Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers

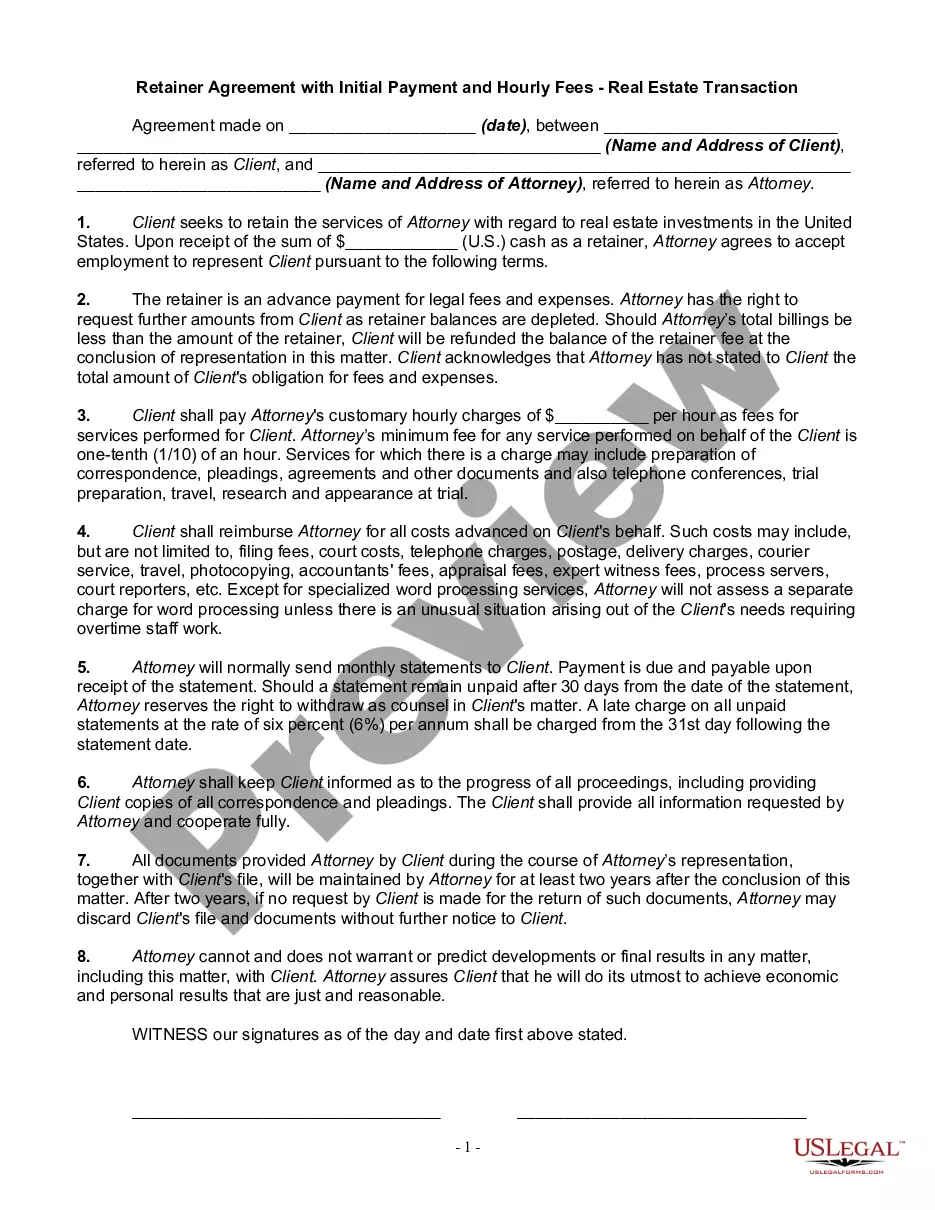

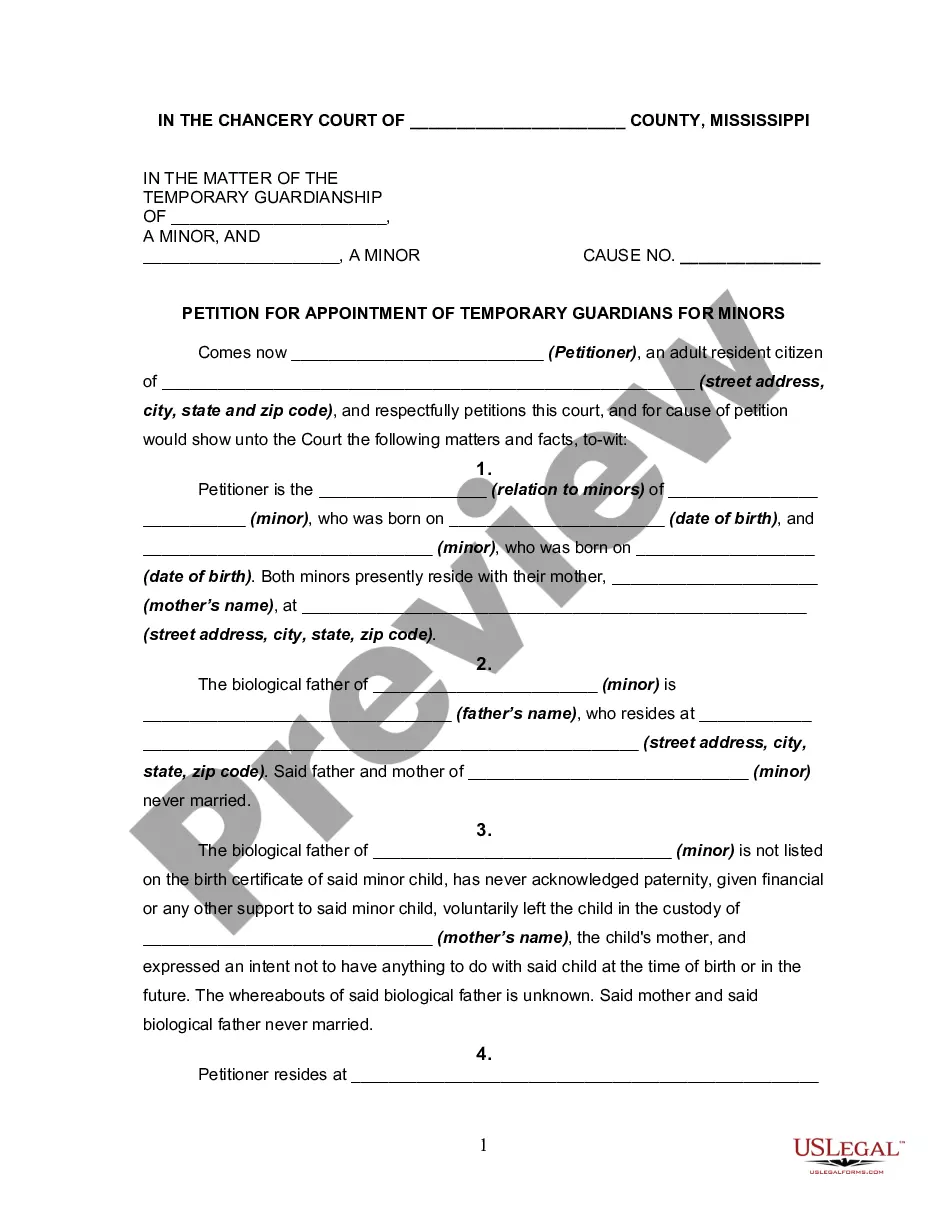

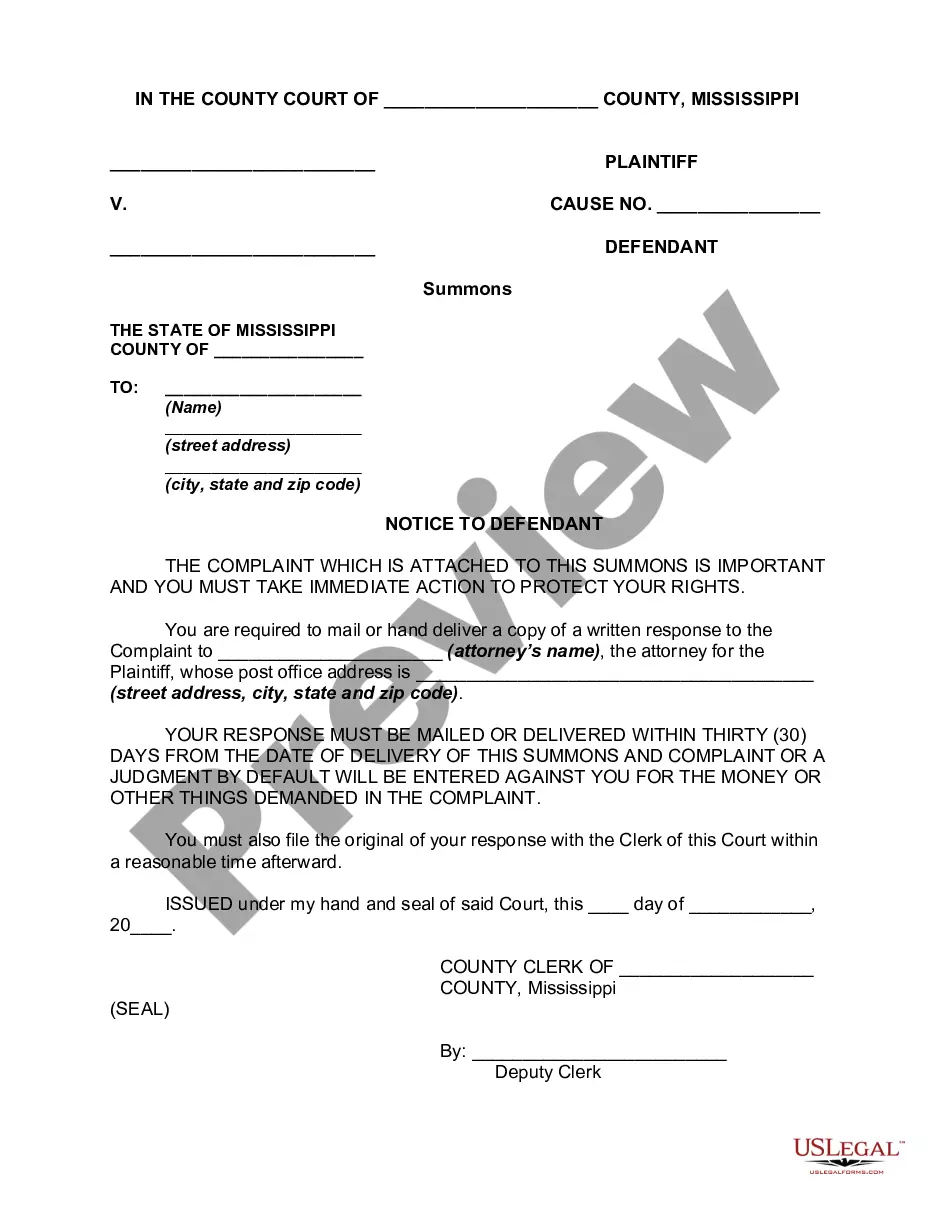

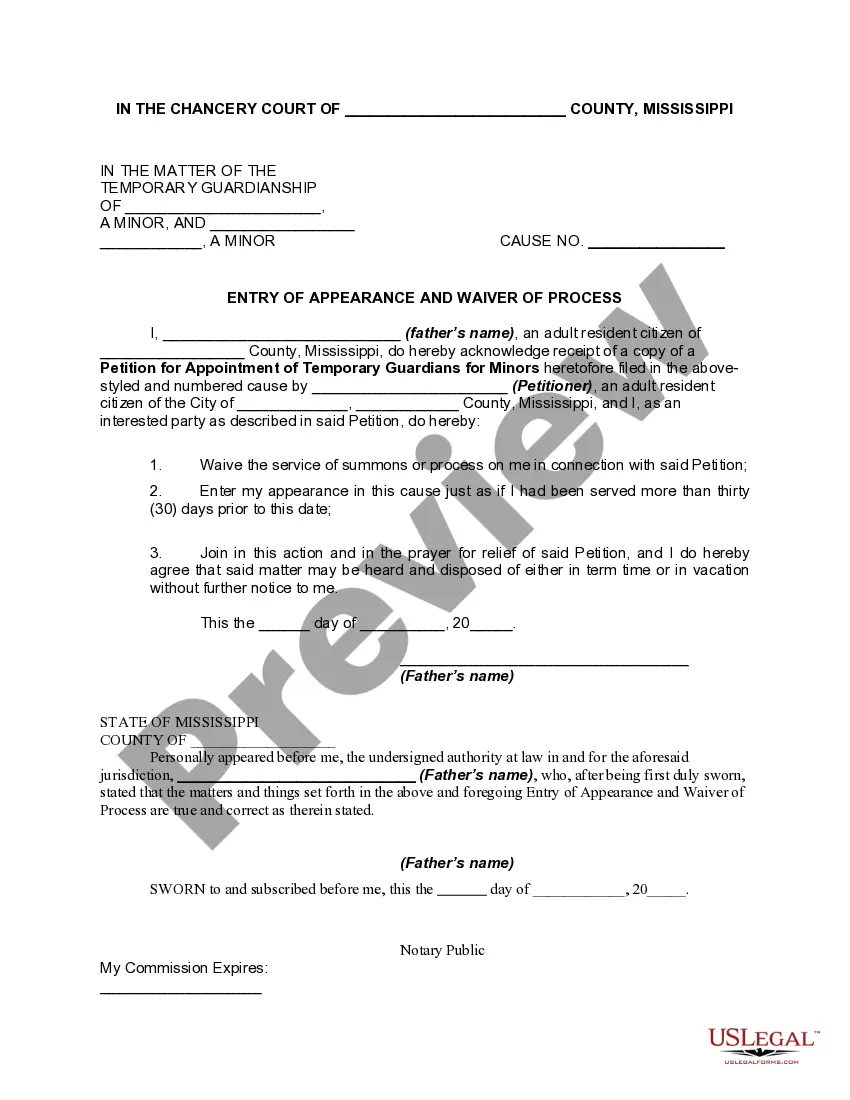

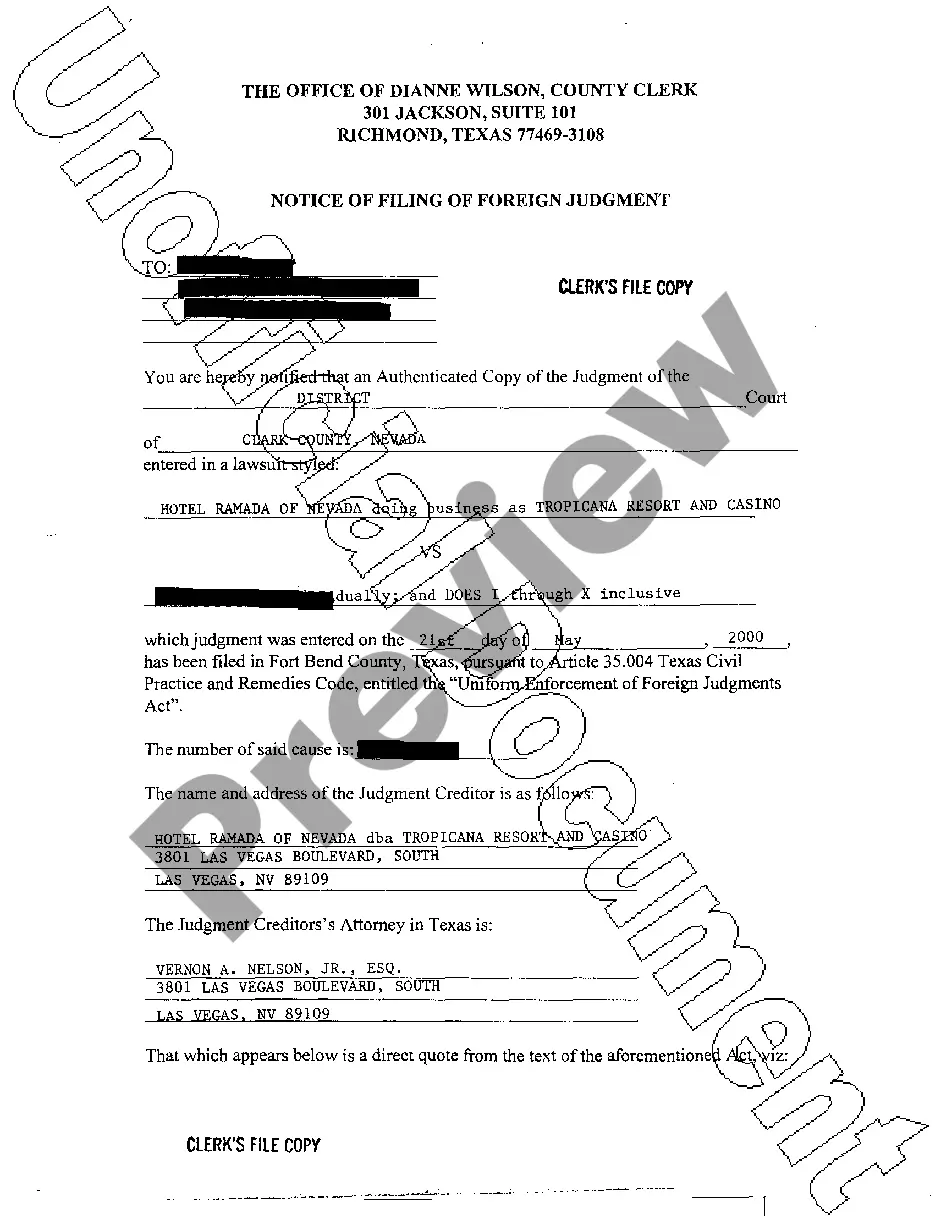

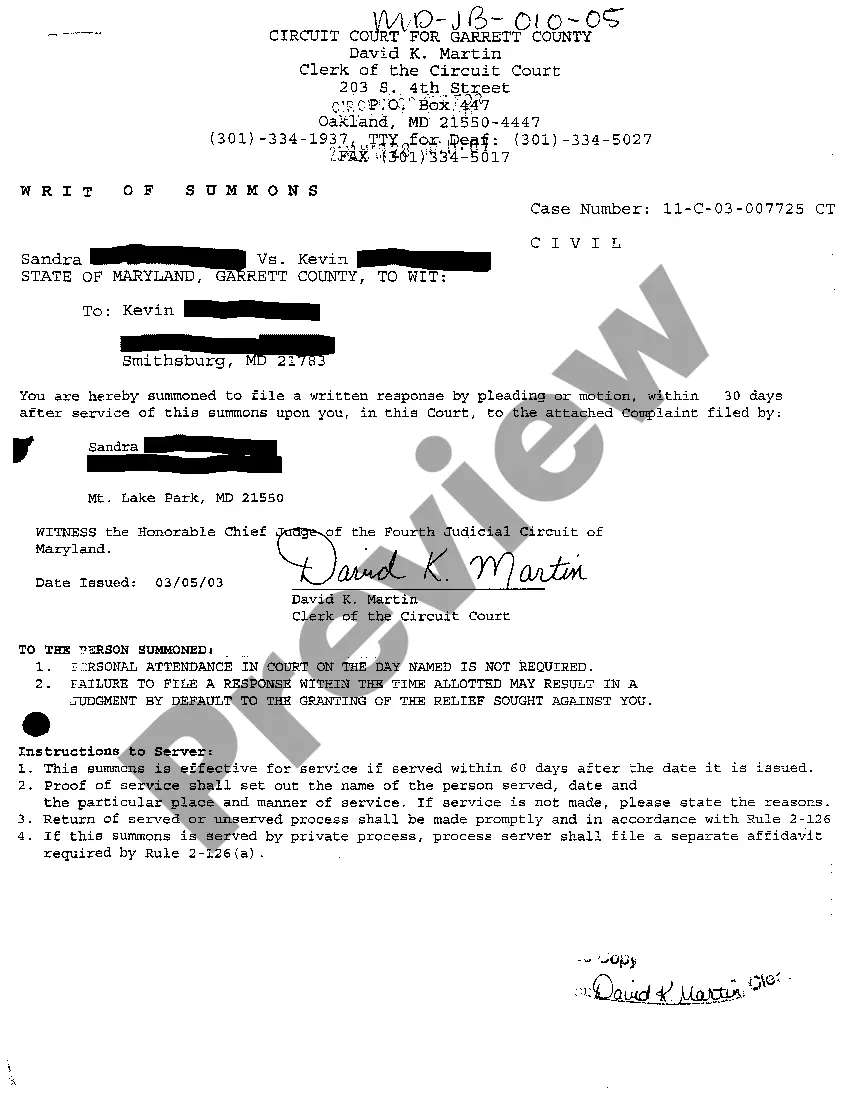

Description Stock Purchase Agreement Sample

How to fill out Stock Purchase N?

Employ the most comprehensive legal library of forms. US Legal Forms is the best place for getting updated Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers templates. Our platform offers a huge number of legal documents drafted by licensed lawyers and grouped by state.

To get a sample from US Legal Forms, users simply need to sign up for an account first. If you are already registered on our service, log in and select the template you are looking for and purchase it. After buying templates, users can see them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the steps listed below:

- Check if the Form name you’ve found is state-specific and suits your needs.

- If the form features a Preview option, use it to check the sample.

- In case the template does not suit you, use the search bar to find a better one.

- Hit Buy Now if the sample meets your expections.

- Choose a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with yourr credit/credit card.

- Select a document format and download the sample.

- After it is downloaded, print it and fill it out.

Save your time and effort using our service to find, download, and fill out the Form name. Join a large number of pleased subscribers who’re already using US Legal Forms!

Sample Stock Agreement Form popularity

Stock Any Registration Other Form Names

Sample Stock Purchase Agreement Form FAQ

The target company's short-term share price tends to rise because the shareholders only agree to the deal if the purchase price exceeds their company's current value. Over the long haul, an acquisition tends to boost the acquiring company's share price.

If the buyout is an all-cash deal, shares of your stock will disappear from your portfolio at some point following the deal's official closing date and be replaced by the cash value of the shares specified in the buyout. If it is an all-stock deal, the shares will be replaced by shares of the company doing the buying.

An all-cash, all-stock offer is a proposal by one company to buy another company's outstanding shares from its shareholders for cash. The acquirer may sweeten the deal to entice the target company's shareholders by offering a premium over its current stock price.

In a stock acquisition, a buyer acquires a target company's stock. An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company's residual assets and earnings (should the company ever be dissolved).directly from the selling shareholders.

An acquisition is when one company purchases most or all of another company's shares to gain control of that company. Purchasing more than 50% of a target firm's stock and other assets allows the acquirer to make decisions about the newly acquired assets without the approval of the company's other shareholders.

The accountant records each purchase through a journal entry. To record the stock purchase, the accountant debits Investment In Company and credits Cash. At the end of each period, the accountant evaluates the value of the investment.

After a merge officially takes effect, the stock price of the newly-formed entity usually exceeds the value of each underlying company during its pre-merge stage. In the absence of unfavorable economic conditions, shareholders of the merged company usually experience favorable long-term performance and dividends.

In this type of acquisition, shareholders of the target company receive shares in the acquiring company as payment, rather than cash.All-stock deals can be favorable for the shareholders of target companies if the merger is successful and results in an increase in the value of the acquiring company's stock.

How a merger or acquisition is paid for often reveals how an acquirer views the relative value of a company's stock price. M&As can be paid for by cash, equity, or a combination of the two, with equity being the most common.Conversely, if its stock is undervalued, it will choose to pay with cash.