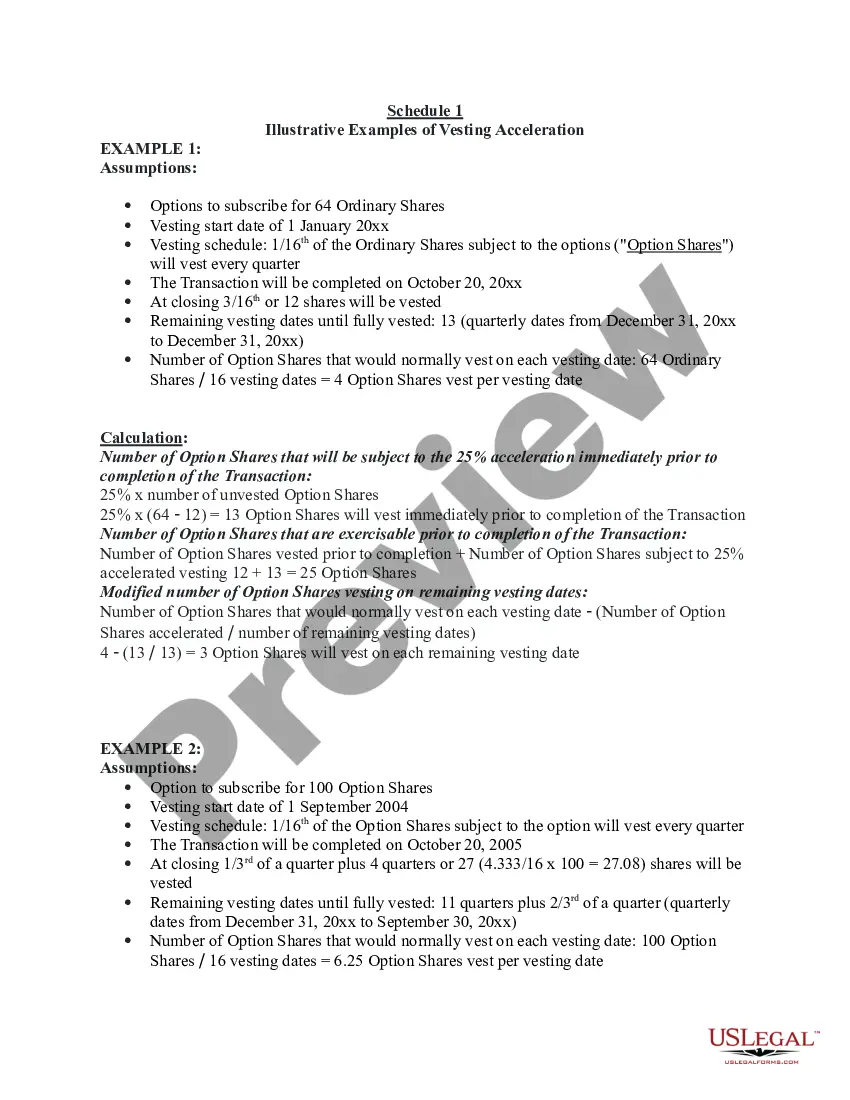

An Option Assumption Agreement between the Purchaser and Company is a contract that clarifies the terms of an option that the Purchaser holds in relation to the Company. This agreement outlines the Purchaser’s rights and responsibilities with respect to the option, such as the right to exercise the option at any time during the term of the agreement, the Company’s obligation to provide the Purchaser with the option, and the Purchaser’s obligation to pay the exercise price if the option is exercised. The agreement also outlines the conditions under which the option can be terminated or extended, as well as any other relevant terms and conditions. The two main types of Option Assumption Agreements between the Purchaser and Company are call option agreements and put option agreements. A call option agreement gives the Purchaser the right to purchase a particular asset or security at a predetermined price during a specified period of time. A put option agreement gives the Purchaser the right to sell a particular asset or security at a predetermined price during a specified period of time. In both cases, the Purchaser pays the exercise price to the Company upon exercising the option.

Option Assumption Agreement between the Purchaser and Company

Description

How to fill out Option Assumption Agreement Between The Purchaser And Company ?

Coping with official documentation requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Option Assumption Agreement between the Purchaser and Company template from our library, you can be certain it complies with federal and state regulations.

Working with our service is straightforward and fast. To obtain the necessary document, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to obtain your Option Assumption Agreement between the Purchaser and Company within minutes:

- Remember to carefully check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another formal template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Option Assumption Agreement between the Purchaser and Company in the format you need. If it’s your first time with our service, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are created for multi-usage, like the Option Assumption Agreement between the Purchaser and Company you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

An assumption is something that you assume to be the case, even without proof. For example, people might make the assumption that you're a nerd if you wear glasses, even though that's not true.

Advantages. If the assumable interest rate is lower than current market rates, the buyer saves money straight away. There are also fewer closing costs associated with assuming a mortgage. This can save money for the seller as well as the buyer.

At the Effective Time, the Company Stock Option Plan and each outstanding option to purchase Shares under the Company Stock Option Plan, whether vested or unvested, will be assumed by Parent.

In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price.

Stock options aren't actual shares of stock?they're the right to buy a set number of company shares at a fixed price, usually called a grant price, strike price, or exercise price. Because your purchase price stays the same, if the value of the stock goes up, you could make money on the difference.

A stock option is the contractual right to purchase shares of a company's stock at a specified price during a specified period.

Buyer shall receive a credit at Closing in an amount equal to the sum of the unpaid principal balance of the Loan, and any interest, default interest, or other sum that is accrued, due and/or payable to Existing Lender on the Closing Date.