Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005

Description Creditors Unsecured

How to fill out Creditors E?

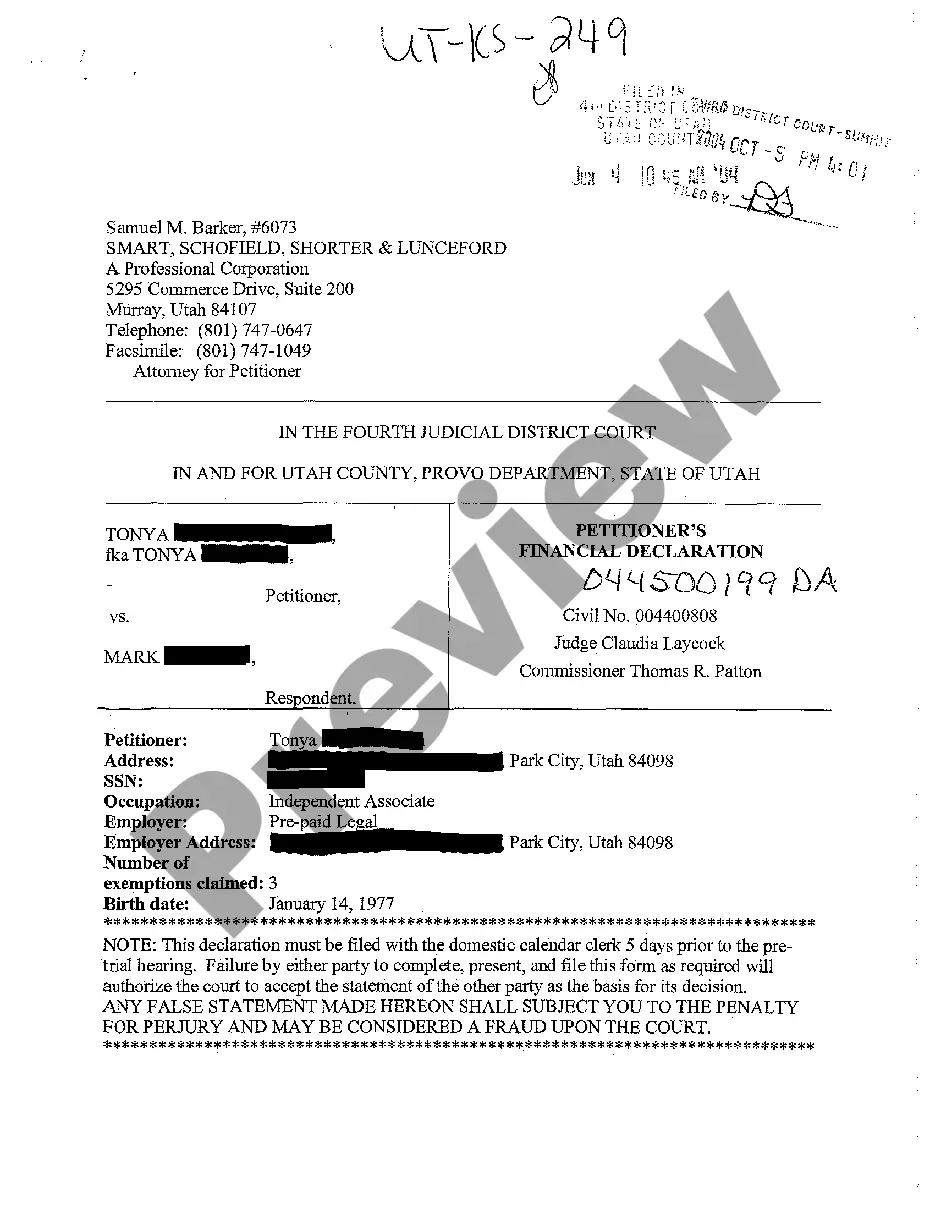

Use the most complete legal catalogue of forms. US Legal Forms is the perfect platform for getting up-to-date Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 templates. Our service provides 1000s of legal forms drafted by certified lawyers and sorted by state.

To obtain a template from US Legal Forms, users simply need to sign up for an account first. If you’re already registered on our platform, log in and select the document you need and buy it. After buying forms, users can find them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines listed below:

- Find out if the Form name you have found is state-specific and suits your needs.

- In case the template features a Preview option, utilize it to check the sample.

- If the template does not suit you, utilize the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your needs.

- Select a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with the credit/credit card.

- Select a document format and download the template.

- After it’s downloaded, print it and fill it out.

Save your time and effort with our service to find, download, and fill out the Form name. Join a large number of pleased customers who’re already using US Legal Forms!

E Form Form popularity

Creditors Schedule Application Other Form Names

Unsecured Claims FAQ

Priority unsecured debts are non-dischargeable, which means that any amounts that do not get paid in your bankruptcy are still outstanding. Bankruptcy does not wipe out your obligation on priority unsecured debts unless they are paid in full through the case.

An unsecured claim is a payment request made to the bankruptcy court by a creditor who doesn't have the right to sell property to satisfy the underlying debt. Credit card companies, medical providers, and utility companies often file unsecured claims.

Examples of nonpriority, unsecured debts include credit card debt, medical debt, personal loans, student loans, utility service arrearages, judgments from lawsuits, and the like.

Is the claim subject to Offset? Asks if you have to pay back the whole debt. For example, if you owe the creditor $1,000 but the creditor owes you $200, then the claim can be offset.

An unsecured claim is a debt that is not secured by property (debts secured by property include your mortgage or car loan). Priority unsecured debtssuch as unpaid taxes and family support arrearagesget special treatment and are paid before nonpriority unsecured debtssuch as credit card debt and medical bills.

A. Setoff is an equitable right of a creditor to deduct a debt it owes to the debtor from a claim it has against the debtor arising out of a separate transaction. Recoupment differs in that the opposing claims must arise from the same transaction.

Priority debts include: Council Tax.Income Tax, National Insurance and VAT. mortgage, rent and any loans secured against your home. hire purchase agreements, if what you're buying with them is essential.

Is the Claim Subject to Offset? A claim is subject to offset if you owe the creditor, but the creditor also owes you money. A common offset claim arises when you owe money to Big Bank and you have a checking account there. Because Big Bank is holding your money, Big Bank owes that money to you.

General unsecured claims have the lowest priority of all claims. After the bankruptcy estate pays administrative expenses, priority unsecured claims and secured claims, general unsecured creditors will receive a pro rata distribution of the remaining funds.