Order Conditionally Approving Disclosure Statement, etc - B 13S

Description Order Disclosure Statement

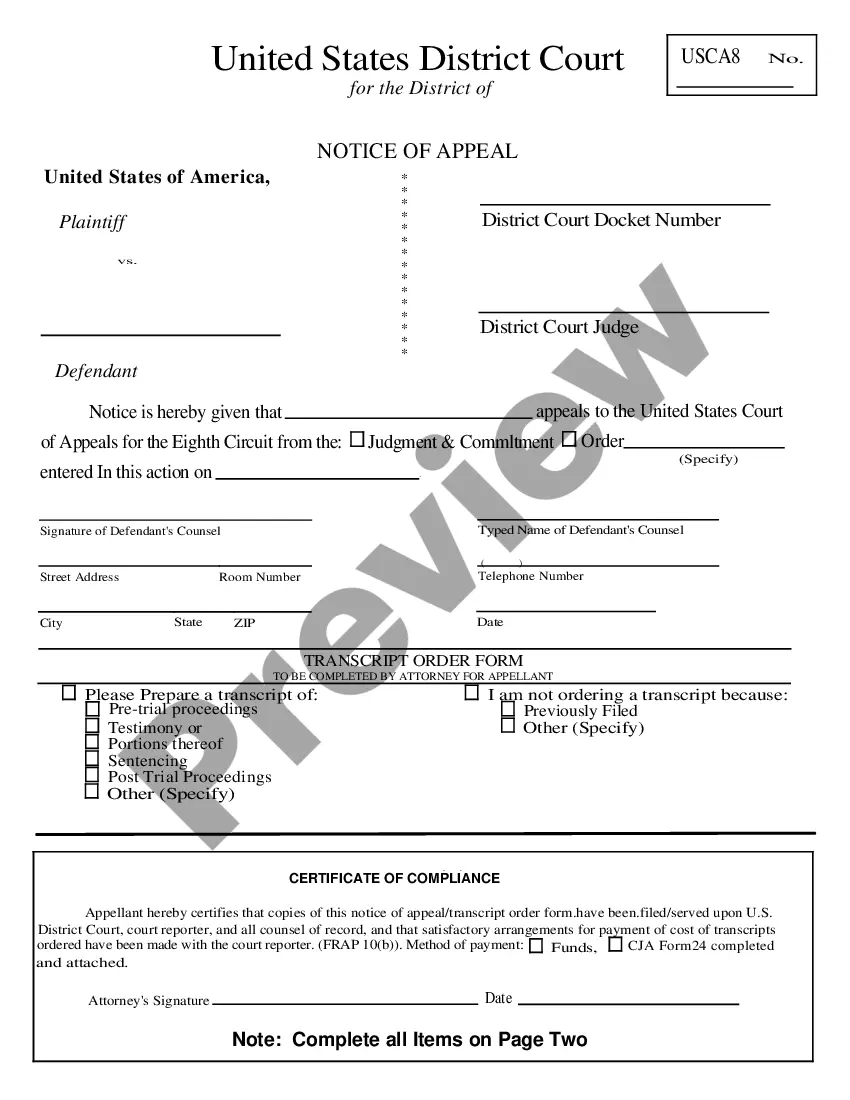

How to fill out Order Conditionally Approving Disclosure Statement, Etc - B 13S?

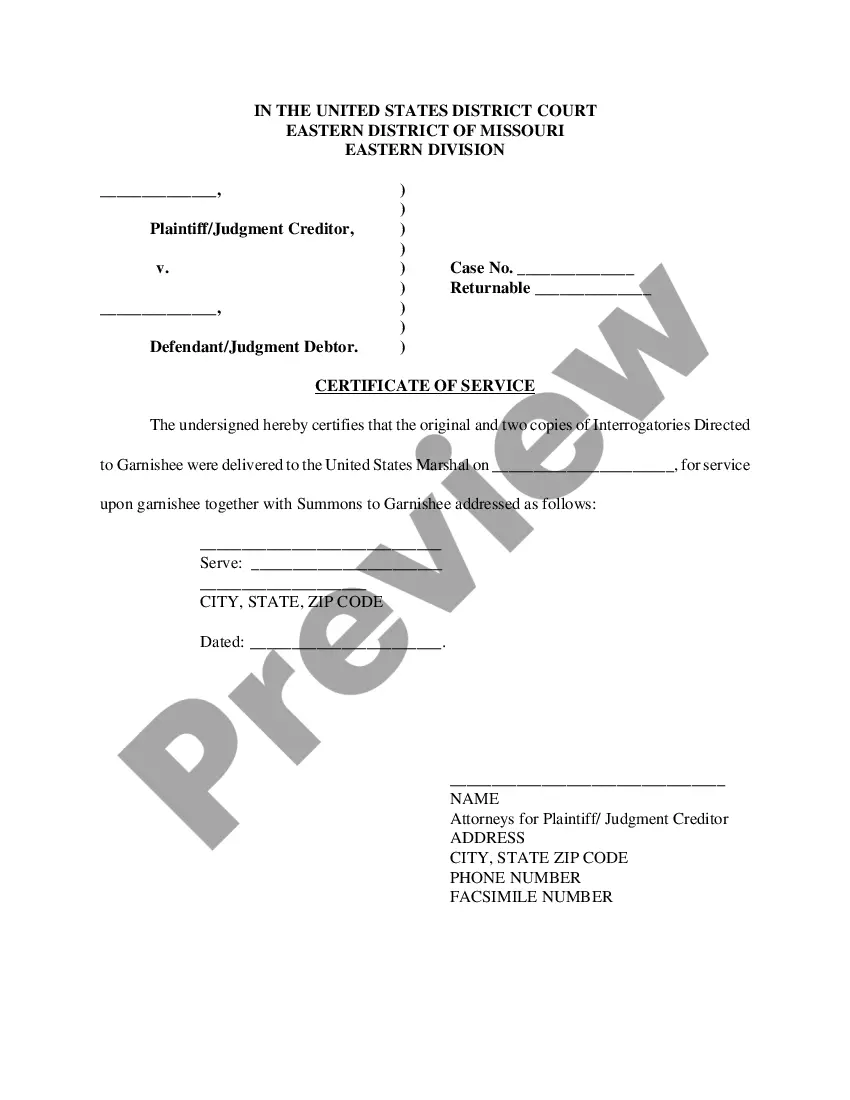

Employ the most complete legal library of forms. US Legal Forms is the best place for finding up-to-date Order Conditionally Approving Disclosure Statement, etc - B 13S templates. Our service provides a huge number of legal forms drafted by certified lawyers and categorized by state.

To download a template from US Legal Forms, users simply need to sign up for an account first. If you are already registered on our platform, log in and choose the document you are looking for and purchase it. Right after buying forms, users can find them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the steps below:

- Check if the Form name you’ve found is state-specific and suits your requirements.

- In case the template features a Preview function, use it to check the sample.

- In case the sample doesn’t suit you, make use of the search bar to find a better one.

- Hit Buy Now if the template meets your needs.

- Select a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with yourr credit/credit card.

- Choose a document format and download the sample.

- As soon as it is downloaded, print it and fill it out.

Save your effort and time with our platform to find, download, and complete the Form name. Join a large number of satisfied clients who’re already using US Legal Forms!

Form popularity

FAQ

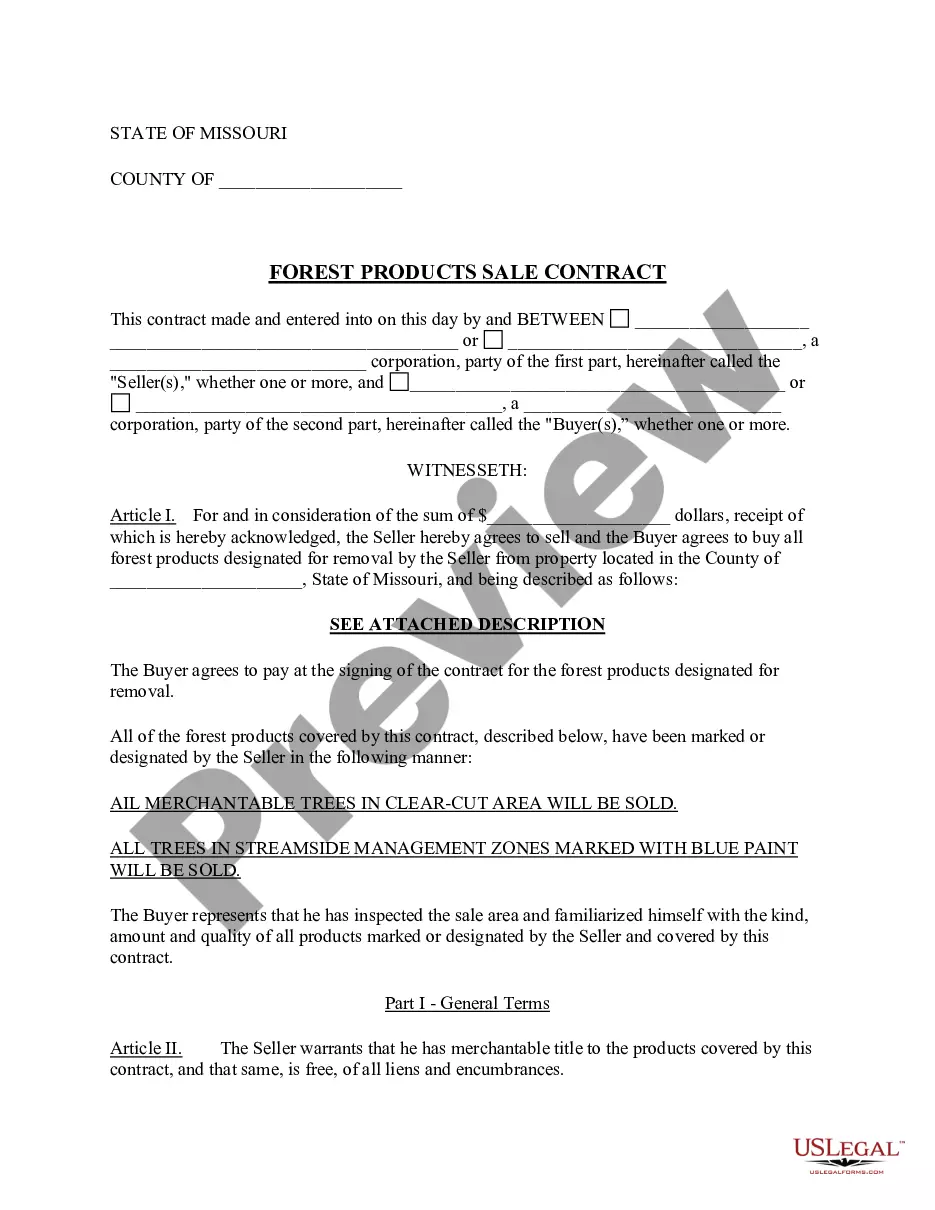

A seller's disclosure form, often called a property disclosure statement, is a form you fill out that details all the potential problems with your home. Sellers are legally required to produce these statements in most parts of the country. The idea is to protect buyers from purchasing a home with undisclosed problems.

Do not exclude any information. Be honest. Write clearly. Use simple words in writing your income statement for disclosure. Attach necessary documents to your disclosure statement. Review and revise.

It includes the name of the organization, the party of the loans, approval, date, and place at which the document was signed, key terms such as tenure of the loan, interest charged, annual percentage rate, total processing fees, loan statement, prepayment terms, and various other information including the terms

Disclosure is defined as the act of revealing or something that is revealed. An example of disclosure is the announcement of a family secret. An example of a disclosure is the family secret which is told. (law) The making known of a previously hidden fact or series of facts to another party; the act of disclosing.

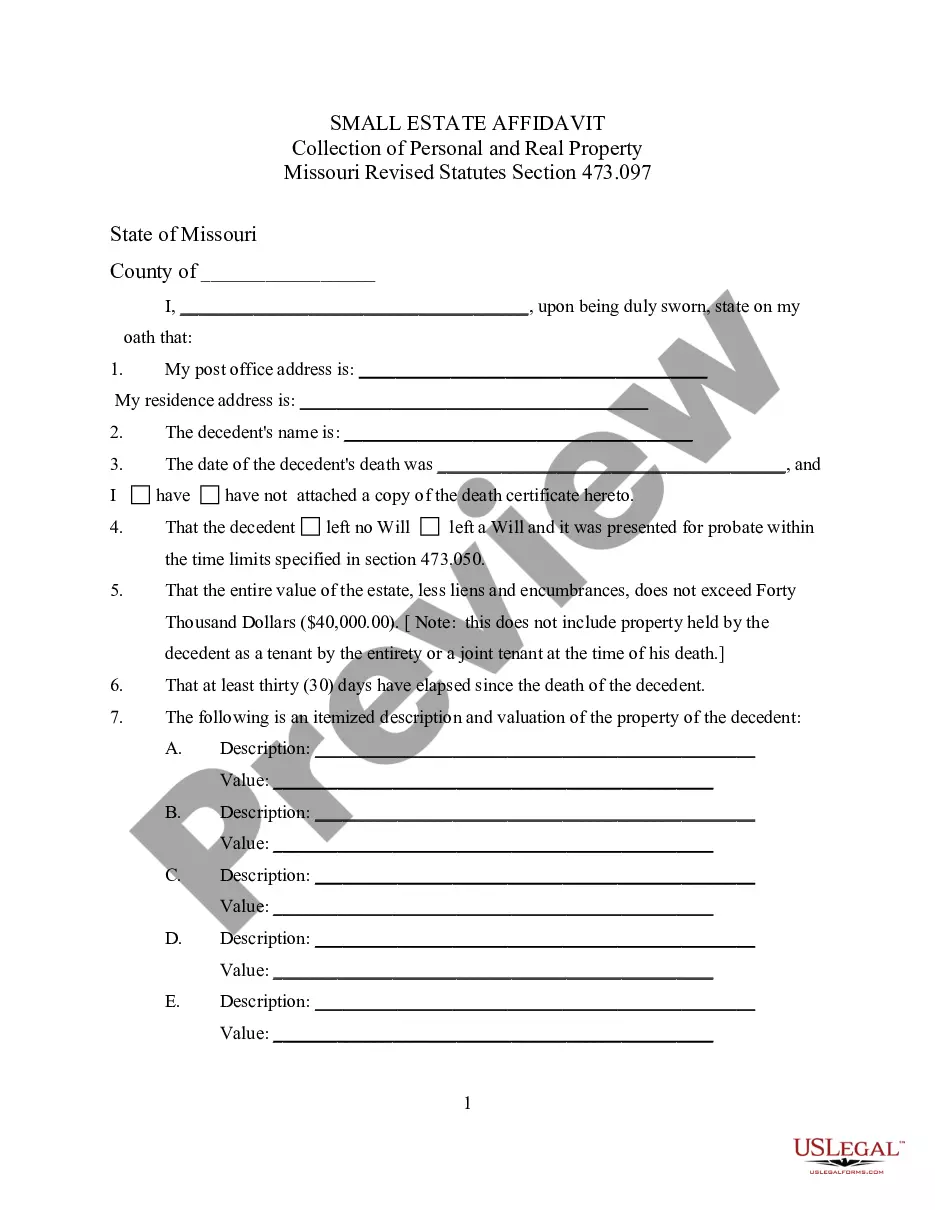

The purpose of a disclosure statement is to provide explanatory information regarding the significant features of the insurance policy to enable the insured to make an informed decision regarding purchasing the insurance policy.

The disclosure statement must provide adequate information about your financial affairs to allow your creditors to make an informed decision about whether to accept or reject your plan. Once you file your disclosure statement, the court will hold a hearing to approve or reject it.

A disclosure statement is a financial document given to a participant in a transaction explaining key information in plain language. Disclosure statements for retirement plans must clearly spell out who contributes to the plan, contribution limits, penalties, and tax status.