Chapter 13 Discharge is the process of legally ending a Chapter 13 Bankruptcy repayment plan. This discharge releases the debtor from their obligations to pay back any remaining balances on their eligible debts. The debtor must fulfill all the repayment plan requirements specified by the court in order to be eligible for a discharge. There are three types of Chapter 13 Discharge: General, Full, and Partial. A General Discharge applies to all debts covered by the repayment plan, except those explicitly excluded by the court. A Full Discharge relieves the debtor of all their debts that are covered by the repayment plan. A Partial Discharge applies only to certain debts that have been specifically identified by the court.

Chapter 13 Discharge

Description

How to fill out Chapter 13 Discharge?

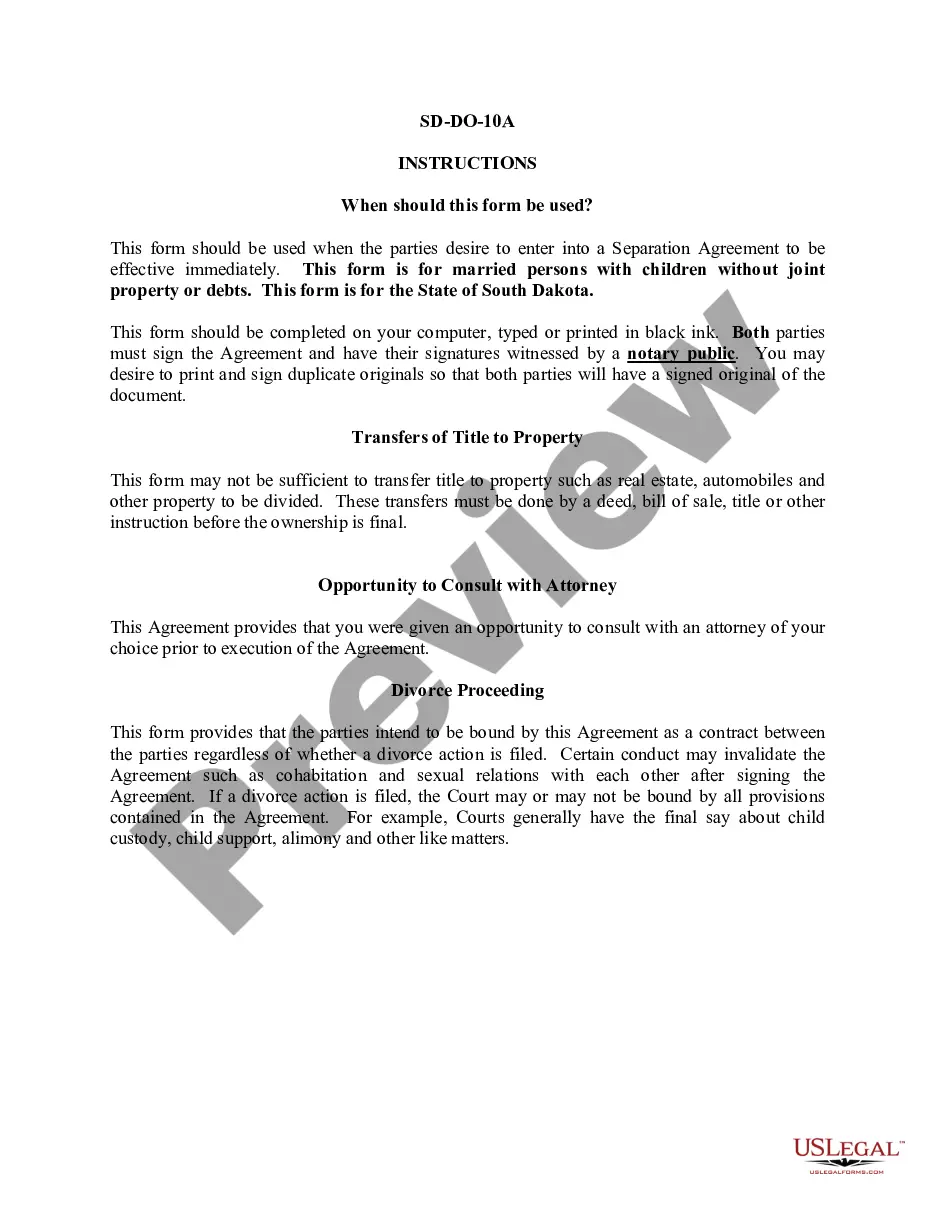

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state laws and are verified by our specialists. So if you need to complete Chapter 13 Discharge, our service is the perfect place to download it.

Getting your Chapter 13 Discharge from our catalog is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they find the proper template. Afterwards, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a brief guide for you:

- Document compliance check. You should carefully examine the content of the form you want and check whether it satisfies your needs and complies with your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable template, and click Buy Now when you see the one you want.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Chapter 13 Discharge and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to get any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or your car while also discharging unsecured debt.

You may like to file Chapter 13 instead of a Chapter 7 bankruptcy, if you're behind on your mortgage payments and you're trying to save your home. Chapter 7 does not give you the opportunity to catch up mortgage payments or otherwise save your house. A Chapter 13 would be the appropriate chapter to file for that.

However, the discharge in chapter 13 is broader than in chapter 7. Unlike a chapter 7 debtor, a chapter 13 debtor can discharge debts for willful and malicious injury to property, debts incurred to pay non-dischargeable tax obligations, and debts arising from property settlements in divorce or separation proceedings.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors;

Chapter 13 Discharge Clears Qualified Debts Congratulations, you've spent years slowly repaying your debts and the plan is now complete. The judge issues the discharge and now any remaining balances on your qualified debts are forgiven. Chapter 13 bankruptcy allows for more qualified debts than Chapter 7.

Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing.

Debts not discharged in chapter 13 include certain long term obligations (such as a home mortgage), debts for alimony or child support, certain taxes, debts for most government funded or guaranteed educational loans or benefit overpayments, debts arising from death or personal injury caused by driving while intoxicated

About 45 days after you've received your discharge, you will receive a document called a Final Decree. It's the document that officially closes your case. Once this document is received, you are no longer in bankruptcy.