Acknowledgment Form for Consultants or Self-Employed Independent Contractors

Description Form Independent Contractors

How to fill out Consultants Contractors Contract?

Employ the most extensive legal library of forms. US Legal Forms is the best platform for getting updated Acknowledgment Form for Consultants or Self-Employed Independent Contractors templates. Our service provides 1000s of legal forms drafted by certified lawyers and grouped by state.

To get a template from US Legal Forms, users only need to sign up for an account first. If you’re already registered on our platform, log in and select the template you need and buy it. Right after buying forms, users can find them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines listed below:

- Find out if the Form name you have found is state-specific and suits your requirements.

- In case the form features a Preview function, utilize it to check the sample.

- If the template doesn’t suit you, utilize the search bar to find a better one.

- PressClick Buy Now if the sample corresponds to your needs.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with the debit/bank card.

- Choose a document format and download the template.

- Once it’s downloaded, print it and fill it out.

Save your effort and time using our service to find, download, and fill out the Form name. Join a huge number of delighted customers who’re already using US Legal Forms!

Consultants Self Employed Form popularity

Consultants Independent Contractors Other Form Names

Consultants Contractors Fill FAQ

An independent contractor is not considered an employee for Form I-9 purposes and does not need to complete Form I-9.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Form 1099-NEC is used by payers to report payments made in the course of a trade or business to others for services.In either case, they should be aware of their tax responsibilities, including filing and reporting requirements, for these workers.

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.

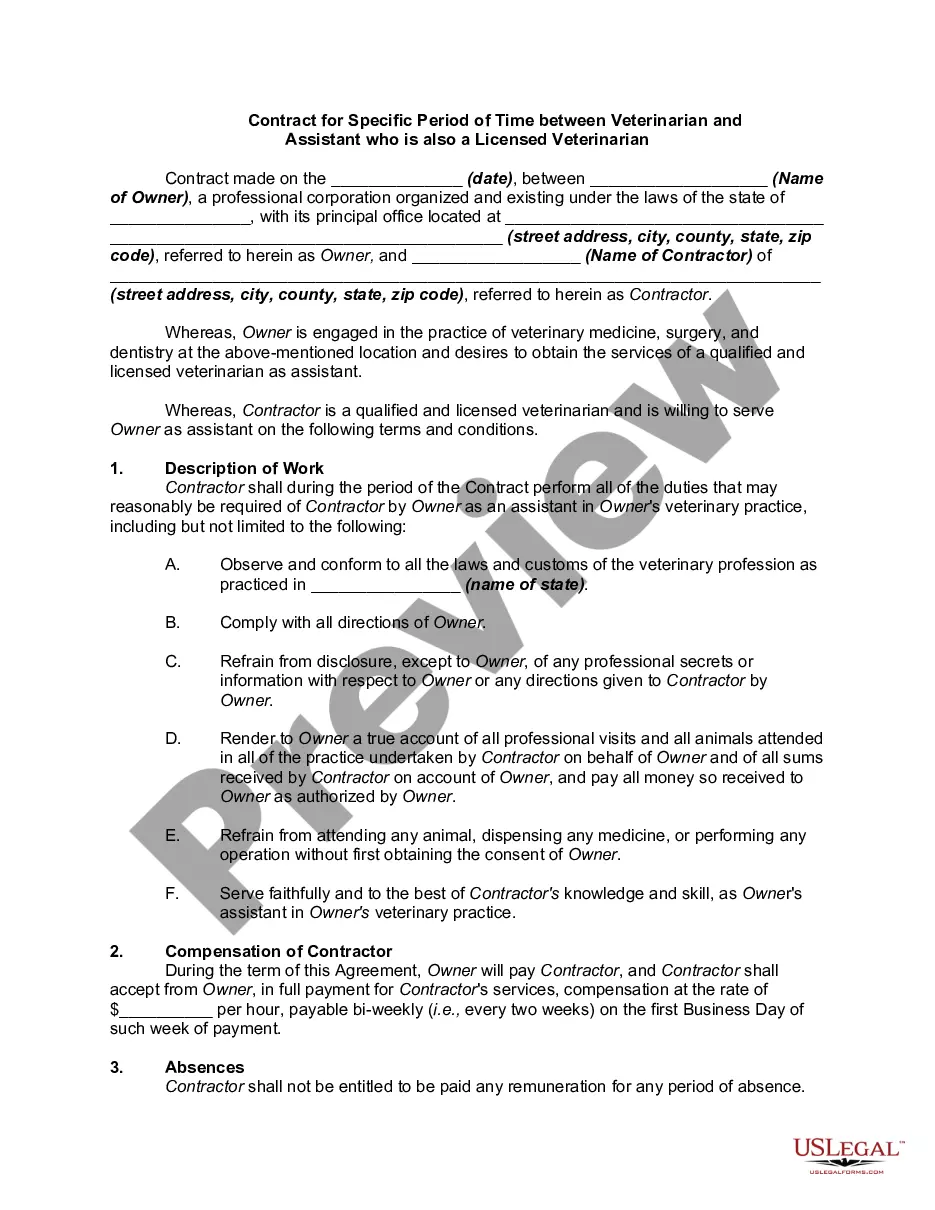

Length of Contract. Each client contractor agreement should outline the length of the working relationship. Project Description. Payment Terms. Nondisclosure Terms. Rights and Responsibilities. Termination Clause. Disclaimers.

An Independent Contractor Agreement should contain all of these basic terms: Description of the services to be provided.Explanation of what the hiring party will provide or not provide, such as equipment, for the independent contractor to use. Ownership of work product if that is relevant to the work being performed.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed. To find out what your tax obligations are, visit the Self-Employed Tax Center.

Generally, a Consultant is a self-employed independent businessperson who has a special field of expertise or skill.The definition of the terms becomes critically important when a trying to decide whether an individual is an employee, contractor or consultant. Generally, contractors and consultants are not employees.

Step 1: Ask your independent contractor to fill out Form W-9. Step 2: Fill out two 1099-NEC forms (Copy A and B) Ask your independent contractor for invoices. Add your freelancer to payroll. Keep records like a boss. Tools to check out: