Statutory Guidelines [Appendix A(1) IRC 104] regarding compensation for injuries or sickness under workmen's compensation acts, damages (other than punitive damages), accident or health insurance, etc. as stated in the guidelines.

Compensation for Injuries or Sickness IRS Code 104

Description Irs Section 104

How to fill out Compensation For Injuries Or Sickness IRS Code 104?

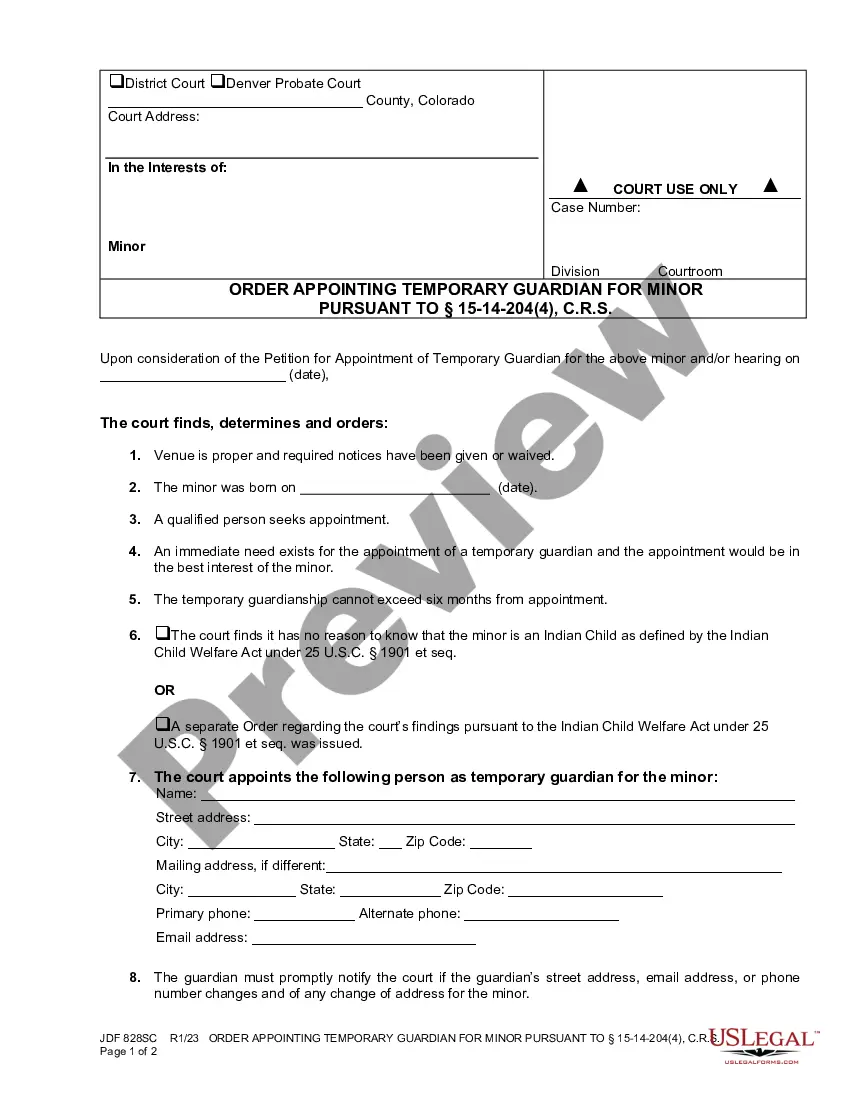

Employ the most extensive legal library of forms. US Legal Forms is the perfect place for finding up-to-date Compensation for Injuries or Sickness IRS Code 104 templates. Our platform provides a huge number of legal forms drafted by licensed attorneys and categorized by state.

To download a sample from US Legal Forms, users simply need to sign up for a free account first. If you’re already registered on our platform, log in and choose the document you need and purchase it. Right after purchasing templates, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines below:

- Find out if the Form name you have found is state-specific and suits your requirements.

- In case the template has a Preview function, utilize it to review the sample.

- If the sample doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your needs.

- Select a pricing plan.

- Create your account.

- Pay via PayPal or with yourr credit/visa or mastercard.

- Choose a document format and download the sample.

- As soon as it’s downloaded, print it and fill it out.

Save your time and effort using our platform to find, download, and fill in the Form name. Join a huge number of satisfied clients who’re already using US Legal Forms!

Form popularity

FAQ

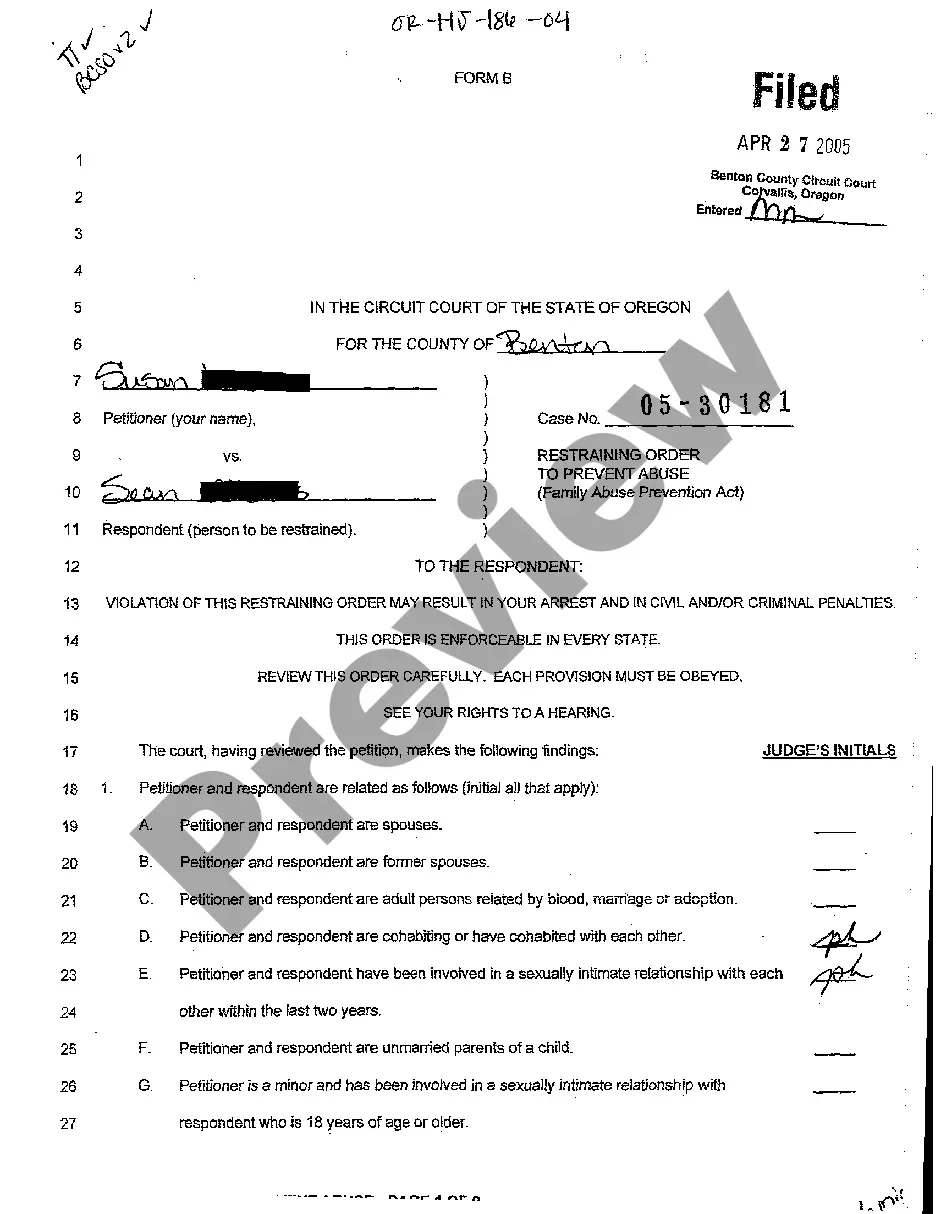

If you receive a settlement, the IRS requires the paying party to send you a Form 1099-MISC. Box 3 of Form 1099-MISC will show other income in this case, money received from a legal settlement. Generally, all taxable damages are required to be reported in Box 3.

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money, although personal injury settlements are an exception (most notably: car accident settlement and slip and fall settlements are nontaxable).

If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable.The tax benefit amount should be reported as Other Income on line 21 of Form 1040, Schedule 1.

As a taxpayer, any monetary award you receive is assumed to be gross income and is taxable. Fortunately, the Internal Revenue Code (IRC) permits a taxpayer to avoid paying taxes on any settlement money aside from punitive damages received due to personal physical injuries or physical sickness.

Pain and suffering, along with emotional distress directly caused by a physical injury or ailment from an accident, are not taxable in a California settlement for personal injuries.

Section 104 does not limit the exclusion to personal physical injury. It also allows for any type of any nonphysical injury inflicted.

Report taxable settlement amounts on Line 6 of Form 1040 after completing Schedule 1 (1040).

Pain and suffering, along with emotional distress directly caused by a physical injury or ailment from an accident, are not taxable in a California settlement for personal injuries.

As opposed to claims originating from a physical injury, settlement recoveries for emotional distress claims usually are taxed. This rule also highlights the difference between a plaintiff showing physical signs of emotional distress (such as headaches, insomnia, and nausea) and physical injuries or sickness.