Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005

Description Nonpriority Schedule Template

How to fill out Nonpriority E F?

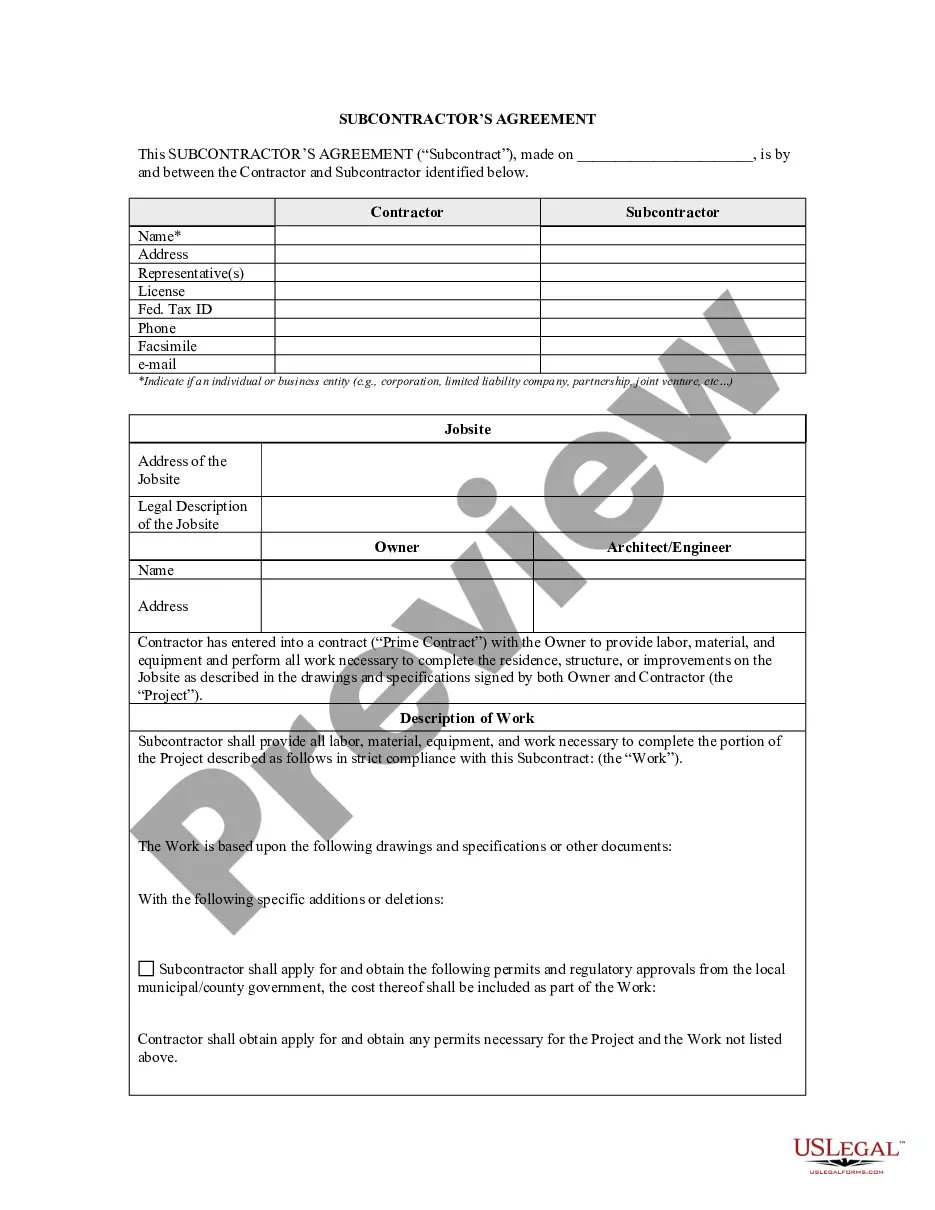

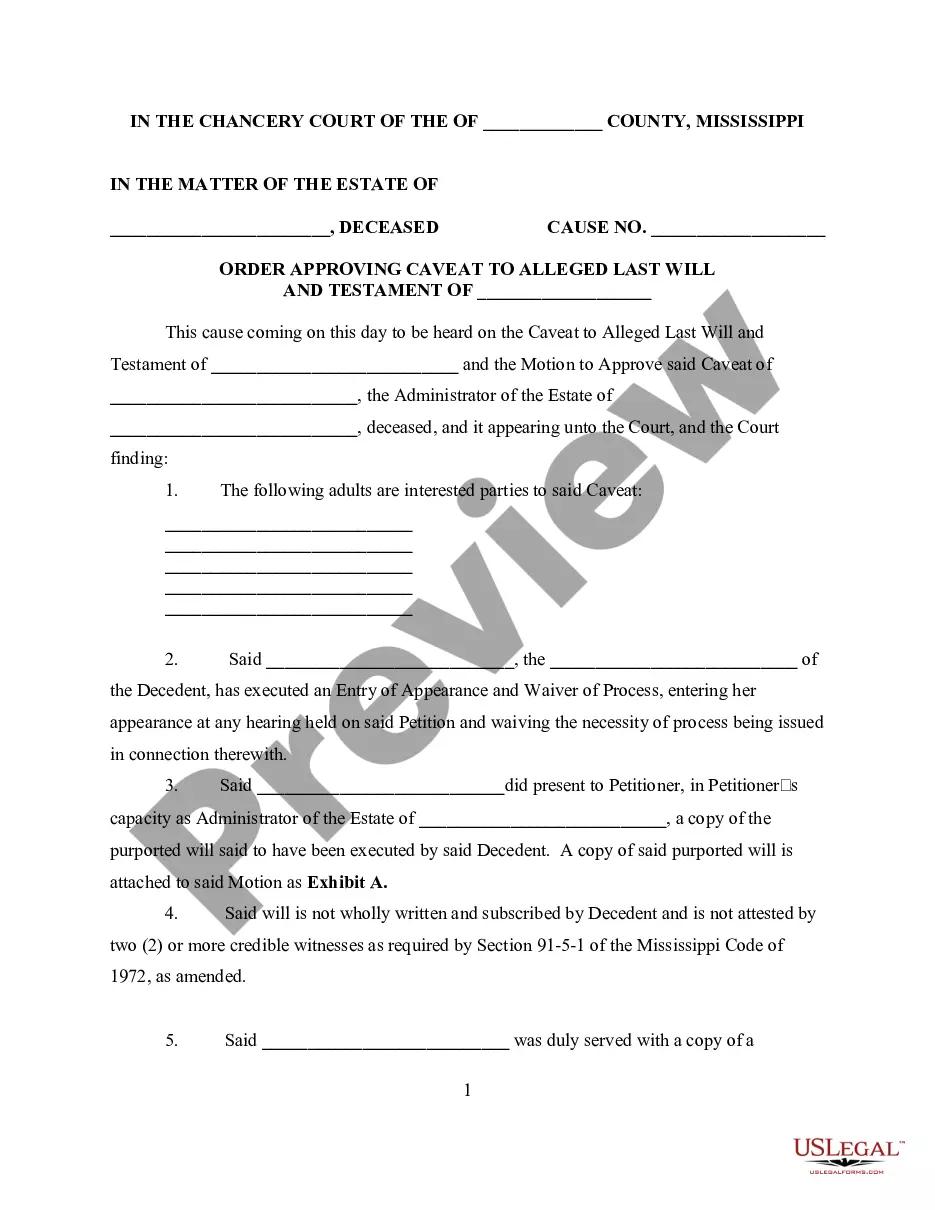

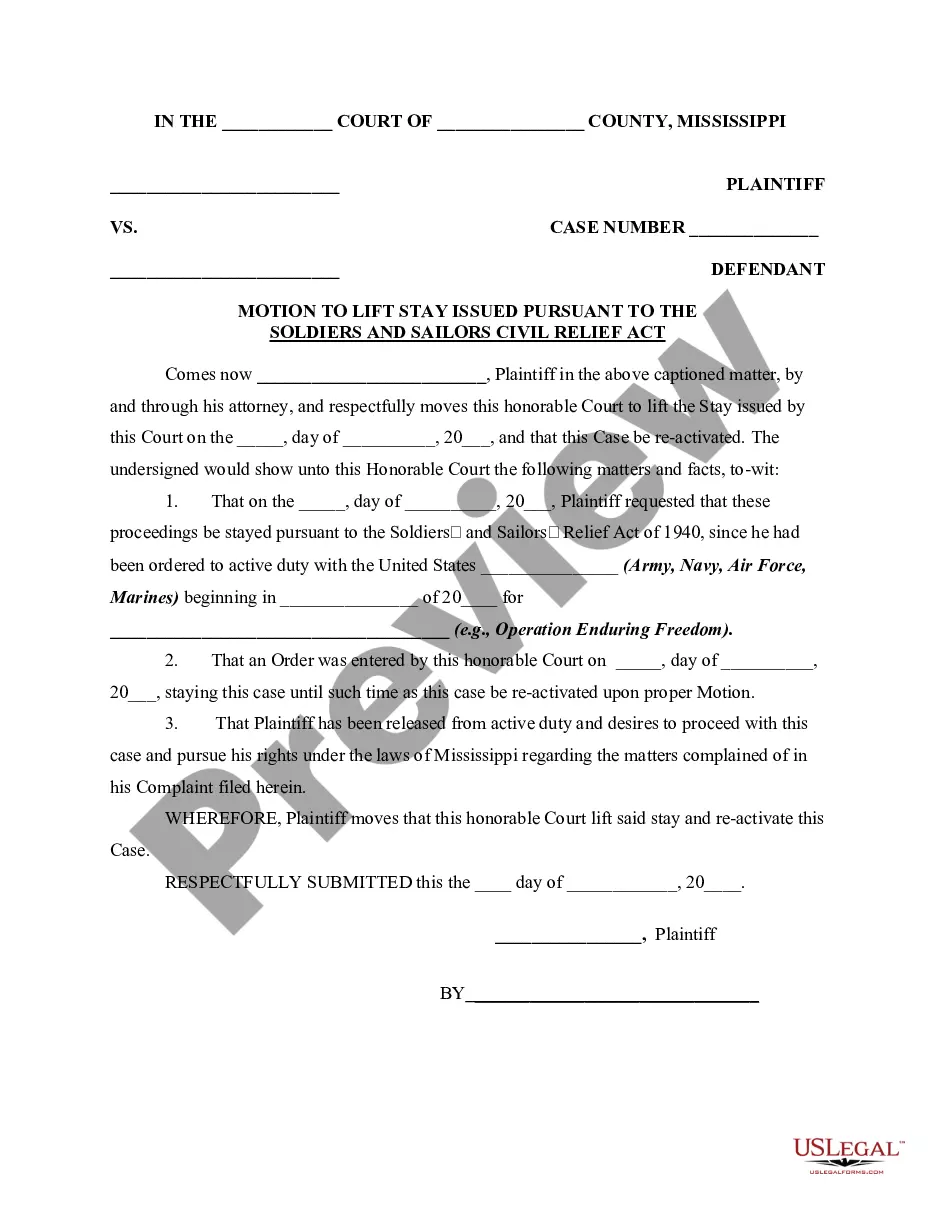

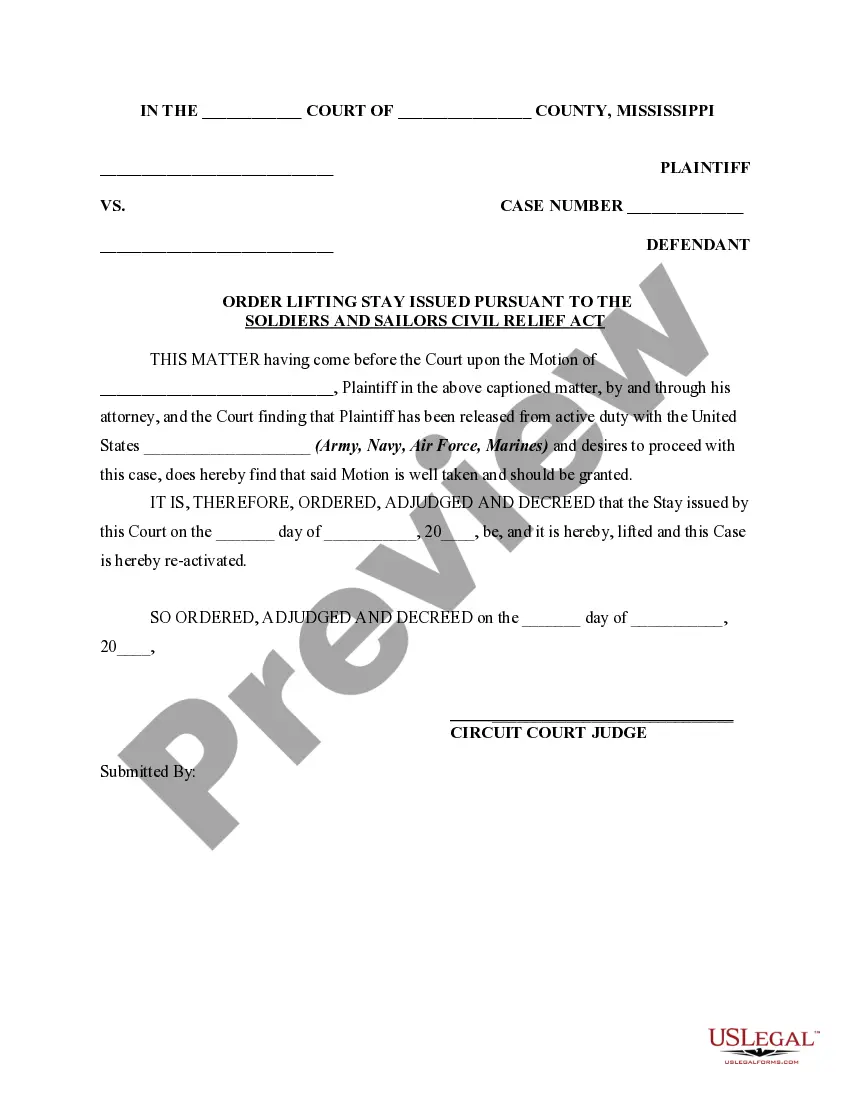

Employ the most complete legal library of forms. US Legal Forms is the best place for getting updated Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005 templates. Our platform offers 1000s of legal documents drafted by licensed lawyers and sorted by state.

To download a sample from US Legal Forms, users just need to sign up for an account first. If you’re already registered on our platform, log in and select the template you need and buy it. After buying templates, users can see them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines listed below:

- Check if the Form name you’ve found is state-specific and suits your requirements.

- When the template features a Preview function, utilize it to check the sample.

- If the sample does not suit you, make use of the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your requirements.

- Choose a pricing plan.

- Create your account.

- Pay with the help of PayPal or with the credit/bank card.

- Select a document format and download the template.

- After it is downloaded, print it and fill it out.

Save your time and effort with our service to find, download, and fill out the Form name. Join a large number of satisfied customers who’re already using US Legal Forms!

Schedule E Form Pdf Form popularity

Unsecured F Other Form Names

Claim Account Creditor FAQ

Only farmers who operate as businesses are required to file Schedule F. You must be engaged in farming for profit to be considered a business. This means that you've made money in at least three of the last five tax years, or two out of seven years for breeding or raising horses.

If you are the sole member of a domestic LLC engaged in the business of farming, file Schedule F (Form 1040). However, you can elect to treat a do- mestic LLC as a corporation. See Form 8832 for details on the election.

Use Schedule F (Form 1040) to report farm income and expenses.

Farmers who operate their businesses as a sole proprietorship or through a trust or partnership must file a Schedule F to report their farming income and claim their expense deductions.

The IRS stipulates that you can typically claim three consecutive years of farm losses.

Only farmers who operate as businesses are required to file Schedule F. You must be engaged in farming for profit to be considered a business. This means that you've made money in at least three of the last five tax years, or two out of seven years for breeding or raising horses.

IRS Schedule F is used to report taxable income earned from farming or agricultural activities. This schedule must be included on Form 1040 tax return regardless of the type of farm income and whether it's a primary business activity or not. Schedule F also allows for various farm-related credits and deductions.