forms section.

To get a US Legal Forms subscription online, follow the steps below:

- Find out if the Form name you have found is state-specific and suits your needs.

- When the template features a Preview function, utilize it to review the sample.

- In case the template doesn’t suit you, utilize the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your requirements.

- Choose a pricing plan.

- Create your account.

- Pay with the help of PayPal or with yourr debit/visa or mastercard.

- Select a document format and download the sample.

- As soon as it is downloaded, print it and fill it out.

Save your time and effort with the platform to find, download, and fill in the Form name. Join thousands of pleased subscribers who’re already using US Legal Forms!

Form popularity

FAQ

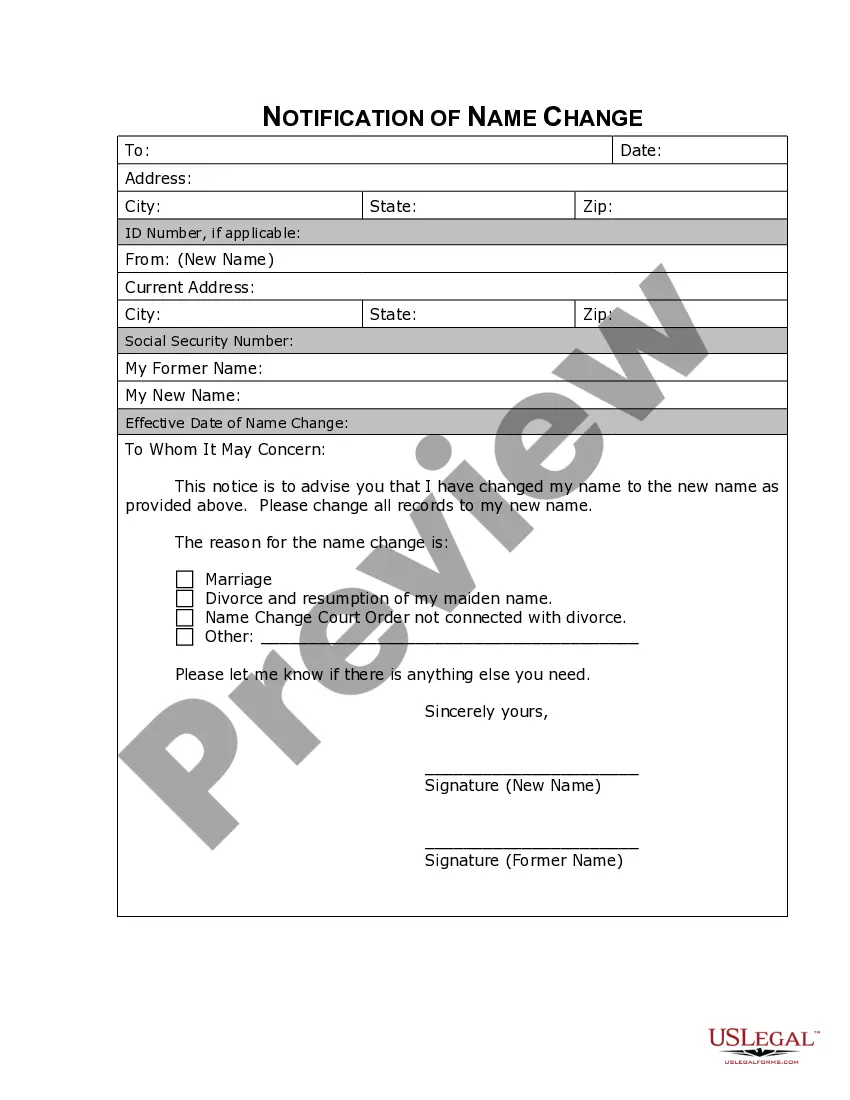

Names of all tenants. Limits on occupancy. Term of the tenancy. Rent. Deposits and fees. Repairs and maintenance. Entry to rental property. Restrictions on tenant illegal activity.

The Introduction. The beginning of the lease agreement should contain the name of the landlord and tenant, as well as a statement of the agreement into which they are entering. Rent. Deposit. Taxes. Property Insurance. Utilities and Amenities. Remodeling and Improvements. Repairs and Maintenance.

Commercial leases fall within the ambit of the CPA and refer to an agreement between a landlord and a business setting out terms and conditions governing a property rental. The CPA applies to contracts entered with natural persons and juristic persons with an annual turnover or asset value of less than R2 million.

This means that a private lease agreement will be covered by the CPA.The CPA does not apply to transactions where the consumer is a company, close corporation or a trust with an annual turnover or net asset value of R2M.

The Introduction. The beginning of the lease agreement should contain the name of the landlord and tenant, as well as a statement of the agreement into which they are entering. Rent. Deposit. Taxes. Property Insurance. Utilities and Amenities. Remodeling and Improvements. Repairs and Maintenance.

The cost of registering a lease is generally paid by a tenant. Leases with a lease period of more than three years, including any option period, must be registered. This helps to protect the tenant's interests. The tenant pays their own legal costs.

The Consumer Protection Act (CPA) does NOT apply to all lease agreements (or rental agreements). This is really important to know because the Consumer Protection Act has a big influence on the lease and changes the legal position between the landlord and tenant significantly.Tenants already have lots of protection.

The Parties & Personal Guarantees. Lease Term & Renewals. Rent Payments and Expenses. Business Protection Clauses.

Single-net lease (N lease) In a single-net lease, the tenant pays a base rent, a share of the building's property tax, as well as utilities and janitorial services. Double-net lease (NN lease) Triple-net lease (NNN lease) Absolute triple-net lease.