Employee Notice to Correct IRCA Compliance

Description

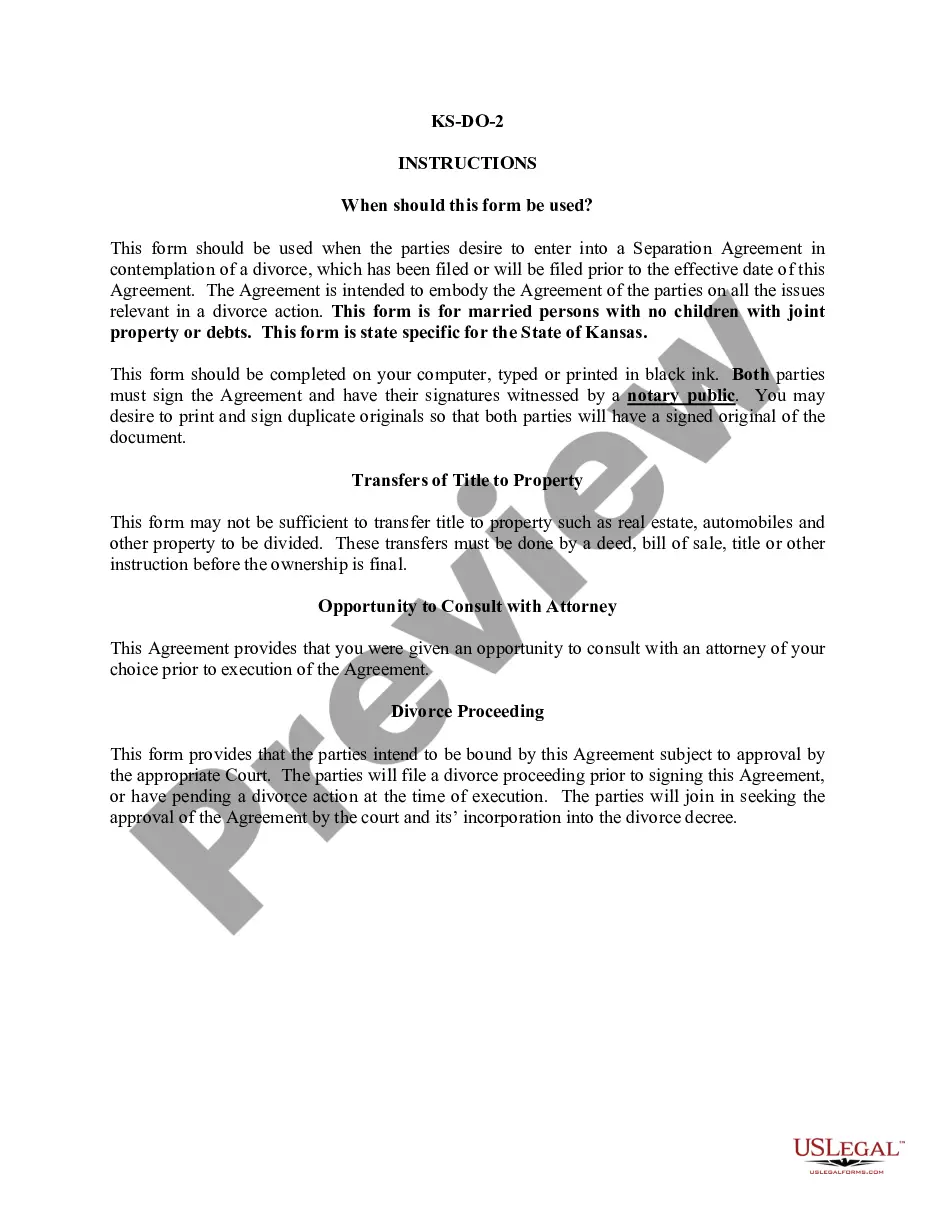

How to fill out Employee Notice To Correct IRCA Compliance?

Make use of the most complete legal library of forms. US Legal Forms is the best place for finding updated Employee Notice to Correct IRCA Compliance templates. Our service provides a huge number of legal forms drafted by certified lawyers and categorized by state.

To obtain a sample from US Legal Forms, users just need to sign up for an account first. If you are already registered on our service, log in and select the document you need and purchase it. Right after buying forms, users can find them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the steps below:

- Find out if the Form name you’ve found is state-specific and suits your needs.

- When the form features a Preview function, utilize it to check the sample.

- If the sample doesn’t suit you, utilize the search bar to find a better one.

- Hit Buy Now if the sample meets your needs.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with the debit/bank card.

- Select a document format and download the template.

- When it’s downloaded, print it and fill it out.

Save your time and effort with our service to find, download, and fill in the Form name. Join a large number of delighted clients who’re already using US Legal Forms!

Form popularity

FAQ

The minimum fine per individual for paperwork or technical violations increased from $230 to $234, while the maximum fine increased from $2,292 to $2,332. Fines for knowingly hiring or continuing to employ unauthorized workers went up as well.

A. Yes. The law requires that you complete the I-9 only when the person actually begins working. However, you may complete the form earlier, as long as you complete the form at the same point in the employment process for all employees.

An I-9 audit can be triggered for a number of reasons, including random samples and reporting by disgruntled employees (or ex-employees). Certain business sectors, for example food production, are especially susceptible to I-9 audits, and "silent raids" by ICE.

The latest that the new hire must complete Section 1 of the form is the end of the first day of work for pay;If the new hire does not present acceptable identification documents by the end of three business days after the first day of work for pay, you may terminate the employee for failing to complete the I-9 form.

You may not use the I-9 form as part of the applicant screening process or background check;If the new hire does not present acceptable identification documents by the end of three business days after the first day of work for pay, you may terminate the employee for failing to complete the I-9 form.

Federal regulations state you must retain a Form I-9 for each person you hire for three years after the date of hire, or one year after the date employment ends, whichever is later.

The Law provides for penalties from $100 to $1,100 for each incorrect or missing I-9. These penalties may add up quickly. Recently, the Immigration Service accused Disneyland in California of having over a thousand paperwork violations, and issued a notice to fine Disneyland $395,000.

To correct multiple errors in one section, you may redo the section on a new Form I-9 and attach it to the old form. You can also complete a new Form I-9 if it contains major errors (such as entire sections that were left blank or you completed Section 2 based on unacceptable documents).

You are required to complete and retain a Form I-9 for every employee you hire for employment in the United States, except for: Individuals hired on or before Nov. 6, 1986, who are continuing in their employment and have a reasonable expectation of employment at all times.