Statutory Guidelines [Appendix A(3) IRC 130] regarding certain personal injury liability assignments.

Certain Personal Injury Liability Assignments IRS Code 130

Description

How to fill out Certain Personal Injury Liability Assignments IRS Code 130?

Make use of the most complete legal library of forms. US Legal Forms is the best platform for getting updated Certain Personal Injury Liability Assignments IRS Code 130 templates. Our platform provides a huge number of legal forms drafted by certified legal professionals and sorted by state.

To download a sample from US Legal Forms, users just need to sign up for an account first. If you’re already registered on our service, log in and choose the document you are looking for and buy it. Right after buying templates, users can see them in the My Forms section.

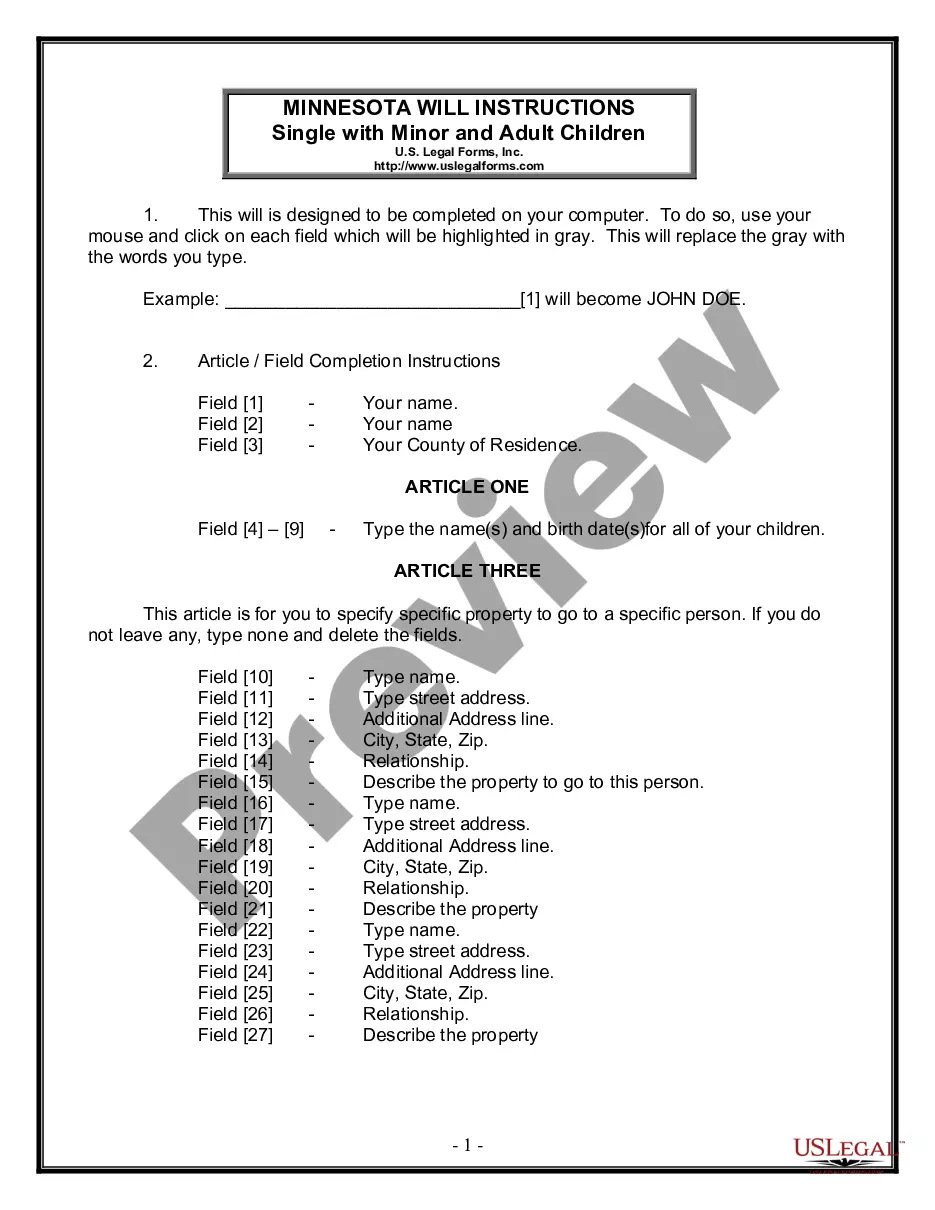

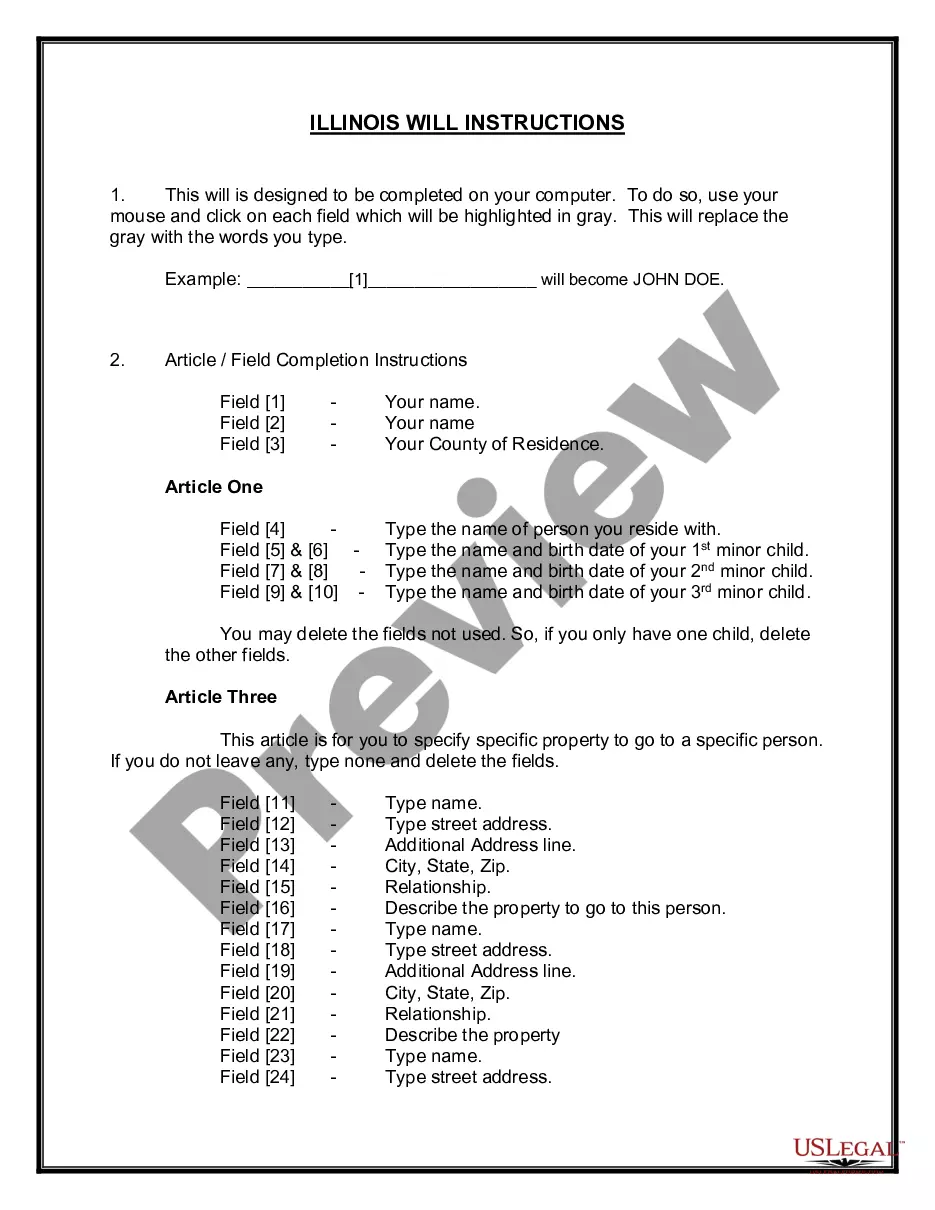

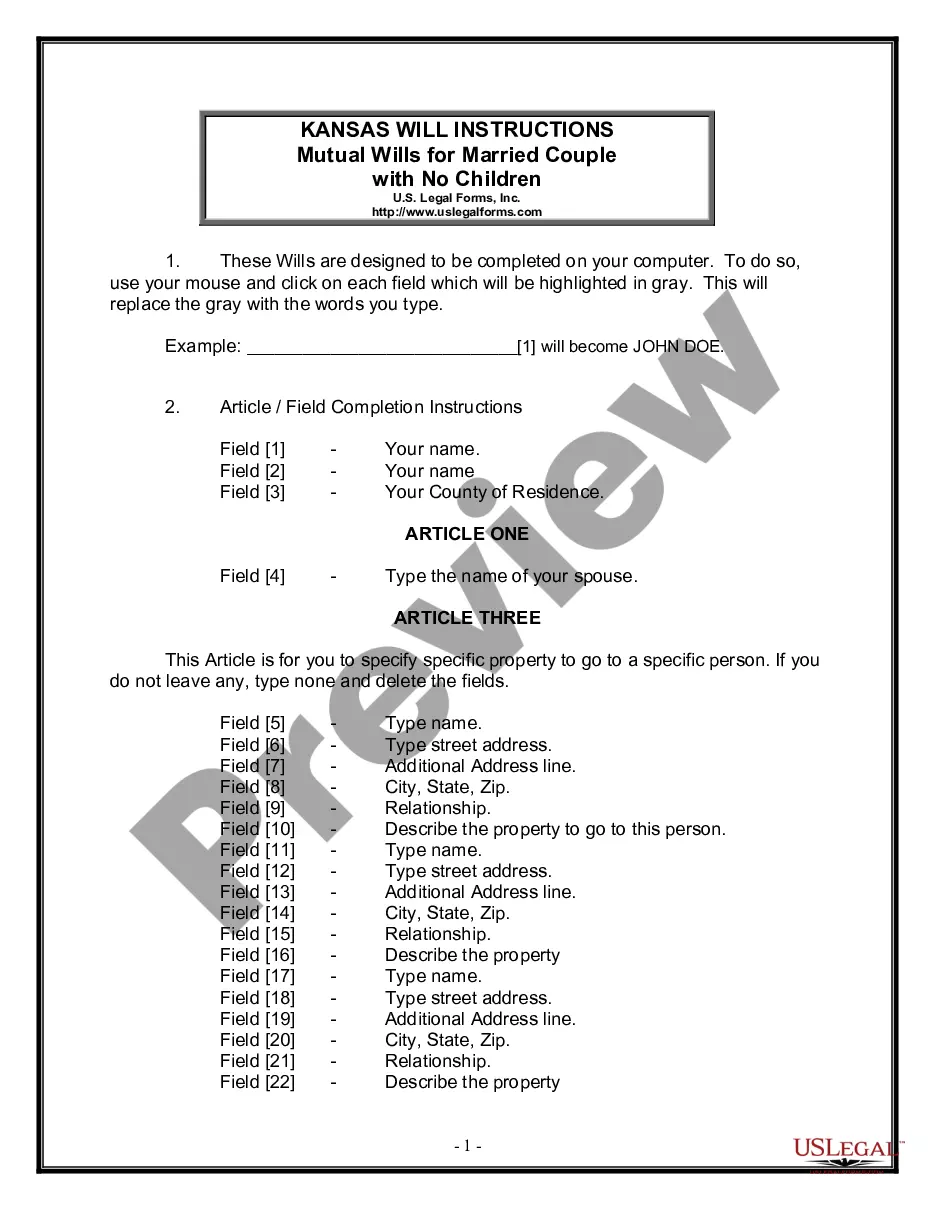

To obtain a US Legal Forms subscription online, follow the guidelines below:

- Check if the Form name you have found is state-specific and suits your requirements.

- If the template has a Preview option, utilize it to check the sample.

- If the sample does not suit you, use the search bar to find a better one.

- Hit Buy Now if the sample meets your requirements.

- Choose a pricing plan.

- Create your account.

- Pay via PayPal or with the debit/bank card.

- Choose a document format and download the template.

- After it’s downloaded, print it and fill it out.

Save your time and effort with our service to find, download, and complete the Form name. Join thousands of satisfied subscribers who’re already using US Legal Forms!

Form popularity

FAQ

Yes. California law requires drivers and vehicle owners to mandatory bodily injury liability insurance with a minimum of 15/30/5 limits. Such insurance also covers: Someone other than the policyholder who drives a covered vehicle with the policy holder's permission; and.

If you cause a car accident that injures another person, bodily injury liability coverage helps pay for their medical expenses and lost income as a result of their injuries. This coverage may also help pay for your legal fees if you're taken to court over an accident.

Bodily injury liability is car insurance coverage that pays for injuries a driver causes to other people, including other drivers, passengers and pedestrians. The policy covers medical expenses and lost wages as well as legal and funeral expenses in some cases.

If you cause a car accident that injures another person, bodily injury liability coverage helps pay for their medical expenses and lost income as a result of their injuries.Most states have laws that require you to have bodily injury liability coverage on your car insurance policy.

To break it down a bit more, Liability coverage is made up of two parts: Bodily Injury and Property Damage. Bodily Injury is what pays for any injuries to others from the accident. This includes everything from medical expenseslike doctor visits and physical therapyto lost wages.

Bodily injury liability can cover medical bills, funeral expenses, lost wages, legal fees, and other related costs.In most states, if your bodily injury limits are not high enough to pay for all the medical bills from an accident, the not-at-fault driver and their passengers can sue you for any uncompensated expenses.

State minimums don't come close to covering the cost of a serious accident. You should carry bodily-injury coverage of at least $100,000 per person, and $300,000 per accident, and property-damage coverage of $50,000, or a minimum of $300,000 on a single-limit policy.

Personal injury protection (PIP) insurance coverage includes payment for injury-related medical and rehabilitation expenses, loss of income, and funeral and burial expenses. Bodily injury liability coverage includes payment for any physical injuries that occur in an accident you cause.

Bodily injury liability coverage pays for other drivers' and passengers' injuries when the policyholder is at-fault in an accident. Bodily injury liability can cover medical bills, funeral expenses, lost wages, legal fees, and other related costs.