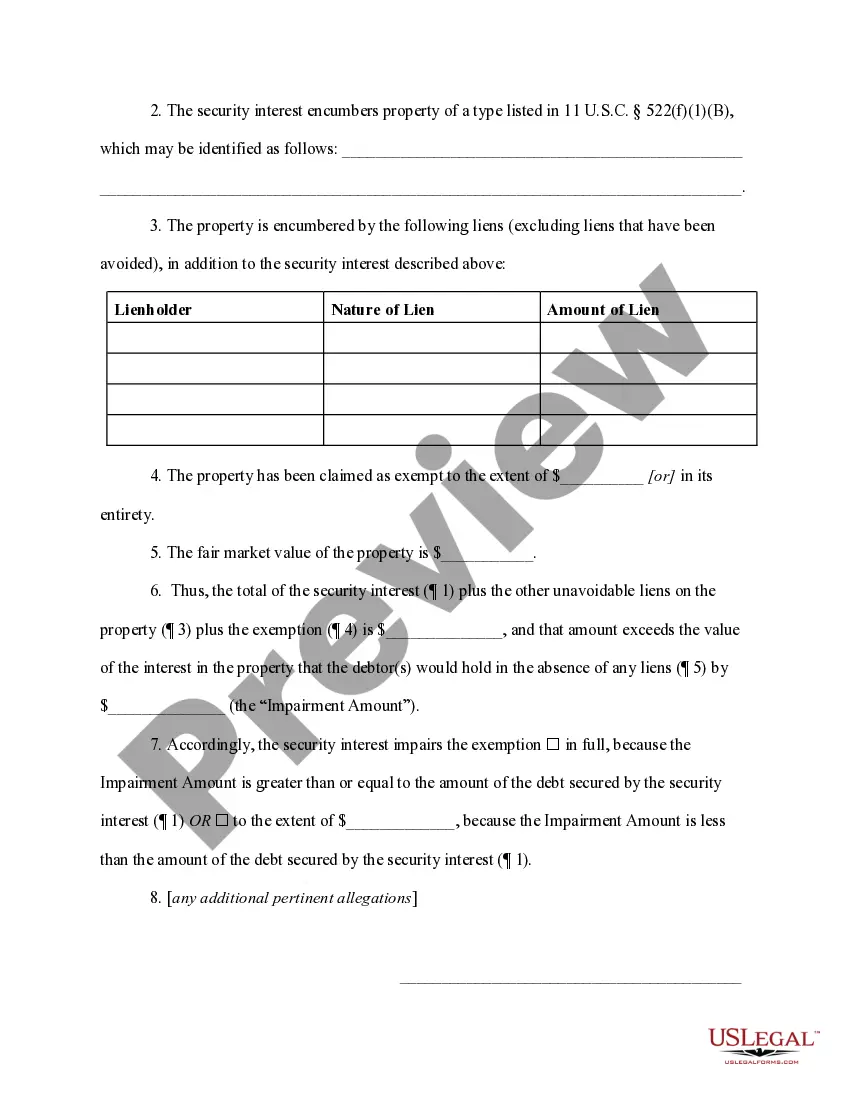

Motion to Avoid Nonpossessory Nonpurchase-Money Security Interest — Passive Notice (also known as "Passive Motion to Avoid") is a legal motion that requests a court to set aside a security interest based on a creditor's failure to provide the debtor with proper notice of the security interest. This motion can be filed by a debtor who has had a security interest placed on their property without their knowledge or consent. The motion requests that the court invalidate the security interest and restore the debtor's full rights to the property. There are two types of Passive Motion to Avoid: 1) Motion to Avoid Nonpossessory Security Interests and 2) Motion to Avoid Nonpurchase-Money Security Interests. Both motions require the same basic elements: 1) Proof that the debtor was not given proper notice of the security interest, 2) Evidence that the security interest was not a purchase-money security interest, and 3) Evidence that the security interest was nonpossessory.

Motion to avoid nonpossessory nonpurchase-money security interest - passive notice

Description

How to fill out Motion To Avoid Nonpossessory Nonpurchase-money Security Interest - Passive Notice?

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state laws and are verified by our experts. So if you need to complete Motion to avoid nonpossessory nonpurchase-money security interest - passive notice, our service is the perfect place to download it.

Obtaining your Motion to avoid nonpossessory nonpurchase-money security interest - passive notice from our service is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they locate the correct template. Later, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

- Document compliance verification. You should carefully review the content of the form you want and ensure whether it suits your needs and complies with your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab on the top of the page until you find an appropriate template, and click Buy Now when you see the one you want.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Motion to avoid nonpossessory nonpurchase-money security interest - passive notice and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to get any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

A quick definition of non-purchase-money: Non-purchase-money refers to a type of loan that is not secured by property obtained through the loan. This means that the loan is not used to purchase the property that is being used as collateral.

With a non-possessory security interest, the debtor maintains possession of the collateral. Most security interests are non-possessory because a debtor usually wants to use the property being used as collateral.

A car loan can be an example of a PMSI situation. A financial institution may agree to lend money to a borrower to finance the purchase of a new car. The bank can register its interest in the car as a PMSI because the loan funds are being directly used to buy the property they want a secured interest in.

What is Non-Purchase Money Security Interest? A security interest in which the property is already owned by the debtor and is put up as security for a loan. This kind of lien is subject to elimination in a bankruptcy proceeding.

A purchase money security interest (PMSI) is an exception to the first-in-time rule. It gives secured creditors who meet its requirements a special advantage to jump ahead in line of other creditors with respect to certain collateral.

One such term is the non-possesory, non-purchase money security interest. This is a very long and complicated-sounding term that basically means that a debt is secured by property you already owned when you made the loan.