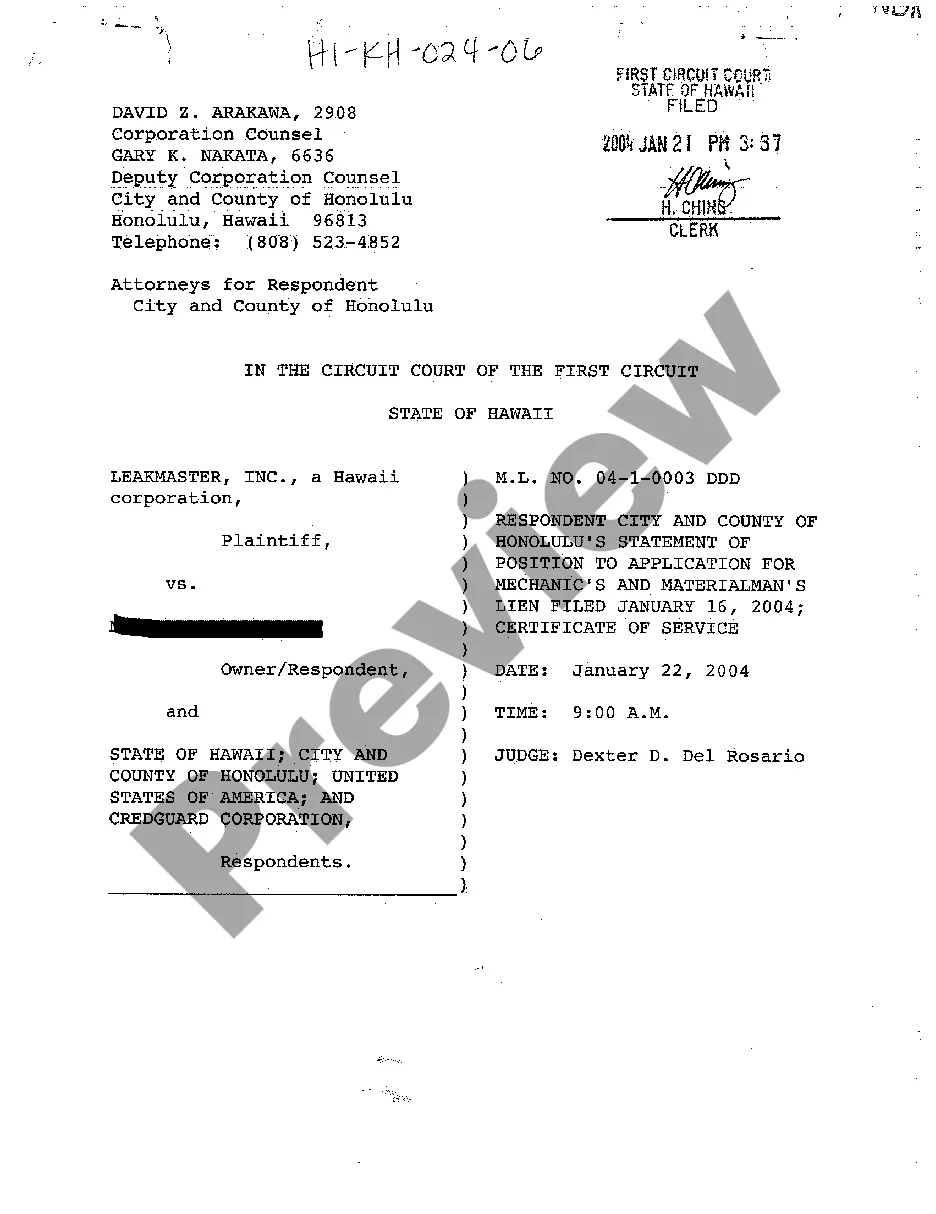

Designation of Rights, Privileges and Preferences of Preferred Stock

Description Rights Preferred Stock

How to fill out Preferences Stock Preferred?

When it comes to drafting a legal document, it is better to leave it to the specialists. However, that doesn't mean you yourself can’t find a sample to use. That doesn't mean you yourself cannot get a sample to utilize, nevertheless. Download Designation of Rights, Privileges and Preferences of Preferred Stock from the US Legal Forms site. It offers numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. When you’re signed up with an account, log in, search for a specific document template, and save it to My Forms or download it to your device.

To make things less difficult, we have incorporated an 8-step how-to guide for finding and downloading Designation of Rights, Privileges and Preferences of Preferred Stock promptly:

- Make confident the form meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Press Buy Now.

- Select the appropriate subscription for your requirements.

- Make your account.

- Pay via PayPal or by credit/visa or mastercard.

- Select a preferred format if several options are available (e.g., PDF or Word).

- Download the document.

Once the Designation of Rights, Privileges and Preferences of Preferred Stock is downloaded you may fill out, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents in a matter of minutes in a preferable format with US Legal Forms!

Designation Stock Form Form popularity

Designation Stock Pdf Other Form Names

Designation Stock Sample FAQ

Preference shares come with no voting rights but they do provide an advantage over ordinary shareholders when it comes to receiving dividends.Dividend payments for preference shareholders are often at an agreed level and are made at defined points throughout the year.

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

Preference shareholders are restricted to vote only on those resolutions which directly affect their rights, however, Section 47(2) of the 2013 Act removes the limitation of exercising their voting rights and entitles the preference shareholder to vote on every resolution placed before the company in general meetings

It sports the name preferred because its owners receive dividends before the owners of common stock. On a classified balance sheet, a company separates accounts into classifications, or subsections, within the main sections. Preferred stock is classified as part of capital stock in the stockholders' equity section.

In general, preferred stock has preference in dividend payments. The preference does not assure the payment of dividends, but the company must pay the stated dividends on preferred stock before or at the same time as any dividends on common stock. Preferred stock can be cumulative or noncumulative.

Unlike common stockholders, preferred stockholders have limited rights which usually does not include voting. 1feff Preferred stock combines features of debt, in that it pays fixed dividends, and equity, in that it has the potential to appreciate in price.

Ordinary Shares: Meaning and Types of Shares Ordinary or equity share is the commonest variant of stock that a public company issues to raise capital. Typically, holders of ordinary shares enjoy voting rights, can attend general and annual meetings of a company, and are also entitled to a company's surplus profits.

For example, the holder of 100 shares of a corporation's 8% $100 par preferred stock will receive annual dividends of $800 (8% X $100 = $8 per share X 100 shares) before the common stockholders are allowed to receive any cash dividends for the year.

Preference shares also commonly known as preferred stock, is a special type of share where dividends are paid to shareholders prior to the issuance of common stock dividends. Ergo, preference share holders hold preferential rights over common shareholders when it comes to sharing profits.