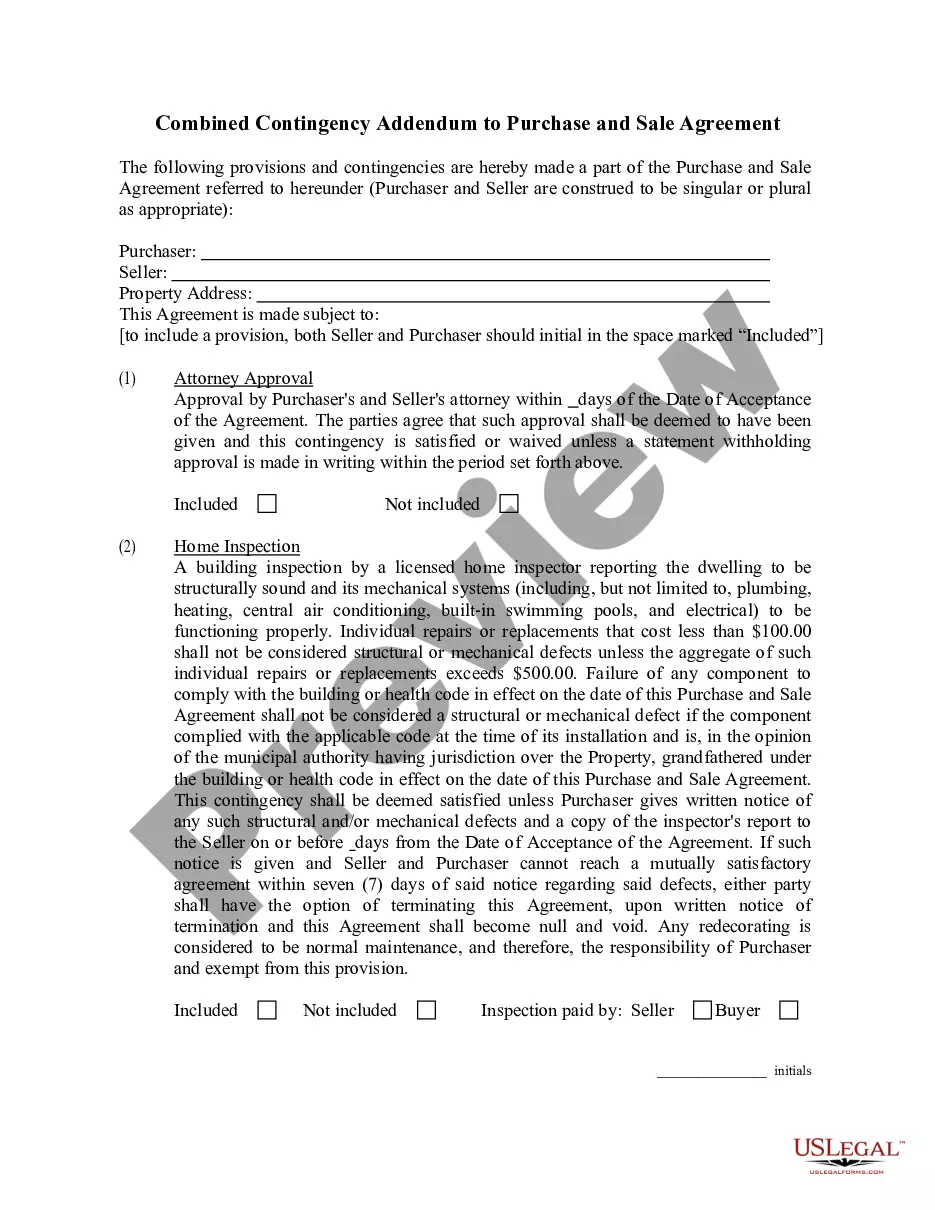

A Contingency Clause: Contract for Real Property is a clause included in a contract for the purchase of real property that outlines conditions that must be met for the contract to become legally binding. This clause allows a buyer to withdraw from a contract if certain conditions are not met. There are several types of contingency clauses, including but not limited to financing, inspection, title, appraisal, and home sale contingencies. A financing contingency clause states that the sale of the property is contingent upon the buyer being approved for a loan with a certain amount and terms. An inspection contingency clause allows the buyer to conduct a professional inspection of the property and then decide whether to proceed with the purchase based on the results of the inspection. A title contingency clause allows the buyer to back out if there are any problems with the title of the property. An appraisal contingency clause allows the buyer to back out if the appraised value of the property is lower than the agreed upon purchase price. A home sale contingency clause allows the buyer to back out of the purchase if they are unable to sell their current home by a specified date.

Contingency Clause: Contract for Real Property

Description

How to fill out Contingency Clause: Contract For Real Property?

US Legal Forms is the most easy and affordable way to locate suitable legal templates. It’s the most extensive online library of business and personal legal documentation drafted and verified by lawyers. Here, you can find printable and fillable templates that comply with national and local laws - just like your Contingency Clause: Contract for Real Property.

Getting your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Contingency Clause: Contract for Real Property if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make certain you’ve found the one corresponding to your requirements, or find another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Create an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Contingency Clause: Contract for Real Property and download it on your device with the appropriate button.

Once you save a template, you can reaccess it anytime - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more efficiently.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the corresponding official paperwork. Try it out!

Form popularity

FAQ

As an appraisal contingency example, if you agree to buy a home for $200,000, but the appraised value comes in at only $190,000, the lender will not give you a loan for the property unless you cover the difference.

A contingency is a clause that buyers include when making an offer on a home that allows them to back out of buying the house if the terms of the clause aren't met. Without a contingency in place, buyers risk losing their earnest money deposit if they decide not to purchase the home after making an offer.

Contingencies can include details such as the time frame (for example, ?the buyer has 14 days to inspect the property?) and specific terms (such as, ?the buyer has 21 days to secure a 30-year conventional loan for 80% of the purchase price at an interest rate no higher than 4.5%?).

A contingency is a condition that needs to be met before an offer can proceed. In other words, it's kind of like a safety net. Therefore, an appraisal contingency means that if your home doesn't appraise for the amount you've agreed to pay, you can walk away from the deal with your deposit.

The Property must appraise at a value equal to or exceeding the purchase price or, at the option of Buyer, this contract may be terminated and all x monies shall be refunded to Buyer.

Some of the most common real estate contingencies include appraisal, mortgage, title and home inspection contingencies. Many home buyers also include a sale of prior home contingency, which allows them to withdraw an offer if they are unable to sell their current home within a specified timeframe.

An appraisal contingency clause is a condition built into a real estate contract that gives the buyer the right to walk away from the transaction if the appraised value of the property is lower than the agreed-upon purchase price.