Stock Package

Description

How to fill out Stock Package?

Use the most comprehensive legal library of forms. US Legal Forms is the best platform for getting updated Stock Package templates. Our service offers a large number of legal documents drafted by certified lawyers and sorted by state.

To get a template from US Legal Forms, users only need to sign up for a free account first. If you are already registered on our service, log in and choose the document you are looking for and buy it. Right after buying forms, users can see them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the steps below:

- Check if the Form name you have found is state-specific and suits your needs.

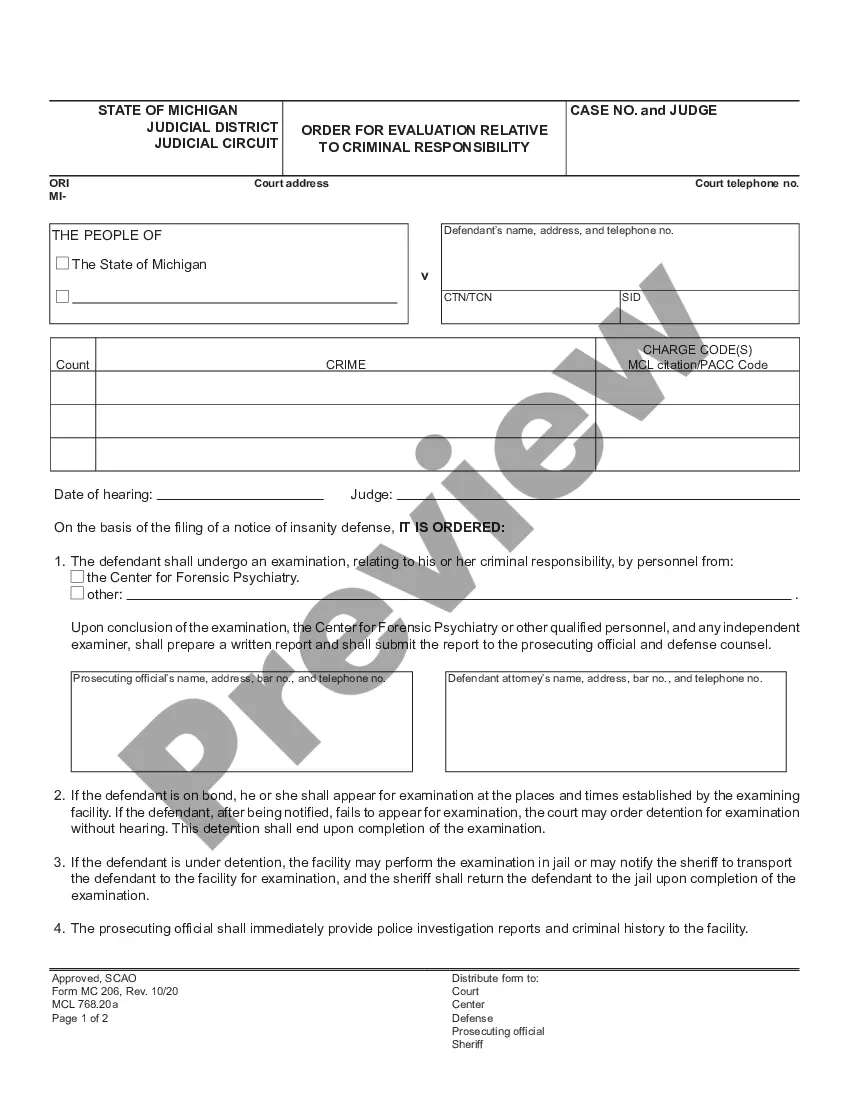

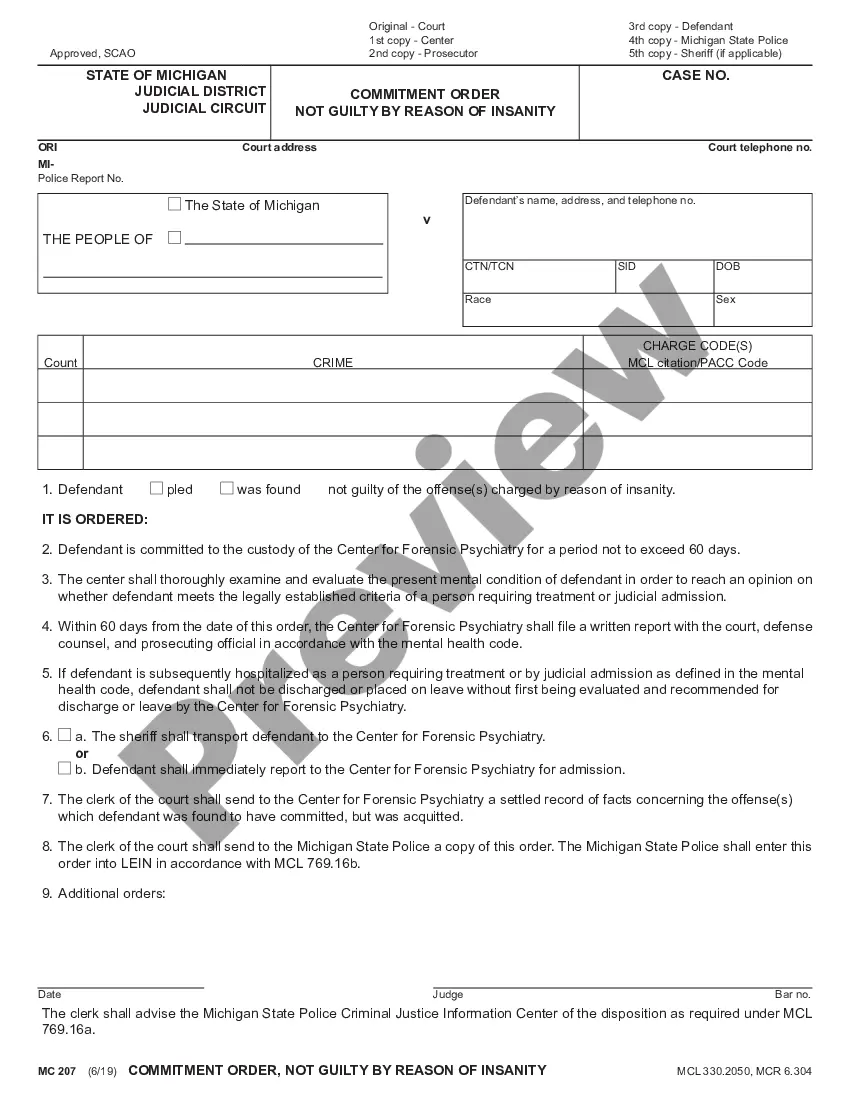

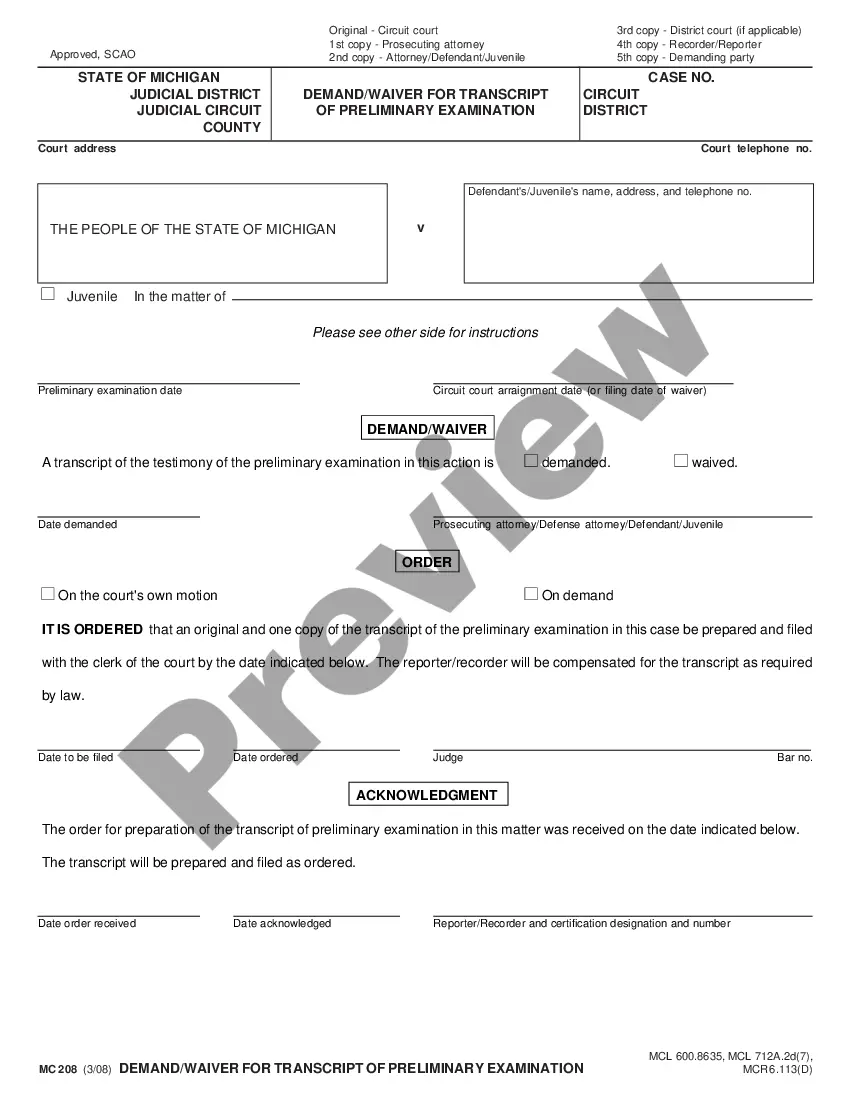

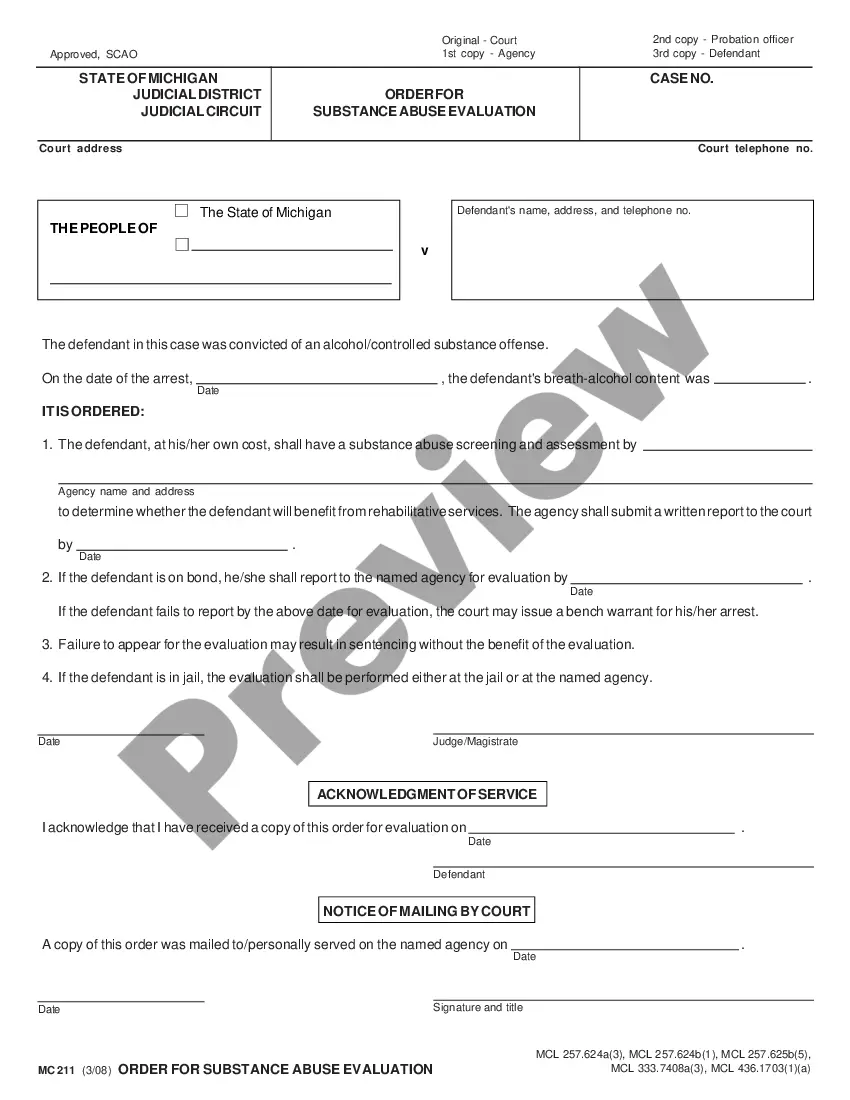

- When the form features a Preview option, utilize it to check the sample.

- If the template does not suit you, utilize the search bar to find a better one.

- PressClick Buy Now if the template meets your requirements.

- Select a pricing plan.

- Create an account.

- Pay via PayPal or with the debit/credit card.

- Choose a document format and download the template.

- As soon as it’s downloaded, print it and fill it out.

Save your effort and time using our service to find, download, and complete the Form name. Join thousands of satisfied clients who’re already using US Legal Forms!

Form popularity

FAQ

What percentage of the company do the options offered represent? Are you including all shares in the total shares outstanding for the purpose of calculating the percentage above? What is the market rate for my position? How does my proposed option grant compare to the market?

One contract is equal to 100 shares of the underlying stock. Using the previous example, a trader decides to buy five call contracts.If the stock rises above $150 by the expiration date, the trader would have the option to exercise or buy 500 shares of IBM's stock at $150, regardless of the current stock price.

Applicable Law: In the first lines, you have to write the name of the state where the company was incorporated. Company Identification: Then, you have to write the name of the corporation and its legal address. Name of the shareholder: The next line is meant for the shareholder's name.

Basics of Option Profitability A put option buyer makes a profit if the price falls below the strike price before the expiration. The exact amount of profit depends on the difference between the stock price and the option strike price at expiration or when the option position is closed.

Depositing stock certificates can be as easy as depositing a check at the bank. After endorsing it and filling in some essential information, simply mail it to your brokerage company and soon you will be tracking your shares on your brokerage account statements.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the exercise or strike price, for a fixed period of time, usually following a predetermined waiting period, called the vesting period. Most vesting periods span follow three to five years, with a certain

The strike price of $70 means that the stock price must rise above $70 before the call option is worth anything; furthermore, because the contract is $3.15 per share, the break-even price would be $73.15.

Depositing stock certificates can be as easy as depositing a check at the bank. After endorsing it and filling in some essential information, simply mail it to your brokerage company and soon you will be tracking your shares on your brokerage account statements.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy or exercise a set number of shares of the company stock at a pre-set price, also known as the grant price.