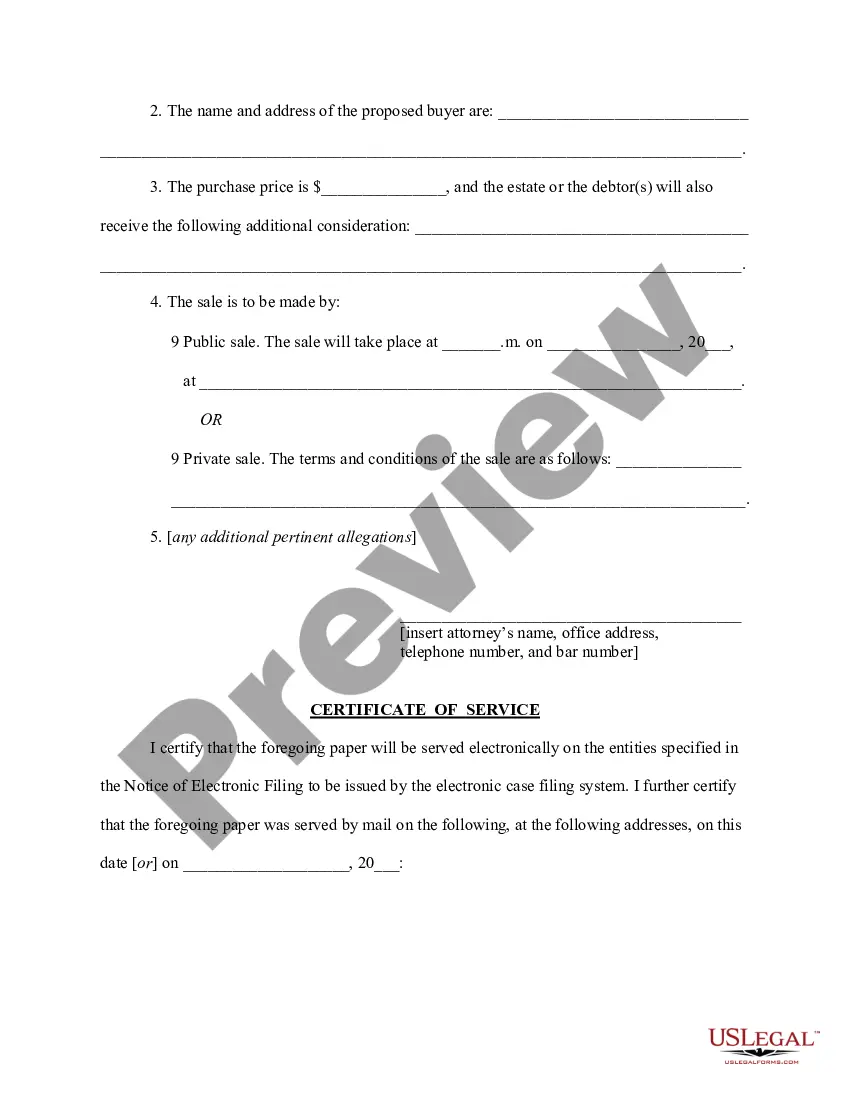

A Notice of Proposed Sale of Property is a legal document which states the intention of a seller to sell a particular piece of real estate property. It is typically used when a seller wishes to sell a property but does not want to advertise it publicly. The document will include details such as the sale price, terms of the sale, and description of the property. There are two types of Notice of Proposed Sale of Property: public notice and private notice. Public notices are typically published in a newspaper or posted on a public notice board. Private notices are sent directly to potential buyers who have expressed interest in the property. Both types of notice are legally binding.

Notice of proposed sale of property

Description

How to fill out Notice Of Proposed Sale Of Property?

If you’re searching for a way to properly complete the Notice of proposed sale of property without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business situation. Every piece of documentation you find on our web service is designed in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Adhere to these simple guidelines on how to obtain the ready-to-use Notice of proposed sale of property:

- Make sure the document you see on the page meets your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the document name in the Search tab on the top of the page and select your state from the dropdown to find an alternative template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to save your Notice of proposed sale of property and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Rule 144 at (a)(1) defines an ?affiliate? of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.?

Form 144, required under Rule 144, is filed by a person who intends to sell either restricted securities or control securities (i.e., securities held by affiliates. Form 144 is notification to the SEC of this intention to sell and must take place at the time the sell order is placed with the broker-dealer.

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

All affiliates are required to file a Form 144, notifying the SEC if the sale of securities within any three-month period exceeds either 5,000 shares or a total dollar amount of $50,000.

Form 144 must be filed with the SEC by an affiliate as a notice of the proposed sale of securities when the amount to be sold under Rule 144 during any three-month period exceeds 5,000 shares or units or has an aggregate sales price in excess of $50,000.

SEC Rule 144A modifies a two-year holding period requirement on privately placed securities to permit qualified institutional buyers to trade. Unregistered shares, also called restricted stock, are securities not registered with the Securities and Exchange Commission.

How long is the Form 144 good for? For an affiliate of an issuing company, each Form 144 is good for three months from the filing date.

Form 144 must be filed with the SEC by an affiliate as a notice of the proposed sale of securities when the amount to be sold under Rule 144 during any three-month period exceeds 5,000 shares or units or has an aggregate sales price in excess of $50,000.

Property owners have 2 years from the date taxes become delinquent (April 1st) before they risk loss of the property. As stated in Florida Statute 197.502, after the 2 year period has elapsed and taxes remain unpaid, the certificate holder may file a tax deed application with the Tax Collector's office.