Employee Evaluation Form for Sole Trader

Description

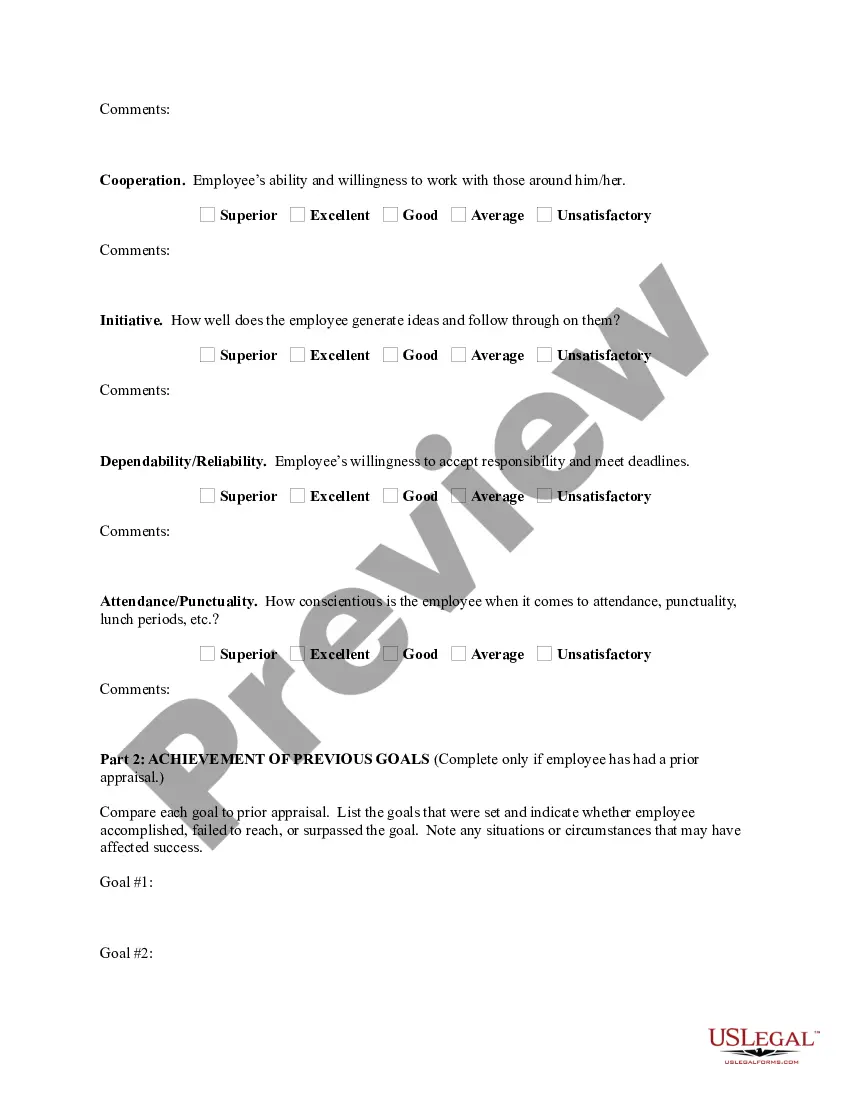

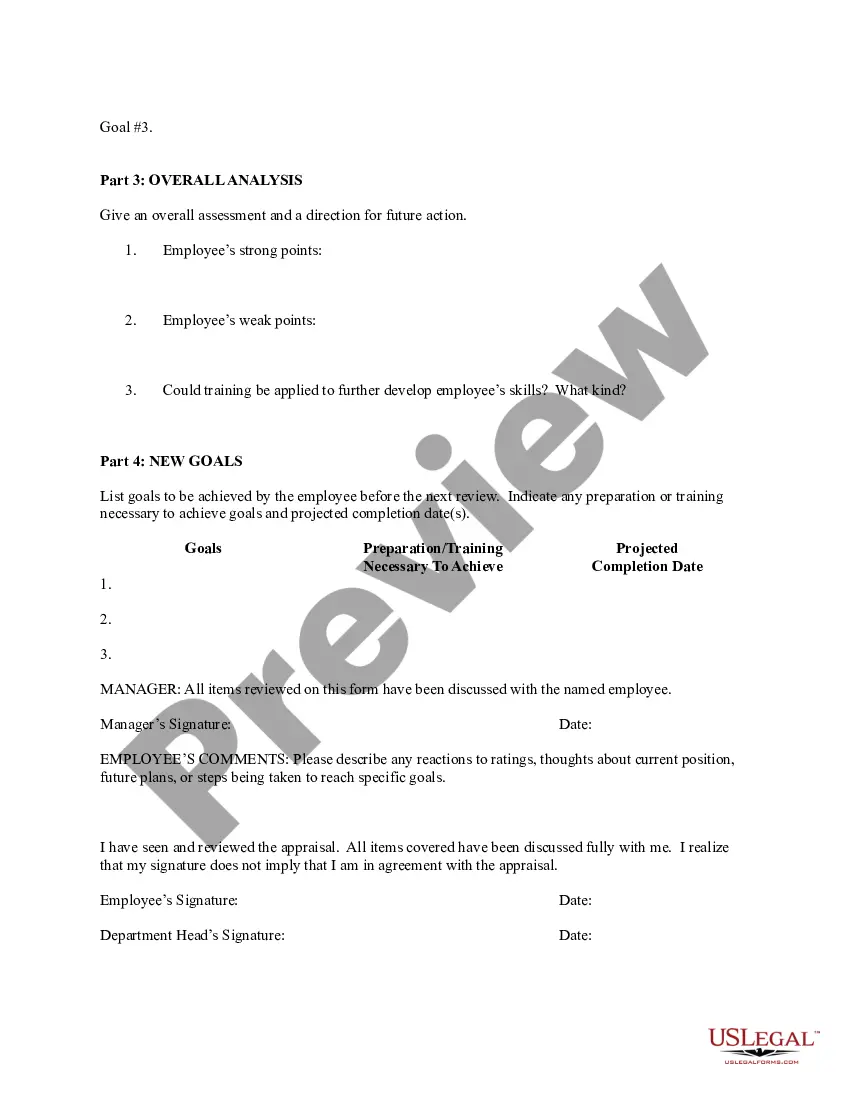

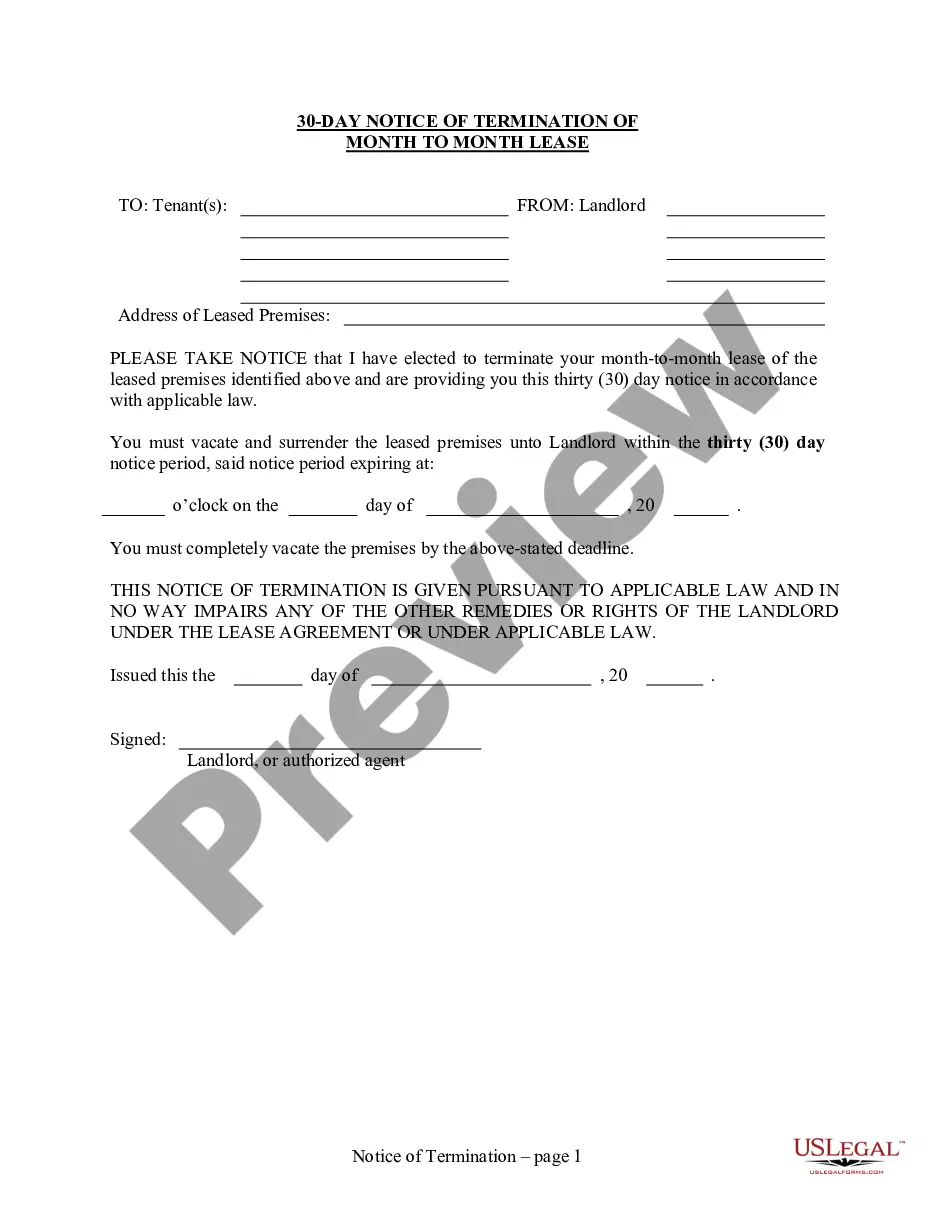

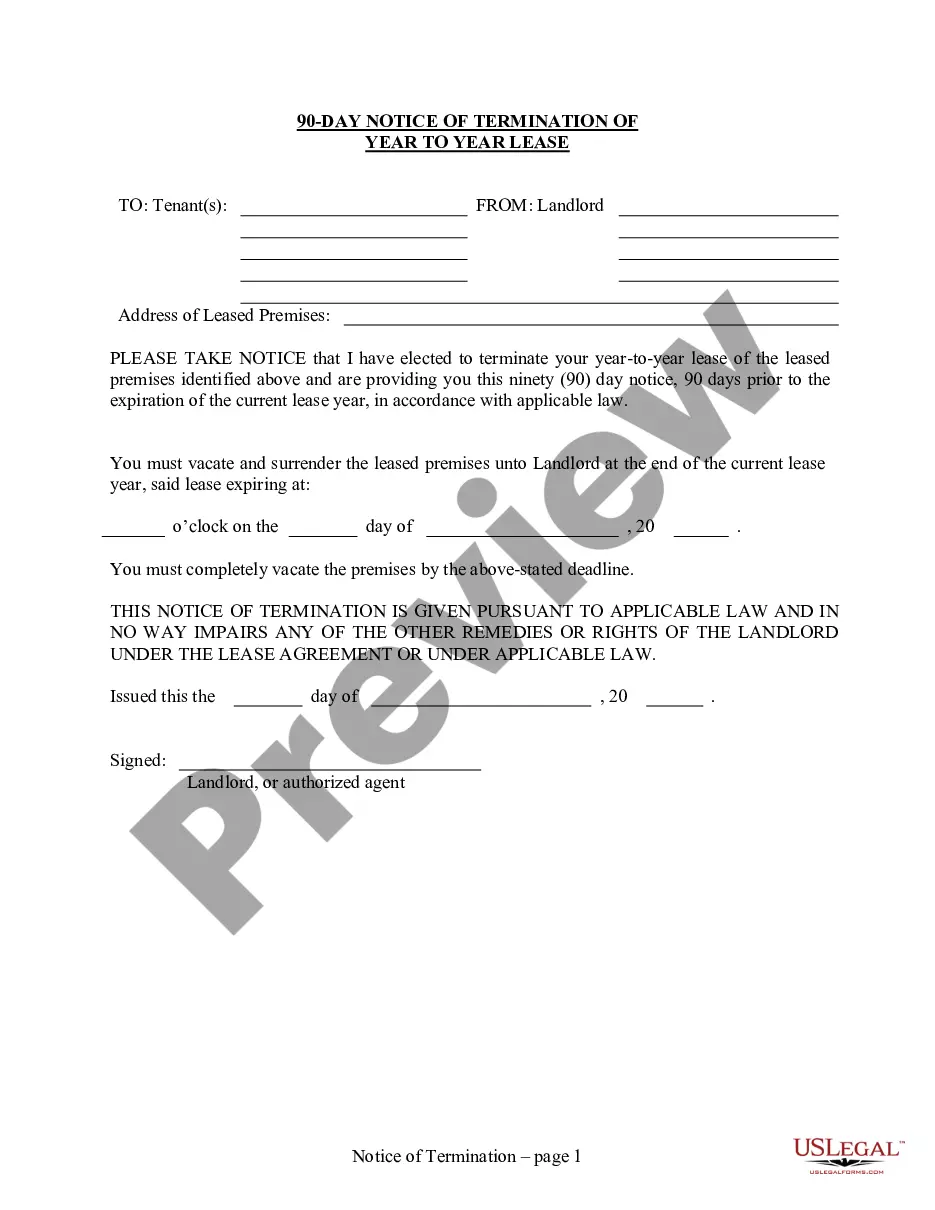

How to fill out Employee Evaluation Form For Sole Trader?

Use US Legal Forms to get a printable Employee Evaluation Form for Sole Trader. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most extensive Forms library on the web and offers reasonably priced and accurate samples for customers and legal professionals, and SMBs. The documents are grouped into state-based categories and a few of them might be previewed prior to being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Hit Download next to any template you need and find it in My Forms.

For individuals who do not have a subscription, follow the tips below to easily find and download Employee Evaluation Form for Sole Trader:

- Check out to make sure you get the correct form with regards to the state it is needed in.

- Review the document by reading the description and using the Preview feature.

- Press Buy Now if it is the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Use the Search engine if you want to get another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Employee Evaluation Form for Sole Trader. Over three million users have already used our platform successfully. Select your subscription plan and get high-quality forms in just a few clicks.

Form popularity

FAQ

The only proof that you will get that you have registered as a sole trader is a Unique Tax Reference (UTR) number. HMRC will send this to you around 10 days after your sole trader registration has been completed.

As the owner of a sole proprietorship you're not considered an employee of your own business. This means you don't receive a paycheck or W-2 Form or have taxes withheld from your self-employment income.

A sole proprietor can hire employees. There is no limit to the number of workers you can employ. As an employer, you are responsible for all employment administration, recordkeeping, and taxes. You have the same responsibilities as any other employer.

If you think you'll earn above the trading allowance from your sole trader business in a single tax year, you need to register as self-employed in order to file a tax return and pay tax on your earnings. To register you simply need to tell HMRC that it can expect a Self Assessment tax return from you.

As a sole proprietor, you don't pay yourself a salary and you cannot deduct your salary as a business expense. Technically, your pay is the profit (sales minus expenses) the business makes at the end of the year. You can hire other employees and pay them a salary.

The good news is that you can employ people and remain a sole trader. There's no need to set up a limited company if you don't want to. While sole traders operate the business on their own, that doesn't mean they have to work alone. The term sole trader just means that you are trading as yourself, under your own name.

You don't need to report BAS. However, you will still need to report your business income and expenses in your annual Tax Return - so ensure you still keep adequate records of your business activity. You can do this via Airtax through the income tax service, which includes a custom-built sole trader module.

Register for Self Assessment You have to register with HMRC for Self Assessment by 5 October in your business's second tax year. HMRC might fine you if you don't register by this deadline, so don't delay. To register for Self Assessment, you need to visit the gov.uk registration page and submit your details.

The good news is that you can employ people and remain a sole trader. There's no need to set up a limited company if you don't want to. While sole traders operate the business on their own, that doesn't mean they have to work alone. The term sole trader just means that you are trading as yourself, under your own name.