Venture Capital Package

Description

How to fill out Venture Capital Package?

Make use of the most complete legal library of forms. US Legal Forms is the perfect platform for finding up-to-date Venture Capital Package templates. Our platform offers a large number of legal documents drafted by certified attorneys and grouped by state.

To download a template from US Legal Forms, users simply need to sign up for a free account first. If you are already registered on our service, log in and select the template you are looking for and purchase it. After buying templates, users can find them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines listed below:

- Find out if the Form name you have found is state-specific and suits your needs.

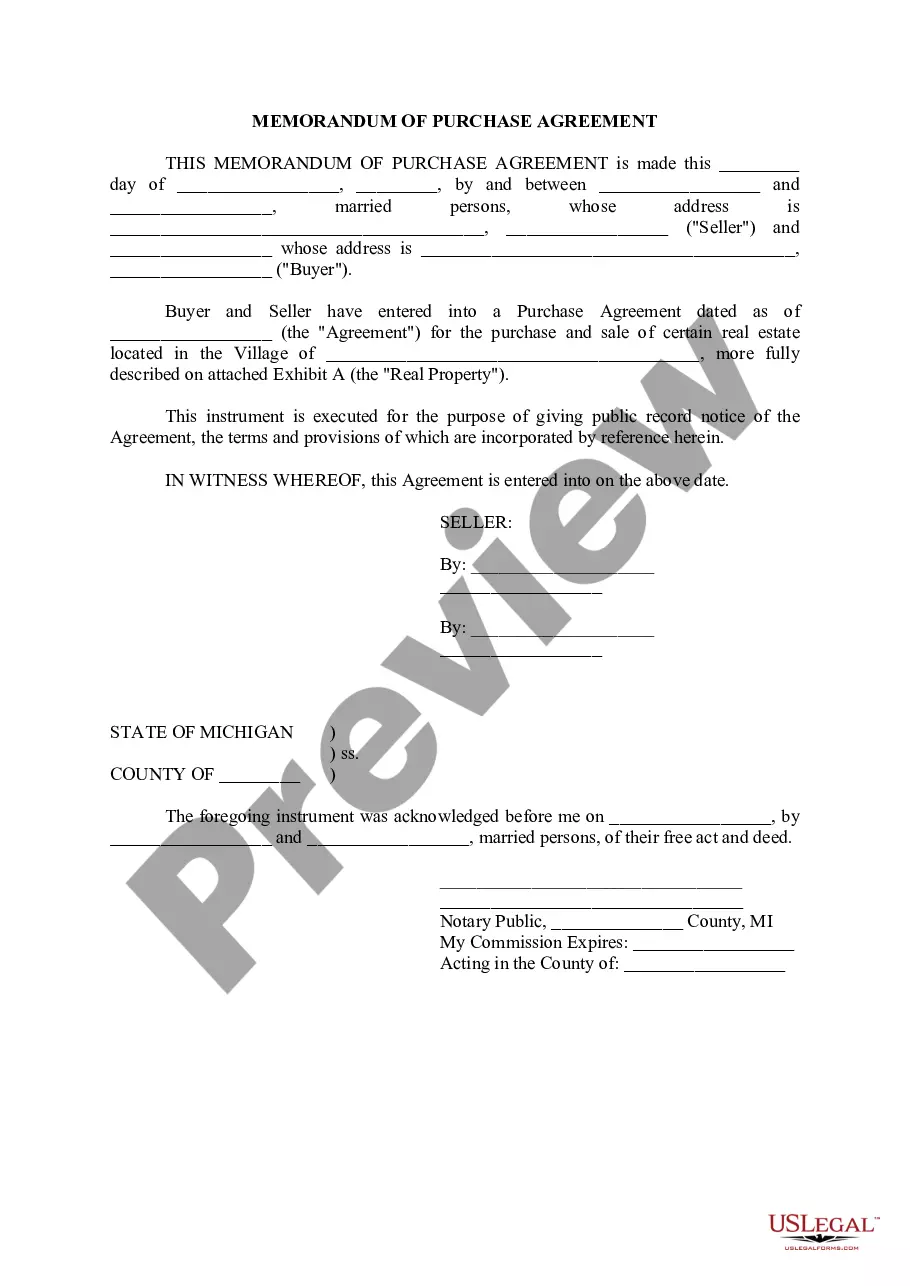

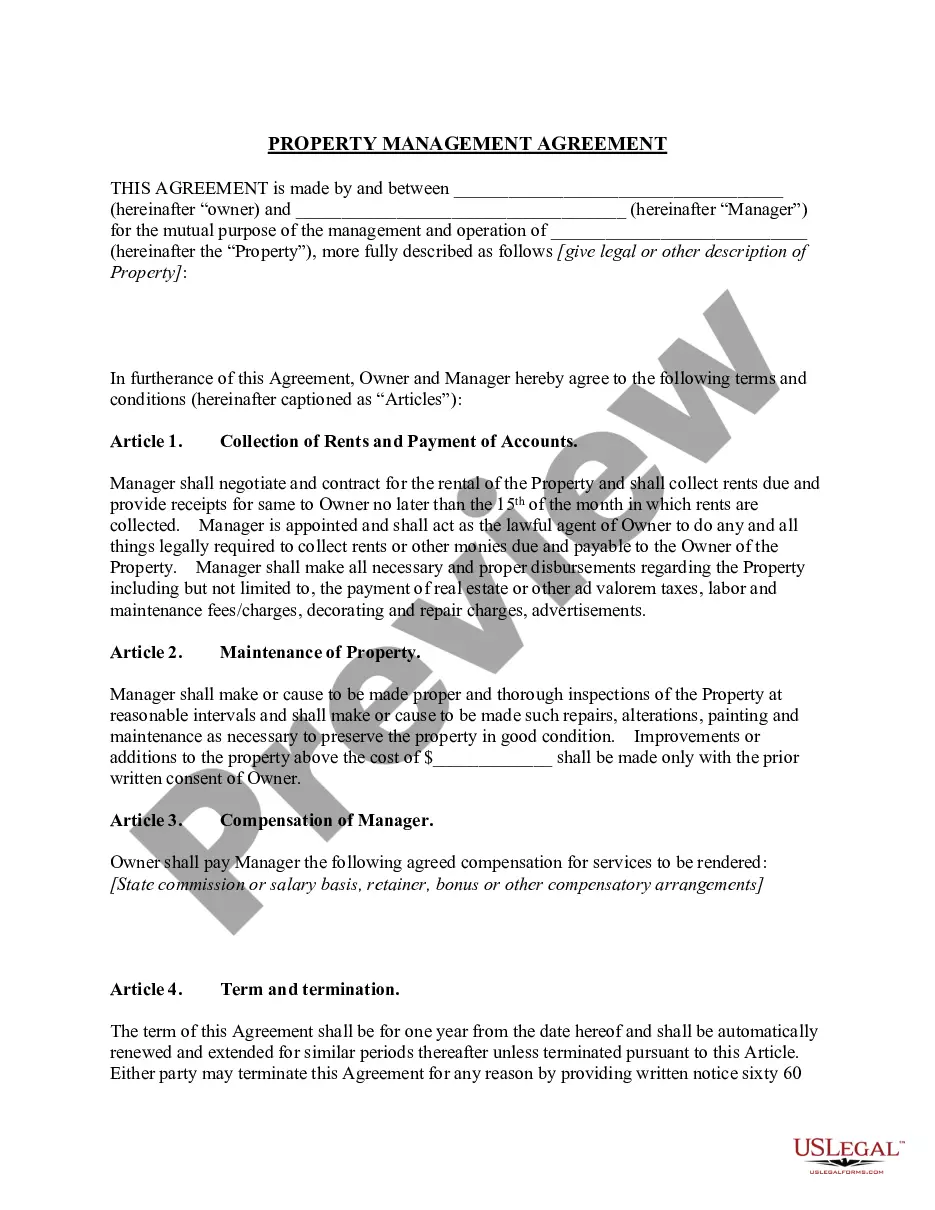

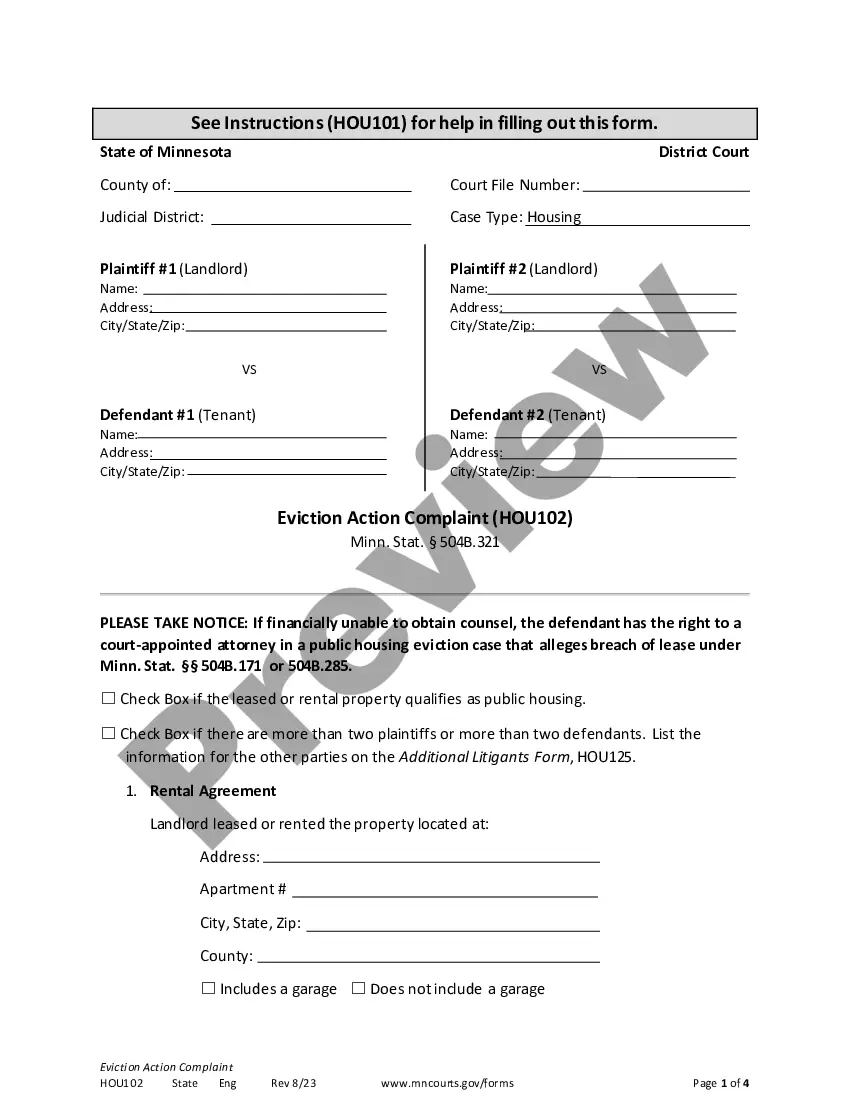

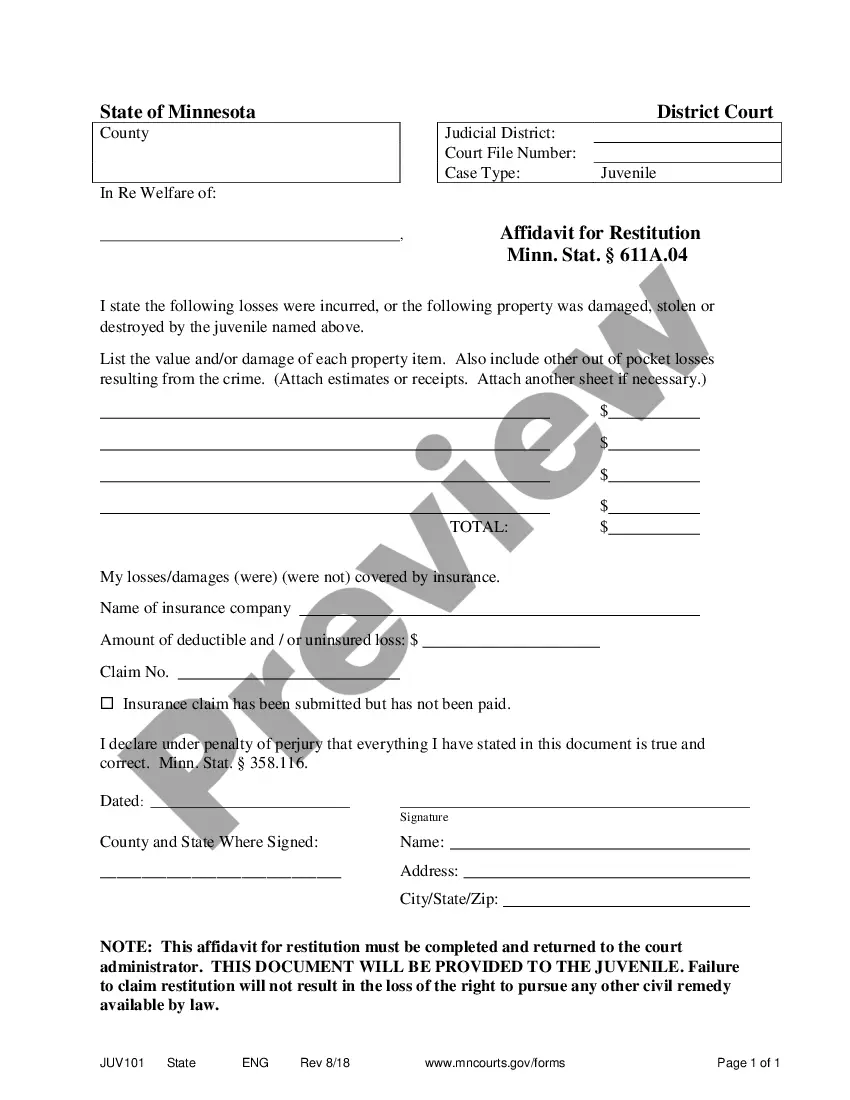

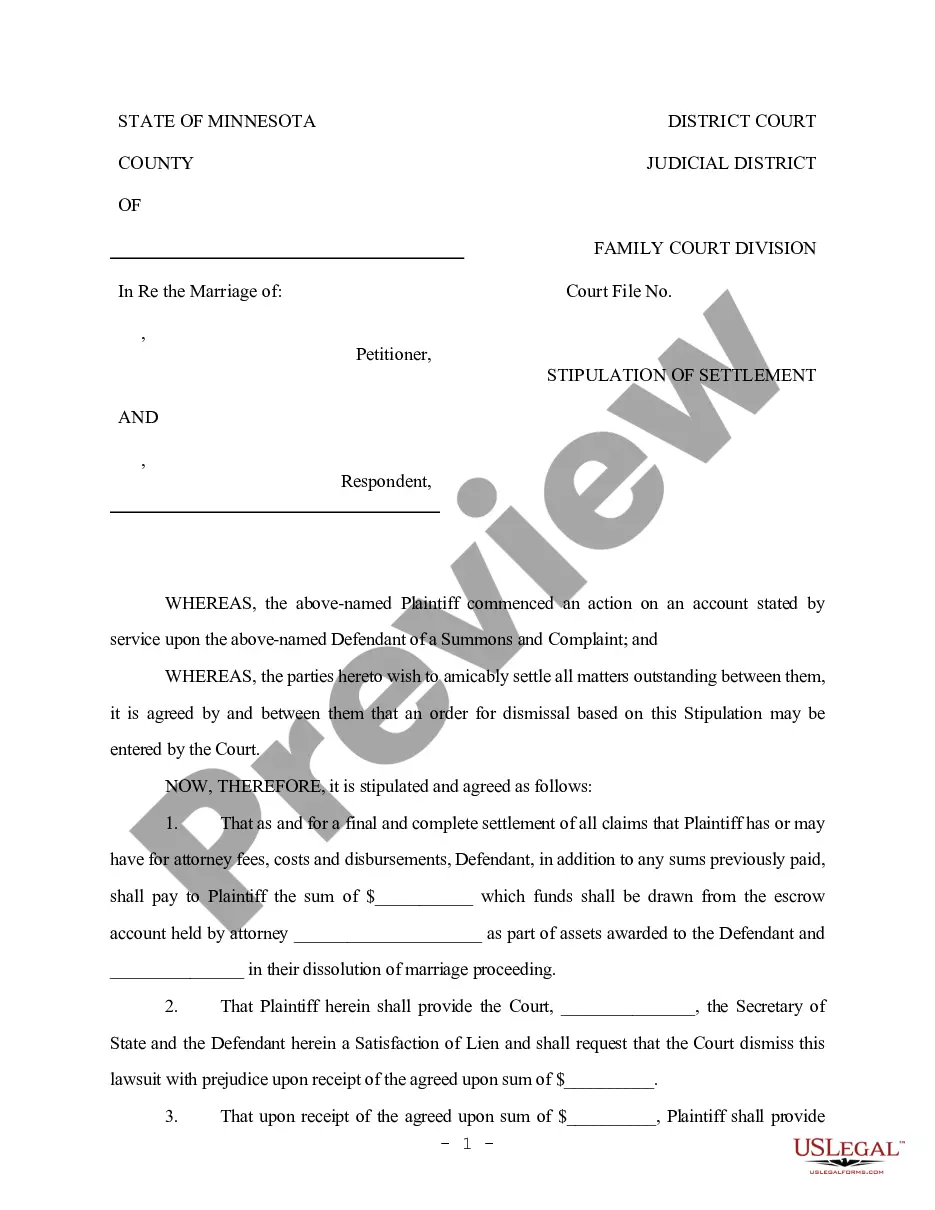

- When the template has a Preview function, utilize it to review the sample.

- In case the template doesn’t suit you, use the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your requirements.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with yourr credit/credit card.

- Select a document format and download the template.

- Once it’s downloaded, print it and fill it out.

Save your effort and time using our platform to find, download, and complete the Form name. Join a huge number of happy subscribers who’re already using US Legal Forms!

Form popularity

FAQ

A typical venture capitalist wants a higher rate of return than other investments, such as for example, the stock market. They invest in promising startups or young companies that have a high potential for growth.

Your company contact information. An introduction to your product. Your company's financial information. A marketing plan. A description of the competition. A summary of why the VC should invest in your company.

When individual investors entrust their money to a venture capital firm, the firm puts the money in a fund.The money is then paid back to the venture capital firm, with interest. Sometimes, the money is repaid through shares of stock in the company.

Executive summary. Briefly tell your reader what your company is and why it will be successful. Company description. Market analysis. Organization and management. Service or product line. Marketing and sales. Funding request. Financial projections.

Venture partners tend to be compensated via carry interest, which is a percentage of the returns that funds make once they cash out of investment opportunities.Ultimately the goal of an EIR is to launch another start-up for positive investment. Investors of VC firms are called Limited Partners (LPs).

Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential.

Hook them on the first page. Most investors are inundated with business plans. Your first page must make them want to keep reading. Keep it simple. After reading the first page, investors often do not understand the business. Be brief. The executive summary should be 2 to 4 pages in length.

The three principal types of venture capital are early stage financing, expansion financing and acquisition/buyout financing.