16.01 EXPLANATORY: DETERMINING HOURS WORKED is a tool used by employers to accurately track and pay employees for the hours they work. This tool is used to calculate total hours worked, overtime hours, and holiday/vacation pay. It is important for employers to accurately track employee hours in order to comply with wage and hour laws. There are three types of 16.01 EXPLANATORY: DETERMINING HOURS WORKED: manual time tracking, electronic time tracking, and integrated time tracking. Manual time tracking is done using paper timesheets, which can be filled out and signed by an employee at the end of each shift. Electronic time tracking is done using online systems that allow employees to clock in and out of their shifts using a computer or mobile device. Integrated time tracking is done using an integrated payroll system that tracks hours worked and automatically calculates pay.

16.01 EXPLANATORY: DETERMINING HOURS WORKED

Description

How to fill out 16.01 EXPLANATORY: DETERMINING HOURS WORKED?

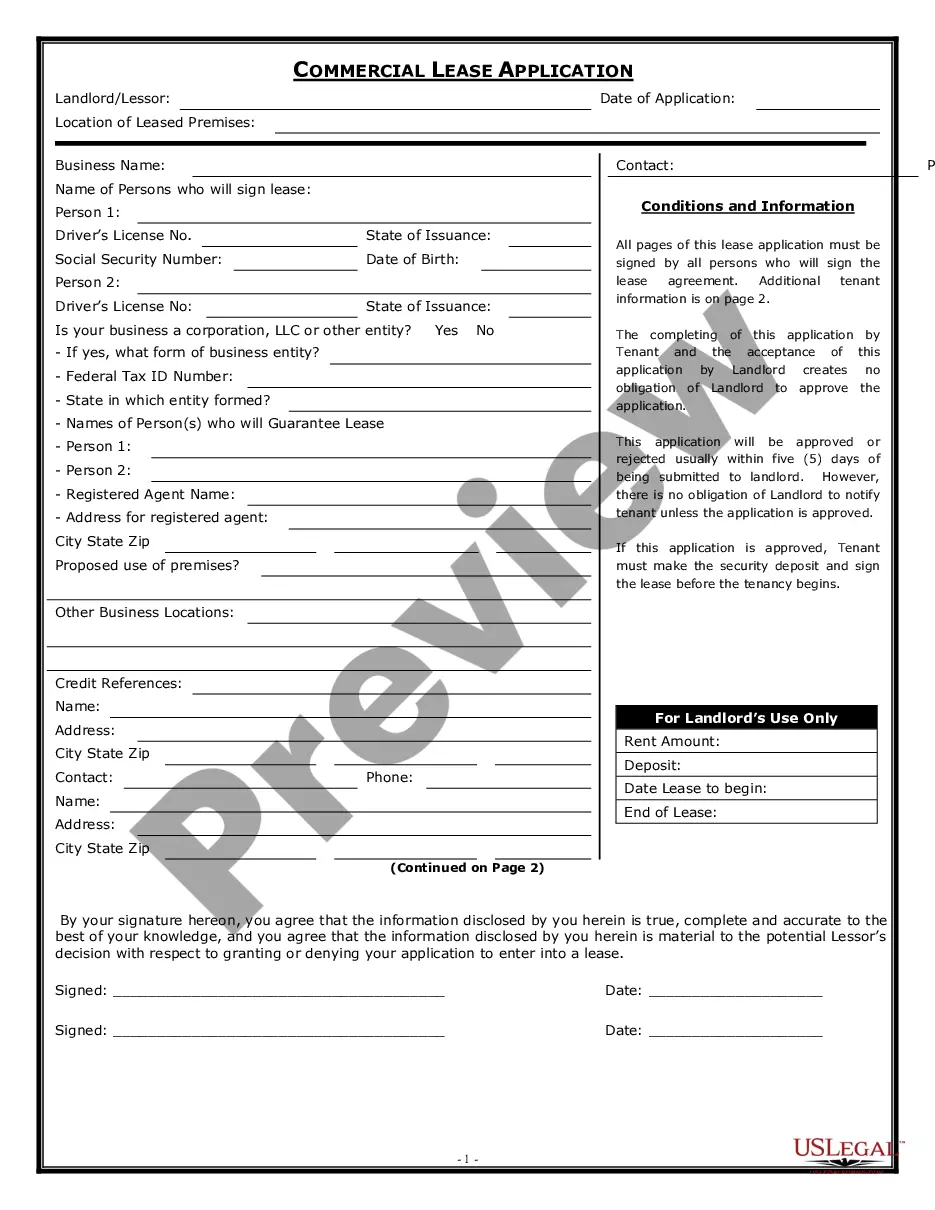

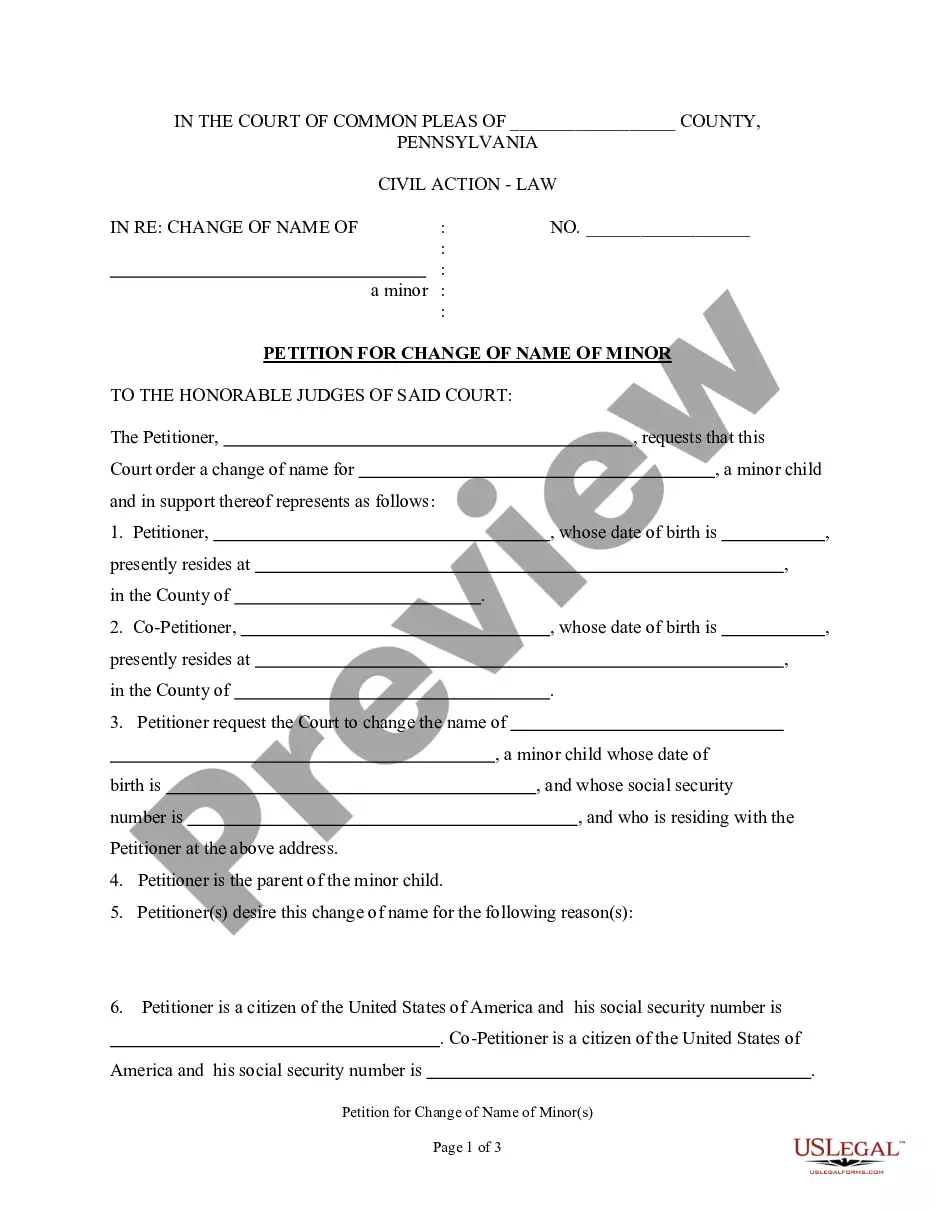

If you’re searching for a way to properly prepare the 16.01 EXPLANATORY: DETERMINING HOURS WORKED without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every personal and business scenario. Every piece of paperwork you find on our web service is drafted in accordance with federal and state regulations, so you can be certain that your documents are in order.

Follow these simple instructions on how to get the ready-to-use 16.01 EXPLANATORY: DETERMINING HOURS WORKED:

- Ensure the document you see on the page corresponds with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and choose your state from the list to find another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your 16.01 EXPLANATORY: DETERMINING HOURS WORKED and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Once you know the number of hours you typically work in a week, you can then take that number and multiply it by 52 (the number of weeks in the year) to see the average number of hours you worked over the course of the year. Keep in mind that this number doesn't account for holidays or vacation days.

The four main components or elements covered by the FLSA are: payment of a minimum wage. overtime pay for working 40+ hours in a week. recordkeeping by the employer on employees: accurate information identifying the worker and the hours worked and the wages earned. child labor standards and restrictions.

Generally, no, there are no federal laws that limit how many hours you can work in a single day.

What About Timekeeping: Employers may use any timekeeping method they choose. For example, they may use a time clock, have a timekeeper keep track of employee's work hours, or tell their workers to write their own times on the records. Any timekeeping plan is acceptable as long as it is complete and accurate.

Under the FLSA, overtime pay is determined by multiplying the employee's ?straight time rate of pay? by all overtime hours worked PLUS one-half of the employee's ?hourly regular rate of pay? times all overtime hours worked. All overtime work that is ordered or approved must be compensated.

The easiest and the best way is to retain copies of your paystub, which should show the total number of hours you worked each day and each week during the pay period.

The United States Department of Labor says, ?In general, ?hours worked? includes all time an employee must be on duty, or on the employer's premises or at any other prescribed place of work. Also included is any additional time the employee is allowed (i.e., suffered or permitted) to work.?

The Fair Labor Standards Act (FLSA) is a federal employment law that defines employer obligations relating to employee wages, hours, overtime, and child labor.