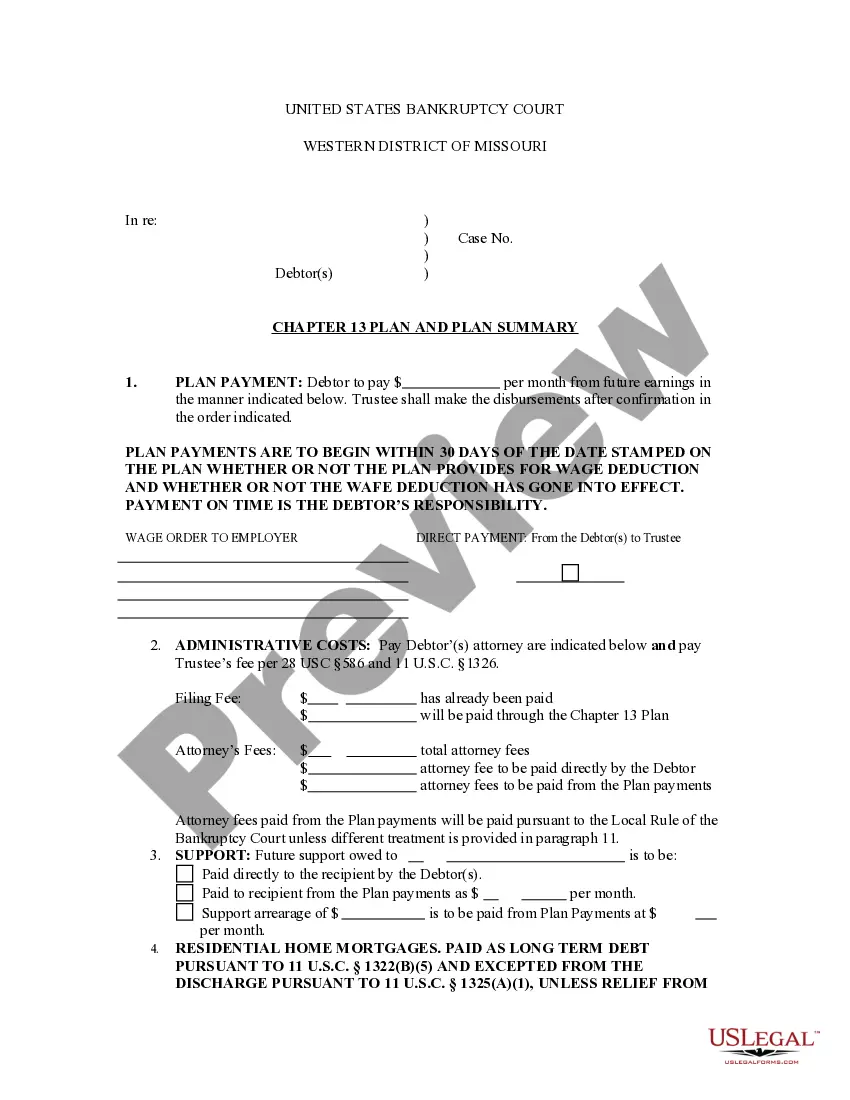

A Chapter 7 Statement of Your Current Monthly Income, also known as Form 122A-2, is an official document that is part of the bankruptcy filing process. This form is used to provide information on the debtor's current income and expenses. It is intended to give the court an accurate picture of the debtor's financial situation in order to determine if they are eligible for a Chapter 7 bankruptcy. The form must be completed and submitted along with other bankruptcy forms and documents. The Chapter 7 Statement of Your Current Monthly Income includes a detailed breakdown of the debtor's income, including wages, self-employment and other sources, as well as their estimated living expenses. This form also requires the debtor to list any assets they own and to provide information on any debts they owe, including secured and unsecured debts. Once the form is completed, the debtor's bankruptcy lawyer will use the information to help determine if they qualify for a Chapter 7 bankruptcy. There are two different versions of the Chapter 7 Statement of Your Current Monthly Income, Form 122A-1 and Form 122A-2. Form 122A-1 is used for individuals or married couples filing joint bankruptcies while Form 122A-2 is used for businesses and partnerships.

Chapter 7 Statement of Your Current Monthly Income

Description

How to fill out Chapter 7 Statement Of Your Current Monthly Income?

Coping with official documentation requires attention, precision, and using well-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Chapter 7 Statement of Your Current Monthly Income template from our library, you can be sure it complies with federal and state regulations.

Working with our service is simple and fast. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your Chapter 7 Statement of Your Current Monthly Income within minutes:

- Remember to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Chapter 7 Statement of Your Current Monthly Income in the format you need. If it’s your first experience with our website, click Buy now to continue.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the Chapter 7 Statement of Your Current Monthly Income you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

Section 101(10A) of the Bankruptcy Code. This may include income and payments from some unexpected sources. As expected, all income from your employer is included?all gross wages or salary, as well as any tips, overtime, shift differentials, and commissions, WITHOUT subtracting any tax or other deductions.

For example, typically under Federal exemptions, you can have approximately $20,000.00 cash on hand or in the bank on the day you file bankruptcy. The vast majority of my clients have considerable less than $20,000.00 in the bank the day I file their bankruptcy.

Yes. For high income earners, however, it may be challenging to meet the requirements for filing for Chapter 7. Since Bankruptcy Abuse Prevention & Consumer Protection Act (BAPCPA) was passed in 2005, it has become more difficult for individuals with a high income to qualify for Chapter 7.

Total average monthly payment for all mortgages and other debts secured by your home. To calculate the total average monthly payment, add all amounts that are contractually due to each secured creditor in the 60 months after you file for bankruptcy. Then divide by 60.

An income statement is a financial statement that shows you the company's income and expenditures. It also shows whether a company is making profit or loss for a given period. The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business.

Making a significant income won't stop you from filing for bankruptcy?but it might determine under which bankruptcy chapter?Chapter 7 or Chapter 13?you can wipe out qualifying debt. Your ability to file a particular chapter will depend on your income, and, in some cases, your deductible expenses.

To determine your Chapter 7 bankruptcy income limit, add the last six months of your gross income ? this is what you earned before taxes and other deductions were taken out.

Look at Your Disposable Income If your disposable income after expenses is less than $128, you qualify for Chapter 7 under the means test. If it's more than $214, you do not qualify. If you fall into the gray area between, you'll have to complete one more step.