Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description Schedule C Fillable Form

How to fill out Property Gain Exemption?

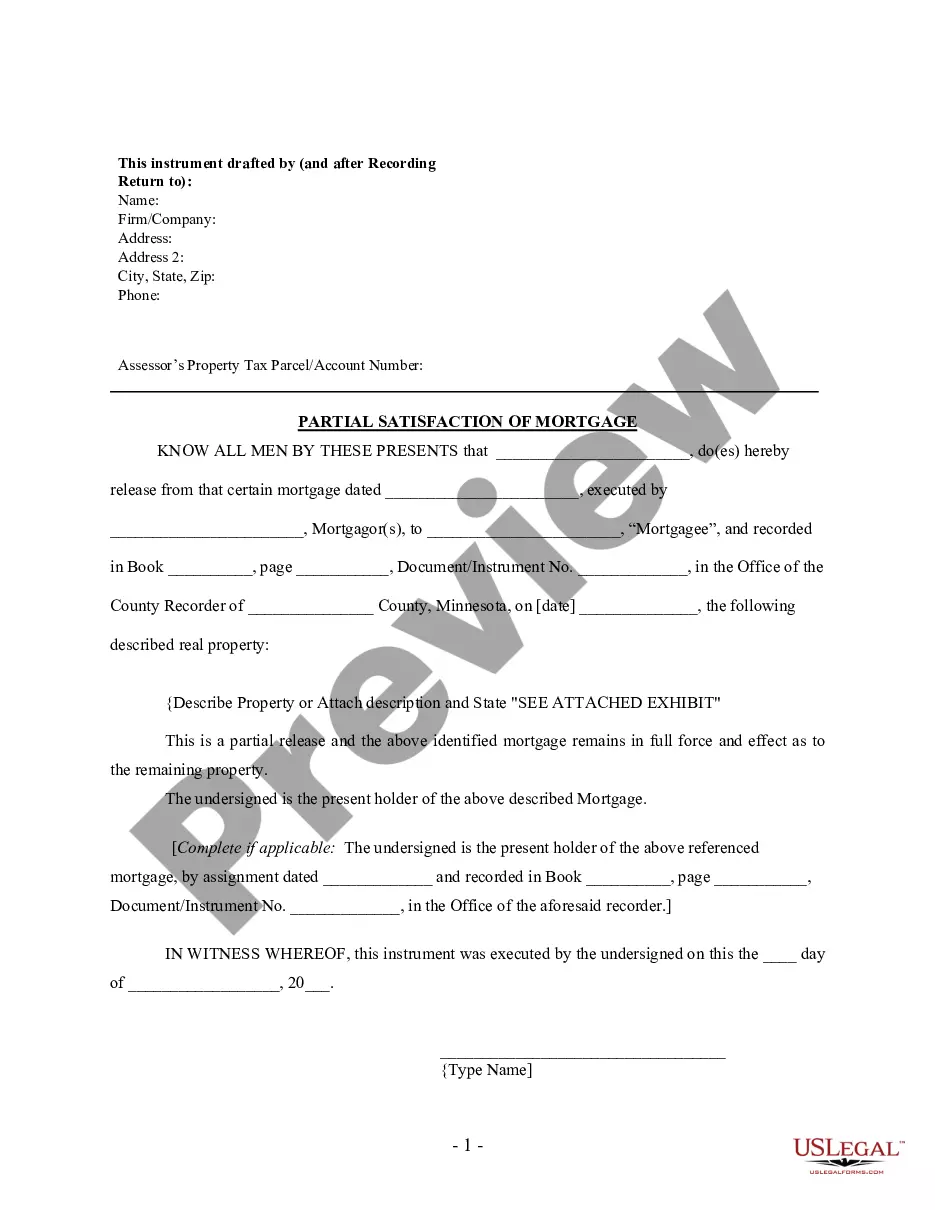

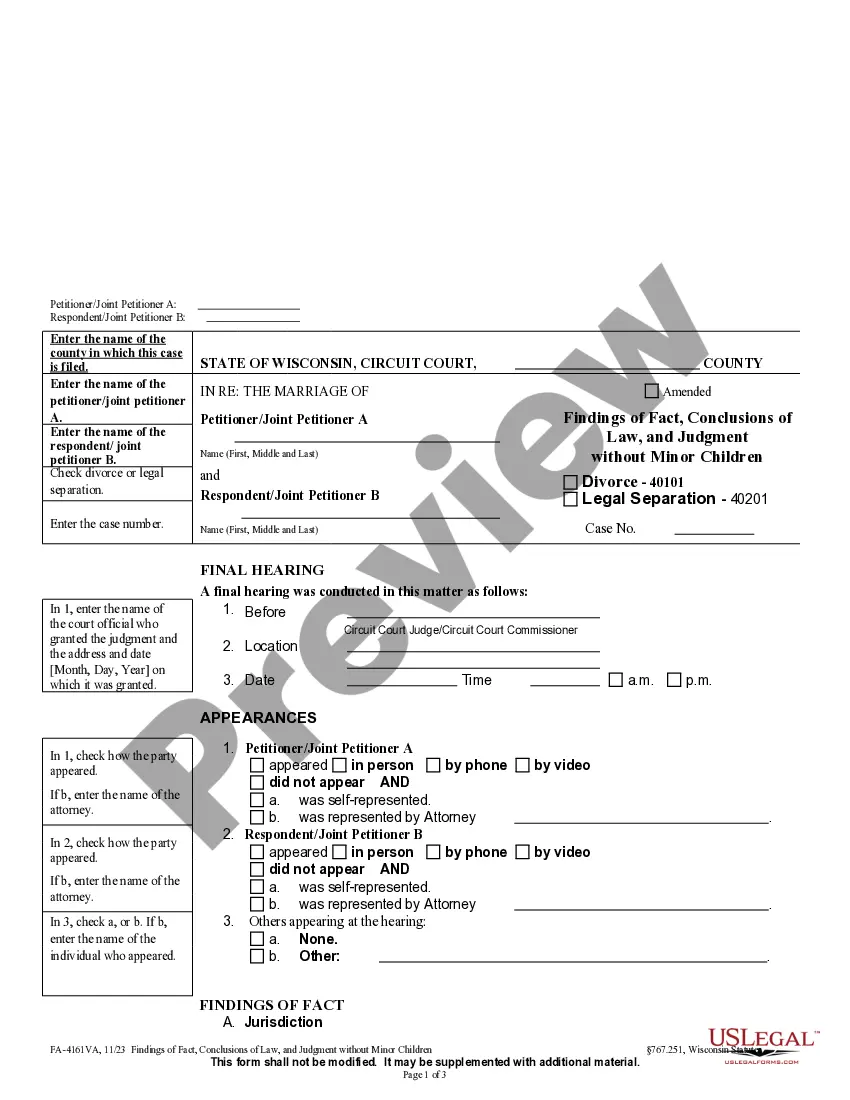

Make use of the most comprehensive legal catalogue of forms. US Legal Forms is the best platform for getting updated Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 templates. Our platform provides thousands of legal forms drafted by certified lawyers and grouped by state.

To download a sample from US Legal Forms, users only need to sign up for an account first. If you are already registered on our platform, log in and choose the template you are looking for and purchase it. Right after purchasing templates, users can see them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the steps listed below:

- Check if the Form name you’ve found is state-specific and suits your requirements.

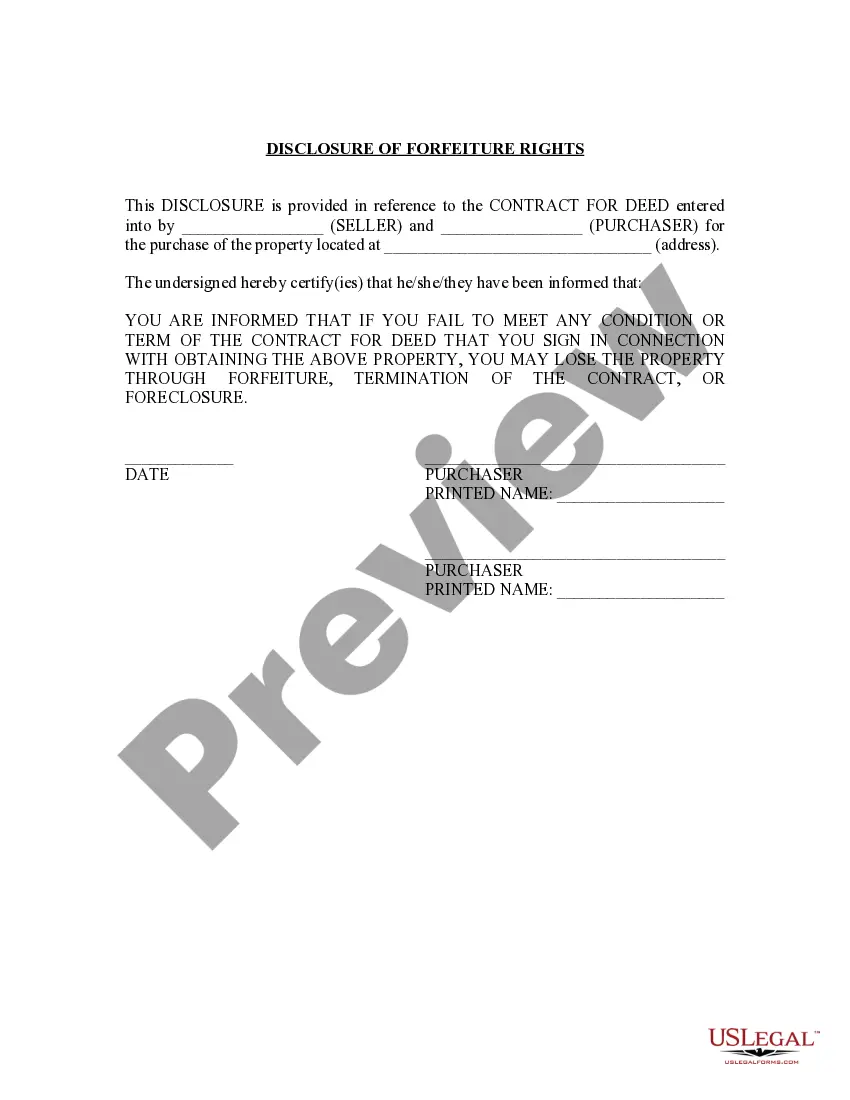

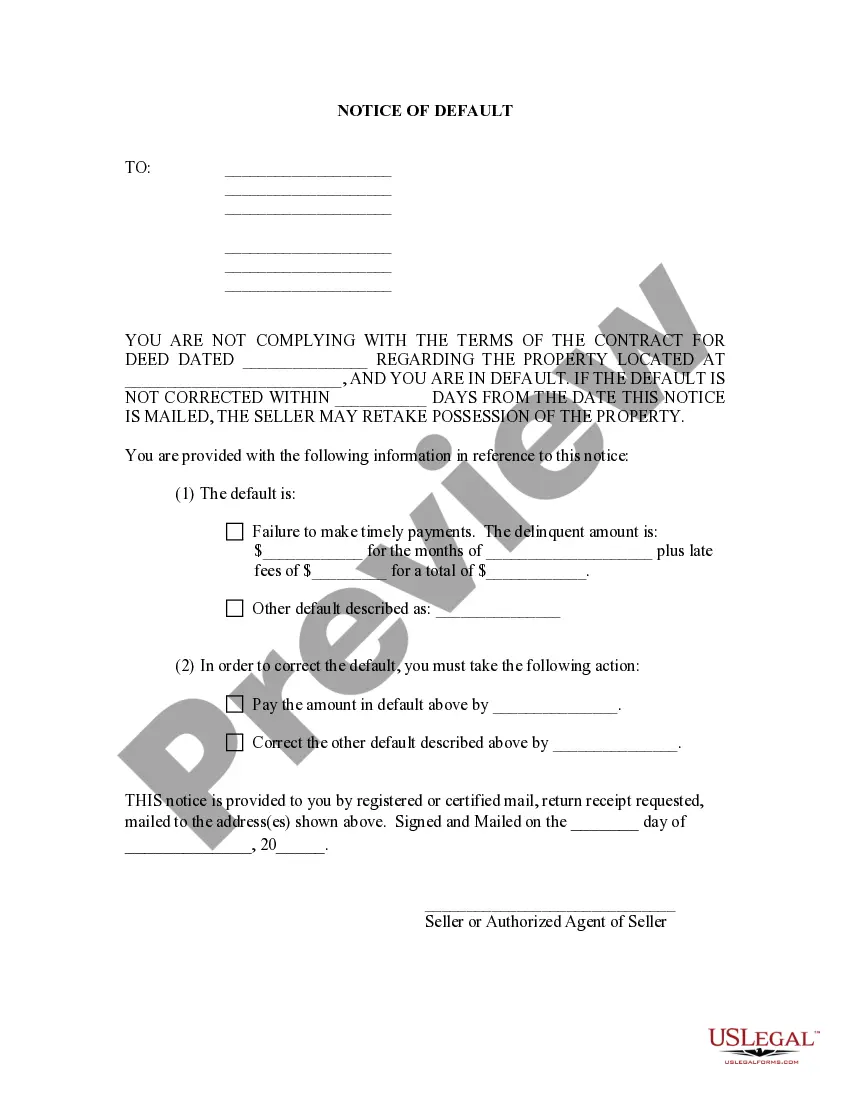

- If the form has a Preview option, use it to review the sample.

- In case the template does not suit you, use the search bar to find a better one.

- Hit Buy Now if the sample meets your needs.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with the credit/bank card.

- Choose a document format and download the template.

- After it’s downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and fill out the Form name. Join thousands of satisfied customers who’re already using US Legal Forms!

Schedule C Form Printable Form popularity

Exempt Property Definition Other Form Names

Property Exempt FAQ

Step 1: Gather Information. Business income: You'll need detailed information about the sources of your business income. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income.

Step 1: Gather Information. Business income: You'll need detailed information about the sources of your business income. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income.

Schedule C is the tax form filed by most sole proprietors.You will need to file Schedule C annually as an attachment to your Form 1040. The quickest, safest, and most accurate way to file is by using IRS e-file either online or through a tax professional that is an authorized IRS e-file provider.

25b6 Go to www.irs.gov/ScheduleC for instructions and the latest information. 25b6 Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships generally must file Form 1065. C Business name.

A form 1099 is not the same as a Schedule C form.You do not fill out form 1099, that company does, and it will include the fees it paid you on that form. It will then file the 1099 with the government, and provide you a copy too so that you can do your personal income tax return using the figure provided.

There is no minimum income to file the Schedule C. All income and expenses must be reported on the Schedule C, regardless of how little you earned. If you meet certain criteria detailed below you may be able to file the Schedule C EZ instead. There is a minimum threshold of $400 for paying self employment tax.

Use Schedule C (Form 1040 or 1040-SR) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit.

25b6 Go to www.irs.gov/ScheduleC for instructions and the latest information. 25b6 Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships generally must file Form 1065. C Business name.