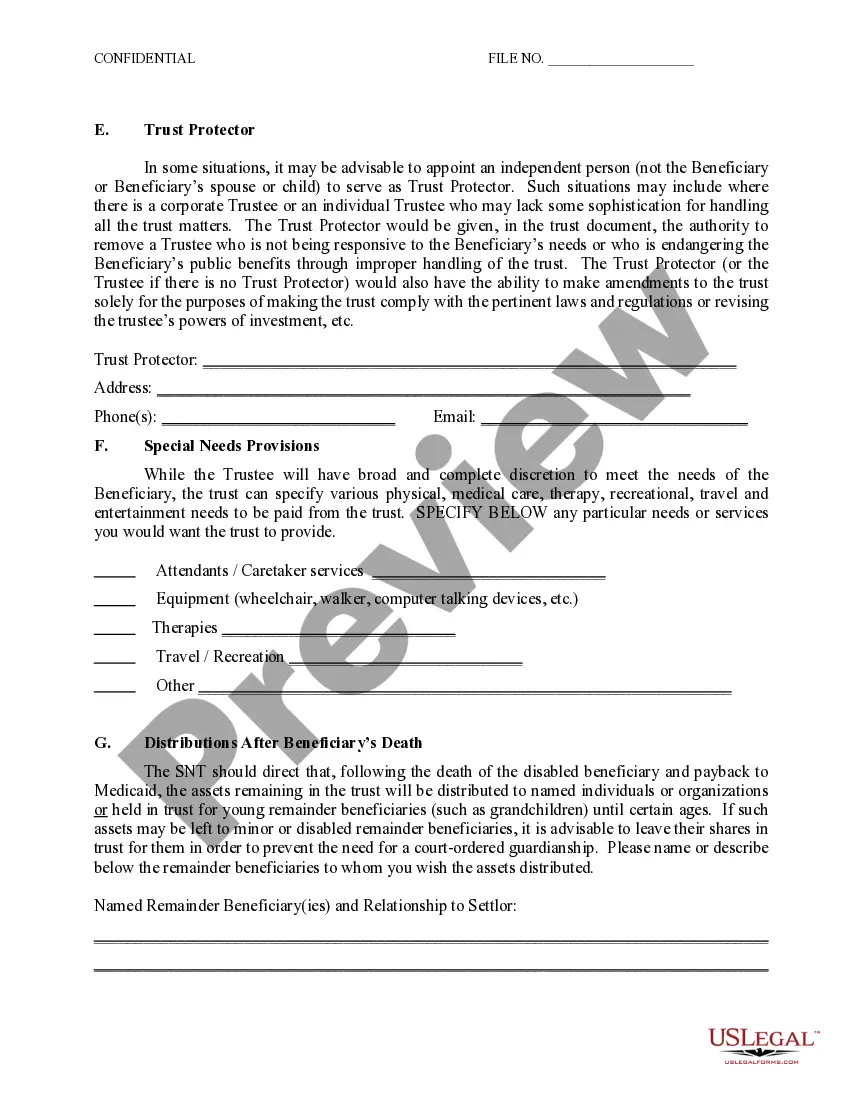

A Self-Settled Special Needs Trust Information Schedule is a document that outlines the details of a trust that has been created to provide financial support to an individual with a disability. This type of trust is typically funded with the disabled individual’s own assets, such as personal or inherited funds, and is designed to provide supplemental financial assistance without affecting the individual’s eligibility for certain public benefits, such as Supplemental Security Income (SSI) or Medicaid. The Self-Settled Special Needs Trust Information Schedule typically includes details such as the trust’s name and purpose, the individual’s name and disability, the trust’s funding source, the name of the trustee, and the trust terms. There are two types of Self-Settled Special Needs Trusts: the first-party trust and the third-party trust. A first-party trust is funded with the assets of the disabled individual, while a third-party trust is funded with the assets of someone other than the disabled individual.

Self-Settled Special Needs Trust Information Schedule

Description

How to fill out Self-Settled Special Needs Trust Information Schedule?

US Legal Forms is the most straightforward and profitable way to locate suitable formal templates. It’s the most extensive web-based library of business and individual legal documentation drafted and verified by lawyers. Here, you can find printable and fillable templates that comply with national and local regulations - just like your Self-Settled Special Needs Trust Information Schedule.

Getting your template requires only a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted Self-Settled Special Needs Trust Information Schedule if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make sure you’ve found the one meeting your needs, or locate another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Create an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Select the preferred file format for your Self-Settled Special Needs Trust Information Schedule and download it on your device with the appropriate button.

After you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more efficiently.

Benefit from US Legal Forms, your reliable assistant in obtaining the corresponding formal documentation. Give it a try!

Form popularity

FAQ

Disadvantages of a Special Needs Trust The beneficiary lacks control of the funds. The trustee is in charge of the trust, and the person the trust is created to benefit has little say in how their own money is spent.The trust must pay back Medicaid.

What is a self-settled trust? These trusts, also known as domestic asset protection trusts, self-designated trusts, or spendthrift self-settled trusts, are irrevocable trusts that allow the grantor to also be a beneficiary of the trust.

Self-settled trust (also called a spendthrift trust) is a type of trust allowed in a small number of states where a person that creates the trust is also the beneficiary of the trust. The assets are permanently in the trust and controlled by the trustee which keeps the assets from the reach of most creditors.

settled asset protection trust allows for a grantor to convey her own assets into a trust where she is also the sole beneficiary. This differs from a typical trust where the grantor conveys her own assets into a trust for the benefit of others?often her family members or charitable organizations.

settled spendthrift trust is an irrevocable trust in which the settlor is a beneficiary and the settlor's creditors generally can't reach the trust property. Several states ?including Delaware, Nevada, New Hampshire, South Dakota, Tennessee, and Wyoming?recognize selfsettled spendthrift trusts.

Social Security must be paid directly to the beneficiary. It cannot be paid to a trust. If you are receiving Social Security by direct deposit, you should leave the account that receives the payments outside of your trust.

Forming a holding company and subsidiaries protects properties from one another, and the self-settled trust protects the properties from any personal risks such as car accidents, divorces, the IRS and bankruptcy. Other Examples: Personal assets cannot be protected with a limited liability company.

SSDI does not depend upon having limited assets, and it is not affected by distributions from a Disability Trust.