Order Fixing Time to Object to Proposed Modification of Confirmed Chapter 13 Plan - B 231B

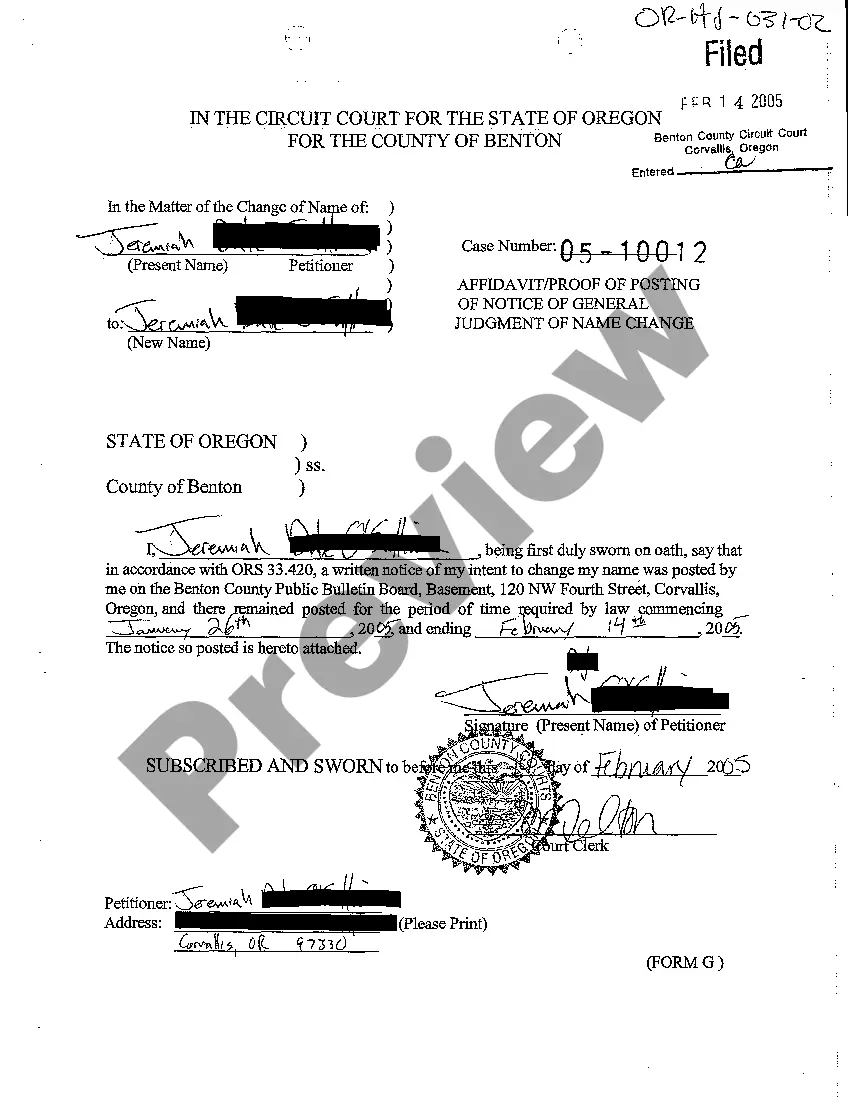

Description Example Of A Proposed Order

How to fill out Chapter 13 Form Application?

Make use of the most complete legal catalogue of forms. US Legal Forms is the perfect place for finding up-to-date Order Fixing Time to Object to Proposed Modification of Confirmed Chapter 13 Plan - B 231B templates. Our service provides a huge number of legal documents drafted by certified attorneys and grouped by state.

To get a sample from US Legal Forms, users only need to sign up for an account first. If you are already registered on our service, log in and select the document you are looking for and buy it. Right after purchasing templates, users can see them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines below:

- Check if the Form name you have found is state-specific and suits your needs.

- When the form has a Preview option, utilize it to review the sample.

- In case the template does not suit you, use the search bar to find a better one.

- Hit Buy Now if the template corresponds to your needs.

- Select a pricing plan.

- Create an account.

- Pay with the help of PayPal or with the credit/bank card.

- Select a document format and download the template.

- Once it is downloaded, print it and fill it out.

Save your time and effort with our service to find, download, and fill in the Form name. Join a huge number of pleased subscribers who’re already using US Legal Forms!

Order Chapter 13 Form popularity

Chapter 13 Form Other Form Names

Order Confirmed Form FAQ

In Chapter 13 bankruptcy, you propose a repayment plan to pay back some or all of your debts over a three to five-year period. This article explains how the monthly payment is determined. To get an estimate of what the minimum payment could be in your case, see our Chapter 13 Bankruptcy Payment Calculator.

In Chapter 13 bankruptcy, you pay your unsecured creditors an amount between 0 and 100% of what you owe them. The exact amount is depends on these rules: (1) The minimum amount you must pay is equal to the amount your unsecured creditors would have received had you filed for Chapter 7 bankruptcy.

Through the repayment plan, which lasts either three or five years, you pay a set amount to the bankruptcy trustee each month. The trustee then uses that money to pay your creditors. Some creditors get paid in full through the plan, others (mostly unsecured creditors) get paid a portion of what you owe them.

A 100% plan is a Chapter 13 bankruptcy in which you develop a plan with your attorney and creditors to pay back your debt. It is required to pay back all secured debt and 100% of all unsecured debt.

The difference between your income on Schedule I and your expenses on Schedule J will be your Chapter 13 plan payment. Your unsecured creditors will receive a percentage of the disposable income that remains after secured and priority creditors receive payment.

Credit card debt. medical bills. personal loans. older nonpriority income tax obligations. utility bills, and. most lawsuit judgments.

Chapter 13 trustees get paid by taking a percentage of all amounts they distribute to creditors through your repayment plan. This percentage varies depending on where you live but can be up to 10%. In addition, you typically have to pay interest on secured claims you are paying off through your plan.

Before the court confirms (approves) your Chapter 13 repayment plan, you must show that it represents your "best efforts" to pay back creditors. It's also called the disposable income test because you must pay all of your disposable income at a minimum.