Startup Package

Description

How to fill out Startup Package?

Use the most comprehensive legal catalogue of forms. US Legal Forms is the perfect place for finding up-to-date Startup Package templates. Our service provides thousands of legal documents drafted by licensed attorneys and sorted by state.

To get a template from US Legal Forms, users just need to sign up for a free account first. If you’re already registered on our service, log in and select the template you need and purchase it. After purchasing forms, users can find them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the guidelines listed below:

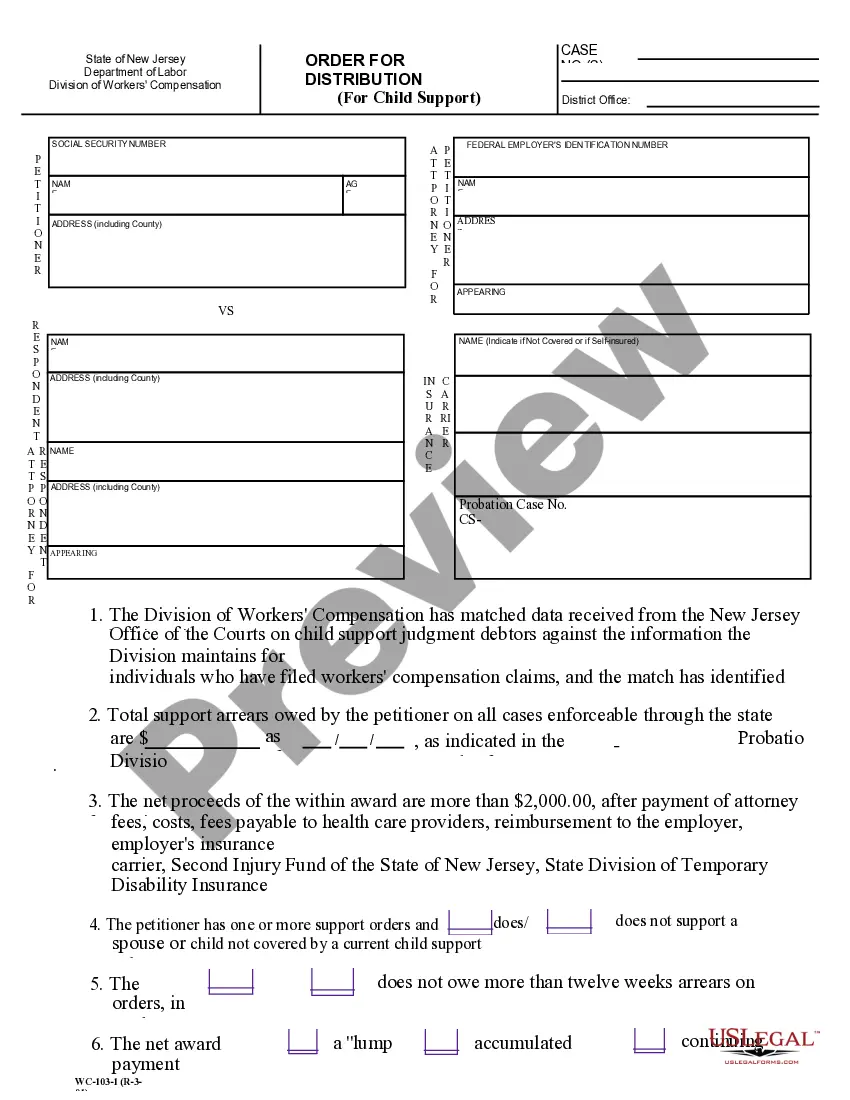

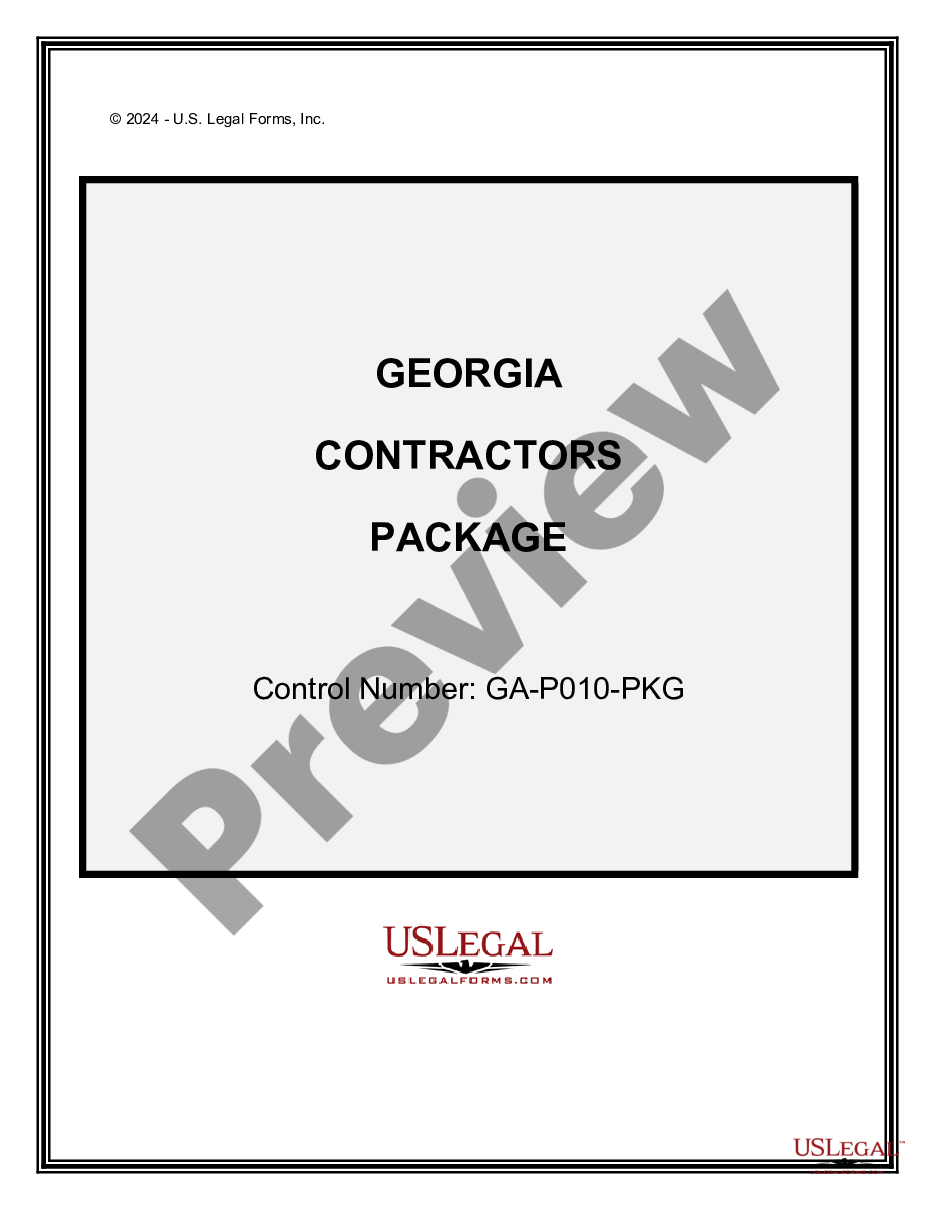

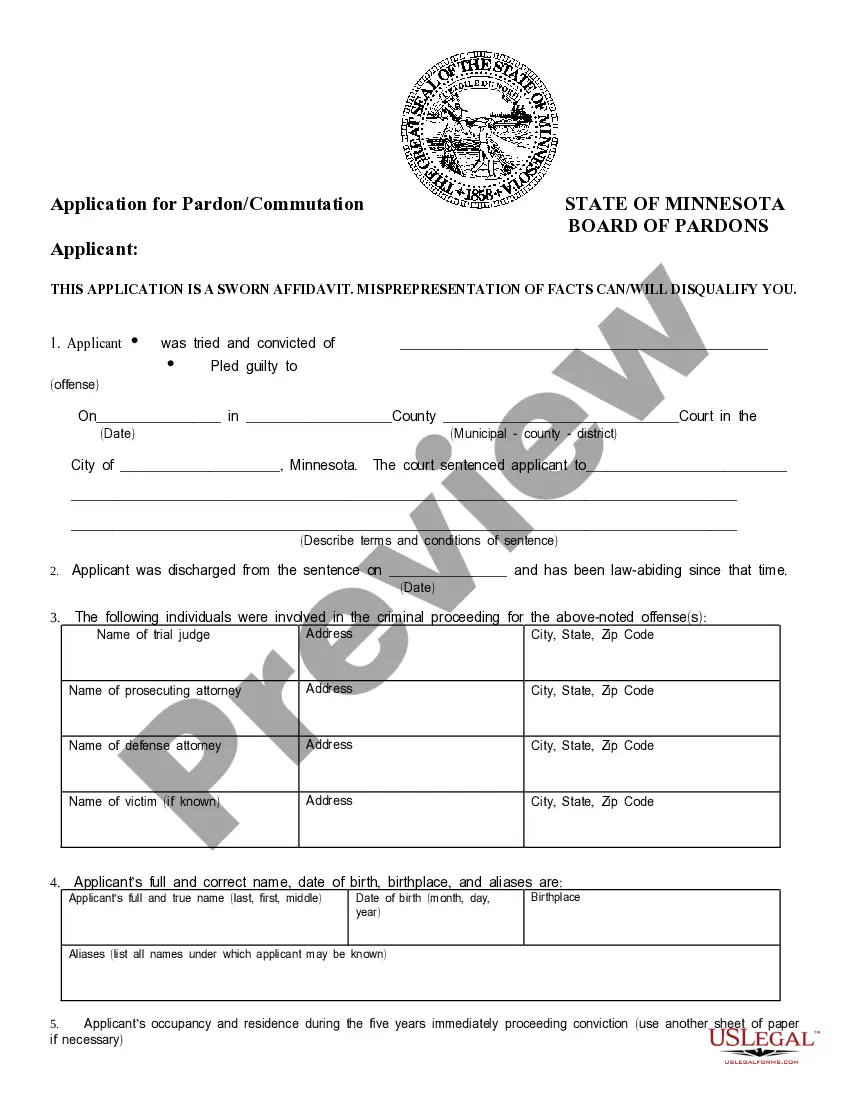

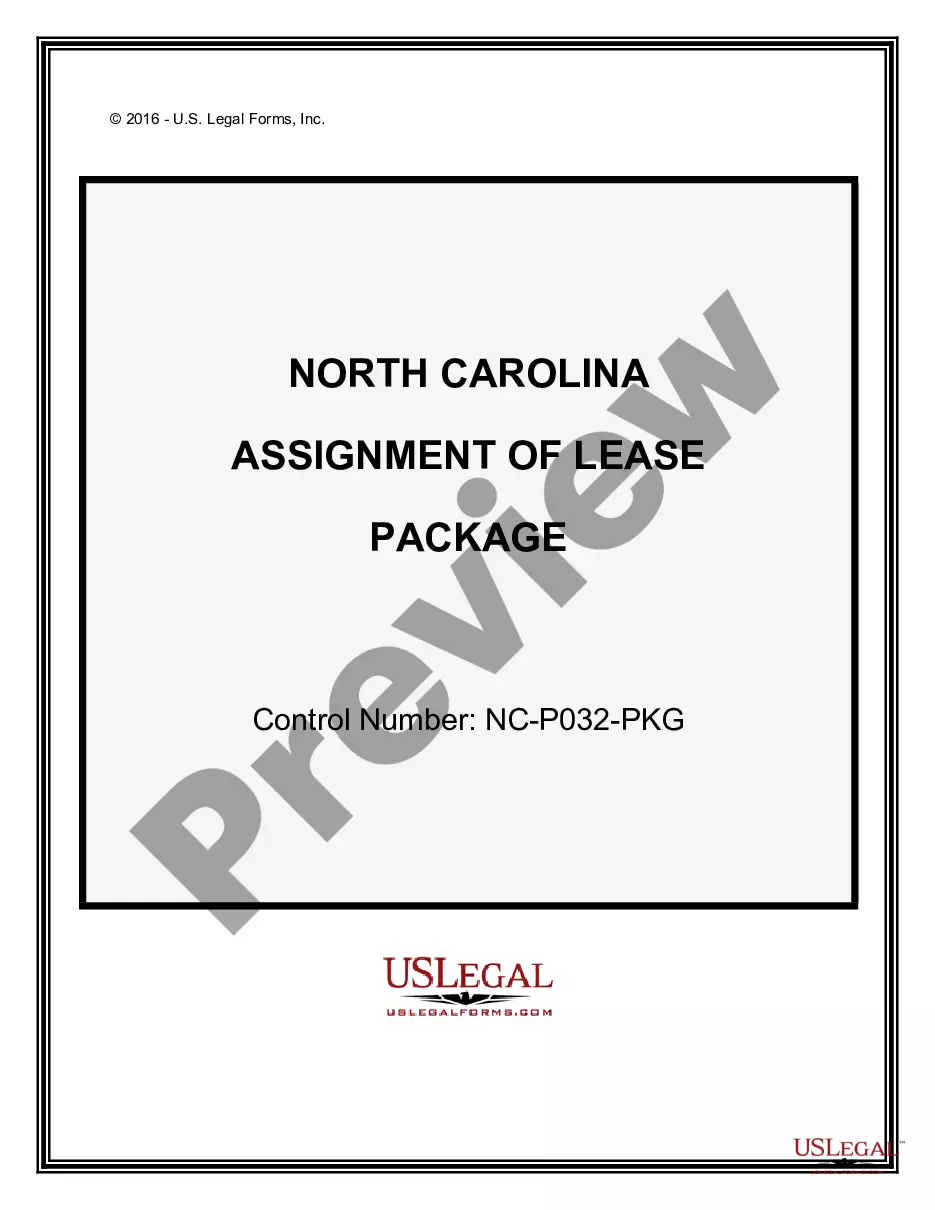

- Find out if the Form name you’ve found is state-specific and suits your needs.

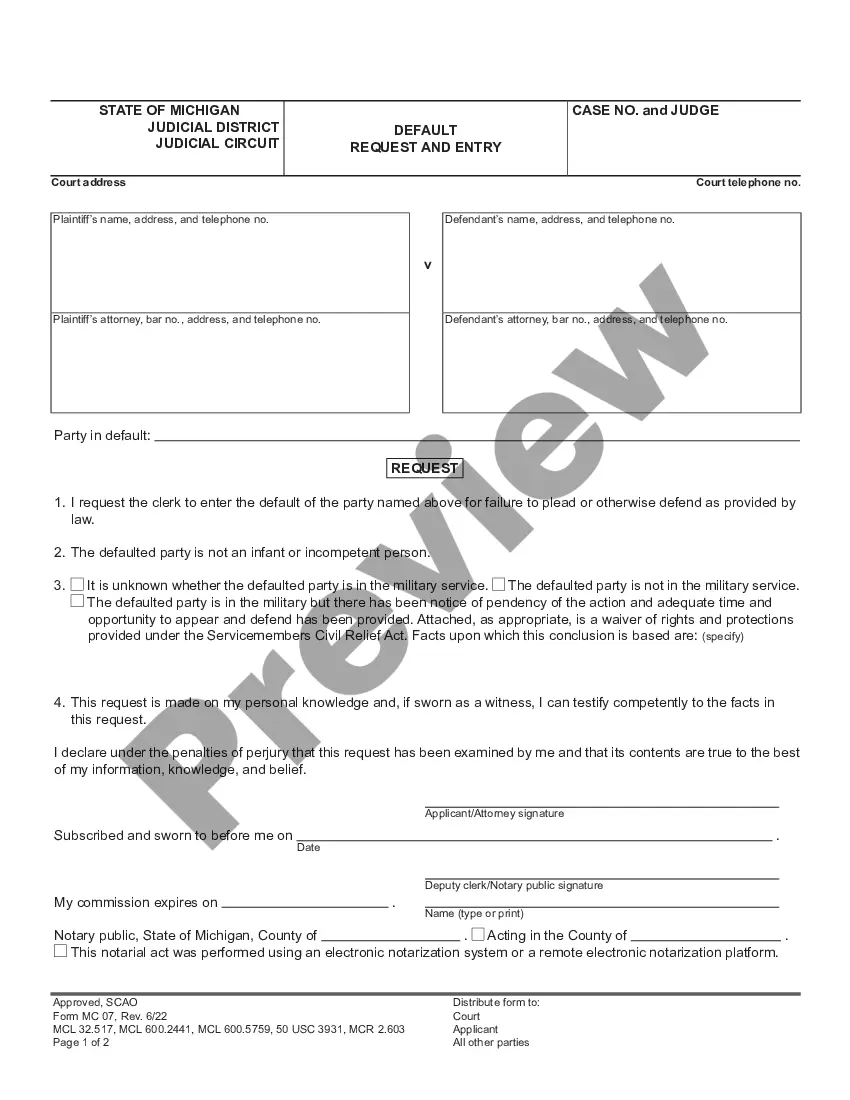

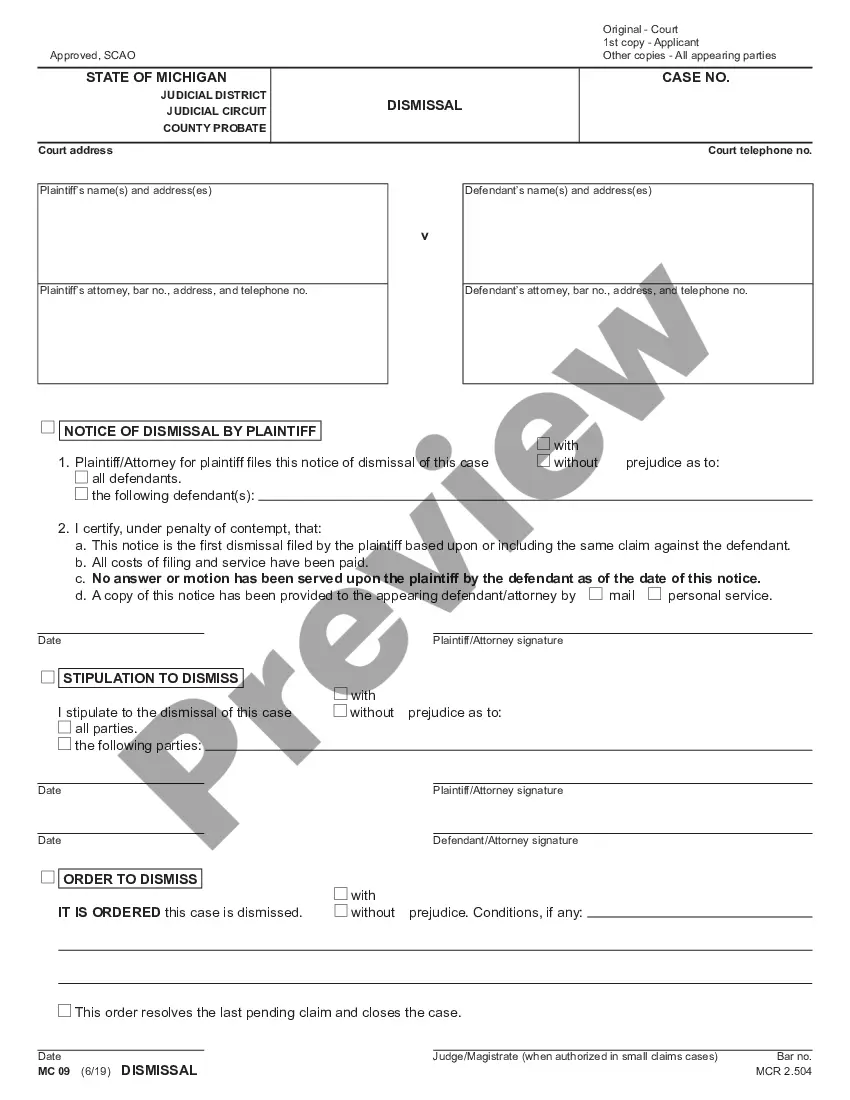

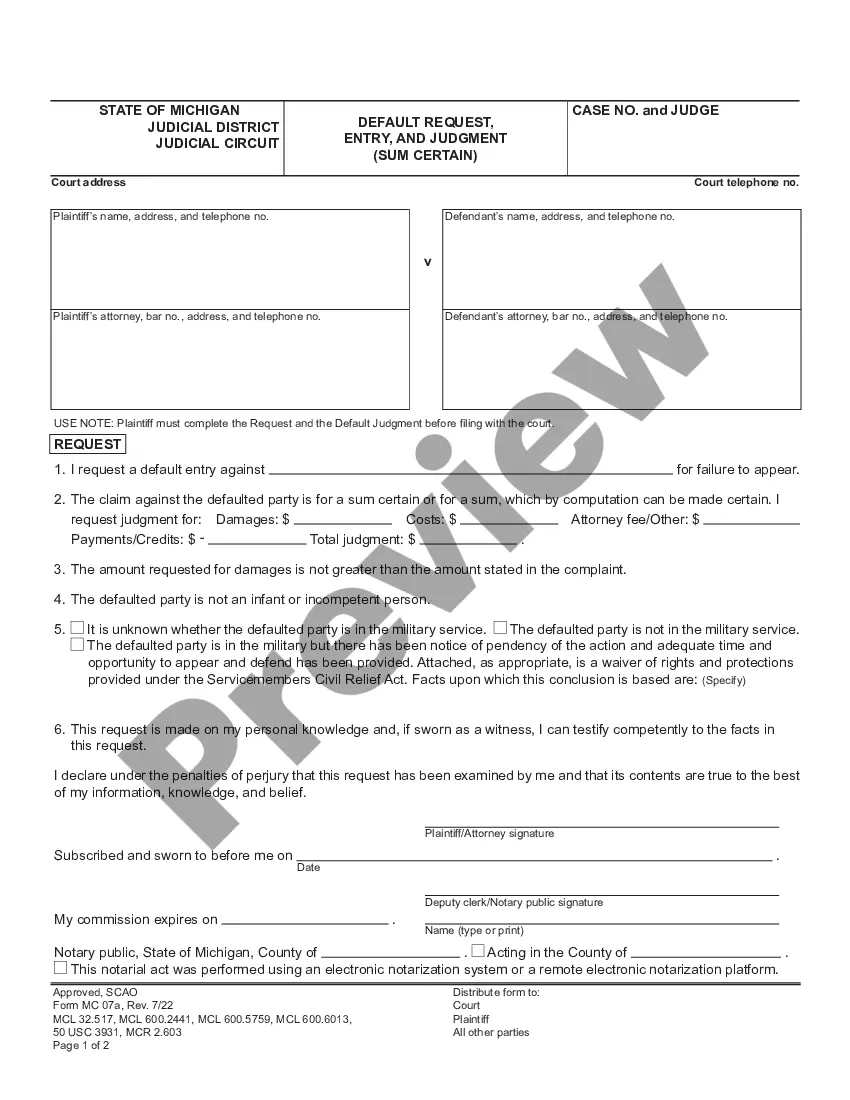

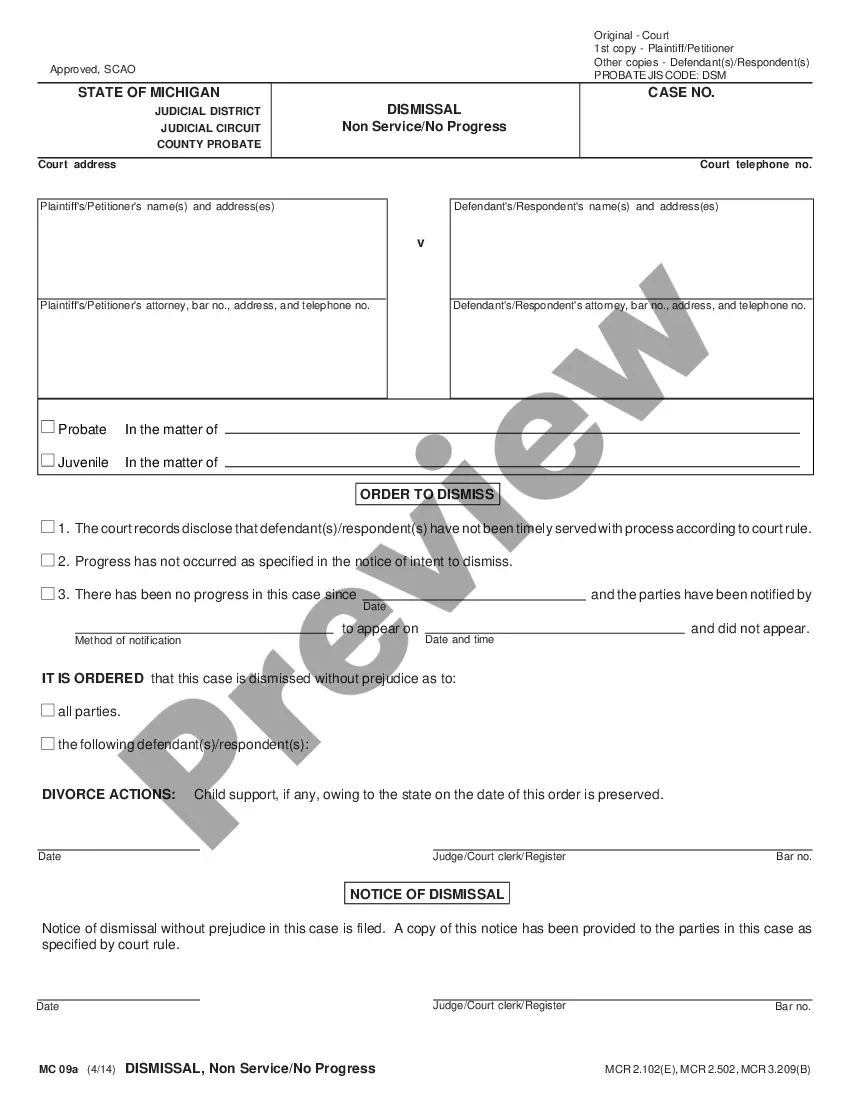

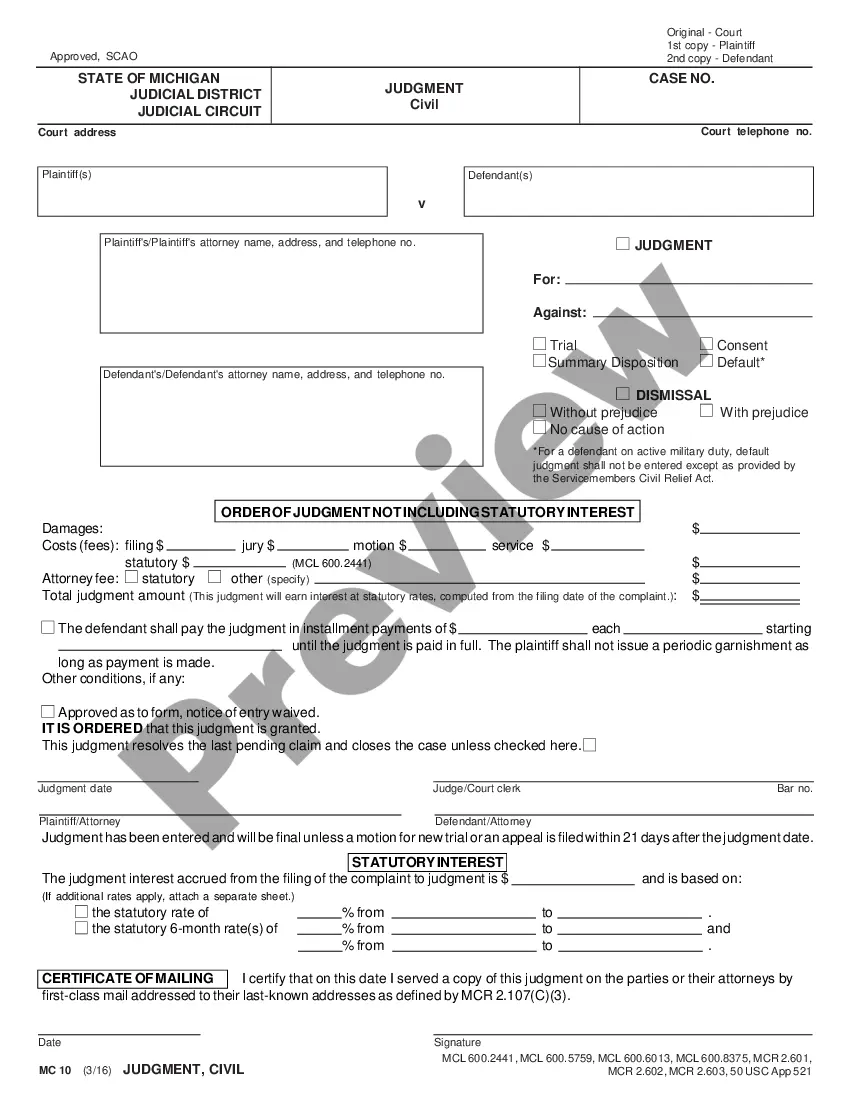

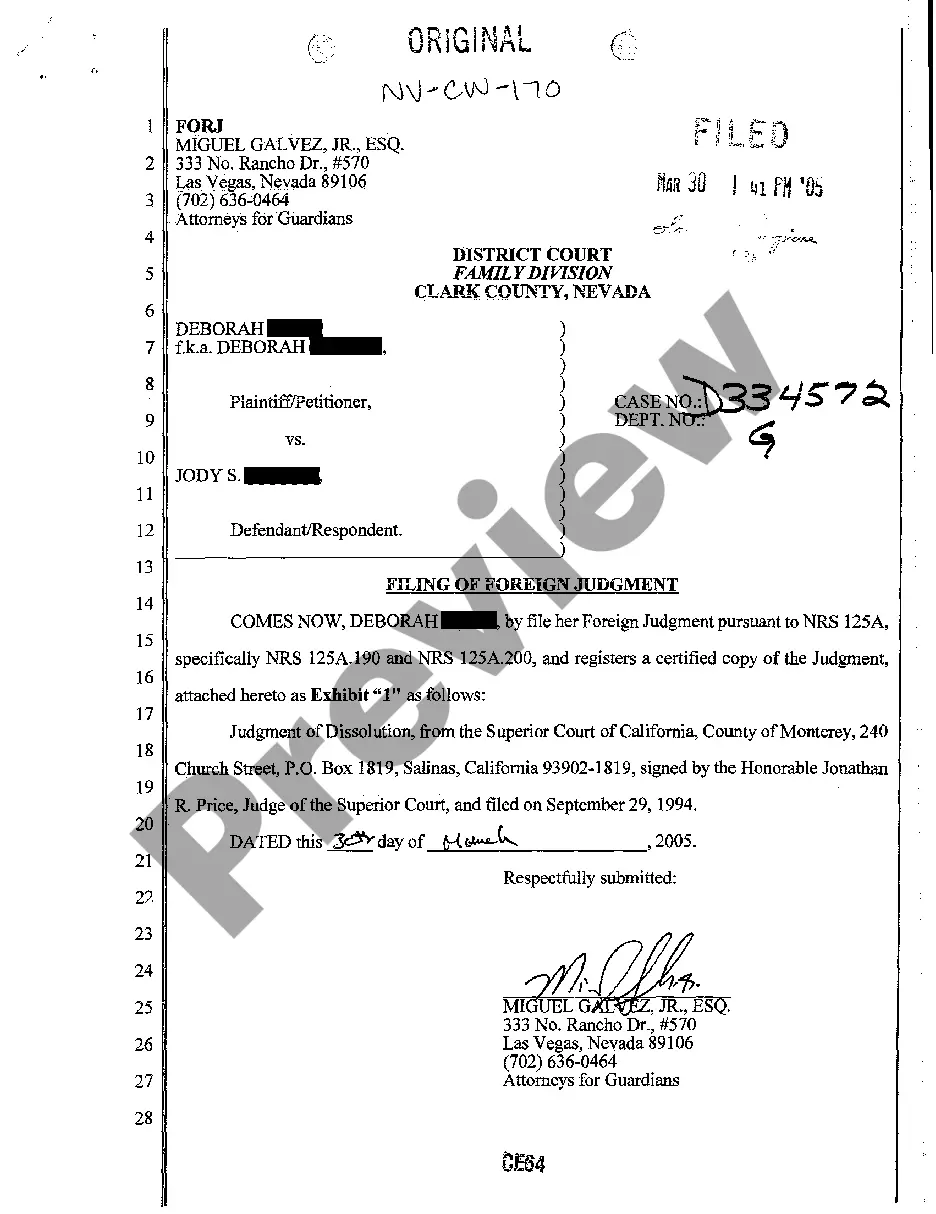

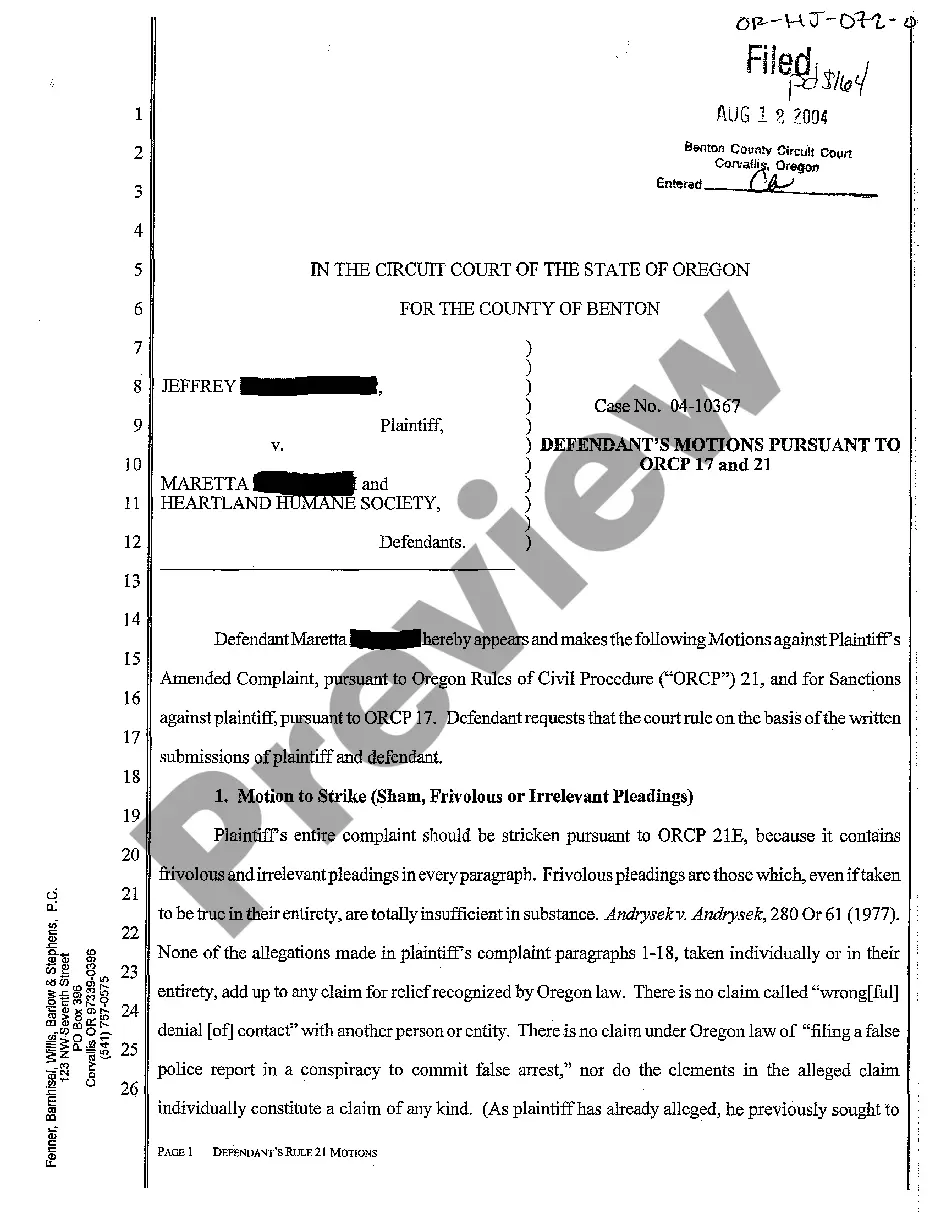

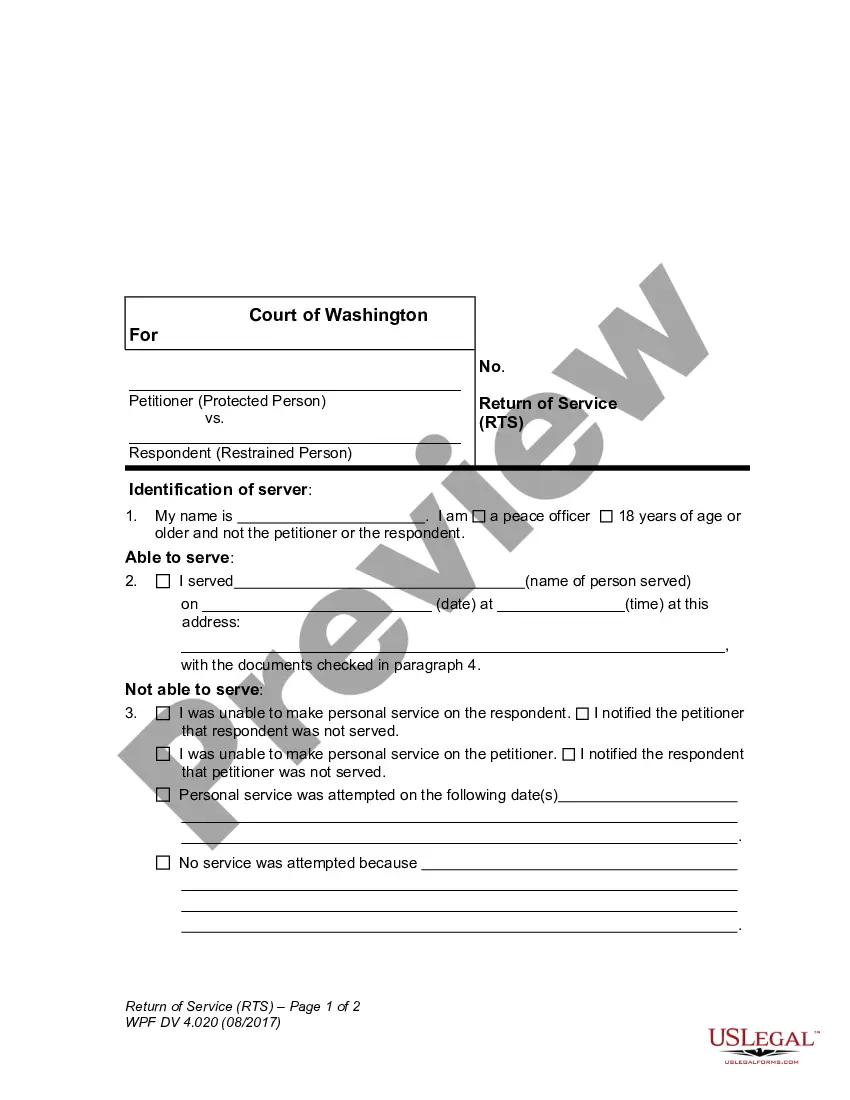

- If the template features a Preview option, utilize it to review the sample.

- If the template doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the sample meets your expections.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with the credit/bank card.

- Select a document format and download the sample.

- As soon as it is downloaded, print it and fill it out.

Save your time and effort using our platform to find, download, and complete the Form name. Join thousands of pleased customers who’re already using US Legal Forms!

Form popularity

FAQ

Under Generally Accepted Accounting Principles, you report startup costs as expenses incurred at the time you spend the money. Some of your initial expenses, such as buying equipment, are not classified as startup costs under GAAP and have to be capitalized, not expensed.

Calculate your business startup costs before you launch. Identify your startup expenses. Estimate how much your expenses will cost. Add up your expenses for a full financial picture. Use your startup cost calculations to get startup funding.

Key Takeaways. Startup costs are the expenses incurred during the process of creating a new business. Pre-opening startup costs include a business plan, research expenses, borrowing costs, and expenses for technology. Post-opening startup costs include advertising, promotion, and employee expenses.

Salary. Summer support. Moving costs. Tech, grant, and/or teaching support. Travel and development. Reduced teaching load. TA or RA support.

Such examples of typical pre-launch start-up costs include digital and traditional advertising in readiness for launch, office or studio furnishings and equipment, damage deposits with commercial property landlords, salaries for staff training and installation charges for digital infrastructure e.g. Wi-Fi.

What are four common types of startup costs? (1.0 points) Location, utilities, employees, supplies.

Under Generally Accepted Accounting Principles, you report startup costs as expenses incurred at the time you spend the money. Some of your initial expenses, such as buying equipment, are not classified as startup costs under GAAP and have to be capitalized, not expensed.

Know your minimum number. Leverage sites like PayScale and Glassdoor to learn to learn what employers in your city are paying for similar roles and industries. Provide a salary range. Consider the whole package not just salary. Ensure your pay increases with funding.