Personal Property - Schedule B - Form 6B - Post 2005

Description Schedule B Form Printable

How to fill out Schedule B Form Editable?

Make use of the most complete legal catalogue of forms. US Legal Forms is the best platform for finding up-to-date Personal Property - Schedule B - Form 6B - Post 2005 templates. Our service provides 1000s of legal documents drafted by licensed lawyers and categorized by state.

To obtain a template from US Legal Forms, users only need to sign up for an account first. If you’re already registered on our service, log in and choose the document you are looking for and purchase it. After buying templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the steps listed below:

- Check if the Form name you’ve found is state-specific and suits your requirements.

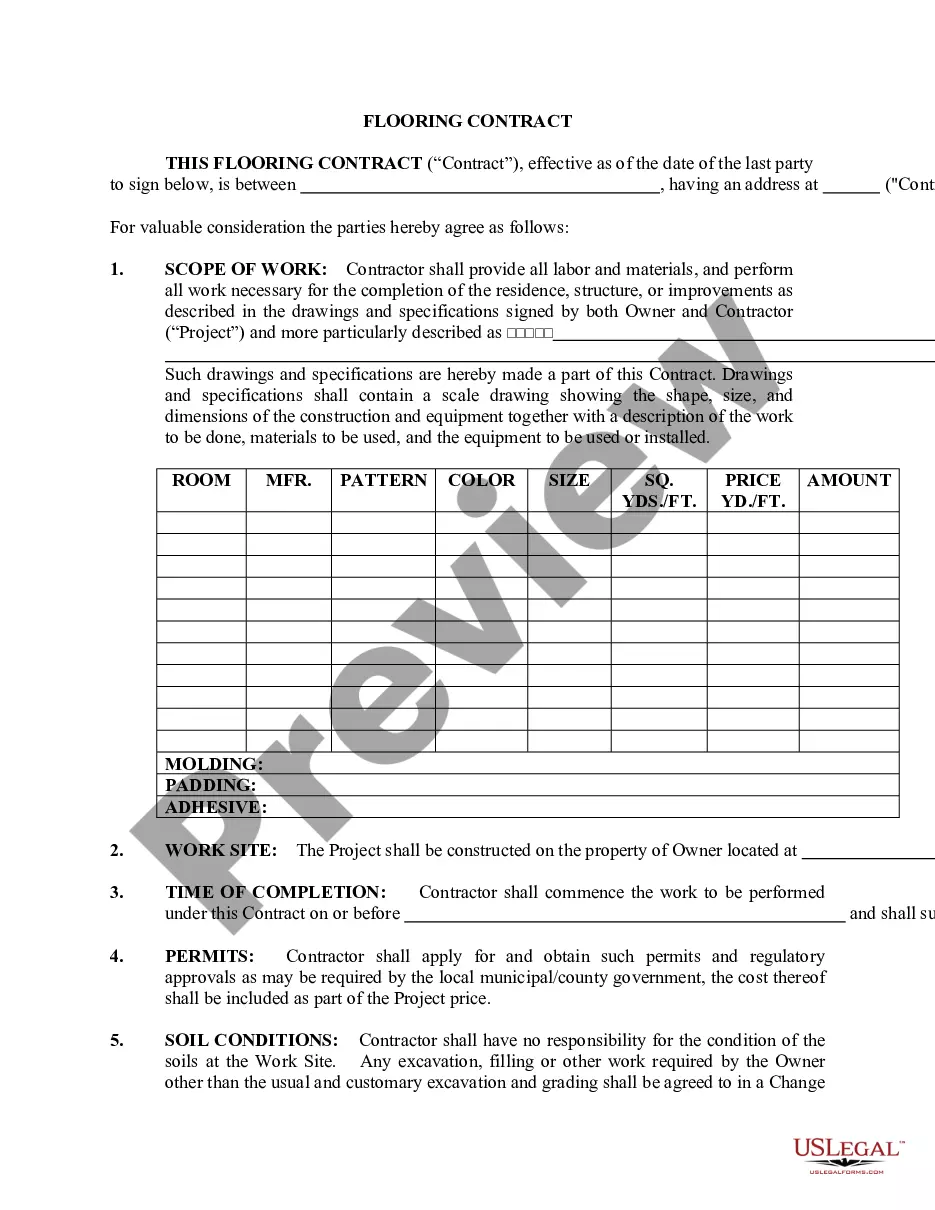

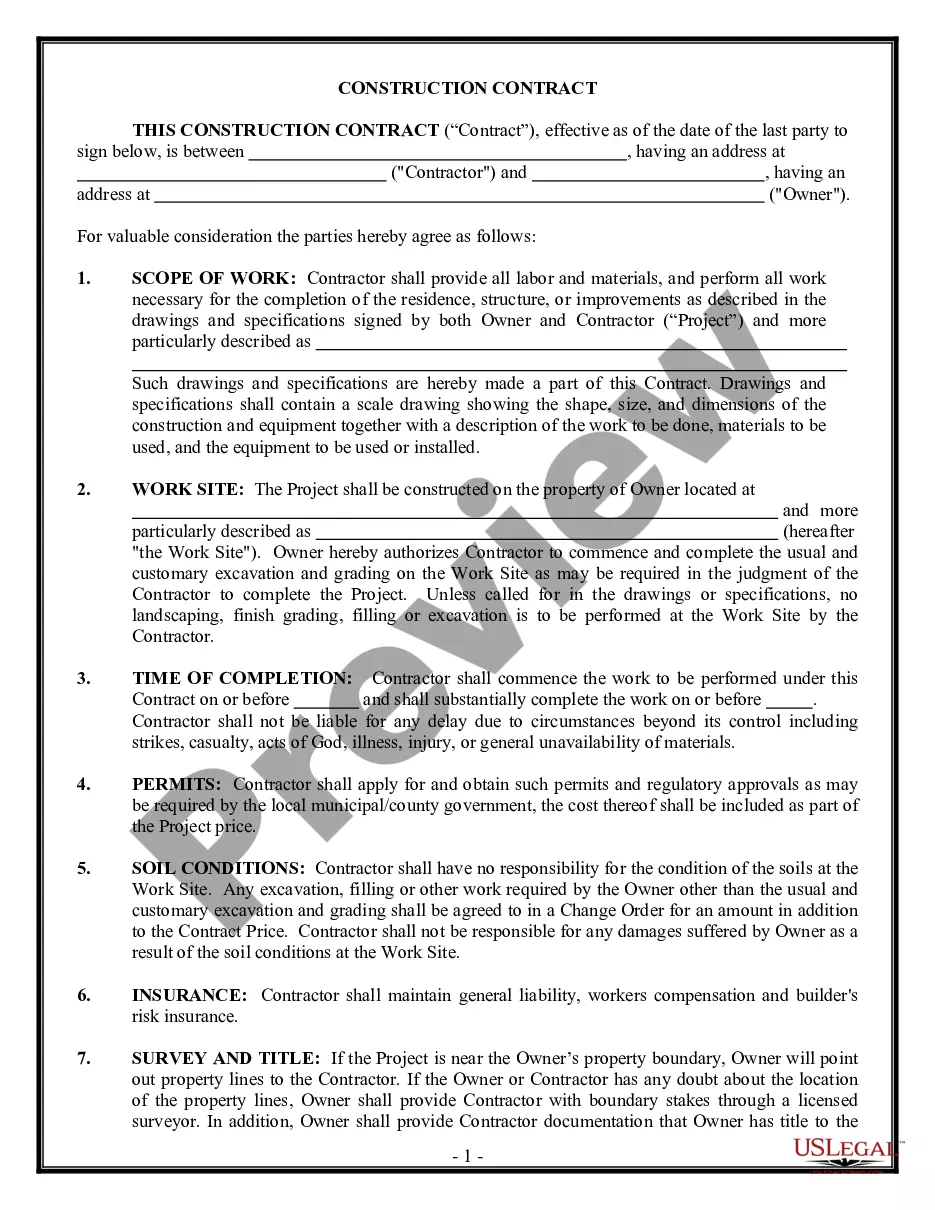

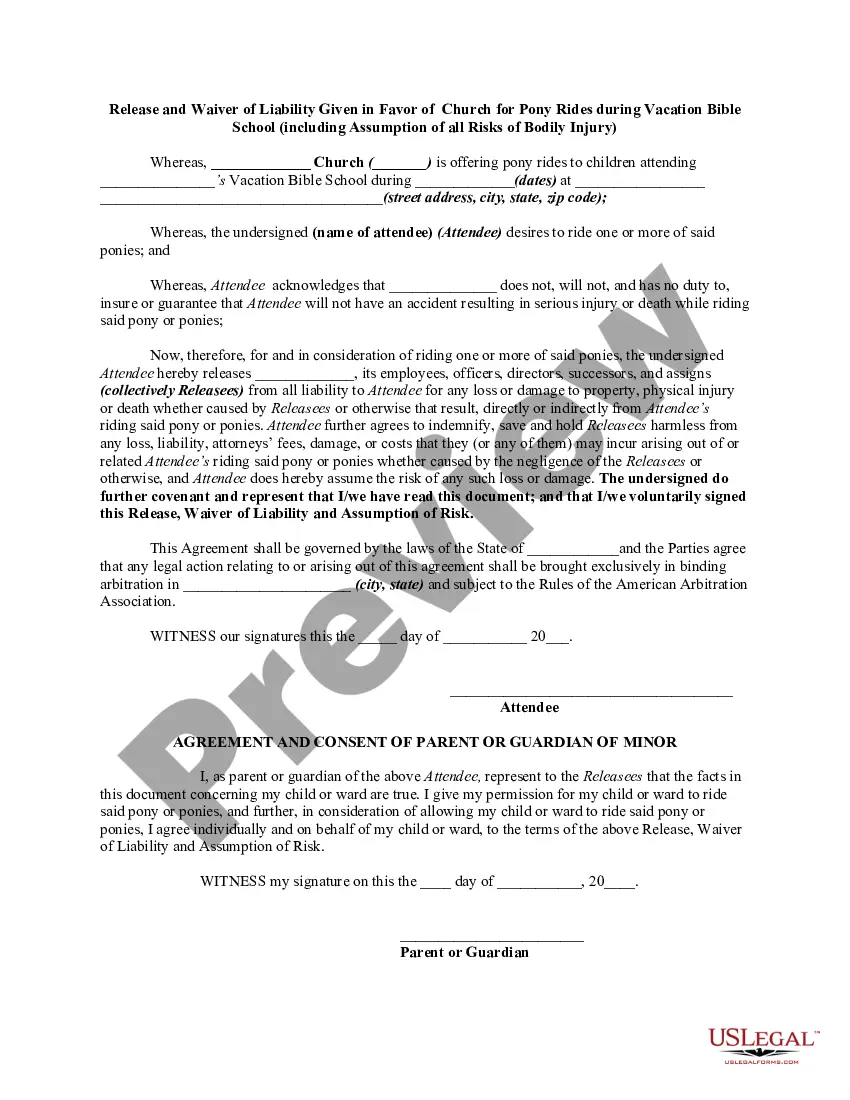

- In case the template has a Preview option, use it to check the sample.

- In case the template doesn’t suit you, use the search bar to find a better one.

- PressClick Buy Now if the sample corresponds to your expections.

- Select a pricing plan.

- Create your account.

- Pay via PayPal or with the credit/credit card.

- Choose a document format and download the template.

- As soon as it’s downloaded, print it and fill it out.

Save your time and effort using our platform to find, download, and fill out the Form name. Join a huge number of pleased subscribers who’re already using US Legal Forms!

Schedule B Form Sample Form popularity

Form 6b Other Form Names

Personal Property Post FAQ

Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

To fill out a Schedule B, first separate all documents reporting interest payments. You'll then list on the Schedule B each payer and the corresponding amount paid. The next step is to total those numbers. You'll then subtract any interest that can be excluded, such as interest on qualifying US savings bonds.

Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

Introduction. Schedule B reports the interest and dividend income you receive during the tax year. However, you don't need to attach a Schedule B every year you earn interest or dividends.In 2020 for example, a Schedule B is only necessary when you receive more than $1,500 of taxable interest or dividends.

Schedule B is an IRS tax form that must be completed if a taxpayer has received interest income and/or ordinary dividends over the course of the year. Schedule B is also used to report less common forms of interest or corporate distributions to individuals.

Schedule B reports the interest and dividend income you receive during the tax year. However, you don't need to attach a Schedule B every year you earn interest or dividends.In 2020 for example, a Schedule B is only necessary when you receive more than $1,500 of taxable interest or dividends.

If you are a semi-weekly schedule depositor, you are required to file a Form 941 along with Schedule B. This designation applies if you: Reported more than $50,000 of employment taxes in the lookback period. Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year.

Schedule B is used to report interest and/or dividends. Taxpayers should use Schedule B if they: Had over $1,500 in interest or dividends. Received interest from seller-financed mortgage and the buyer used the property as a personal residence.