Management Agreement between a Trust and a Corporation

Description Agreement Trust Corporation

How to fill out Trust Corporation Form?

Make use of the most extensive legal library of forms. US Legal Forms is the best place for getting up-to-date Management Agreement between a Trust and a Corporation templates. Our service provides a large number of legal forms drafted by certified legal professionals and categorized by state.

To get a template from US Legal Forms, users only need to sign up for a free account first. If you are already registered on our service, log in and select the template you need and buy it. Right after purchasing templates, users can find them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines below:

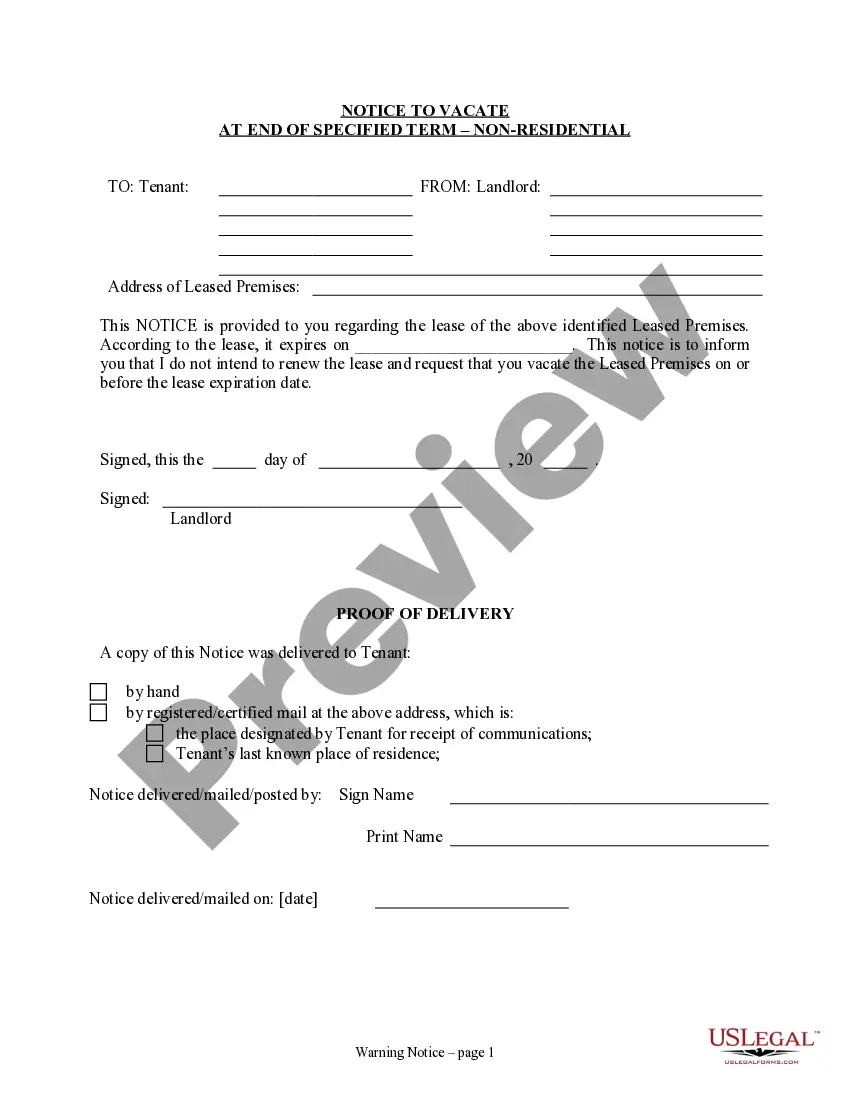

- Check if the Form name you have found is state-specific and suits your needs.

- When the template has a Preview function, utilize it to review the sample.

- In case the sample does not suit you, use the search bar to find a better one.

- PressClick Buy Now if the template meets your requirements.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with yourr debit/visa or mastercard.

- Select a document format and download the template.

- Once it’s downloaded, print it and fill it out.

Save your effort and time with our service to find, download, and complete the Form name. Join a huge number of satisfied clients who’re already using US Legal Forms!

Trust Corporation Fill Form popularity

Between Trust Other Form Names

Management Agreement Between FAQ

A trust company is a legal entity that acts as a fiduciary, agent, or trustee on behalf of a person or business for a trust. A trust company is typically tasked with the administration, management, and the eventual transfer of assets to beneficiaries.

Avoid Probate Court. Your Personal And Financial Matters Remain Private. You Maintain Control Of Your Finances After You Pass Away. Reduce The Possibility Of A Court Challenge. Prevent A Conservatorship.

A trust company is a financial institution that operates under either provincial or federal legislation and conducts activities similar to those of a bank.The following institutions are regulated under the federal Trust and Loan Companies Act.

No. A trust is a relationship to property. It is not a separate legal entity like a corporation.

A trust that a corporation creates to secure a bond or other debt security. That is, a corporate trust is effectively money set aside to ensure that bondholders are covered in the event of default on the issue.

A trust company is a legal entity that acts as a fiduciary, agent, or trustee on behalf of a person or business for a trust. A trust company is typically tasked with the administration, management, and the eventual transfer of assets to beneficiaries.

Companies are usually more tax-effective when income generated is retained to fund ongoing working capital requirements. In contrast, trusts are generally taxed at higher rates when profits are retained.

The trustees must file to incorporate according to the laws of their state.They can then transfer the assets from the trust to the new corporation, or the corporation can administer the trust, depending on state law.

Trusts are a way that individuals own property for personal and family purposes just as corporations are a way that individuals own property for business purposes.Corporations are intended to operate businesses for profit for the benefit of the shareholders (the owners).