Real Property - Schedule A - Form 6A - Post 2005

Description Property Schedule Any

How to fill out Schedule Form 6a?

Employ the most extensive legal catalogue of forms. US Legal Forms is the best place for getting updated Real Property - Schedule A - Form 6A - Post 2005 templates. Our service provides thousands of legal documents drafted by certified lawyers and grouped by state.

To download a template from US Legal Forms, users just need to sign up for a free account first. If you are already registered on our service, log in and choose the document you are looking for and buy it. After purchasing forms, users can see them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the guidelines below:

- Check if the Form name you have found is state-specific and suits your requirements.

- When the template has a Preview option, utilize it to review the sample.

- In case the template doesn’t suit you, make use of the search bar to find a better one.

- PressClick Buy Now if the sample corresponds to your needs.

- Select a pricing plan.

- Create your account.

- Pay via PayPal or with the credit/bank card.

- Choose a document format and download the sample.

- As soon as it’s downloaded, print it and fill it out.

Save your effort and time using our service to find, download, and complete the Form name. Join a large number of pleased customers who’re already using US Legal Forms!

Real Property Form Form popularity

Property Interest Hold Other Form Names

Property Interest Secured FAQ

Schedule A is required in any year you choose to itemize your deductions. The schedule has seven categories of expenses: medical and dental expenses, taxes, interest, gifts to charity, casualty and theft losses, job expenses and certain miscellaneous expenses.

Schedule A is an IRS form used to claim itemized deductions on your tax return. You fill out and file a Schedule A at tax time and attach it to or file it electronically with your Form 1040. The title of IRS Schedule A is Itemized Deductions.

Miscellaneous itemized deductions are those deductions that would have been subject to the 2%-of-adjusted-gross-income (AGI) limitation. You can still claim certain expenses as itemized deductions on Schedule A (Form 1040), Schedule A (1040-NR), or as an adjustment to income on Form 1040 or 1040-SR.

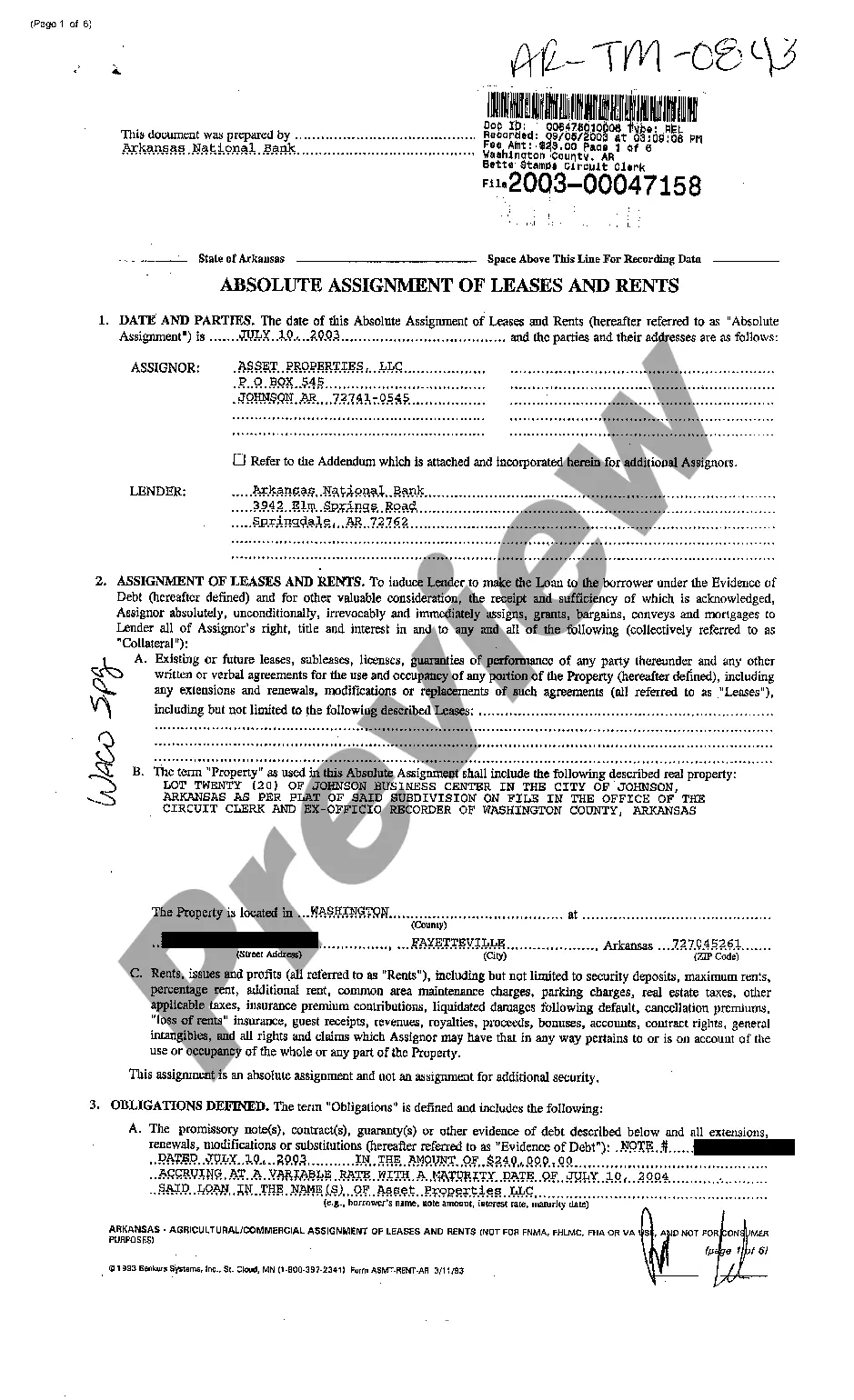

You can't deduct home mortgage interest unless the following conditions are met. You file Form 1040 or 1040-SR and itemize deductions on Schedule A (Form 1040). The mortgage is a secured debt on a qualified home in which you have an ownership interest. Secured Debt and Qualified Home are explained later.

Medical and Dental Expenses. State and Local Taxes. Mortgage and Home Equity Loan Interest. Charitable Deductions. Casualty and Theft Losses. Eliminated Itemized Deductions.

Some taxes and fees you can't deduct on Schedule A include federal income taxes, social security taxes, transfer taxes (or stamp taxes) on the sale of property, homeowner's association fees, estate and inheritance taxes, and service charges for water, sewer, or trash collection.

Medical and Dental Expenses. State and Local Taxes. Mortgage and Home Equity Loan Interest. Charitable Deductions. Casualty and Theft Losses. Eliminated Itemized Deductions.

Line 5. The deduction for state and local taxes is generally limited to $10,000 ($5,000 if married filing separately). State and local taxes subject to this limit are the taxes that you include on lines 5a, 5b, and 5c. Safe harbor for certain charitable contributions made in exchange for a state or local tax credit.

Form 6A: for a no fault possession notice on an assured shorthold tenancy. This form should be used where a no fault possession of accommodation let under an assured shorthold tenancy is sought under section 21(1) or (4) of the Housing Act 1988.