Opinion of CS First Boston Corporation

Description Cs Corporation Purchase

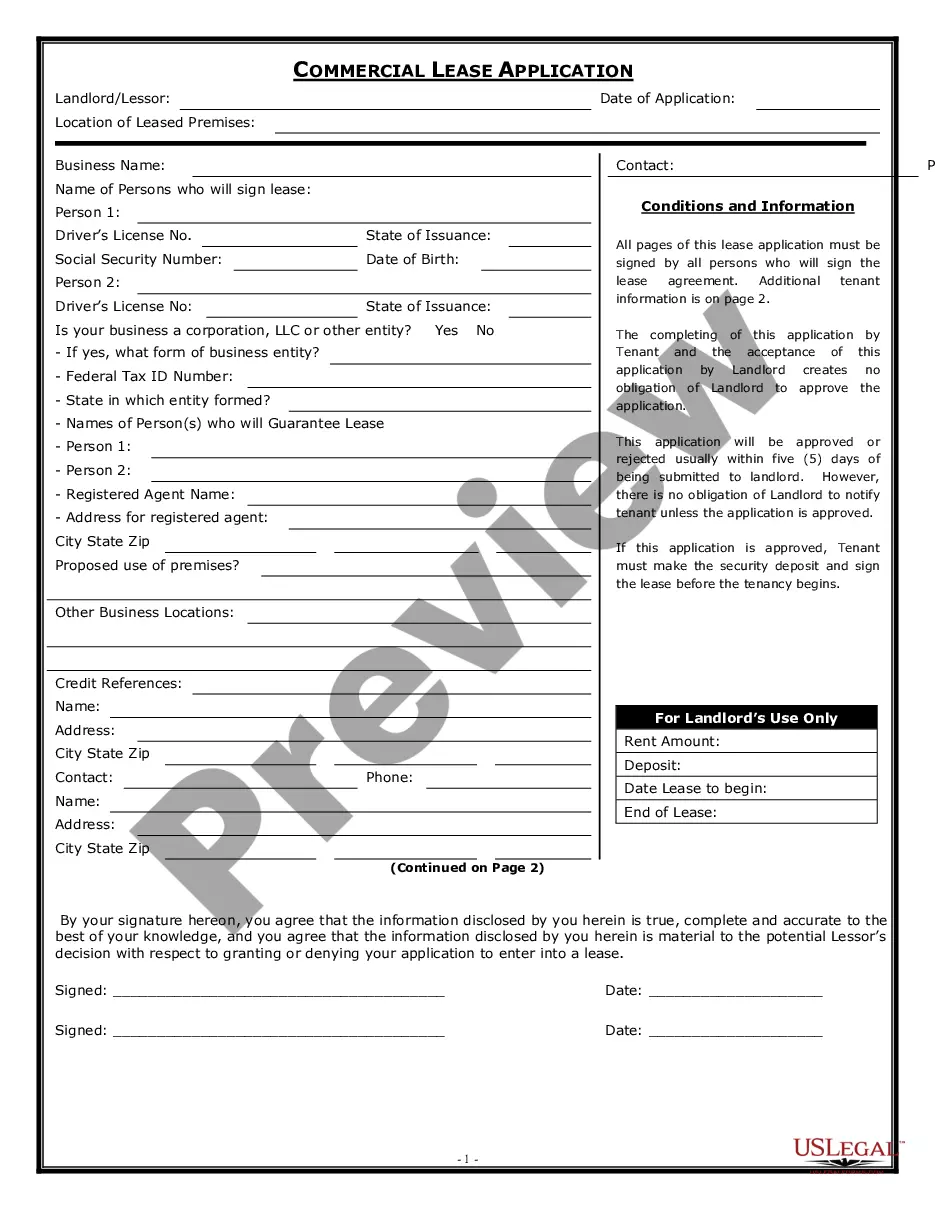

How to fill out Opinion Of CS First Boston Corporation?

When it comes to drafting a legal document, it’s easier to delegate it to the professionals. However, that doesn't mean you yourself can not find a sample to utilize. That doesn't mean you yourself cannot get a sample to utilize, nevertheless. Download Opinion of CS First Boston Corporation straight from the US Legal Forms website. It gives you numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and choose a subscription. As soon as you are signed up with an account, log in, look for a specific document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we have included an 8-step how-to guide for finding and downloading Opinion of CS First Boston Corporation quickly:

- Make sure the form meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the suitable subscription to meet your needs.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the file.

As soon as the Opinion of CS First Boston Corporation is downloaded it is possible to complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant files in a matter of minutes in a preferable format with US Legal Forms!

The First Boston Corporation Form popularity

FAQ

Notifications. UBS is one of the largest-wealth managers in the world and manages the largest amount of private wealth in the world. As of 2018, UBS's client assets of $2.3 trillion was roughly 50% more than that of Credit Suisse's $1.5 trillion.

Some banks that are commonly recognized as being a part of the bulge bracket are: Goldman Sachs, Barclays Capital, Credit Suisse, Deutsche Bank, JPMorgan Chase, Citigroup, Morgan Stanley, and UBS. Bulge bracket banks are massive, multinational corporations.

The top banks in Switzerland are: UBS. Credit Suisse. Swiss Raiffeisen. Zurich Cantonal Bank. Julius Baer. Banque cantonale de Geneve (BCGE) Vontobel.

Credit Suisse has been recognised as the world's best private bank by Euromoney's Global Private Banking Survey and as the best European Equity Manager by Global Investors.

Credit Suisse is one of the world's leading financial institutions. We offer wealthy individuals the benefits of truly global wealth management as well as access to the best in investment and corporate banking.

Credit Suisse bought a stake in First Boston in 1978 and acquired a controlling stake in 1988. It changed the name to Credit Suisse First Boston, or CSFB. The bank made its reputation with a series of mergers in the 1980s, overseen by star bankers such as Bruce Wasserstein.

Credit Suisse acquired a 44% stake in First Boston in 1988. The investment bank acquired its shares held by the public and the company was taken private.Credit Suisse bailed them out and acquired a controlling stake in 1990.